2017 Commercial Law (judge Escalante)

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View 2017 Commercial Law (judge Escalante) as PDF for free.

More details

- Words: 6,988

- Pages: 11

Loading documents preview...

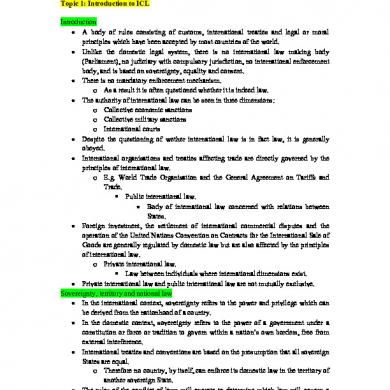

UPDATES ON COMMERCIAL LAW BAR 2017 by: Judge Ella Dumlao-Escalante TRANSPORTATION LAW MANAY, JR. v. CEBU AIR, INC. G.R. No. 210621, April 04, 2016 Jose (with Manay as one of the passengers) purchased 20 Cebu Pacific round-trip tickets from Manila to Palawan for himself and on behalf of his relatives and friends. He made the purchase at Cebu Pacific's branch office in Robinsons Galleria. Jose alleged that he specified to the Cebu Pacific ticketing agent, that his preferred date and time of departure from Manila to Palawan should be on July 20, 2008 at 8:20 a.m. and that his preferred date and time for their flight back to Manila should be on July 22, 2008 at 4:15 p.m. He paid, and tickets were issued. The Cebu Pac agent printed the tickets which consisted of three (3) pages, and recapped only the first page to him. Since the first page contained the details he specified to Alou, he no longer read the other pages of the flight information. On July 20, 2008, Jose and his 19 companions boarded the 0820 Cebu Pacific flight to Palawan and had an enjoyable stay. On the afternoon of July 22, 2008, the group proceeded to the airport for their flight back to Manila. During the processing of their boarding passes, they were informed by Cebu Pacific personnel that nine (9) of them could not be admitted because their tickets were for the morning flight earlier that day. Jose informed the ground personnel that he personally purchased the tickets and specifically instructed the ticketing agent that all 20 of them should be on the 4:15 p.m. flight to Manila. Upon reading the tickets, they learned that Cebu Pac was correct. So they rebooked and paid again. Are the passengers entitled to damages? NO. The Air Passenger Bill of Right mandates that the airline must inform the passenger in writing of all the conditions and restrictions in the contract of carriage. Purchase of the contract of carriage binds the passenger and imposes reciprocal obligations on both the airline and the passenger. The airline must exercise extraordinary diligence in the fulfillment of the terms and conditions of the contract of carriage. The passenger, however, has the correlative obligation to exercise ordinary diligence in the conduct of his or her affairs. Even assuming that the ticketing agent encoded the incorrect flight information, it is incumbent upon the purchaser of the tickets to at least check if all the information is correct before making the purchase. Once the ticket is paid for and printed, the purchaser is presumed to have agreed to all its terms and conditions. PASSENGER NOT ENTITLED TO DAMAGES. Pereñas v. Zarate, 679 SCRA 208, 29 August 2012 Are school bus operators common carriers? Aaron Zarate was a high school Don Bosco student. Operator – Pereñas- operator. School bus. Running late, so school bus detoured through a narrow path underneath the Magallanes Interchange. At the time, the narrow path was marked by piles of construction materials and parked passenger jeepneys, and the railroad crossing in the narrow path had no railroad warning signs, or watchmen, or other responsible persons manning the crossing. In fact, the bamboo barandilla was up, leaving the railroad crossing open to traversing motorists. The bus driver did not see the train as his view was blocked by another vehicle. The train hit the bus, all passengers were thrown out. Aaron's was dragged by the train, and his head was severed. The parents sued the operator of the school bus insisting that as a common carrier, it is liable for damages. The operator of a school bus is a common carrier because he holds himself out indiscriminately as ready to transport students of a particular school living within or near the area where he operates the service, and for a fee. DESPITE HAVING A LIMITED CLIENTELE;

PNR – jointly and solidarily liable with the school bus SULPICIO LINES, INC. vs. NAPOLEON SESANTE G.R. NO. 172682, July 27, 2016 Water transportation; Is vessel liable even if the sinking was due to force majuere? In 1998, M/V Princess of the Orient sank near Fortune Island in Batangas. Of the 388 recorded passengers, 150 were lost. Napoleon Sesante, then a member of the Philippine National Police (PNP) and a lawyer, was one of the passengers who survived the sinking. He sued the petitioner for breach of contract and damages alleging that Sulpicio Lines committed bad faith in allowing the vessel to sail despite the storm signal. In its defense, the petitioner insisted on the seaworthiness of the M/V Princess of the Orient due to its having been cleared to sail from the Port of Manila by the proper authorities; that the sinking had been due to force majeure. Should damages be awarded? YES. The trial court is not required to make an express finding of the common carrier's fault or negligence. The presumption of negligence applies so long as there is evidence showing that: (a) a contract exists between the passenger and the common carrier; and (b) the injury or death took place during the existence of such contract. In such event, the burden shifts to the common carrier to prove its observance of extraordinary diligence, and that an unforeseen event or force majeure had caused the injury. However, for a common carrier to be absolved from liability in case of force majeure, it is not enough that the accident was caused by a fortuitous event. The common carrier must still prove that it did not contribute to the occurrence of the incident due to its own or its employees' negligence. It is true that there was force majeure. There were big waves 7-8 meters high. But it was also established that the sinking was due to high speed of the vessel and the faulty manuever of the captain of the ship. NEGLIGENCE CATHAY PACIFIC AIRWAYS, LTD. v. SPOUSES ARNULFO and EVELYN FUENTEBELLA G. R. No. 188283, July 20, 2016, Congressman; downgrading of seats Congressman Fuentebuella travelled with his wife, Evelyn, to Sydney Austrailia along with other members of Congress on an official business trip. They purchased business class tickets, but later the Fuentebellas upgraded their tickets to First Class. Cathay Pacific admitted that first class tickets were purchased, but according to the carrier, the tickets were “waitlisted.” The spouses lined up in the First Class counter, but they were given business class boarding passes. They did not notice this until they were denied entry into the first class lounge. Cong. Fuentebella demanded entry into the lounge, and the issuance of first class boarding passes, but the ground staff was discourteous. The other congressmen were able to travel first class. DAMAGES? YES. The aggrieved party does not have to prove that the common carrier was at fault or was negligent; all that he has to prove is the existence of the contract and the fact of its nonperformance by the carrier. In this case, both the trial and appellate courts found that respondents were entitled to First Class accommodations under the contract of carriage, and that petitioner failed to perform its obligation. However, the award of P5 million as moral damages is excessive, considering that the highest amount ever awarded by this Court for moral damages in cases involving airlines is P500,000. As said in Air France v. Gillego, "the mere fact that respondent was a Congressman should not result in an automatic increase in the moral and exemplary damages." Upon the facts established, the amount of P500,000 as moral damages is reasonable to obviate the moral suffering that respondents have undergone. With regard to exemplary damages, jurisprudence shows that P50,000 is sufficient to deter similar acts of bad faith attributable to airline representatives. MENDOZA vs. GOMEZ G.R. No. 160110, June 18, 2014 Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

2

Kabit system A truck was hit by Mayamy Bus, Gomez was injured. The registered owner of Mayamy Bus was Mendoza. The driver of the bus eluded arrest, so Gomez sued Mendoza. She however claimed that she may be the registered owner, but the real owner was SPO1 Cirilo Enriquez, who had the bus attached with Mayamy Transportation Company under the so-called "kabit system." WHO IS LIABLE? REGISTERED OWNER OR REAL OWNER? REGISTERED OWNER. In case of collision of motor vehicles, the person whose name appears in the certificate of registration shall be considered the employer of the person driving the vehicle and shall be directly and primarily liable with the driver under the principle of vicarious liability. The registered owner cannot elude liability by claiming that she is not the true owner of the bus. The rule is founded on public policy. The main aim of motor vehicle registration is to identify the owner so that if any accident happens, or that any damage or injury is caused by the vehicles on the public highways, responsibility therefore can be fixed on a definite individual, the registered owner. NEGOTIABLE INSTRUMENTS LAW HSBC v. CIR G.R. Nos. 166018 & 167728, 04 June 2014 HSBC’s investor-clients maintain Philippine peso and/or foreign currency accounts, which are managed by HSBC through instructions given through electronic messages. The said instructions are standard forms known in the banking industry as SWIFT, or “Society for Worldwide Interbank Financial Telecommunication.” In purchasing shares of stock and other investment in securities, the investor-clients would send electronic messages from abroad instructing HSBC to debit their local or foreign currency accounts and to pay the purchase price therefor upon receipt of the securities. CIR imposed doc. Stamp tax insisting that the electronic messages are bills of exchange. Is it? No. The electronic messages are not signed by the investor-clients as supposed drawers of a bill of exchange; they do not contain an unconditional order to pay a sum certain in money as the payment is supposed to come from a specific fund or account of the investor-clients; and, they are not payable to order or bearer but to a specifically designated third party. Thus, the electronic messages are not bills of exchange. As there was no bill of exchange or order for the payment drawn abroad and made payable here in the Philippines, there could have been no acceptance or payment that may give rise to the imposition of the DST under Section 181 of the Tax Code. MARQUEZ v. ELISAN CREDIT CORPORATION G.R. No. 194642, April 6, 2015 loans and prom notes Marquez obtained a P53,000.00 loan from Elisan, covered by a promissory note which provides for payment of interest and penalty. He also mortgaged his motor vehicle. Then, Marquez obtained a second loan for P55,000.00. On maturity, failed to pay in full. Months after maturity, Marquez was able to pay P56,000.00, an amount greater than the original amount of the loan. Despite this, Elisan still foreclosed the mortgaged saying that it imposed the interest and penalty so Marquez still owed Elisan a sum of money. Marquez denies that he stipulated upon and consented to the interest, penalty and attorney's fees because he purportedly signed the promissory note in blank. This allegation deserves scant consideration. The promissory notes securing the first and second loan contained exactly the same terms and conditions, except for the date and amount of principal. Marquez knew of such terms and conditions even assuming that the entries on the interest and penalty charges were in blank when he signed the promissory note. He is an engineer by profession so he should read documents before signing.

Ting Ting Pua vs. Spouses Tiong and Teng G.R. No. 198660, October 23, 2013 Check is evidence of obligation Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

3

Spouses Tiong and Teng obtained loan from Ting Ting Pua on different occasions, and issued 17 checks, which were all dishonored for DAIF. When sued for payment, spouses insisted they did not obtain loan, as they were business partners with Ting Ting Pua. May a check prove a loan transaction? YES. A check, the entries of which are in writing, could prove a loan transaction A check constitutes an evidence of indebtedness and is a veritable proof of an obligation. Under Section 24 of the Negotiable Instruments Law, “Every negotiable instrument is deemed prima facie to have been issued for a valuable consideration; and every person whose signature appears thereon to have become a party for value.” Checks completed and delivered to a person by another are sufficient by themselves to prove the existence of the loan obligation obtained by the latter from the former. ALVIN PATRIMONIO vs. NAPOLEON GUTIERREZ AND OCTAVIO MARASIGAN III G.R. No. 187769, June 4, 2014 Patrimonio and Nap are business partners: Slam Dunk – mini concerts and shows related to basketball. Patrimonio pre-signed checks with instruction. Nap was in need of money so he took out a loan with Marasigan, who knew of the arrangement between Patrimonio and Nap. But Nap told Octavio the money was for Patrimonio who was then building a house. Nap used the checks signed by Patrimonio. Checks bounced. Marasigan sued Patrimonio. Under Sec. 14, NIL, if the maker or drawer delivers a pre-signed blank paper to another person for the purpose of converting it into a negotiable instrument, that person is deemed to have prima facie authority to fill it up. To collect payment, it must be filed up strictly in accordance with the authority given and within a reasonable time. SEC. 14 is a personal defense. Meaning, a holder not a HIDC may not be able to collect payment if Incomplete but Delivered Instrument is raised as a defense. Is Marasigan a HIDC? NO. Section 52(c) of the NIL states that a holder in due course is one who takes the instrument "in good faith and for value." Acquisition in good faith means taking without knowledge or notice of equities of any sort which could be set up against a prior holder of the instrument. It means that he does not have any knowledge of fact which would render it dishonest for him to take a negotiable paper. In this case, after having been found out that the blanks were not filled up in accordance with the authority the Patrimonio gave, Marasigan has no right to enforce payment against Patrimonio, thus, the latter cannot be obliged to pay the face value of the check. RCBC SAVINGS BANK versus - NOEL M. ODRADA, G.R. No. 219037,October 19, 2016 MANAGER'S CHECKS Lim purchased a second hand Montero from Odrada. Loan financed by RCBC. Manager's check as payment. Later, there were issues with the roadworthiness of the Montero so Lim called Odrada and told him not to deposit the check. Lim also instructed RCBC not to honor the check. Despite notice, Odrada deposited the check. Dishonored. Sued Lim and RCBC. ISNT IT THAT MANAGER'S CHECKS ARE TREATED AS GOOD AS CASH? While a manager's check is automatically accepted, a holder other than a holder in due course is still Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

4

subject to defenses. The drawee bank of a manager's check may interpose personal defenses of the purchaser of the manager's check if the holder is not a holder in due course. ODRADA had notice. In short, the purchaser of a manager's check may validly countermand payment to a holder who is not a holder in due course. Accordingly, the drawee bank may refuse to pay the manager's check by interposing a personal defense of the purchaser. The mere issuance of a manager's check creates a privity of contract between the holder and the drawee bank, the latter primarily binding itself to pay according to the tenor of its acceptance. The drawee bank, as a result, has the unconditional obligation to pay a manager's check to a holder in due course irrespective of any available personal defenses. However, while this Court has consistently held that a manager's check is automatically accepted, a holder other than a holder in due course is still subject to defenses. METROBANK vs. WILFRED N. CHIOK G.R. No. 172652 November 26, 2014 NO FACTS MANAGER'S CHECKS ; CASHIER'S CHECKS The accepted banking practice is that such checks are as good as cash. The legal effects of a manager’s check and a cashier’s check are the same. A manager’s check, like a cashier’s check, is an order of the bank to pay, drawn upon itself, committing in effect its total resources, integrity, and honor behind its issuance. By its peculiar character and general use in commerce, a manager’s check or a cashier’s check is regarded substantially to be as good as the money it represents. BUT Manager’s and cashier’s checks are still the subject of clearing to ensure that the same have not been materially altered or otherwise completely counterfeited. SO NOT PRE-CLEARED. BUT PRE-ACCEPTED by the mere issuance thereof by the bank, which is both its drawer and drawee. Thus, while manager’s and cashier’s checks are still subject to clearing, they cannot be countermanded for being drawn against a closed account, for being drawn against insufficient funds, or for similar reasons such as a condition not appearing on the face of the check. However, in view of the peculiar circumstances of the case at bench, We are constrained to set aside the foregoing concepts and principles in favor of the exercise of the right to rescind a contract upon the failure of consideration thereof. RIVERA v. SPOUSES CHUA G.R. No. 184458, January 14, 2015 citing Nacar v. Gallery Frames, G.R. No. 189871, 13 August 2013 BSP Circular No. 799; beginning 1 July 2013 = 6% At the time interest accrued from 1 January 1996, the date of default under the Promissory Note, the then prevailing rate of legal interest was 12% per annum under Central Bank (CB) Circular No. 416 in cases involving the loan or forbearance of money. Thus, the legal interest accruing from the Promissory Note is 12% per annum from the date of default on 1 January 1996. However, the 12% per annum rate of legal interest is only applicable until 30 June 2013, before the advent and effectivity of Bangko Sentral ng Pilipinas (BSP) Circular No. 799, Series of 2013 reducing the rate of legal interest to 6% per annum. Pursuant to our ruling in Nacar v. Gallery Frames, BSP Circular No. 799 is prospectively applied from 1 July 2013. In short, the applicable rate of legal interest from 1 January 1996, the date when Rivera defaulted, to date when this Decision becomes final and executor is divided into two periods reflecting two rates of legal interest: (1) 12% per annum from 1 January 1996 to 30 June 2013; and (2) 6% per annum FROM 1 July 2013 to date when this Decision becomes final and executory. INSURANCE LAW ALPHA INSURANCE AND SURETY CO. vs. ARSENIA SONIA CASTOR G.R. No. 198174, September 02, 2013 Castor insured her Toyota Revo against loss or damage with Alpha. Unfortunately, the car was stolen by her driver. Alpha denied the insurance claim on the ground that the insurance policy provides that: The Company shall Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

5

not be liable for any malicious damage caused by the Insured, any member of his family or by “A PERSON IN THE INSURED’S SERVICE. Castor insists the policy also provided: The insurance company, subject to the limits of liability, is obligated to indemnify the insured against theft. Which of the two provisions must prevail? Interpretation of contract. Always in favor of insured (if ambiguous terms) Contracts of insurance, like other contracts, are to be construed according to the sense and meaning of the terms which the parties themselves have used. If such terms are clear and unambiguous, they must be taken and understood in their plain, ordinary and popular sense. Accordingly, in interpreting the exclusions in an insurance contract, the terms used specifying the excluded classes therein are to be given their meaning as understood in common speech. A contract of insurance is a contract of adhesion. So, when the terms of the insurance contract contain limitations on liability, courts should construe them in such a way as to preclude the insurer from non-compliance with the obligation. Theft perpetrated by a driver of the insured is not an exception to the coverage from the insurance policy subject of this case. Thus, there being no categorical declaration of exception, the same must be covered. As correctly pointed out by the plaintiff, “(A)n insurance contract should be interpreted as to carry out the purpose for which the parties entered into the contract which is to insure against risks of loss or damage to the goods. Such interpretation should result from the natural and reasonable meaning of language in the policy. Where restrictive provisions are open to two interpretations, that which is most favorable to the insured is adopted. INCONTESTABILITY CLAUSE MANILA BANKERS LIFE INSURANCE CORPORATION vs. CRESENCIA P. ABAN G.R. No. 175666. July 29, 2013 Sotero took out a life insurance policy from Manila Bankers Life Insurance Corporation (Bankers Life), designating Aban (Aban), her niece, as beneficiary. Policy issued after the requisite medical examination and payment of the insurance premium. On April 10, 1996, when the insurance policy had been in force for more than two years and seven months, Sotero died. Aban claimed proceeds but denied due to fraud, concealment and/or misrepresentation which renders it voidable. Sotero had no means to pay, Aban is an insurance agent and named herself as beneficiary. Should payment be given to ABAn? YES. The "Incontestability Clause" under Section 48 of the Insurance Code provides that an insurer is given two years – from the effectivity of a life insurance contract and while the insured is alive – to discover or prove that the policy is void ab initio or is rescindible by reason of the fraudulent concealment or misrepresentation of the insured or his agent. After the two-year period lapses, or when the insured dies within the period, the insurer must make good on the policy, even though the policy was obtained by fraud, concealment, or misrepresentation. After a policy of life insurance made payable on the death of the insured shall have been in force during the lifetime of the insured for a period of two years from the date of its issue or of its last reinstatement, the insurer cannot prove that the policy is void ab initio or is rescindible by reason of the fraudulent concealment or misrepresentation of the insured or his agent. Section 48 regulates both the actions of the insurers and prospective takers of life insurance. It gives insurers enough time to inquire whether the policy was obtained by fraud, concealment, or misrepresentation; on the other hand, it forewarns scheming individuals that their attempts at insurance fraud would be timely uncovered – thus deterring them from venturing into such nefarious enterprise. At the same time, legitimate policy holders are absolutely protected from unwarranted denial of their claims or delay in the collection of insurance proceeds occasioned by allegations of fraud, concealment, or misrepresentation by insurers, claims which may no longer be set up after the two-year period expires as ordained under the law. The insurer is deemed to have the necessary facilities to discover such fraudulent concealment or misrepresentation within a period of two (2) years. It is not fair for the insurer to collect the premiums as long as the insured is still alive, only to raise the issue of fraudulent concealment or misrepresentation when the insured dies in order to defeat the right of the beneficiary to recover under the policy. Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

6

At least two (2) years from the issuance of the policy or its last reinstatement, the beneficiary is given the stability to recover under the policy when the insured dies. The provision also makes clear when the two-year period should commence in case the policy should lapse and is reinstated, that is, from the date of the last reinstatement. INCONTESTABILITY CLAUSE Insular Life Assurance v. Khu gr No. 195276 April 18, 2016 Art. 48, IC, The date of last reinstatement pertains to the date that the insurer approved the application for reinstatement. Sunlife of Canada (Philippines), Inc. v. Sibya, et. al. G.R. No. 211212, 08 June 2016, Reyes, J: After the two-year period from the effectivity of a life insurance contract lapses, or when the insured dies within said period, the insurer must make good on the policy, even though the policy was obtained by fraud, concealment, or misrepresentation. ---Paramount Insurance V. Spouses Remondeulaz Gr 173773, November 28 2012 THEFT CLAUSE Remondeulaz insured his car against loss or damage. Later, he brought it to the repair shop for auto-detailing. The agreement was to return it within 3 days, but it was not returned by the shop owner. Claim denied by insurer because car was not lost, it was entrusted to a third person/shop owner. THEFT? YES. When one takes the motor vehicle of another without the latter’s consent even if the motor vehicle is later returned, there is theft – there being intent to gain as the use of the thing unlawfully taken constitutes gain. Also, in Malayan Insurance Co., Inc. v. Court of Appeals, this Court held that the taking of a vehicle by another person without the permission or authority from the owner thereof is sufficient to place it within the ambit of the word theft as contemplated in the policy, and is therefore, compensable. The shop owner's act of depriving Remondeulaz their motor vehicle at, or soon after the transfer of physical possession of the movable property, constitutes theft under the insurance policy, which is compensable. MALAYAN INSURANCE COMPANY, INC. vs. PAP CO., LTD. (PHILIPPINE BRANCH) G.R. No. 200784. August 7, 2013 ALTERATION – FIRE INSURANCE Several equipment of PAP Co. were insured against fire. The contract states that the equipment shall be stored in a building where old computer parts owned by PAP are stored. During the effectivity of the contract, the equipment subject of the insurance were transferred to another building which was factory for repacking of silicone sealant. Fire razed the building, equipment burned. Insured cannot collect. An alteration in the use or condition of a thing insured from that to which it is limited by the policy made without the consent of the insurer, by means within the control of the insured, and increasing the risks, entitles an insurer to rescind a contract of fire insurance. Manulife Philippines v. Ybanez G.R. No. 204736, November 28, 2016, Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

7

Who is the best witness who should have testified? The insurer filed an action for rescission of an insurance contract against the insured for supposed misrepresentation by the insured of her real state of health. The claim is largely based on the insured’s alleged failure to disclose her confinement at the CDH hospital and the records pertaining thereto. During trial, the insured presented its sole witness, the Senior Manager of its Claims and Settlements Department, whose testimony chiefly involved identifying the CDH records, among others. Will this testimony suffice to rescind the contract? No. Who is the best witness who should have testified? The physician or any responsible official of the CDH who could confirm or attest to the due execution and authenticity of the alleged medical records. Manulife had utterly failed to prove by convincing evidence that it had been beguiled, inveigled, or cajoled into selling the insurance to the insured who purportedly with malice and deceit passed himself off as thoroughly sound and healthy, and thus a fit and proper applicant for life insurance. Manulife's sole witness gave no evidence at all relative to the particulars of the purported concealment or misrepresentation allegedly perpetrated by the insured. In fact, Victoriano merely perfunctorily identified the documentary exhibits adduced by Manulife; she never testified in regard to the circumstances attending the execution of these documentary exhibits much less in regard to its contents. Of course, the mere mechanical act of identifying these documentary exhibits, without the testimonies of the actual participating parties thereto, adds up to nothing. These documentary exhibits did not automatically validate or explain themselves. "The fraudulent intent on the part of the insured must be established to entitle the insurer to rescind the contract. Misrepresentation as a defense of the insurer to avoid liability is an affirmative defense and the duty to establish such defense by satisfactory and convincing evidence rests upon the insurer." For failure of Manulife to prove intent to defraud on the part of the insured, it cannot validly sue for rescission of insurance contracts. H.H. HOLLERO CONSTRUCTION, INC. vs. GOVERNMENT SERVICE INSURANCE SYSTEM and POOL OF MACHINERY INSURERS G.R. No. 152334, September 24, 2014 GSIS and Hollero Construction entered into a Project Agreement whereby the latter undertook the development of a GSIS housing project known as Modesta Village Section B. Hollero obligated itself to insure the Project, including all the improvements, under a Contractors’ All Risks (CAR) Insurance which it also obtained with with the GSIS General Insurance Department. The policy provided that all claims must be filed without in the reglementary period of 1 year. 3 thypoons hit the country causing considerable damage to the project. Hollero filed claim with GSIS on April 26, 1990. GSIS rejected the claim on June 1990. GSIS stated in its letter that Hollero did not suffer any loss but Hollero may “dispute its findings.” September 1991 – Hollero filed suit in Court. PRESCRIBED? YES. DEFENSE of Hollero - “may dispute its findings” Because of that phrase, Hollero insists that GSIS did not categorically deny its claim. The prescriptive period for the insured’s action for indemnity should be reckoned from the "final rejection" of the claim. "Final rejection" simply means denial by the insurer of the claims of the insured and not the rejection or denial by the insurer of the insured’s motion or request for reconsideration. The letter may have stated “Hollero may dispute the findings of GSIS” but the said letter was also categorical in denying Hollero's claim because according to GSIS, no loss was suffered by Hollero that may compensable under the policy.

STRONGHOLD INSURANCE CO., INC. v. PAMANA ISLAND RESORT HOTEL AND MARINA CLUB, INC. G.R. No. 174838, June 01, 2016 Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

8

Given the provisions of the Insurance Code, which is a special law, the applicable rate of interest shall be that imposed in a loan or forbearance of money as imposed by the Bangko Sentral ng Pilipinas (BSP), even irrespective of the nature of insurer's liability. In the past years, this rate was at 12% per annum. However, in light of Circular No. 799 issued by the BSP on June 21, 2013 decreasing interest on loans or forbearance of money, the CA's declared rate of 12% per annum shall be reduced to 6% per annum from the time of the circular's effectivity on July 1, 2013. The Court explained in Nacar Gallery Frames that the new rate imposed under the circular could only be applied prospectively, and not retroactively. CORPORATION LAW MACASAET vs. FRANCISCO R. CO, JR. G.R. No. 156759, June 5, 2013 DID YOU KNOW THAT ABANTE TONITE IS NOT INCORPORATED? A retired police officer sued Abante Tonite, its publisher Macasaet and other officers. Sheriff tried to serve the summons but all the officers/defendants were out. Sheriff resorted to substituted service. The officers of Abante Tonite moved for the dismissal of the case on the ground of lack of jurisdiction over their persons. They insisted that the summons should have been served personally on each of them. Also, Abante Tonite according to the officers is not incorporated so it should be dropped as a party to the suit. May Abante Tonite be sued even if it is not incorporated? YES. The non-incorporation of AbanteTonite was of no consequence for, otherwise, anyone who suffers damage from the publication of the articles in the pages of its tabloids would be left without recourse. Corporation by estoppel results when a corporation represented itself to the reading public as such despite its not being incorporated. It is founded on principles of equity and is designed to prevent injustice and unfairness. PIERCING CORPORATE VEIL JOSE EMMANUEL P. GUILLERMO v. CRISANTO P. USON G.R. No. 198967, March 07, 2016 iLLEGAL DISMISSAL CASE. Officers not impleaded in the case, only the corporation. Final judgment against corporation, unsatisfied. Uson filed Motion to Hold Directors and Officers liable? Allowed? YES. The veil of corporate fiction can be pierced, and responsible corporate directors and officers or even a separate but related corporation, may be impleaded and held answerable solidarily in a labor case, even after final judgment and on execution, so long as it is established that such persons have deliberately used the corporate vehicle to unjustly evade the judgment obligation, or have resorted to fraud, bad faith or malice.. Guillermo as President and General Manager of the company FIRED Uson. He also received the summons to the case, and who also subsequently and without justifiable cause refused to receive all notices and orders of the Labor Arbiter that followed. Bad faith. Republic Of The Philippines v. Mega Pacific Esolutions, Inc. G.R. No. 184666, June 27, 2016 For the 2004 elections, the COMELEC attempted to implement the automated election system. Mega Pacific eSolutions, Inc. (MPEI), as lead company, purportedly formed a joint venture - known as the Mega Pacific Consortium (MPC) won in the bidding and Comelec awarded the automation project to MPC. Later, the SC in another case – declared as void the aforesaid contract because MPEI was declared as disqualified to bid. The Republic sought to recover the payments made to MPC. Republic wanted to implead the officers of MPEI, the latter objected since it was MPEI which entered into contract with Comelec. Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

9

May the officers be impleaded? YES. MPEI had perpetrated a scheme against COMELEC to secure the automation contract. MPEI was created 11 days before the bidding. The officers must be held liable. Pierce corporate fiction.

Erson Ang Lee Doing Business As "SUPER Lamination Services," Versus - Samahang Manggagawa Ng Super Lamination (SMSLSNAFLU-KMU) G.R. No. 193816, First Division, November 21, 2016

The Court has time and again disregarded separate juridical personalities under the doctrine of piercing the corporate veil where a separate legal entity is used to defeat public convenience, justify wrong, protect fraud, or defend crime, among other grounds. Anna Teng v. Securities And Exchange Commission (SEC) And Ting Ping Lay, G.R. No. 184332, February 17, 2016 Ting Ping purchased SHARES of stock of TCL Sales Corporation (TCL) from different shareholders. Later, he requested TCL to record his acquisition and to issue new certificates of stock in his favor. TCL refused on the ground that the previous stockholders from whom Ting Ping purchased his stocks have not yet returned their Certificates. JUSTIFIED? YES. The surrender of the original certificate of stock is necessary before the issuance of a new one so that the old certificate may be cancelled. A corporation is not bound and cannot be required to issue a new certificate unless the original certificate is produced and surrendered. Surrender and cancellation of the old certificates serve to protect not only the corporation but the legitimate shareholder and the public as well, as it ensures that there is only one document covering a particular share of stock. BANKING LAWS

Land Bank Of The Philippines v. Narciso L. Kho G.R. No. 205839; Ma. Lorena Flores And Alexander Cruz vs. Narciso L. Kho G.R. No. 205840, July 7, 2016

MISCREDITING OF AMOUNT IN ACCOUNTS. Oñate opened and maintained seven trust accounts with Land Bank. LANDBANK demanded return of P4M – miscrediting. Onate refused saying his funds came from legitimate sources.

LANDBANK lost. A bank who mismanages the trust accounts of its client cannot benefit from the inaccuracies of the reports resulting therefrom. It cannot impute the consequence of its negligence to the client. The bank must record every single transaction accurately, down to the last centavo and as promptly as possible. This has to be done if the account is to reflect at any given time the amount of money the depositor can dispose of as he sees fit, confident that the bank will deliver it as and to whomever he directs. Intellectual Property Code of the Philippines JURISDICTION RA No. 8293 (Intellectual Property Code of the Philippines). Sec. 170 of RA No. 8293 provides the penalty for violation of the aforesaid provisions: Independent of the civil and administrative sanctions imposed by law, a criminal penalty of imprisonment from two (2) years to five (5) years and a fine ranging from Fifty thousand pesos (P50,000) to Two hundred thousand pesos(P200,000), shall be imposed on any person who is found guilty of committing any of the acts mentioned in Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard 10 Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

Section 155, Section 168 and Subsection 169.1. However, albeit the penalty of imprisonment is within the purview of the first level court, it is settled that violations of RA No. 8293 fall within the jurisdiction of the Regional Trial Court, duly designated as Special Commercial Court. This has been settled in the cases of Samson v. Daway1 and Samson v. Cabanos.2

UFC Philippines, Inc. (NOW Merged With Nutri-Asia, Inc., With Nutri-Asia, Inc. As The Surviving Entity) V. Fiesta Barrio Manufacturing Corporation G.R. No. 198889, January 20, 2016 Respondent Fiesta Barrio applied for registration of the mark “PAPA BOY” for lechon sauces. UFC opposed saying it has a product known as “PAPA BANANA KETCHUP.” May the mark be registered? No. THE consuming public would be confused.

Respondent had an infinite field of words and combinations of words to choose from to coin a mark for its lechon sauce. ABS CBN v. GOZON March 11, 2015 ABS had a live footage of the arrival/ homecoming of OFW and Iraqi militant hostage victim Angelo dela Cruz. It allowed Reuters to air the footages it had taken earlier under a special embargo agreement. GMA-7 subscribes to Reuters and it received a live video feed coverage of Angelo dela Cruz’ arrival from them. Thereafter, it carried the live newsfeed in its program “Flash Report” together with its live broadcast. ABS CBN sued for infringement. Channel 7 liable. News or the event itself is not copyrightable. However, an event can be captured and presented in a specific medium. News coverage in television involves framing shots, using images, graphics, and sound effects. It involves creative process and originality. Television news footage is an expression of the news. News as expressed in a video footage is entitled to copyright protection. ANTI-MONEY LAUNDERING LAW

Subido Pagente Certeza Mendoza And Binay Law Offices, Versus - The Court Of Appeals G.R. No. 216914 December 6, 2016

In 2015, a year before the 2016 presidential elections, reports abound on the supposed disproportionate wealth of then Vice President Jejomar Binay and the rest of his family, some of whom were likewise elected public officers. The Office of the Ombudsman and the Senate conducted investigations and inquiries thereon. A news report came out in Manila Times that the AMLC asked the CA to allow it to look into the law office linked to the Binay family, the Subido Pagente Certeza Mendoza & Binay Law Firm, where the Vice President's daughter Abigail was a former partner. Petitioner questioned this saying it was deprived of due process, and the AMLC cannot asked the CA to look into its account, ex parte. EX PARTE ALLOWED? YES. This is not yet freezing account. No violation of due process. It is after the freeze order is issued that the bank owner may question the seizure.

1 2

G.R. Nos. 160054-55, 21 July 2004. G.R. No. 161693, 28 June 2005. Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard 11 Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

PNR – jointly and solidarily liable with the school bus SULPICIO LINES, INC. vs. NAPOLEON SESANTE G.R. NO. 172682, July 27, 2016 Water transportation; Is vessel liable even if the sinking was due to force majuere? In 1998, M/V Princess of the Orient sank near Fortune Island in Batangas. Of the 388 recorded passengers, 150 were lost. Napoleon Sesante, then a member of the Philippine National Police (PNP) and a lawyer, was one of the passengers who survived the sinking. He sued the petitioner for breach of contract and damages alleging that Sulpicio Lines committed bad faith in allowing the vessel to sail despite the storm signal. In its defense, the petitioner insisted on the seaworthiness of the M/V Princess of the Orient due to its having been cleared to sail from the Port of Manila by the proper authorities; that the sinking had been due to force majeure. Should damages be awarded? YES. The trial court is not required to make an express finding of the common carrier's fault or negligence. The presumption of negligence applies so long as there is evidence showing that: (a) a contract exists between the passenger and the common carrier; and (b) the injury or death took place during the existence of such contract. In such event, the burden shifts to the common carrier to prove its observance of extraordinary diligence, and that an unforeseen event or force majeure had caused the injury. However, for a common carrier to be absolved from liability in case of force majeure, it is not enough that the accident was caused by a fortuitous event. The common carrier must still prove that it did not contribute to the occurrence of the incident due to its own or its employees' negligence. It is true that there was force majeure. There were big waves 7-8 meters high. But it was also established that the sinking was due to high speed of the vessel and the faulty manuever of the captain of the ship. NEGLIGENCE CATHAY PACIFIC AIRWAYS, LTD. v. SPOUSES ARNULFO and EVELYN FUENTEBELLA G. R. No. 188283, July 20, 2016, Congressman; downgrading of seats Congressman Fuentebuella travelled with his wife, Evelyn, to Sydney Austrailia along with other members of Congress on an official business trip. They purchased business class tickets, but later the Fuentebellas upgraded their tickets to First Class. Cathay Pacific admitted that first class tickets were purchased, but according to the carrier, the tickets were “waitlisted.” The spouses lined up in the First Class counter, but they were given business class boarding passes. They did not notice this until they were denied entry into the first class lounge. Cong. Fuentebella demanded entry into the lounge, and the issuance of first class boarding passes, but the ground staff was discourteous. The other congressmen were able to travel first class. DAMAGES? YES. The aggrieved party does not have to prove that the common carrier was at fault or was negligent; all that he has to prove is the existence of the contract and the fact of its nonperformance by the carrier. In this case, both the trial and appellate courts found that respondents were entitled to First Class accommodations under the contract of carriage, and that petitioner failed to perform its obligation. However, the award of P5 million as moral damages is excessive, considering that the highest amount ever awarded by this Court for moral damages in cases involving airlines is P500,000. As said in Air France v. Gillego, "the mere fact that respondent was a Congressman should not result in an automatic increase in the moral and exemplary damages." Upon the facts established, the amount of P500,000 as moral damages is reasonable to obviate the moral suffering that respondents have undergone. With regard to exemplary damages, jurisprudence shows that P50,000 is sufficient to deter similar acts of bad faith attributable to airline representatives. MENDOZA vs. GOMEZ G.R. No. 160110, June 18, 2014 Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

2

Kabit system A truck was hit by Mayamy Bus, Gomez was injured. The registered owner of Mayamy Bus was Mendoza. The driver of the bus eluded arrest, so Gomez sued Mendoza. She however claimed that she may be the registered owner, but the real owner was SPO1 Cirilo Enriquez, who had the bus attached with Mayamy Transportation Company under the so-called "kabit system." WHO IS LIABLE? REGISTERED OWNER OR REAL OWNER? REGISTERED OWNER. In case of collision of motor vehicles, the person whose name appears in the certificate of registration shall be considered the employer of the person driving the vehicle and shall be directly and primarily liable with the driver under the principle of vicarious liability. The registered owner cannot elude liability by claiming that she is not the true owner of the bus. The rule is founded on public policy. The main aim of motor vehicle registration is to identify the owner so that if any accident happens, or that any damage or injury is caused by the vehicles on the public highways, responsibility therefore can be fixed on a definite individual, the registered owner. NEGOTIABLE INSTRUMENTS LAW HSBC v. CIR G.R. Nos. 166018 & 167728, 04 June 2014 HSBC’s investor-clients maintain Philippine peso and/or foreign currency accounts, which are managed by HSBC through instructions given through electronic messages. The said instructions are standard forms known in the banking industry as SWIFT, or “Society for Worldwide Interbank Financial Telecommunication.” In purchasing shares of stock and other investment in securities, the investor-clients would send electronic messages from abroad instructing HSBC to debit their local or foreign currency accounts and to pay the purchase price therefor upon receipt of the securities. CIR imposed doc. Stamp tax insisting that the electronic messages are bills of exchange. Is it? No. The electronic messages are not signed by the investor-clients as supposed drawers of a bill of exchange; they do not contain an unconditional order to pay a sum certain in money as the payment is supposed to come from a specific fund or account of the investor-clients; and, they are not payable to order or bearer but to a specifically designated third party. Thus, the electronic messages are not bills of exchange. As there was no bill of exchange or order for the payment drawn abroad and made payable here in the Philippines, there could have been no acceptance or payment that may give rise to the imposition of the DST under Section 181 of the Tax Code. MARQUEZ v. ELISAN CREDIT CORPORATION G.R. No. 194642, April 6, 2015 loans and prom notes Marquez obtained a P53,000.00 loan from Elisan, covered by a promissory note which provides for payment of interest and penalty. He also mortgaged his motor vehicle. Then, Marquez obtained a second loan for P55,000.00. On maturity, failed to pay in full. Months after maturity, Marquez was able to pay P56,000.00, an amount greater than the original amount of the loan. Despite this, Elisan still foreclosed the mortgaged saying that it imposed the interest and penalty so Marquez still owed Elisan a sum of money. Marquez denies that he stipulated upon and consented to the interest, penalty and attorney's fees because he purportedly signed the promissory note in blank. This allegation deserves scant consideration. The promissory notes securing the first and second loan contained exactly the same terms and conditions, except for the date and amount of principal. Marquez knew of such terms and conditions even assuming that the entries on the interest and penalty charges were in blank when he signed the promissory note. He is an engineer by profession so he should read documents before signing.

Ting Ting Pua vs. Spouses Tiong and Teng G.R. No. 198660, October 23, 2013 Check is evidence of obligation Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

3

Spouses Tiong and Teng obtained loan from Ting Ting Pua on different occasions, and issued 17 checks, which were all dishonored for DAIF. When sued for payment, spouses insisted they did not obtain loan, as they were business partners with Ting Ting Pua. May a check prove a loan transaction? YES. A check, the entries of which are in writing, could prove a loan transaction A check constitutes an evidence of indebtedness and is a veritable proof of an obligation. Under Section 24 of the Negotiable Instruments Law, “Every negotiable instrument is deemed prima facie to have been issued for a valuable consideration; and every person whose signature appears thereon to have become a party for value.” Checks completed and delivered to a person by another are sufficient by themselves to prove the existence of the loan obligation obtained by the latter from the former. ALVIN PATRIMONIO vs. NAPOLEON GUTIERREZ AND OCTAVIO MARASIGAN III G.R. No. 187769, June 4, 2014 Patrimonio and Nap are business partners: Slam Dunk – mini concerts and shows related to basketball. Patrimonio pre-signed checks with instruction. Nap was in need of money so he took out a loan with Marasigan, who knew of the arrangement between Patrimonio and Nap. But Nap told Octavio the money was for Patrimonio who was then building a house. Nap used the checks signed by Patrimonio. Checks bounced. Marasigan sued Patrimonio. Under Sec. 14, NIL, if the maker or drawer delivers a pre-signed blank paper to another person for the purpose of converting it into a negotiable instrument, that person is deemed to have prima facie authority to fill it up. To collect payment, it must be filed up strictly in accordance with the authority given and within a reasonable time. SEC. 14 is a personal defense. Meaning, a holder not a HIDC may not be able to collect payment if Incomplete but Delivered Instrument is raised as a defense. Is Marasigan a HIDC? NO. Section 52(c) of the NIL states that a holder in due course is one who takes the instrument "in good faith and for value." Acquisition in good faith means taking without knowledge or notice of equities of any sort which could be set up against a prior holder of the instrument. It means that he does not have any knowledge of fact which would render it dishonest for him to take a negotiable paper. In this case, after having been found out that the blanks were not filled up in accordance with the authority the Patrimonio gave, Marasigan has no right to enforce payment against Patrimonio, thus, the latter cannot be obliged to pay the face value of the check. RCBC SAVINGS BANK versus - NOEL M. ODRADA, G.R. No. 219037,October 19, 2016 MANAGER'S CHECKS Lim purchased a second hand Montero from Odrada. Loan financed by RCBC. Manager's check as payment. Later, there were issues with the roadworthiness of the Montero so Lim called Odrada and told him not to deposit the check. Lim also instructed RCBC not to honor the check. Despite notice, Odrada deposited the check. Dishonored. Sued Lim and RCBC. ISNT IT THAT MANAGER'S CHECKS ARE TREATED AS GOOD AS CASH? While a manager's check is automatically accepted, a holder other than a holder in due course is still Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

4

subject to defenses. The drawee bank of a manager's check may interpose personal defenses of the purchaser of the manager's check if the holder is not a holder in due course. ODRADA had notice. In short, the purchaser of a manager's check may validly countermand payment to a holder who is not a holder in due course. Accordingly, the drawee bank may refuse to pay the manager's check by interposing a personal defense of the purchaser. The mere issuance of a manager's check creates a privity of contract between the holder and the drawee bank, the latter primarily binding itself to pay according to the tenor of its acceptance. The drawee bank, as a result, has the unconditional obligation to pay a manager's check to a holder in due course irrespective of any available personal defenses. However, while this Court has consistently held that a manager's check is automatically accepted, a holder other than a holder in due course is still subject to defenses. METROBANK vs. WILFRED N. CHIOK G.R. No. 172652 November 26, 2014 NO FACTS MANAGER'S CHECKS ; CASHIER'S CHECKS The accepted banking practice is that such checks are as good as cash. The legal effects of a manager’s check and a cashier’s check are the same. A manager’s check, like a cashier’s check, is an order of the bank to pay, drawn upon itself, committing in effect its total resources, integrity, and honor behind its issuance. By its peculiar character and general use in commerce, a manager’s check or a cashier’s check is regarded substantially to be as good as the money it represents. BUT Manager’s and cashier’s checks are still the subject of clearing to ensure that the same have not been materially altered or otherwise completely counterfeited. SO NOT PRE-CLEARED. BUT PRE-ACCEPTED by the mere issuance thereof by the bank, which is both its drawer and drawee. Thus, while manager’s and cashier’s checks are still subject to clearing, they cannot be countermanded for being drawn against a closed account, for being drawn against insufficient funds, or for similar reasons such as a condition not appearing on the face of the check. However, in view of the peculiar circumstances of the case at bench, We are constrained to set aside the foregoing concepts and principles in favor of the exercise of the right to rescind a contract upon the failure of consideration thereof. RIVERA v. SPOUSES CHUA G.R. No. 184458, January 14, 2015 citing Nacar v. Gallery Frames, G.R. No. 189871, 13 August 2013 BSP Circular No. 799; beginning 1 July 2013 = 6% At the time interest accrued from 1 January 1996, the date of default under the Promissory Note, the then prevailing rate of legal interest was 12% per annum under Central Bank (CB) Circular No. 416 in cases involving the loan or forbearance of money. Thus, the legal interest accruing from the Promissory Note is 12% per annum from the date of default on 1 January 1996. However, the 12% per annum rate of legal interest is only applicable until 30 June 2013, before the advent and effectivity of Bangko Sentral ng Pilipinas (BSP) Circular No. 799, Series of 2013 reducing the rate of legal interest to 6% per annum. Pursuant to our ruling in Nacar v. Gallery Frames, BSP Circular No. 799 is prospectively applied from 1 July 2013. In short, the applicable rate of legal interest from 1 January 1996, the date when Rivera defaulted, to date when this Decision becomes final and executor is divided into two periods reflecting two rates of legal interest: (1) 12% per annum from 1 January 1996 to 30 June 2013; and (2) 6% per annum FROM 1 July 2013 to date when this Decision becomes final and executory. INSURANCE LAW ALPHA INSURANCE AND SURETY CO. vs. ARSENIA SONIA CASTOR G.R. No. 198174, September 02, 2013 Castor insured her Toyota Revo against loss or damage with Alpha. Unfortunately, the car was stolen by her driver. Alpha denied the insurance claim on the ground that the insurance policy provides that: The Company shall Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

5

not be liable for any malicious damage caused by the Insured, any member of his family or by “A PERSON IN THE INSURED’S SERVICE. Castor insists the policy also provided: The insurance company, subject to the limits of liability, is obligated to indemnify the insured against theft. Which of the two provisions must prevail? Interpretation of contract. Always in favor of insured (if ambiguous terms) Contracts of insurance, like other contracts, are to be construed according to the sense and meaning of the terms which the parties themselves have used. If such terms are clear and unambiguous, they must be taken and understood in their plain, ordinary and popular sense. Accordingly, in interpreting the exclusions in an insurance contract, the terms used specifying the excluded classes therein are to be given their meaning as understood in common speech. A contract of insurance is a contract of adhesion. So, when the terms of the insurance contract contain limitations on liability, courts should construe them in such a way as to preclude the insurer from non-compliance with the obligation. Theft perpetrated by a driver of the insured is not an exception to the coverage from the insurance policy subject of this case. Thus, there being no categorical declaration of exception, the same must be covered. As correctly pointed out by the plaintiff, “(A)n insurance contract should be interpreted as to carry out the purpose for which the parties entered into the contract which is to insure against risks of loss or damage to the goods. Such interpretation should result from the natural and reasonable meaning of language in the policy. Where restrictive provisions are open to two interpretations, that which is most favorable to the insured is adopted. INCONTESTABILITY CLAUSE MANILA BANKERS LIFE INSURANCE CORPORATION vs. CRESENCIA P. ABAN G.R. No. 175666. July 29, 2013 Sotero took out a life insurance policy from Manila Bankers Life Insurance Corporation (Bankers Life), designating Aban (Aban), her niece, as beneficiary. Policy issued after the requisite medical examination and payment of the insurance premium. On April 10, 1996, when the insurance policy had been in force for more than two years and seven months, Sotero died. Aban claimed proceeds but denied due to fraud, concealment and/or misrepresentation which renders it voidable. Sotero had no means to pay, Aban is an insurance agent and named herself as beneficiary. Should payment be given to ABAn? YES. The "Incontestability Clause" under Section 48 of the Insurance Code provides that an insurer is given two years – from the effectivity of a life insurance contract and while the insured is alive – to discover or prove that the policy is void ab initio or is rescindible by reason of the fraudulent concealment or misrepresentation of the insured or his agent. After the two-year period lapses, or when the insured dies within the period, the insurer must make good on the policy, even though the policy was obtained by fraud, concealment, or misrepresentation. After a policy of life insurance made payable on the death of the insured shall have been in force during the lifetime of the insured for a period of two years from the date of its issue or of its last reinstatement, the insurer cannot prove that the policy is void ab initio or is rescindible by reason of the fraudulent concealment or misrepresentation of the insured or his agent. Section 48 regulates both the actions of the insurers and prospective takers of life insurance. It gives insurers enough time to inquire whether the policy was obtained by fraud, concealment, or misrepresentation; on the other hand, it forewarns scheming individuals that their attempts at insurance fraud would be timely uncovered – thus deterring them from venturing into such nefarious enterprise. At the same time, legitimate policy holders are absolutely protected from unwarranted denial of their claims or delay in the collection of insurance proceeds occasioned by allegations of fraud, concealment, or misrepresentation by insurers, claims which may no longer be set up after the two-year period expires as ordained under the law. The insurer is deemed to have the necessary facilities to discover such fraudulent concealment or misrepresentation within a period of two (2) years. It is not fair for the insurer to collect the premiums as long as the insured is still alive, only to raise the issue of fraudulent concealment or misrepresentation when the insured dies in order to defeat the right of the beneficiary to recover under the policy. Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

6

At least two (2) years from the issuance of the policy or its last reinstatement, the beneficiary is given the stability to recover under the policy when the insured dies. The provision also makes clear when the two-year period should commence in case the policy should lapse and is reinstated, that is, from the date of the last reinstatement. INCONTESTABILITY CLAUSE Insular Life Assurance v. Khu gr No. 195276 April 18, 2016 Art. 48, IC, The date of last reinstatement pertains to the date that the insurer approved the application for reinstatement. Sunlife of Canada (Philippines), Inc. v. Sibya, et. al. G.R. No. 211212, 08 June 2016, Reyes, J: After the two-year period from the effectivity of a life insurance contract lapses, or when the insured dies within said period, the insurer must make good on the policy, even though the policy was obtained by fraud, concealment, or misrepresentation. ---Paramount Insurance V. Spouses Remondeulaz Gr 173773, November 28 2012 THEFT CLAUSE Remondeulaz insured his car against loss or damage. Later, he brought it to the repair shop for auto-detailing. The agreement was to return it within 3 days, but it was not returned by the shop owner. Claim denied by insurer because car was not lost, it was entrusted to a third person/shop owner. THEFT? YES. When one takes the motor vehicle of another without the latter’s consent even if the motor vehicle is later returned, there is theft – there being intent to gain as the use of the thing unlawfully taken constitutes gain. Also, in Malayan Insurance Co., Inc. v. Court of Appeals, this Court held that the taking of a vehicle by another person without the permission or authority from the owner thereof is sufficient to place it within the ambit of the word theft as contemplated in the policy, and is therefore, compensable. The shop owner's act of depriving Remondeulaz their motor vehicle at, or soon after the transfer of physical possession of the movable property, constitutes theft under the insurance policy, which is compensable. MALAYAN INSURANCE COMPANY, INC. vs. PAP CO., LTD. (PHILIPPINE BRANCH) G.R. No. 200784. August 7, 2013 ALTERATION – FIRE INSURANCE Several equipment of PAP Co. were insured against fire. The contract states that the equipment shall be stored in a building where old computer parts owned by PAP are stored. During the effectivity of the contract, the equipment subject of the insurance were transferred to another building which was factory for repacking of silicone sealant. Fire razed the building, equipment burned. Insured cannot collect. An alteration in the use or condition of a thing insured from that to which it is limited by the policy made without the consent of the insurer, by means within the control of the insured, and increasing the risks, entitles an insurer to rescind a contract of fire insurance. Manulife Philippines v. Ybanez G.R. No. 204736, November 28, 2016, Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

7

Who is the best witness who should have testified? The insurer filed an action for rescission of an insurance contract against the insured for supposed misrepresentation by the insured of her real state of health. The claim is largely based on the insured’s alleged failure to disclose her confinement at the CDH hospital and the records pertaining thereto. During trial, the insured presented its sole witness, the Senior Manager of its Claims and Settlements Department, whose testimony chiefly involved identifying the CDH records, among others. Will this testimony suffice to rescind the contract? No. Who is the best witness who should have testified? The physician or any responsible official of the CDH who could confirm or attest to the due execution and authenticity of the alleged medical records. Manulife had utterly failed to prove by convincing evidence that it had been beguiled, inveigled, or cajoled into selling the insurance to the insured who purportedly with malice and deceit passed himself off as thoroughly sound and healthy, and thus a fit and proper applicant for life insurance. Manulife's sole witness gave no evidence at all relative to the particulars of the purported concealment or misrepresentation allegedly perpetrated by the insured. In fact, Victoriano merely perfunctorily identified the documentary exhibits adduced by Manulife; she never testified in regard to the circumstances attending the execution of these documentary exhibits much less in regard to its contents. Of course, the mere mechanical act of identifying these documentary exhibits, without the testimonies of the actual participating parties thereto, adds up to nothing. These documentary exhibits did not automatically validate or explain themselves. "The fraudulent intent on the part of the insured must be established to entitle the insurer to rescind the contract. Misrepresentation as a defense of the insurer to avoid liability is an affirmative defense and the duty to establish such defense by satisfactory and convincing evidence rests upon the insurer." For failure of Manulife to prove intent to defraud on the part of the insured, it cannot validly sue for rescission of insurance contracts. H.H. HOLLERO CONSTRUCTION, INC. vs. GOVERNMENT SERVICE INSURANCE SYSTEM and POOL OF MACHINERY INSURERS G.R. No. 152334, September 24, 2014 GSIS and Hollero Construction entered into a Project Agreement whereby the latter undertook the development of a GSIS housing project known as Modesta Village Section B. Hollero obligated itself to insure the Project, including all the improvements, under a Contractors’ All Risks (CAR) Insurance which it also obtained with with the GSIS General Insurance Department. The policy provided that all claims must be filed without in the reglementary period of 1 year. 3 thypoons hit the country causing considerable damage to the project. Hollero filed claim with GSIS on April 26, 1990. GSIS rejected the claim on June 1990. GSIS stated in its letter that Hollero did not suffer any loss but Hollero may “dispute its findings.” September 1991 – Hollero filed suit in Court. PRESCRIBED? YES. DEFENSE of Hollero - “may dispute its findings” Because of that phrase, Hollero insists that GSIS did not categorically deny its claim. The prescriptive period for the insured’s action for indemnity should be reckoned from the "final rejection" of the claim. "Final rejection" simply means denial by the insurer of the claims of the insured and not the rejection or denial by the insurer of the insured’s motion or request for reconsideration. The letter may have stated “Hollero may dispute the findings of GSIS” but the said letter was also categorical in denying Hollero's claim because according to GSIS, no loss was suffered by Hollero that may compensable under the policy.

STRONGHOLD INSURANCE CO., INC. v. PAMANA ISLAND RESORT HOTEL AND MARINA CLUB, INC. G.R. No. 174838, June 01, 2016 Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

8

Given the provisions of the Insurance Code, which is a special law, the applicable rate of interest shall be that imposed in a loan or forbearance of money as imposed by the Bangko Sentral ng Pilipinas (BSP), even irrespective of the nature of insurer's liability. In the past years, this rate was at 12% per annum. However, in light of Circular No. 799 issued by the BSP on June 21, 2013 decreasing interest on loans or forbearance of money, the CA's declared rate of 12% per annum shall be reduced to 6% per annum from the time of the circular's effectivity on July 1, 2013. The Court explained in Nacar Gallery Frames that the new rate imposed under the circular could only be applied prospectively, and not retroactively. CORPORATION LAW MACASAET vs. FRANCISCO R. CO, JR. G.R. No. 156759, June 5, 2013 DID YOU KNOW THAT ABANTE TONITE IS NOT INCORPORATED? A retired police officer sued Abante Tonite, its publisher Macasaet and other officers. Sheriff tried to serve the summons but all the officers/defendants were out. Sheriff resorted to substituted service. The officers of Abante Tonite moved for the dismissal of the case on the ground of lack of jurisdiction over their persons. They insisted that the summons should have been served personally on each of them. Also, Abante Tonite according to the officers is not incorporated so it should be dropped as a party to the suit. May Abante Tonite be sued even if it is not incorporated? YES. The non-incorporation of AbanteTonite was of no consequence for, otherwise, anyone who suffers damage from the publication of the articles in the pages of its tabloids would be left without recourse. Corporation by estoppel results when a corporation represented itself to the reading public as such despite its not being incorporated. It is founded on principles of equity and is designed to prevent injustice and unfairness. PIERCING CORPORATE VEIL JOSE EMMANUEL P. GUILLERMO v. CRISANTO P. USON G.R. No. 198967, March 07, 2016 iLLEGAL DISMISSAL CASE. Officers not impleaded in the case, only the corporation. Final judgment against corporation, unsatisfied. Uson filed Motion to Hold Directors and Officers liable? Allowed? YES. The veil of corporate fiction can be pierced, and responsible corporate directors and officers or even a separate but related corporation, may be impleaded and held answerable solidarily in a labor case, even after final judgment and on execution, so long as it is established that such persons have deliberately used the corporate vehicle to unjustly evade the judgment obligation, or have resorted to fraud, bad faith or malice.. Guillermo as President and General Manager of the company FIRED Uson. He also received the summons to the case, and who also subsequently and without justifiable cause refused to receive all notices and orders of the Labor Arbiter that followed. Bad faith. Republic Of The Philippines v. Mega Pacific Esolutions, Inc. G.R. No. 184666, June 27, 2016 For the 2004 elections, the COMELEC attempted to implement the automated election system. Mega Pacific eSolutions, Inc. (MPEI), as lead company, purportedly formed a joint venture - known as the Mega Pacific Consortium (MPC) won in the bidding and Comelec awarded the automation project to MPC. Later, the SC in another case – declared as void the aforesaid contract because MPEI was declared as disqualified to bid. The Republic sought to recover the payments made to MPC. Republic wanted to implead the officers of MPEI, the latter objected since it was MPEI which entered into contract with Comelec. Address: Unit 2, 4th Floor, España Place Building, 1139 Adelina Street corner España Boulevard Sampaloc, Manila (Beside UST near Morayta Street) * www.villasislawcenter.com / www.facebook.com/villasislawcenter / www.remediallawdoctrines.blogspot.com / [email protected] / [email protected] Tel. No. (02) 241-4830 / Cel. Nos. (0949) 343-6092; (0922) 898-8626

9

May the officers be impleaded? YES. MPEI had perpetrated a scheme against COMELEC to secure the automation contract. MPEI was created 11 days before the bidding. The officers must be held liable. Pierce corporate fiction.

Erson Ang Lee Doing Business As "SUPER Lamination Services," Versus - Samahang Manggagawa Ng Super Lamination (SMSLSNAFLU-KMU) G.R. No. 193816, First Division, November 21, 2016

The Court has time and again disregarded separate juridical personalities under the doctrine of piercing the corporate veil where a separate legal entity is used to defeat public convenience, justify wrong, protect fraud, or defend crime, among other grounds. Anna Teng v. Securities And Exchange Commission (SEC) And Ting Ping Lay, G.R. No. 184332, February 17, 2016 Ting Ping purchased SHARES of stock of TCL Sales Corporation (TCL) from different shareholders. Later, he requested TCL to record his acquisition and to issue new certificates of stock in his favor. TCL refused on the ground that the previous stockholders from whom Ting Ping purchased his stocks have not yet returned their Certificates. JUSTIFIED? YES. The surrender of the original certificate of stock is necessary before the issuance of a new one so that the old certificate may be cancelled. A corporation is not bound and cannot be required to issue a new certificate unless the original certificate is produced and surrendered. Surrender and cancellation of the old certificates serve to protect not only the corporation but the legitimate shareholder and the public as well, as it ensures that there is only one document covering a particular share of stock. BANKING LAWS

Land Bank Of The Philippines v. Narciso L. Kho G.R. No. 205839; Ma. Lorena Flores And Alexander Cruz vs. Narciso L. Kho G.R. No. 205840, July 7, 2016

MISCREDITING OF AMOUNT IN ACCOUNTS. Oñate opened and maintained seven trust accounts with Land Bank. LANDBANK demanded return of P4M – miscrediting. Onate refused saying his funds came from legitimate sources.