Auditing Theory Mcqs (continuation) By Salosagcol With Answers

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Auditing Theory Mcqs (continuation) By Salosagcol With Answers as PDF for free.

More details

- Words: 5,205

- Pages: 21

Loading documents preview...

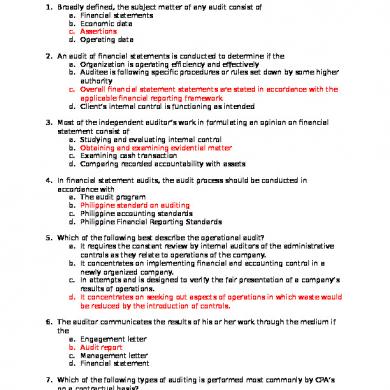

AUDITING THEORY MCQs BY SALOSAGCOL CHAPTER 9 1. Of the following procedures, which does not produce analytical evidence? a. Compare revenue, cost of sales, and gross profit with the prior year and investigate significant variations b. Examine monthly performance reports and investigate significant revenue and expense variances c. Confirm customers account receivable and clear all material exceptions. d. Compare sales trends and profit margins with industry average and investigate significant differences 2. Which of the following comparisons is most useful to an auditor in evaluating the results of an entity’s operations? a. Prior year accounts payable to current year accounts payable b. Prior year payroll expense to budgeted current year payroll expense c. Current year revenue to budgeted current year revenue d. Current year warranty expense to current year contingent liabilities. 3. Which of the following analytical procedures should be applied to the income statement? a. Select sales and expense items and trace amounts to related supporting documents b. Ascertain that the new income amount in the statement of cash flows agrees with the net income amount in the income statements c. Obtain from the client representatives, the beginning and ending inventory amounts that were used to determine costs of sales d. Compare the actual revenues and expenses with the corresponding figures of the previous year and investigate significant differences. 4. Which of the following tends to be most predictable for the purpose of analytical procedures applied as substantive test? a. Relationships involving balance sheet accounts b. Transactions subject to management discretion c. Relationships involving income statement accounts. d. Data subject to audit testing in the prior year 5. Auditors try to identify predictable relationships when using analytical procedures. Relationships involving transactions from which of the following accounts most likely would yield the highest level of evidence? a. Accounts payable b. Advertising expense c. Accounts receivable d. Interest expense. 6. Auditors sometimes use comparison of ratios as audit evidence. For example, an unexplained decrease in the ratio of gross profit to sales may suggest which of the following possibilities? a. Unrecorded purchases b. Unrecorded sales.

AUDITING THEORY MCQs BY SALOSAGCOL c. Merchandise purchase being charged to operating expense d. Fictitious sales 7. Which result of merchandise? a. Decrease b. Decrease c. Decrease d. Decrease

an analytical procedure suggests the existence of obsolete in in in in

the the the the

inventory turnover rate. ratio of gross profit to sales ratio of inventory to accounts payable ratio of inventory to accounts receivable

8. If accounts receivable turned over 8 times in 2014 as compared to only 6 times in 2015, it is possible that there were a. Unrecorded credit sales in 2015. b. Unrecorded cash receipts in 2014 c. More thorough credit investigations made by the company late in 2014 d. Fictitious sales in 2015 9. Which of the following would not be classified as an analytical procedure? a. Benchmarking the company’s profitability ratios against others in the industry b. Variance analysis of actual revenue versus budgeted amounts for production c. Reperforming the client’s depreciation expense using the client’s accounting policies for capital expenditures made during the year d. Reconciling fixed assets disposition with the fixed asset ledger. 10.An auditor compares this year’s revenues and expenses with those of the prior year and investigates all changes exceeding 10%. By this procedure the auditor is most likely to learn that a. An increase in property tax rates has not been recognized in the client’s accrual b. This year’s provision for uncollectible account is inadequate because of worsening economic conditions c. December payroll taxes were not paid d. The client changed its capitalization policy for small tools during the year.

CHAPTER 10

AUDITING THEORY MCQs BY SALOSAGCOL 1. The primary emphasis in most tests of details of balances is on the a. Balance sheet accounts b. Revenue accounts c. Cash flow statements accounts. d. Expense account 2. Evidence is usually more persuasive for balance sheet accounts where it is obtained: a. As close to the balance sheet date as possible b. Only from transactions occurring on the balance sheet date c. From various times throughout the client’s year d. From time period when transactions during the fiscal year. 3. Which of the following assertions is relevant to whether the company has title to the cash accounts as of the balance sheet date? a. Existence or occurrence b. Completeness c. Rights and obligations. d. Valuation or allocation 4. Which of the following assertions is relevant to whether the cash balances reflect the true underlying economic value of those assets? a. Existence or occurrence b. Completeness c. Rights and obligations d. Valuation or allocation. 6. Employee steals a payment from Customer X. To cover the theft, the employee applies a payment from Customer Y to Customer X’s account. Before Customer Y has time to notice that its account has not been appropriately credited, the employee applies a payment from Customer Z to Customer Y’s account. a. Skimming b. Kiting c. Collateralizing d. Lapping. 7. Which of the following controls represents a control over cash that is unique to cash accounts? a. Separation of duties b. Restrictive endorsements of customer checks. c. Periodic internal audits d. Competent, well-trained employees 8. Which of the following assertions is relevant to the audit procedure for marketable securities that requires the auditor to examine selected documents to identify any restrictions on the marketability of securities? a. Existence or occurrence b. Completeness c. Rights and obligations. d. Valuation or allocation

AUDITING THEORY MCQs BY SALOSAGCOL

9. Which of the following represents a reasonable test of controls for cash receipts and cash management controls? a. Document internal controls over cash by completing the internal control questionnaire or by flowcharting the process. b. Prepare an independent bank reconciliation c. Obtain a bank confirmation d. Obtain a bank cutoff statement 10. Which of the following assertions is relevant to whether the marketable securities balances include all securities transactions that have taken place during the period? a. Existence or occurrence b. Completeness. c. Rights and obligations d. Valuation or allocation

CHAPTER 11 1. A proper segregation of duties requires

AUDITING THEORY MCQs BY SALOSAGCOL a. An individual authorizing a transaction records it b. An individual authorizing a transaction maintains a custody of the asset that resulted from the transaction c. An individual maintain custody of an asset be entitled to access the accounting records for the asset d. An individual recording a transaction not compare the accounting record of the asset with the asset itself 2. The primary responsibility for establishing and maintaining an internal control rests with a. The external auditors b. The internal auditors c. Management and those charged with governance d. The controller or the treasurer 3. When the auditor attempts to understand the operation of the accounting system by tracing a few transactions through the accounting system, the auditor is said to be: a. Tracing b. Vouching c. Performing a walk-through d. Testing controls 4. Which of the following statements is incorrect about walk-through tests? a. It involves tracing a few transactions through the accounting systems. b. This procedure may form part of tests of control. c. The nature and extent of walk-through tests performed by the auditor are such that they alone would provide sufficient appropriate audit evidence to support a low assessment of control risk. d. This procedure is performed to determine whether the controls are being implemented. 5. You are auditing the company’s purchasing process for goods and services. You are primarily concerned with the company not recording all purchase transactions. Which audit procedure below would be the most effective audit procedure in this case? a. Vouching from the accounts payable account to the vendor invoices. b. Tracing vendor invoices to recorded amounts in the accounts payable account. c. Confirmation of accounts payable recorded amounts. d. Reconciling the accounts payable subsidiary ledger to the accounts payable account. 6. Which result of merchandise? a. Decrease b. Decrease c. Decrease d. Decrease

an analytical procedure suggests the existence of obsolete in in in in

inventory turnover rate the ratio of gross profit to sales the ratio of inventory to accounts payable the ratio of inventory to accounts receivable

AUDITING THEORY MCQs BY SALOSAGCOL 7. Which of the following is the best example of a corroborating evidence? a. General journal b. Worksheet cost allocations c. Vendor’s invoice d. Cash receipts journal 8. An entity’s ongoing monitoring activities often include a. Periodic audits by the audit committee. b. Reviewing the purchasing function. c. The audit of the annual financial statements. d. Control risk assessment in conjunction with quarterly reviews. 9. Which of the following is an example of fraudulent financial reporting? a. Company management changes inventory count tags and overstates ending inventory, while understating costs of goods sold. b. The treasurer diverts customer payments to his personal due, concealing his actions by debiting an expense account, thus overstating expenses. c. An employee steals small tools from the company and neglects to return them; the cost is reported as a miscellaneous operating expense. d. An employee omitted an entry to record a bank transfer to cover a cash shortage. 10.When obtaining audit evidence about the effective operation of internal controls, the auditor considers all of the following except a. How they were applied b. The consistency with which they were applied during the period c. By whom they were applied d. Why they were applied

AUDITING THEORY MCQs BY SALOSAGCOL CHAPTER 12 1. Which of the following is an internal control weakness related to acquisition of factory equipment? a. Acquisitions are to be made through and approved by the department in need of the equipment. b. Variances between authorized equipment expenditures and actual costs are to be immediately reported to management. c. Depreciation policies are reviewed only once a year. d. Advance executive approvals are required for equipment acquisitions. 2. It is an approximation of the amount of an item in the absence of a precise means of measurement a. Accounting estimate b. Audit sampling c. Materiality d. Audit risk 3. In evaluating the reasonableness of an accounting estimate, an auditor most likely would concentrate on key factors and assumptions that are a. Consistent with prior periods. b. Similar to industry guidelines. c. Objective and not susceptible to bias. d. Deviations from historical patterns. 4. In evaluating an entity’s accounting estimates, one of an auditor’s objectives is to determine whether the estimates are a. Not subject to bias. b. Consistent with the industry guidelines. c. Based on objective assumptions. d. Reasonable in the circumstances. 5. The auditor should adopt one or a combination of the following approaches in the audit of an accounting estimate: I. Review and test the process used by management to develop the estimate. II. Use an independent estimate for comparison with that prepared by management. III. Review subsequent events which confirms the estimate made. a. b. c. d.

Any of the above None of the above Either I or II I only

6. In evaluating the assumptions on which the estimate is based, the auditor would need to pay particular attention to assumptions which are a. Reasonable in light of actual results in prior periods. b. Consistent with those used for other accounting estimates. c. Consistent with management’s plans which appear appropriate.

AUDITING THEORY MCQs BY SALOSAGCOL d. Subjective or susceptible to material misstatement. 7. Which of the following statements is incorrect about accounting estimates? a. Management is responsible for making accounting estimates included in the financial statements. b. The risk of material misstatement is greater when accounting estimates are involved. c. The evidence available to support an accounting estimate will often be more difficult to obtain and less conclusive than evidence available to support other items in the financial statements. d. When evaluating accounting estimates, the auditor should pay particular attention to assumptions that are objective and are consistent with industry patterns. 8. Which of the following would an auditor generally perform to obtain assurance that accounting estimates are properly accounted for and disclosed? a. Inquiry of management b. Make an independent estimate for comparison with client’s estimate c. Review subsequent events d. Obtain knowledge about the applicable financial reporting standards related to the accounting estimate. 9. Which of the following procedures would an auditor least likely perform when evaluating the reasonableness of management’s estimates? a. Make an independent estimates for comparison with management estimates b. Read the minutes of board of director’s meeting c. Review and test the process used by management d. Review subsequent events which confirm the estimates made 10.Which of the following procedures would an auditor ordinarily perform first in evaluating management’s accounting estimates for reasonableness? a. Develop independent expectations of management’s estimates. b. Consider the appropriateness of the key factors or assumption used in preparing the estimates. c. Test the calculations used by the management in developing the estimates. d. Obtain an understanding of how management developed its estimates.

CHAPTER 13

AUDITING THEORY MCQs BY SALOSAGCOL

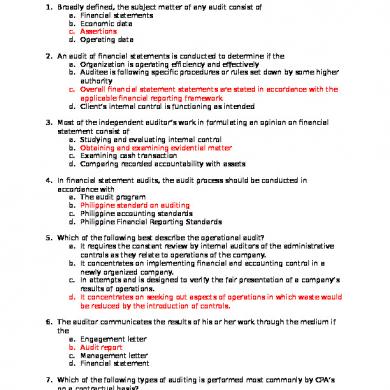

1. The current file of an auditor’s working papers most likely would include a copy of the a. Bank reconciliation b. Articles of incorporation c. Pension plan contract d. Flowchart of the internal control procedures 2. The primary concern of the auditor regarding related party transactions is that a. They are reported to proper regulatory authorities because they are illegal b. Their form be emphasized rather than their economic substance c. Their existence and significance be adequately disclosed d. Their effects are eliminated from the financial statements 3. The permanent file of an auditor’s working papers generally would not include a. Bond indenture agreements b. Working trial balance c. Lease agreements d. Flowchart of the intentional control structure 4. A person or firm possessing special skill, knowledge and experience in a particular field other than accounting and auditing is called a/an a. Professional b. Consultant c. Expert d. Assistant 5. Which of the following is not an expert upon whose work an auditor may rely? a. Actuary b. Internal auditor c. Appraiser d. Engineer 6. To operate effectively, an internal auditor must be independent of a. The line functions of the organization b. The entity c. The employer-employee relationship which exists for other employees in the organization d. The audit committee of the board of directors 7. The sufficiency and appropriateness of evidential matter ultimately is based on the a. Availability of corroborating data b. Philippine Standards on Auditing c. Pertinence of the evidence d. Judgment of the auditor 8. An auditor’s working papers will generally be least likely to include documentation showing how the a. Client’s schedules were prepared

AUDITING THEORY MCQs BY SALOSAGCOL b. Engagement had been planned c. Client’s system of internal control had been reviewed and evaluated d. Unusual matters were resolved 9. Audit files that are updated with new information of continuing importance is called a. Current files b. Working paper file c. Permanent files d. Correspondence file 10. The permanent (continuing) file of an auditor’s working papers more likely would include copies of the a. Bank statements b. Lead schedule c. Debt agreements d. Attorney’s letters

AUDITING THEORY MCQs BY SALOSAGCOL CHAPTER 14 1. “Subsequent events” are defined as events which occur subsequent to the a. Financial statement date b. Date of the auditor’s report c. Financial statement date but prior to the date of the auditor’s report d. Date of the auditor’s report and concern contingencies which are not reflected in the financial statements 2. Which of the following events in the subsequent period will require disclosure in the notes to financial statements? a. Realization of recorded year-end receivables at a different amount than recorded b. Settlement of recorded year-end estimated product warranty liabilities at a different amount than recorded c. Purchase of a machine d. Purchase of a business 3. Which of the following statements about a representation letter is not correct? a. It is optional b. It is addressed to the auditor c. It confirms oral representation made by management d. Its date should coincide with the date of the audit report 4. A representation letter issued by a client a. Is essential for the preparation of the audit program b. Is a substitute for testing c. Does not reduce auditor’s responsibility d. Reduces the auditor’s responsibility only to the extent that it is relied upon 5. Which of the following conditions or events most likely would cause an auditor to have significant doubt about an entity’s ability to continue as a going concern? a. Cash flow from operating activities are negative b. Research and development projects are postponed c. Significant related party transactions are pervasive d. Stock dividends replace annual cash dividends 6. The date of the management representation letter should coincide with the date of the a. Balance sheet b. Latest interim financial statements c. Auditor’s report d. Latest related party transaction 7. If a lawyer refuses to furnish corroborating information regarding litigation, claims and assessments, the auditor should a. Honor the confidentiality of the client-lawyer relationship b. Consider the refusal to be tantamount to a scope limitation c. Seek to obtain the corroborating information from management d. Disclose this fact in a footnote to the financial statements

AUDITING THEORY MCQs BY SALOSAGCOL 8. Soon after Kyle’s audit report was issued, Kyle learned of certain related party transactions that occurred during the year under audit. These transactions that occurred during the year under audit. These transactions were not disclosed in the notes to the financial statements. Kyle should a. Plan to audit the transactions during the next engagement b. Recall all copies of the audited financial statements c. Determine whether the lack of disclosure would affect the auditor’s report d. Ask the client to disclose the transactions in subsequent interim statements 9. The auditor is most likely to discover omitted audit procedures during a. Preparation of the management letter b. Follow-up procedures performed in compliance with generally accepted auditing standards c. The conference held with the client prior to issuing the audit report d. A post engagement review performed as part of the firm’s quality control inspection program 10. When an investigation of the discovery of facts existing at the report date confirms the existence of the fact and the auditor believes the information is important to those relying or likely to rely on the financial statements, the auditor should immediately: a. Take steps to prevent future reliance on the audit report b. Notify the SEC or other regulatory agency c. Resign from the engagement d. Take no action since the auditor is not responsible for such matters

AUDITING THEORY MCQs BY SALOSAGCOL

CHAPTER 15 1. Which of the following statement is not correct about the unmodified audit report in the financial statement? a. The auditor’s report shall include a section with a heading “Management’s Responsibility for the financial statements” b. The auditor’s report shall include a section with a heading “Auditor’s Responsibility” c. The auditor’s report shall include a section with a heading “Basis for Opinion” d. The auditor’s report shall include a section with a heading “Opinion” 2. PSA 700 requires the auditor’s report to describe management’s responsibility for the financial statements. The description shall include an explanation that management is responsible for the preparation of the financial statements and a. For selecting and applying appropriate accounting policies b. For such internal control as it determines necessary to enable the preparation of financial statement that are free from material misstatement c. For making accounting estimates that are reasonable in the circumstances d. Preventing collusion among employees 3. Which section of the auditor’s report gives a general description of opinion a. Introductory paragraph b. Auditor’s responsibility c. Management’s responsibility d. Auditor’s Opinion 4. The auditor’s inability to obtain sufficient appropriate audit evidence may arise from all of the following conditions, except a. Restriction imposed my management on the scope of the audit b. Limitations beyond the control of the entity c. Limitations relating to the nature or timing of the auditor’s work d. Restrictions on the disclosures in the financial statements 5. When an auditor expresses a qualified opinion due to a material misstatement, the auditor shall include in the opinion paragraph A description of material misstatement a. b. c.

Yes Yes No

A quantification of effects of misstatement if practicable No Yes No

AUDITING THEORY MCQs BY SALOSAGCOL d.

No

Yes

6. Which of the following is correct about “Emphasis of a Matter” paragraph a. In a very rare circumstances, the “Emphasis of a Matter” paragraph may be used as a substitute for a qualification of an opinion b. An “Emphasis of a Matter” paragraph may be used to give emphasis to as specific item that has not been appropriately disclosed in the notes to the financial statements c. An “Emphasis of a Matter” paragraph may be used to restrict the distribution of the auditor’s report when examining special purpose financial statements d. An “Emphasis of a Matter” paragraph may be used to alert the readers that the financial statement are presented in accordance with a special purpose framework 7. Which of the following circumstances will least likely affect the auditor’s opinion? a. A client imposed scope limitation b. A circumstance imposed scope limitations c. Inadequacy of disclosure in the notes to financial statements d. Uncertainty arises about entity’s continued existence 8. When reporting on comparative financial statements where the financial statements of the prior year have been examined by the predecessor auditor whose report is not presented, the successor auditor should make a. No reference to the predecessor auditor b. Reference to the predecessor auditor only if the predecessor auditor expressed a qualified opinion c. Reference to the predecessor auditor only if the predecessor auditor expressed an unmodified opinion d. Reference to the predecessor auditor regardless of the type of opinion expressed by the predecessor auditor 9. Which of the following best describes the auditor’s responsibility for “other information” included in the annual report to the stockholders that contains financial statements and the auditor’s report? a. The auditor has no obligation to read the other information. b. The auditor has no obligation to corroborate the other information but should read it to determine whether it is materially inconsistent with the financial statements c. The auditor should extend the examination to the extent necessary to verify the other information. d. The auditor must modify the auditor’s report to state that the other information is unaudited or not covered by the auditor’s report

AUDITING THEORY MCQs BY SALOSAGCOL 10.If the auditor’s report on audited financial statements contains an adverse or disclaimer of opinion, the auditor’s report on the summary financial statements should a. Not have to indicate the fact that the auditor’s report on the audited financial statements contains an adverse or disclaimer of opinion b. Indicate the effect of such modification on the summary financial statements c. Indicate the basis for that opinion d. Contain either an adverse or disclaimer of opinion on the summary financial statements

AUDITING THEORY MCQs BY SALOSAGCOL

CHAPTER 16 1. Which of the following procedures should an auditor generally perform regarding subsequent events? a. Compare the latest available interim financial statements with the financial statements being audited. b. Send second requests to the client’s customers who failed to respond to initial account receivable confirmation request. c. Communicate material weaknesses in the internal control structure to the client’s audit committee d. Review the cut-off bank statements for several months after the yearend. 2. The procedures to identify events that may require adjustment of, or disclosure in, the financial statements would be performed as near as practicable to the date of the auditor’s report. These procedures would ordinarily include the following except a. Reviewing procedures management has established to ensure that subsequent events are identified. b. Reading minutes of the meetings of shareholders, the board of directors and audit and executive committee held after period end and inquiring about matters discussed at meetings for which minutes are not yet available. c. Testing the effectiveness of those internal control policies and procedures that may have significantly changed in the subsequent period. d. Inquiring or extending previous oral or written inquiries, of the entity’s lawyers concerning litigation and claims. 3. Which of the following subsequent events will be least likely to result in an adjustment to the financial statements? a. Culmination of events affecting the realization of account receivable owned as of the balance sheet date. b. Culmination of events affecting the realization of inventories owned as of the balance sheet date. c. Material changes in the settlement of liabilities which were estimated as of the balance sheet date. d. Material changes in the quoted market prices of listed investment securities since the balance sheet date. 4. Which of the following is not among the characteristics of the procedures performed in completing the audit?

AUDITING THEORY MCQs BY SALOSAGCOL a. They are optional since they have only an indirect impact on the opinion to be expressed b. They involve many subjective judgments by the auditor. c. They are usually after the balance sheet date. d. They are usually performed by audit managers or other senior members of the audit team who have extensive audit experience with the client. 5. Which of the following procedures would an auditor most likely perform to obtain evidence about the occurrence of subsequent events? a. Recomputing a sample of large-peso transactions occurring after yearend for arithmetic accuracy. b. Investigating changes in stockholders’ equity occurring after year-end. c. Inquiring of the entity’s legal counsel concerning litigation, claims and assessments arising after year-end. d. Confirming ban accounts established after year-end. 6. A major customer of an audit client suffers a fire just prior to completion of year-end field work. The audit client believes that this event could have a significant direct effect on the financial statements. The auditor should a. Advise management to disclose the event in notes to the financial statements. b. Disclose the event in the auditor’s report. c. Withhold submission of the auditor’s report until the extent of the direct effect on the financial statements is known. d. Advise management to adjust the financial statements. 7. Which of the following statement about representation letter is not correct? a. It is optional b. It is addressed to the auditor c. It confirms oral representation made by management d. Its date should coincide with the date of the audit report. 8. Which of the following conditions or events most likely would cause an auditor to have significant doubt about an entity’s ability to continue as a going concern?? a. Cash flow from operating activities are negative b. Research and development projects are postponed c. Significant related party transactions are pervasive d. Stock dividends replace annual cash dividends 9. Analytical procedures in the overall review should be: a. Applied to every item on the financial statement. b. Performed by the partner or manager on the engagement c. Based on financial statement data before all audit adjustments and reclassification have been recognized. d. Performed only when material misstatement is expected.

AUDITING THEORY MCQs BY SALOSAGCOL 10.After issuing a report, an auditor has no obligation to make continuing inquiries or perform other procedures concerning the audited financial statements, unless a. Information, which existed at the report date and may affect the report, comes to the auditor’s attention. b. Management of the entity request the auditor to reissue the auditor’s report c. Information about an event that occurred after the end of fieldwork comes to the auditor’s attention d. Final determinations and resolutions are made of contingencies that had been disclosed in the financial statements.

CHAPTER 17

AUDITING THEORY MCQs BY SALOSAGCOL 1. Which of the following best describes a review service? a. A review engagement focuses on providing advice in a three-party contract. b. A review engagement focuses on providing assurance on the internal controls of a public company. c. A review engagement focuses on providing limited assurance on financial statements of a public company. d. A review engagement focuses on providing on reasonable assurance on the assertions contained in the financial statements of a public company.

2. When performing a review on financial statements, the CPA is required to a. Apply analytical procedures and make inquiries from third parties by sending confirmation letters. b. Assess the effectiveness of the client’s accounting and internal control systems. c. Obtain corroborative evidence to support management’s responses to inquiries. d. Obtain understanding of the client’s business and industry.

3. A review does not provide assurance that the CPA will become aware of all significant matters that would be disclosed in an audit. However, if the CPA becomes aware that information coming to his attention is incorrect, incomplete, or otherwise unsatisfactory, he should a. Withdraw immediately from the engagement b. Perform additional procedures he deems necessary to achieve limited assurance. c. Perform a complete audit and issue a standard audit report with appropriate qualifications. d. Downgrade the engagement to a compilation and issue the appropriate report

4. An agreed-upon procedures is one in which: a. The auditor and management agree that the procedures will be applied to all accounts and circumstances b. The auditor and management agree that the procedures will not be applied to all accounts and circumstances c. The auditor and management or a third party agree that the engagement will be limited to certain specific procedures. d. The auditor and management or a third party agree that the auditor will apply his or her judgment to determine procedures to be performed.

AUDITING THEORY MCQs BY SALOSAGCOL 5. Distribution of which of the following types of reports is limited? a. Audit b. Review c. Agreed-upon procedures d. Examination

6. Which of the following procedures would an accountant most likely perform in a compilation engagement? a. Collect, classify and summarize financial information b. Apply analytical procedures c. Assess risk components d. Test the accounting records

7. A CPA should perform analytical procedures during engagement to I. Audit II. Review III. Compile a. Yes, Yes, Yes b. Yes, Yes, No c. No, Yes, No d. Yes, No, No

8. Which of the following is not one of the elements of an assurance engagement? a. Sufficient appropriate evidence b. A subject matter c. Suitable criteria d. An opinion about whether the subject matter conform, in all material respects, with identified criteria

9. In an engagement to examine prospective financial information, the auditor should obtain sufficient appropriate evidence as to whether: I. Management’s best estimate assumptions on which the prospective financial information is based are not unreasonable and, in the case of hypothetical assumptions, such assumptions are consistent with the purpose of the information. II. The prospective financial information is properly prepared on the basis of the assumptions. III. The prospective financial information is properly presented and all material assumptions are adequately disclosed, including a clear indication as to whether they are best-estimate assumptions or hypothetical assumptions.

AUDITING THEORY MCQs BY SALOSAGCOL IV.

a. b. c. d.

The prospective financial information is prepared on a consistent basis with historical financial statements, using appropriate accounting principles. I, II, III and IV I, II and III I and II I, II and IV

10.The party responsible for assumptions identified in the preparation of prospective financial statements is usually a. A third-party lending institution b. The client’s management c. The reporting accountant d. The independent auditor

AUDITING THEORY MCQs BY SALOSAGCOL c. Merchandise purchase being charged to operating expense d. Fictitious sales 7. Which result of merchandise? a. Decrease b. Decrease c. Decrease d. Decrease

an analytical procedure suggests the existence of obsolete in in in in

the the the the

inventory turnover rate. ratio of gross profit to sales ratio of inventory to accounts payable ratio of inventory to accounts receivable

8. If accounts receivable turned over 8 times in 2014 as compared to only 6 times in 2015, it is possible that there were a. Unrecorded credit sales in 2015. b. Unrecorded cash receipts in 2014 c. More thorough credit investigations made by the company late in 2014 d. Fictitious sales in 2015 9. Which of the following would not be classified as an analytical procedure? a. Benchmarking the company’s profitability ratios against others in the industry b. Variance analysis of actual revenue versus budgeted amounts for production c. Reperforming the client’s depreciation expense using the client’s accounting policies for capital expenditures made during the year d. Reconciling fixed assets disposition with the fixed asset ledger. 10.An auditor compares this year’s revenues and expenses with those of the prior year and investigates all changes exceeding 10%. By this procedure the auditor is most likely to learn that a. An increase in property tax rates has not been recognized in the client’s accrual b. This year’s provision for uncollectible account is inadequate because of worsening economic conditions c. December payroll taxes were not paid d. The client changed its capitalization policy for small tools during the year.

CHAPTER 10

AUDITING THEORY MCQs BY SALOSAGCOL 1. The primary emphasis in most tests of details of balances is on the a. Balance sheet accounts b. Revenue accounts c. Cash flow statements accounts. d. Expense account 2. Evidence is usually more persuasive for balance sheet accounts where it is obtained: a. As close to the balance sheet date as possible b. Only from transactions occurring on the balance sheet date c. From various times throughout the client’s year d. From time period when transactions during the fiscal year. 3. Which of the following assertions is relevant to whether the company has title to the cash accounts as of the balance sheet date? a. Existence or occurrence b. Completeness c. Rights and obligations. d. Valuation or allocation 4. Which of the following assertions is relevant to whether the cash balances reflect the true underlying economic value of those assets? a. Existence or occurrence b. Completeness c. Rights and obligations d. Valuation or allocation. 6. Employee steals a payment from Customer X. To cover the theft, the employee applies a payment from Customer Y to Customer X’s account. Before Customer Y has time to notice that its account has not been appropriately credited, the employee applies a payment from Customer Z to Customer Y’s account. a. Skimming b. Kiting c. Collateralizing d. Lapping. 7. Which of the following controls represents a control over cash that is unique to cash accounts? a. Separation of duties b. Restrictive endorsements of customer checks. c. Periodic internal audits d. Competent, well-trained employees 8. Which of the following assertions is relevant to the audit procedure for marketable securities that requires the auditor to examine selected documents to identify any restrictions on the marketability of securities? a. Existence or occurrence b. Completeness c. Rights and obligations. d. Valuation or allocation

AUDITING THEORY MCQs BY SALOSAGCOL

9. Which of the following represents a reasonable test of controls for cash receipts and cash management controls? a. Document internal controls over cash by completing the internal control questionnaire or by flowcharting the process. b. Prepare an independent bank reconciliation c. Obtain a bank confirmation d. Obtain a bank cutoff statement 10. Which of the following assertions is relevant to whether the marketable securities balances include all securities transactions that have taken place during the period? a. Existence or occurrence b. Completeness. c. Rights and obligations d. Valuation or allocation

CHAPTER 11 1. A proper segregation of duties requires

AUDITING THEORY MCQs BY SALOSAGCOL a. An individual authorizing a transaction records it b. An individual authorizing a transaction maintains a custody of the asset that resulted from the transaction c. An individual maintain custody of an asset be entitled to access the accounting records for the asset d. An individual recording a transaction not compare the accounting record of the asset with the asset itself 2. The primary responsibility for establishing and maintaining an internal control rests with a. The external auditors b. The internal auditors c. Management and those charged with governance d. The controller or the treasurer 3. When the auditor attempts to understand the operation of the accounting system by tracing a few transactions through the accounting system, the auditor is said to be: a. Tracing b. Vouching c. Performing a walk-through d. Testing controls 4. Which of the following statements is incorrect about walk-through tests? a. It involves tracing a few transactions through the accounting systems. b. This procedure may form part of tests of control. c. The nature and extent of walk-through tests performed by the auditor are such that they alone would provide sufficient appropriate audit evidence to support a low assessment of control risk. d. This procedure is performed to determine whether the controls are being implemented. 5. You are auditing the company’s purchasing process for goods and services. You are primarily concerned with the company not recording all purchase transactions. Which audit procedure below would be the most effective audit procedure in this case? a. Vouching from the accounts payable account to the vendor invoices. b. Tracing vendor invoices to recorded amounts in the accounts payable account. c. Confirmation of accounts payable recorded amounts. d. Reconciling the accounts payable subsidiary ledger to the accounts payable account. 6. Which result of merchandise? a. Decrease b. Decrease c. Decrease d. Decrease

an analytical procedure suggests the existence of obsolete in in in in

inventory turnover rate the ratio of gross profit to sales the ratio of inventory to accounts payable the ratio of inventory to accounts receivable

AUDITING THEORY MCQs BY SALOSAGCOL 7. Which of the following is the best example of a corroborating evidence? a. General journal b. Worksheet cost allocations c. Vendor’s invoice d. Cash receipts journal 8. An entity’s ongoing monitoring activities often include a. Periodic audits by the audit committee. b. Reviewing the purchasing function. c. The audit of the annual financial statements. d. Control risk assessment in conjunction with quarterly reviews. 9. Which of the following is an example of fraudulent financial reporting? a. Company management changes inventory count tags and overstates ending inventory, while understating costs of goods sold. b. The treasurer diverts customer payments to his personal due, concealing his actions by debiting an expense account, thus overstating expenses. c. An employee steals small tools from the company and neglects to return them; the cost is reported as a miscellaneous operating expense. d. An employee omitted an entry to record a bank transfer to cover a cash shortage. 10.When obtaining audit evidence about the effective operation of internal controls, the auditor considers all of the following except a. How they were applied b. The consistency with which they were applied during the period c. By whom they were applied d. Why they were applied

AUDITING THEORY MCQs BY SALOSAGCOL CHAPTER 12 1. Which of the following is an internal control weakness related to acquisition of factory equipment? a. Acquisitions are to be made through and approved by the department in need of the equipment. b. Variances between authorized equipment expenditures and actual costs are to be immediately reported to management. c. Depreciation policies are reviewed only once a year. d. Advance executive approvals are required for equipment acquisitions. 2. It is an approximation of the amount of an item in the absence of a precise means of measurement a. Accounting estimate b. Audit sampling c. Materiality d. Audit risk 3. In evaluating the reasonableness of an accounting estimate, an auditor most likely would concentrate on key factors and assumptions that are a. Consistent with prior periods. b. Similar to industry guidelines. c. Objective and not susceptible to bias. d. Deviations from historical patterns. 4. In evaluating an entity’s accounting estimates, one of an auditor’s objectives is to determine whether the estimates are a. Not subject to bias. b. Consistent with the industry guidelines. c. Based on objective assumptions. d. Reasonable in the circumstances. 5. The auditor should adopt one or a combination of the following approaches in the audit of an accounting estimate: I. Review and test the process used by management to develop the estimate. II. Use an independent estimate for comparison with that prepared by management. III. Review subsequent events which confirms the estimate made. a. b. c. d.

Any of the above None of the above Either I or II I only

6. In evaluating the assumptions on which the estimate is based, the auditor would need to pay particular attention to assumptions which are a. Reasonable in light of actual results in prior periods. b. Consistent with those used for other accounting estimates. c. Consistent with management’s plans which appear appropriate.

AUDITING THEORY MCQs BY SALOSAGCOL d. Subjective or susceptible to material misstatement. 7. Which of the following statements is incorrect about accounting estimates? a. Management is responsible for making accounting estimates included in the financial statements. b. The risk of material misstatement is greater when accounting estimates are involved. c. The evidence available to support an accounting estimate will often be more difficult to obtain and less conclusive than evidence available to support other items in the financial statements. d. When evaluating accounting estimates, the auditor should pay particular attention to assumptions that are objective and are consistent with industry patterns. 8. Which of the following would an auditor generally perform to obtain assurance that accounting estimates are properly accounted for and disclosed? a. Inquiry of management b. Make an independent estimate for comparison with client’s estimate c. Review subsequent events d. Obtain knowledge about the applicable financial reporting standards related to the accounting estimate. 9. Which of the following procedures would an auditor least likely perform when evaluating the reasonableness of management’s estimates? a. Make an independent estimates for comparison with management estimates b. Read the minutes of board of director’s meeting c. Review and test the process used by management d. Review subsequent events which confirm the estimates made 10.Which of the following procedures would an auditor ordinarily perform first in evaluating management’s accounting estimates for reasonableness? a. Develop independent expectations of management’s estimates. b. Consider the appropriateness of the key factors or assumption used in preparing the estimates. c. Test the calculations used by the management in developing the estimates. d. Obtain an understanding of how management developed its estimates.

CHAPTER 13

AUDITING THEORY MCQs BY SALOSAGCOL

1. The current file of an auditor’s working papers most likely would include a copy of the a. Bank reconciliation b. Articles of incorporation c. Pension plan contract d. Flowchart of the internal control procedures 2. The primary concern of the auditor regarding related party transactions is that a. They are reported to proper regulatory authorities because they are illegal b. Their form be emphasized rather than their economic substance c. Their existence and significance be adequately disclosed d. Their effects are eliminated from the financial statements 3. The permanent file of an auditor’s working papers generally would not include a. Bond indenture agreements b. Working trial balance c. Lease agreements d. Flowchart of the intentional control structure 4. A person or firm possessing special skill, knowledge and experience in a particular field other than accounting and auditing is called a/an a. Professional b. Consultant c. Expert d. Assistant 5. Which of the following is not an expert upon whose work an auditor may rely? a. Actuary b. Internal auditor c. Appraiser d. Engineer 6. To operate effectively, an internal auditor must be independent of a. The line functions of the organization b. The entity c. The employer-employee relationship which exists for other employees in the organization d. The audit committee of the board of directors 7. The sufficiency and appropriateness of evidential matter ultimately is based on the a. Availability of corroborating data b. Philippine Standards on Auditing c. Pertinence of the evidence d. Judgment of the auditor 8. An auditor’s working papers will generally be least likely to include documentation showing how the a. Client’s schedules were prepared

AUDITING THEORY MCQs BY SALOSAGCOL b. Engagement had been planned c. Client’s system of internal control had been reviewed and evaluated d. Unusual matters were resolved 9. Audit files that are updated with new information of continuing importance is called a. Current files b. Working paper file c. Permanent files d. Correspondence file 10. The permanent (continuing) file of an auditor’s working papers more likely would include copies of the a. Bank statements b. Lead schedule c. Debt agreements d. Attorney’s letters

AUDITING THEORY MCQs BY SALOSAGCOL CHAPTER 14 1. “Subsequent events” are defined as events which occur subsequent to the a. Financial statement date b. Date of the auditor’s report c. Financial statement date but prior to the date of the auditor’s report d. Date of the auditor’s report and concern contingencies which are not reflected in the financial statements 2. Which of the following events in the subsequent period will require disclosure in the notes to financial statements? a. Realization of recorded year-end receivables at a different amount than recorded b. Settlement of recorded year-end estimated product warranty liabilities at a different amount than recorded c. Purchase of a machine d. Purchase of a business 3. Which of the following statements about a representation letter is not correct? a. It is optional b. It is addressed to the auditor c. It confirms oral representation made by management d. Its date should coincide with the date of the audit report 4. A representation letter issued by a client a. Is essential for the preparation of the audit program b. Is a substitute for testing c. Does not reduce auditor’s responsibility d. Reduces the auditor’s responsibility only to the extent that it is relied upon 5. Which of the following conditions or events most likely would cause an auditor to have significant doubt about an entity’s ability to continue as a going concern? a. Cash flow from operating activities are negative b. Research and development projects are postponed c. Significant related party transactions are pervasive d. Stock dividends replace annual cash dividends 6. The date of the management representation letter should coincide with the date of the a. Balance sheet b. Latest interim financial statements c. Auditor’s report d. Latest related party transaction 7. If a lawyer refuses to furnish corroborating information regarding litigation, claims and assessments, the auditor should a. Honor the confidentiality of the client-lawyer relationship b. Consider the refusal to be tantamount to a scope limitation c. Seek to obtain the corroborating information from management d. Disclose this fact in a footnote to the financial statements

AUDITING THEORY MCQs BY SALOSAGCOL 8. Soon after Kyle’s audit report was issued, Kyle learned of certain related party transactions that occurred during the year under audit. These transactions that occurred during the year under audit. These transactions were not disclosed in the notes to the financial statements. Kyle should a. Plan to audit the transactions during the next engagement b. Recall all copies of the audited financial statements c. Determine whether the lack of disclosure would affect the auditor’s report d. Ask the client to disclose the transactions in subsequent interim statements 9. The auditor is most likely to discover omitted audit procedures during a. Preparation of the management letter b. Follow-up procedures performed in compliance with generally accepted auditing standards c. The conference held with the client prior to issuing the audit report d. A post engagement review performed as part of the firm’s quality control inspection program 10. When an investigation of the discovery of facts existing at the report date confirms the existence of the fact and the auditor believes the information is important to those relying or likely to rely on the financial statements, the auditor should immediately: a. Take steps to prevent future reliance on the audit report b. Notify the SEC or other regulatory agency c. Resign from the engagement d. Take no action since the auditor is not responsible for such matters

AUDITING THEORY MCQs BY SALOSAGCOL

CHAPTER 15 1. Which of the following statement is not correct about the unmodified audit report in the financial statement? a. The auditor’s report shall include a section with a heading “Management’s Responsibility for the financial statements” b. The auditor’s report shall include a section with a heading “Auditor’s Responsibility” c. The auditor’s report shall include a section with a heading “Basis for Opinion” d. The auditor’s report shall include a section with a heading “Opinion” 2. PSA 700 requires the auditor’s report to describe management’s responsibility for the financial statements. The description shall include an explanation that management is responsible for the preparation of the financial statements and a. For selecting and applying appropriate accounting policies b. For such internal control as it determines necessary to enable the preparation of financial statement that are free from material misstatement c. For making accounting estimates that are reasonable in the circumstances d. Preventing collusion among employees 3. Which section of the auditor’s report gives a general description of opinion a. Introductory paragraph b. Auditor’s responsibility c. Management’s responsibility d. Auditor’s Opinion 4. The auditor’s inability to obtain sufficient appropriate audit evidence may arise from all of the following conditions, except a. Restriction imposed my management on the scope of the audit b. Limitations beyond the control of the entity c. Limitations relating to the nature or timing of the auditor’s work d. Restrictions on the disclosures in the financial statements 5. When an auditor expresses a qualified opinion due to a material misstatement, the auditor shall include in the opinion paragraph A description of material misstatement a. b. c.

Yes Yes No

A quantification of effects of misstatement if practicable No Yes No

AUDITING THEORY MCQs BY SALOSAGCOL d.

No

Yes

6. Which of the following is correct about “Emphasis of a Matter” paragraph a. In a very rare circumstances, the “Emphasis of a Matter” paragraph may be used as a substitute for a qualification of an opinion b. An “Emphasis of a Matter” paragraph may be used to give emphasis to as specific item that has not been appropriately disclosed in the notes to the financial statements c. An “Emphasis of a Matter” paragraph may be used to restrict the distribution of the auditor’s report when examining special purpose financial statements d. An “Emphasis of a Matter” paragraph may be used to alert the readers that the financial statement are presented in accordance with a special purpose framework 7. Which of the following circumstances will least likely affect the auditor’s opinion? a. A client imposed scope limitation b. A circumstance imposed scope limitations c. Inadequacy of disclosure in the notes to financial statements d. Uncertainty arises about entity’s continued existence 8. When reporting on comparative financial statements where the financial statements of the prior year have been examined by the predecessor auditor whose report is not presented, the successor auditor should make a. No reference to the predecessor auditor b. Reference to the predecessor auditor only if the predecessor auditor expressed a qualified opinion c. Reference to the predecessor auditor only if the predecessor auditor expressed an unmodified opinion d. Reference to the predecessor auditor regardless of the type of opinion expressed by the predecessor auditor 9. Which of the following best describes the auditor’s responsibility for “other information” included in the annual report to the stockholders that contains financial statements and the auditor’s report? a. The auditor has no obligation to read the other information. b. The auditor has no obligation to corroborate the other information but should read it to determine whether it is materially inconsistent with the financial statements c. The auditor should extend the examination to the extent necessary to verify the other information. d. The auditor must modify the auditor’s report to state that the other information is unaudited or not covered by the auditor’s report

AUDITING THEORY MCQs BY SALOSAGCOL 10.If the auditor’s report on audited financial statements contains an adverse or disclaimer of opinion, the auditor’s report on the summary financial statements should a. Not have to indicate the fact that the auditor’s report on the audited financial statements contains an adverse or disclaimer of opinion b. Indicate the effect of such modification on the summary financial statements c. Indicate the basis for that opinion d. Contain either an adverse or disclaimer of opinion on the summary financial statements

AUDITING THEORY MCQs BY SALOSAGCOL

CHAPTER 16 1. Which of the following procedures should an auditor generally perform regarding subsequent events? a. Compare the latest available interim financial statements with the financial statements being audited. b. Send second requests to the client’s customers who failed to respond to initial account receivable confirmation request. c. Communicate material weaknesses in the internal control structure to the client’s audit committee d. Review the cut-off bank statements for several months after the yearend. 2. The procedures to identify events that may require adjustment of, or disclosure in, the financial statements would be performed as near as practicable to the date of the auditor’s report. These procedures would ordinarily include the following except a. Reviewing procedures management has established to ensure that subsequent events are identified. b. Reading minutes of the meetings of shareholders, the board of directors and audit and executive committee held after period end and inquiring about matters discussed at meetings for which minutes are not yet available. c. Testing the effectiveness of those internal control policies and procedures that may have significantly changed in the subsequent period. d. Inquiring or extending previous oral or written inquiries, of the entity’s lawyers concerning litigation and claims. 3. Which of the following subsequent events will be least likely to result in an adjustment to the financial statements? a. Culmination of events affecting the realization of account receivable owned as of the balance sheet date. b. Culmination of events affecting the realization of inventories owned as of the balance sheet date. c. Material changes in the settlement of liabilities which were estimated as of the balance sheet date. d. Material changes in the quoted market prices of listed investment securities since the balance sheet date. 4. Which of the following is not among the characteristics of the procedures performed in completing the audit?

AUDITING THEORY MCQs BY SALOSAGCOL a. They are optional since they have only an indirect impact on the opinion to be expressed b. They involve many subjective judgments by the auditor. c. They are usually after the balance sheet date. d. They are usually performed by audit managers or other senior members of the audit team who have extensive audit experience with the client. 5. Which of the following procedures would an auditor most likely perform to obtain evidence about the occurrence of subsequent events? a. Recomputing a sample of large-peso transactions occurring after yearend for arithmetic accuracy. b. Investigating changes in stockholders’ equity occurring after year-end. c. Inquiring of the entity’s legal counsel concerning litigation, claims and assessments arising after year-end. d. Confirming ban accounts established after year-end. 6. A major customer of an audit client suffers a fire just prior to completion of year-end field work. The audit client believes that this event could have a significant direct effect on the financial statements. The auditor should a. Advise management to disclose the event in notes to the financial statements. b. Disclose the event in the auditor’s report. c. Withhold submission of the auditor’s report until the extent of the direct effect on the financial statements is known. d. Advise management to adjust the financial statements. 7. Which of the following statement about representation letter is not correct? a. It is optional b. It is addressed to the auditor c. It confirms oral representation made by management d. Its date should coincide with the date of the audit report. 8. Which of the following conditions or events most likely would cause an auditor to have significant doubt about an entity’s ability to continue as a going concern?? a. Cash flow from operating activities are negative b. Research and development projects are postponed c. Significant related party transactions are pervasive d. Stock dividends replace annual cash dividends 9. Analytical procedures in the overall review should be: a. Applied to every item on the financial statement. b. Performed by the partner or manager on the engagement c. Based on financial statement data before all audit adjustments and reclassification have been recognized. d. Performed only when material misstatement is expected.

AUDITING THEORY MCQs BY SALOSAGCOL 10.After issuing a report, an auditor has no obligation to make continuing inquiries or perform other procedures concerning the audited financial statements, unless a. Information, which existed at the report date and may affect the report, comes to the auditor’s attention. b. Management of the entity request the auditor to reissue the auditor’s report c. Information about an event that occurred after the end of fieldwork comes to the auditor’s attention d. Final determinations and resolutions are made of contingencies that had been disclosed in the financial statements.

CHAPTER 17

AUDITING THEORY MCQs BY SALOSAGCOL 1. Which of the following best describes a review service? a. A review engagement focuses on providing advice in a three-party contract. b. A review engagement focuses on providing assurance on the internal controls of a public company. c. A review engagement focuses on providing limited assurance on financial statements of a public company. d. A review engagement focuses on providing on reasonable assurance on the assertions contained in the financial statements of a public company.

2. When performing a review on financial statements, the CPA is required to a. Apply analytical procedures and make inquiries from third parties by sending confirmation letters. b. Assess the effectiveness of the client’s accounting and internal control systems. c. Obtain corroborative evidence to support management’s responses to inquiries. d. Obtain understanding of the client’s business and industry.

3. A review does not provide assurance that the CPA will become aware of all significant matters that would be disclosed in an audit. However, if the CPA becomes aware that information coming to his attention is incorrect, incomplete, or otherwise unsatisfactory, he should a. Withdraw immediately from the engagement b. Perform additional procedures he deems necessary to achieve limited assurance. c. Perform a complete audit and issue a standard audit report with appropriate qualifications. d. Downgrade the engagement to a compilation and issue the appropriate report

4. An agreed-upon procedures is one in which: a. The auditor and management agree that the procedures will be applied to all accounts and circumstances b. The auditor and management agree that the procedures will not be applied to all accounts and circumstances c. The auditor and management or a third party agree that the engagement will be limited to certain specific procedures. d. The auditor and management or a third party agree that the auditor will apply his or her judgment to determine procedures to be performed.

AUDITING THEORY MCQs BY SALOSAGCOL 5. Distribution of which of the following types of reports is limited? a. Audit b. Review c. Agreed-upon procedures d. Examination

6. Which of the following procedures would an accountant most likely perform in a compilation engagement? a. Collect, classify and summarize financial information b. Apply analytical procedures c. Assess risk components d. Test the accounting records

7. A CPA should perform analytical procedures during engagement to I. Audit II. Review III. Compile a. Yes, Yes, Yes b. Yes, Yes, No c. No, Yes, No d. Yes, No, No

8. Which of the following is not one of the elements of an assurance engagement? a. Sufficient appropriate evidence b. A subject matter c. Suitable criteria d. An opinion about whether the subject matter conform, in all material respects, with identified criteria

9. In an engagement to examine prospective financial information, the auditor should obtain sufficient appropriate evidence as to whether: I. Management’s best estimate assumptions on which the prospective financial information is based are not unreasonable and, in the case of hypothetical assumptions, such assumptions are consistent with the purpose of the information. II. The prospective financial information is properly prepared on the basis of the assumptions. III. The prospective financial information is properly presented and all material assumptions are adequately disclosed, including a clear indication as to whether they are best-estimate assumptions or hypothetical assumptions.

AUDITING THEORY MCQs BY SALOSAGCOL IV.

a. b. c. d.

The prospective financial information is prepared on a consistent basis with historical financial statements, using appropriate accounting principles. I, II, III and IV I, II and III I and II I, II and IV

10.The party responsible for assumptions identified in the preparation of prospective financial statements is usually a. A third-party lending institution b. The client’s management c. The reporting accountant d. The independent auditor

Related Documents

Auditing Theory Mcqs (continuation) By Salosagcol With Answers

February 2021 0

Auditing Theory Mcqs By Salosagcol With Answers

January 2021 0

Auditing Theory Salosagcol Summary

January 2021 0

Salosagcol Auditing Theory Solution Manual

February 2021 0

Answer Key Auditing Theory Salosagcol

February 2021 1

Auditing Theory - Overview Of The Audit Process With Answers

February 2021 0More Documents from "Shielle Azon"

Auditing Theory Mcqs (continuation) By Salosagcol With Answers

February 2021 0