Mark Minervini Additional Notes

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Mark Minervini Additional Notes as PDF for free.

More details

- Words: 1,394

- Pages: 3

Loading documents preview...

Mark on general market distribution: With the volume below the previous day I would not classify this as distribution. Also, it takes more than just one distribution day to be considered detrimental to a rally; generally, 4-6 distribution days will be of concern. However, if you get even a single distribution day within a few days after an initial follow-through day, that would be considered very negative Mark on scaling out of positions: If I really like the stock I sometimes will sell half and move my stop to break even. This allows you to essentially “free roll” the second half. I would rather take smaller losses and have more chances at getting the entry correct. 10% is my “uncle point” (max. stop) but I rarely ever see that big of a loss on a trade Mark on moving stop-losses: Generally speaking, I don’t usually move my stop to breakeven until the price advances to a multiple of my R and at or above my historical average gain. Second answer for the same question: A 10% stop would be my max stop and a level that I try to very seldom ever get to. I generally won’t move my stop to breakeven if a stock rises by only 4-5% unless I’m very skeptical of the overall market environment. If the stock advances to a multiple of my risk (say 3:1 or more), I will often then raise my stop to at least breakeven Mark on holding through earnings: The stock gapped down and I sold at the open for a -13.04% loss on the initial position. On the whole position I lost 4.24%. The fact that I traded around my position and nailed down a little profit added to my willingness to hold into earnings. Sometimes I hold and sometimes I don't. It's not an exact science, but I would suggest you never hold an oversized position into earnings. If the stock breaks down on a poor report, I almost always sell immediately. I don't care if it comes back and as it turned out I was wrong to sell; I'm already wrong, at that point I’m not interested in protecting my ego, I'm only interested in protecting my portfolio from additional loss. Mark on market timing: Yes, no stocks setting up. I really focus on the stocks themselves. If the stocks start breaking down abnormally, I will slow down or suspend new commitments. A new buy signal on my risk model does not insure that stock set-ups will be plentiful. It’s just telling me that risk is either high or low and to look for opportunities accordingly Mark on placing stops: If there’s a technical level that stops me out within an acceptable risk great… if not, I use a percentage stop based on my average gain. If my average gain is say 10% and I’m correct about half of the time, then I can’t be taking 10% losses. I try to keep my average loss at no more than onehalf my average gain. Mark on utilizing his market risk model: More often than not, the stocks themselves will have me getting into the market and out of the market before the

risk model changes to buy or sell. Usually, there will be deterioration or improvement in the underlying components of the risk model and I will pick that up in the stocks as things are changing. I will not just sell everything because the model goes on a sell, but it will make me watch things much more carefully and perhaps tighten stops or protect breakeven points. Mark on selling: Selling is a big subject. There are many things to look for that could indicate it’s time to step aside a winning position. The main thing to realize is that you’re virtually never going to get the high price. That’s not what successful trading is about. The goal is to make more than you risk, and do it over and over. Once my position shows a profit and the stock price advances to my historical average gain (example 10%), I will often move my stop to breakeven at the point. I will consider selling if my profit is at or above my average gain and my profit is a multiple of the risk I took (example 3-4Rs or greater). I’m generally looking to sell into strength. I don’t like trailing stops, but I often will set a “Backstop.” That’s a stop that protects a certain portion of my gain, and then allowing the stock to trade as long as it holds above that level. If it moves up much from there, then I may either sell, or set another “Backstop.” I hope that’s helpful. Mark on pivotal points: I virtually always buy in the direction of the trade. That is to say, if I’m looking to go long a name, I will buy as the stock is moving up. That could be above the handle area or possibly coming off what we call a “Pullback Buy.” Buying slightly before the “Breakout” doesn’t accomplish much if it’s only a few percentage points better than just waiting for confirmation that the stock is indeed emerging and moving in the direction you anticipated. When you’re thinking about buying before a stock breakout, ask yourself what advantage you’re getting. Is it math and probabilities or your ego that’s dictating your actions? Mark on stock selection: Fundamentals and technicals are both important. Even though a catalyst may not always be apparent at first glance, there is seldom a big winning stock that has no fundamental reason behind it. In 1995, I began employing a ranking tactic I call “Relative Prioritizing.” Through our study of past big winners, it was discovered that there were many stocks that displayed unexplained strength and went on to become superperformers, even though they did not have the proper fundamentals in line with our Leadership Profile®. In most cases, I have a minimum cut off for earnings. However, there is an exception made for stocks showing the most powerful price action. Generally speaking, I only override fundamentals on very strong, high momentum stocks. On the other hand, I never buy poor technicals based on great fundamentals; I always require technical confirmation.

Mark on percentage losses: I would always prefer to take as small of a loss as I can when I’m wrong. However, I don’t want to choke off the trade, so I try to find the best stop that keeps me in but isn’t too much risk. This is generally a balancing act between a fixed percentage number and the point where the trade sours based on price action. Mark on institutional ownership: The majority of market movement is dominated by big institutions. In order to get the benefit of institutional support, you want to have some ownership. In particular, if a few of the well-managed funds own your stock, then it could be an indication that something favorable is going on. On the other hand, stocks with tons of institutional ownership could indicate that the story is widely known and a huge number of potential sellers exist. Mark on A/D line: The A/D line generally peaks before the market. Therefore, new highs in the A/D line can be a predictor of higher prices. Also, you can look for divergences between the A/D line and the underlying market indexes as signs of strength or weakness. Mark on daily routine: I sit at my trade desk at 8:00AM. The first thing I do is check the news on current holdings. Then I Look at a chart of all my holdings and set my protective (mental) stops for the day. I then sort my watch list into three categories: 1. Stocks immediately buyable that are set-up for a breakout. 2. Stocks that may be buyable on a pullback. 3. Stocks that are “on deck”; which is to say, those names close to properly setup, but need a little more time. Everything else stays on the watch list and each day it either gets eliminated from the watch list, or moves up the ladder to one of the other three categories. Throughout the day I buy the stocks that hit pre-determined buy points and sell the ones that hit my stops.

Mark on general market distribution: With the volume below the previous day I would not classify this as distribution. Also, it takes more than just one distribution day to be considered detrimental to a rally; generally, 4-6 distribution days will be of concern. However, if you get even a single distribution day within a few days after an initial follow-through day, that would be considered very negative Mark on scaling out of positions: If I really like the stock I sometimes will sell half and move my stop to break even. This allows you to essentially “free roll” the second half. I would rather take smaller losses and have more chances at getting the entry correct. 10% is my “uncle point” (max. stop) but I rarely ever see that big of a loss on a trade Mark on moving stop-losses: Generally speaking, I don’t usually move my stop to breakeven until the price advances to a multiple of my R and at or above my historical average gain. Second answer for the same question: A 10% stop would be my max stop and a level that I try to very seldom ever get to. I generally won’t move my stop to breakeven if a stock rises by only 4-5% unless I’m very skeptical of the overall market environment. If the stock advances to a multiple of my risk (say 3:1 or more), I will often then raise my stop to at least breakeven Mark on holding through earnings: The stock gapped down and I sold at the open for a -13.04% loss on the initial position. On the whole position I lost 4.24%. The fact that I traded around my position and nailed down a little profit added to my willingness to hold into earnings. Sometimes I hold and sometimes I don't. It's not an exact science, but I would suggest you never hold an oversized position into earnings. If the stock breaks down on a poor report, I almost always sell immediately. I don't care if it comes back and as it turned out I was wrong to sell; I'm already wrong, at that point I’m not interested in protecting my ego, I'm only interested in protecting my portfolio from additional loss. Mark on market timing: Yes, no stocks setting up. I really focus on the stocks themselves. If the stocks start breaking down abnormally, I will slow down or suspend new commitments. A new buy signal on my risk model does not insure that stock set-ups will be plentiful. It’s just telling me that risk is either high or low and to look for opportunities accordingly Mark on placing stops: If there’s a technical level that stops me out within an acceptable risk great… if not, I use a percentage stop based on my average gain. If my average gain is say 10% and I’m correct about half of the time, then I can’t be taking 10% losses. I try to keep my average loss at no more than onehalf my average gain. Mark on utilizing his market risk model: More often than not, the stocks themselves will have me getting into the market and out of the market before the

risk model changes to buy or sell. Usually, there will be deterioration or improvement in the underlying components of the risk model and I will pick that up in the stocks as things are changing. I will not just sell everything because the model goes on a sell, but it will make me watch things much more carefully and perhaps tighten stops or protect breakeven points. Mark on selling: Selling is a big subject. There are many things to look for that could indicate it’s time to step aside a winning position. The main thing to realize is that you’re virtually never going to get the high price. That’s not what successful trading is about. The goal is to make more than you risk, and do it over and over. Once my position shows a profit and the stock price advances to my historical average gain (example 10%), I will often move my stop to breakeven at the point. I will consider selling if my profit is at or above my average gain and my profit is a multiple of the risk I took (example 3-4Rs or greater). I’m generally looking to sell into strength. I don’t like trailing stops, but I often will set a “Backstop.” That’s a stop that protects a certain portion of my gain, and then allowing the stock to trade as long as it holds above that level. If it moves up much from there, then I may either sell, or set another “Backstop.” I hope that’s helpful. Mark on pivotal points: I virtually always buy in the direction of the trade. That is to say, if I’m looking to go long a name, I will buy as the stock is moving up. That could be above the handle area or possibly coming off what we call a “Pullback Buy.” Buying slightly before the “Breakout” doesn’t accomplish much if it’s only a few percentage points better than just waiting for confirmation that the stock is indeed emerging and moving in the direction you anticipated. When you’re thinking about buying before a stock breakout, ask yourself what advantage you’re getting. Is it math and probabilities or your ego that’s dictating your actions? Mark on stock selection: Fundamentals and technicals are both important. Even though a catalyst may not always be apparent at first glance, there is seldom a big winning stock that has no fundamental reason behind it. In 1995, I began employing a ranking tactic I call “Relative Prioritizing.” Through our study of past big winners, it was discovered that there were many stocks that displayed unexplained strength and went on to become superperformers, even though they did not have the proper fundamentals in line with our Leadership Profile®. In most cases, I have a minimum cut off for earnings. However, there is an exception made for stocks showing the most powerful price action. Generally speaking, I only override fundamentals on very strong, high momentum stocks. On the other hand, I never buy poor technicals based on great fundamentals; I always require technical confirmation.

Mark on percentage losses: I would always prefer to take as small of a loss as I can when I’m wrong. However, I don’t want to choke off the trade, so I try to find the best stop that keeps me in but isn’t too much risk. This is generally a balancing act between a fixed percentage number and the point where the trade sours based on price action. Mark on institutional ownership: The majority of market movement is dominated by big institutions. In order to get the benefit of institutional support, you want to have some ownership. In particular, if a few of the well-managed funds own your stock, then it could be an indication that something favorable is going on. On the other hand, stocks with tons of institutional ownership could indicate that the story is widely known and a huge number of potential sellers exist. Mark on A/D line: The A/D line generally peaks before the market. Therefore, new highs in the A/D line can be a predictor of higher prices. Also, you can look for divergences between the A/D line and the underlying market indexes as signs of strength or weakness. Mark on daily routine: I sit at my trade desk at 8:00AM. The first thing I do is check the news on current holdings. Then I Look at a chart of all my holdings and set my protective (mental) stops for the day. I then sort my watch list into three categories: 1. Stocks immediately buyable that are set-up for a breakout. 2. Stocks that may be buyable on a pullback. 3. Stocks that are “on deck”; which is to say, those names close to properly setup, but need a little more time. Everything else stays on the watch list and each day it either gets eliminated from the watch list, or moves up the ladder to one of the other three categories. Throughout the day I buy the stocks that hit pre-determined buy points and sell the ones that hit my stops.

Related Documents

Mark Minervini Additional Notes

January 2021 1

Mark Minervini Webinar Notes

January 2021 1

Mark Minervini - Webinar Notes

February 2021 6

Mark Minervini Setup

January 2021 5

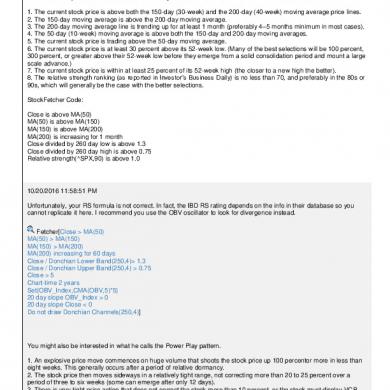

The Trend Template Mark Minervini

January 2021 1

Mark Leveridge - Lecture Notes

January 2021 1More Documents from "joe mckay"

Mark Minervini Additional Notes

January 2021 1

Toyota-tgfl.pdf

February 2021 0

How To Be A Social Entrepreneur

January 2021 1