Module 17 - Receivables.docx

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Module 17 - Receivables.docx as PDF for free.

More details

- Words: 5,188

- Pages: 8

Loading documents preview...

BALIUAG UNIVERSITY Integrated Accounting Course II Summer 2017 MODULE 17: Loans and Receivables

LVC

RELATED STANDARDS: IAS 1 - Presentation of Financial Statements; IFRS 9 - Financial Instruments

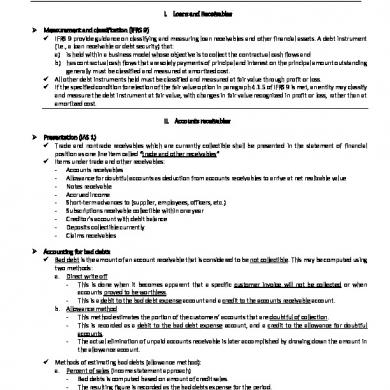

I. Loans and Receivables Measurement and classification (IFRS 9) IFRS 9 provide guidance on classifying and measuring loan receivables and other financial assets. A debt instrument (i.e., a loan receivable or debt security) that: a) is held within a business model whose objective is to collect the contractual cash flows and b) has contractual cash flows that are solely payments of principal and interest on the principal amount outstanding generally must be classified and measured at amortized cost. All other debt instruments held must be classified and measured at fair value through profit or loss. If the specified condition for election of the fair value option in paragraph 4.1.5 of IFRS 9 is met, an entity may classify and measure the debt instrument at fair value, with changes in fair value recognized in profit or loss, rather than at amortized cost. II. Accounts receivables Presentation (IAS 1) Trade and nontrade receivables which are currently collectible shall be presented in the statement of financial position as one line item called “trade and other receivables” Items under trade and other receivables: - Accounts receivables - Allowance for doubtful accounts as deduction from accounts receivables to arrive at net realizable value - Notes receivable - Accrued income - Short-term advances to (supplier, employees, officers, etc.) - Subscriptions receivable collectible within one year - Creditor’s account with debit balance - Deposits collectible currently - Claims receivables Accounting for bad debts Bad debt is the amount of an account receivable that is considered to be not collectible. This may be computed using two methods: a. Direct write off - This is done when it becomes apparent that a specific customer invoice will not be collected or when accounts proved to be worthless. - This is a debit to the bad debt expense account and a credit to the accounts receivable account. b. Allowance method - This method estimates the portion of the customers’ accounts that are doubtful of collection. - This is recorded as a debit to the bad debt expense account, and a credit to the allowance for doubtful accounts. - The actual elimination of unpaid accounts receivable is later accomplished by drawing down the amount in the allowance account. Methods of estimating bad debts (allowance method): a. Percent of sales (Income statement approach) - Bad debts is computed based on amount of credit sales. - The resulting figure is recorded as the bad debts expense for the period. b. Percent of receivables (Statement of financial position approach) - Bad debts is computed based on the amount of outstanding receivables. - The resulting figure is already the required allowance for bad debts that is deducted from the receivables to arrive at the net realizable value of receivables. c. Aging of accounts receivables (Statement of financial position approach) - Similar to percent of receivables, the computed figure here is already the required allowance for bad debts that is deducted from the accounts receivable balance. Module 17

Page 1 of 8

Loans and Receivables LVC - This requires classification of past due customer accounts in terms of length of time outstanding. Various rates are used to compute the bad debts. Rates used in computation increases as the receivables become “older”. Illustration of trade and other receivables Indicate whether the following items is included or excluded from the trade and other receivables balance at the end of the year. o Accounts receivable o Notes receivable from customer o Customer’s credit balance o Supplier’s debit balance o Allowance for doubtful accounts o Receivable from consignee for the sales price of unsold merchandise o Security deposit for a 3-year rent o Notes receivable discounted o Accounts receivable – assigned o Accounts receivable – pledged o Trade installments receivable o Interest receivable o Dividends receivable o Subscription receivable (due in 18 months) o Advances to supplier o Advances from customer o Advances to affiliates o Postdated checks received from customer o Insolvent customer accounts proved to be uncollectible o Subscription receivable (due in 180 days) o Claims against common carrier o Acquired debt instruments III. Notes and Loans Receivable Measurements Financial instruments (including notes and loans receivable) are initially measured at fair value plus, in the case of a financial asset not at fair value through profit or loss, transaction costs (IFRS 9). Long-term notes and loan receivable shall be subsequently measured at amortized cost using effective interest method. Initial measurement of loan receivable = Principal minus direct origination fees received from borrower plus direct origination costs incurred by the lender. Accounting for amortization of loan receivable: Case Difference Amortization Direct origination fees > Direct origination costs Unearned interest income Increase interest income Direct origination costs > Direct origination fees Direct origination costs Decrease interest income Impairment and credit losses Expected credit losses are required to be measured through a loss allowance at an amount equal to: a. The 12-month expected credit losses (expected credit losses that result from those default events on the financial instrument that are possible within 12 months after the reporting date); or b. Full lifetime expected credit losses (expected credit losses that result from all possible default events over the life of the financial instrument). The preceding IFRS 9 provision is the general approach on impairment with the exception of purchased or originated credit impaired financial assets A loss allowance for full lifetime expected credit losses is required for a financial instrument if the credit risk of that financial instrument has increased significantly since initial recognition, as well as to contract assets or trade receivables that do not constitute a financing transaction in accordance with IFRS 15. Any measurement of expected credit losses under IFRS 9 shall reflect an unbiased and probability-weighted amount that is determined by evaluating the range of possible outcomes as well as incorporating the time value of money. Also, the entity should consider reasonable and supportable information about past events, current conditions and reasonable and supportable forecasts of future economic conditions when measuring expected credit losses. Impairment loss = Carrying amount of loan receivable minus present value of cash flows. Allowance for loan impairment is recorded and the allowance account shall be amortized subsequently to interest income. Module 17

Page 2 of 8

Loans and Receivables

LVC IV. Receivable Financing

Definition Receivable financing is a type of asset-financing arrangement in which a company uses its receivables to raise money. Forms of receivable financing: a. Pledging of accounts receivable - Accounts receivable pledging is when a business uses its accounts receivable as collateral on a loan, usually a line of credit. - No special journal entry is made on the accounts receivable pledged. Disclosure of pledging is sufficient. b. Assignment of accounts receivable - Assignment of accounts receivable is an agreement between a lending company and a borrowing company in which the later assigns its accounts receivable to the former in return for a loan. - By assignment of accounts receivable, the lender gets a right to collect the receivables of the borrowing company if it fails to repay the loan in time. - An entry is made to reclassify the accounts receivables as “accounts receivable –assigned”. - The entity shall disclosed the equity in the assigned accounts. It is computed by deducting the related notes payable from the accounts receivable –assigned. c. Factoring of accounts receivable - A type of debtor finance in which a business sells its accounts receivable to a third party (called a factor) at a discount. - The parties to the factoring agreement assess the recoverability of the accounts receivable. They agree on a suitable discount factor to calculate the amount of fee to be charged by the factor. - After deducting such fee from the value of accounts receivable, the factor pays in cash to originating company. The factor may also withheld an additional amount as a refundable security against bad debts which may arise. - In casual factoring, the accounts receivable is simply credited and the related allowance for bad debts is debited. Gain or loss on factoring is also determined. - In a continuing agreement, the accounts receivable is credited and receivable from factor is debited. d. Discounting of notes receivable - Notes are usually sold (discounted) with recourse, which means the company discounting the note agrees to pay the financial institution if the maker dishonors the note. - When notes receivable are sold with recourse, the company has a contingent liability that must be disclosed in the notes accompanying the financial statements. - The accounting entry include a credit to notes receivable discounted. Notes receivable discounted is deducted from the total notes receivable with disclosure of the contingent liability. ******************************************************* Illustrative Problems 1. Loans and receivables may be classified under IFRS 9 at A. Financial asset at amortized cost B. Financial asset at fair value through profit or loss C. Either A or B D. Neither A nor B 2. Line item classification of short-term receivables under IAS 1 for financial statement presentation. A. Trade receivables C. Trade and nontrade receivables B. Trade and other receivables D. Financial and nonfinancial receivables 3. Method of estimating doubtful accounts which computes for the provision for bad debts for the period. A. Aging of receivables C. Percentage of receivables B. Direct write-off D. Percentage of sales 4. Which of the following will be deducted from the loan receivable on initial recognition? A. Direct origination fees received C. Both A and B B. Direct origination costs incurred D. Neither A nor B 5. Receivable financing scheme that does not require additional journal entry A. Pledging of accounts receivable C. Factoring of accounts receivable B. Assignment of accounts receivable D. Discounting of notes receivable 6. Expected credit losses of loan receivables are required to be measured through a loss allowance at an amount equal to (choose the exception) A. 12-month expected credit losses C. Monthly expected credit losses B. Full lifetime expected credit losses D. None of the foregoing 7. An agreement between a lending company and a borrowing company in which the latter assigns its accounts receivable to the former in return for a loan. Module 17

Page 3 of 8

Loans and Receivables

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

LVC

A. Pledging of accounts receivable C. Factoring of accounts receivable B. Assignment of accounts receivable D. Discounting of notes receivable The note receivable discounted account is A. A contingent liability to be disclosed C. Both A and B B. Deducted from the notes receivable balance D. Presented separately in the liability section of balance sheet Which of the following methods of determining bad debt expense most closely matches expense to revenue? A. Charging bad debts only as accounts are written off as uncollectible. B. Charging bad debts with a percentage of sales for that period. C. Estimating the allowance for doubtful accounts as a percentage of accounts receivable. D. Estimating the allowance for doubtful accounts by aging the accounts receivable. A method of estimating uncollectible accounts that emphasizes asset valuation rather than income measurement is the allowance method based on A. Aging the receivables C. Gross sales B. Direct writeoff D. Credit sales less returns and allowances When a specific customer’s account receivable is written off as uncollectible, what will be the effect on net income under each of the following methods of recognizing bad debt expense? Allowance Direct writeoff A. None Decrease B. Decrease None C. Decrease Decrease D. None None When the allowance method of recognizing uncollectible accounts is used, the entry to record the writeoff of a specific account would A. Decrease both accounts receivable and the allowance for uncollectible accounts. B. Decrease accounts receivable and increase the allowance for uncollectible accounts. C. Increase the allowance for uncollectible accounts and decrease net income. D. Decrease both accounts receivable and net income. An entity uses the allowance method for recognizing uncollectible accounts. Ignoring deferred tax, the entry to record the writeoff of a specific uncollectible account A. Affects neither net income nor working capital. B. Affects neither net income nor accounts receivable. C. Decreases both net income and accounts receivable. D. Decreases both net income and working capital. A company uses the allowance method to recognized uncollectible accounts expense. What is the effect at the time of the collection of an account previously written off on each of the following accounts? Allowance for doubtful accounts Uncollectible accounts expense A. No effect Decrease B. Increase Decrease C. Increase No effect D. No effect No effect When an accounts receivable aging schedule is prepared at the end of the fiscal year, a series of computation like the following is sometimes made: 5% of the total peso balance of accounts from 1-30 days past due, plus 10% of the total peso balance of accounts from 31-60 days past due, and so on. Which of the following statements best describes how the sum of the amounts determined in this series of computation is used? A. When added to the total accounts written off during the year, this new sum is the desired credit balance of the allowance for doubtful accounts to be reported in the year-end financial statements. B. It is the amount of bad debt expense for the year. C. It is the amount that should be added to the allowance for doubtful accounts at year-end. D. It is the amount of desired credit balance of the allowance of doubtful accounts to be reported in the year-end financial statements. Assuming that the ideal measure of short-term receivable in the balance sheet is the discounted value of the cash to be received in the future, failure to follow this practice usually does not make the balance sheet misleading because A. Most short-term receivables are not interest-bearing. B. The allowance for uncollectible accounts includes a discount element. C. The amount of the discount is not material. D. Most receivables can be sold to a bank or factor. After being held for 40 days, a 120-day 12% interest-bearing note receivable was discounted at a bank at 15%. The proceeds received from the bank equal A. Maturity value less the discount at 12%. C. Face value less the discount at 12%. B. Maturity value less the discount at 15%. D. Face value less the discount at 15%.

Module 17

Page 4 of 8

Loans and Receivables LVC 18. A 90-day 15% interest-bearing note receivable is solid to a bank without recourse after being held for 60 days. The proceeds are calculated using a 12% interest rate. The amount credited to note receivable at the date of the discounting transaction would be A. The same as the cash proceeds. C. The face value of the note. B. Less than the face value of the note. D. The maturity value of the note. 19. On July 1 of the current year, an entity received a one-year note bearing interest at the market rate. The face amount of the note receivable and the entire amount of the interest are due in one year. When the note receivable was recorded on July 1, which of the following was debited? I. Interest receivable II. Unearned discount on note receivable A. I only C. Neither I nor II B. Both I and II D. II only 20. On July 1 of the current year, an entity received a one-year note receivable bearing interest at the market rate. The face amount of the note receivable and the entire amount of the interest are due on June 30 next year. At December 31 of the current year, the entity should report in its balance sheet A. A deferred credit for interest applicable to next year B. No interest receivable C. Interest receivable for the entire amount of the interest due on June 30 of next year D. Interest receivable for the interest accruing in the current year 21. Y COMPANY provided the following information for Year 2: Accounts receivable – January 1 2,000,000 Credit sales 10,000,000 Collection from customers, excluding the recovery of accounts written off 8,000,000 Accounts written off as worthless 100,000 Sales returns 500,000 Recovery of accounts written off 50,000 Estimated future sales returns on December 31 150,000 Estimated uncollectible accounts on December 31 per aging 300,000 What is the net realizable value of accounts receivable on December 31, Year 2? A. 3,400,000 C. 2,950,000 B. 3,100,000 D. 2,900,000 22. The following data were taken from the records of Z COMPANY for the year ended December 31, Year 1: Accounts receivable determined to be worthless 25,000 Collections received in settlement of notes 180,000 Collections received to settle accounts 2,450,000 Discounts allowed by creditors 260,000 Discounts taken by customers 40,000 Merchandise returned by customers 15,000 Merchandise returned to suppliers 70,000 Notes given to creditors in settlement of accounts 250,000 Notes received to settle accounts 400,000 Payment to creditors 3,200,000 Payments on notes payable 100,000 Provision for doubtful accounts 90,000 Purchases on account 3,900,000 Sales on account 3,600,000 What is the net realizable value of accounts receivable on December 31, Year 1? A. 605,000 C. 825,000 B. 890,000 D. 670,000 23. A COMPANY reported current net receivables on December 31, Year 2 which consisted of the following: Trade accounts receivable 930,000 Allowance for uncollectible accounts 20,000 Claim against shipper for goods in transit on November Year 1 30,000 Selling price of unsold goods sent by Paolo on consignment at 130% of cost and not included in the ending inventory 260,000 Security deposit on lease of warehouse used in storing inventories 300,000 What is the correct total of current net receivables on December 31, Year 2? A. 1,500,000 C. 1,240,000 B. 1,200,000 D. 940,000 24. When examining the accounts of B COMPANY, it is ascertained that balances relating to both receivables and payables are included in a single controlling account called “receivable control” that has a debit balance of P4,850,000. An analysis of the make-up of this account revealed the following: Debit/(Credit) Module 17

Page 5 of 8

Loans and Receivables LVC Accounts receivable – customers 7,800,000 Accounts receivable – officers 500,000 Debit balances – creditors 300,000 Postdated checks from customers 400,000 Subscription receivable 800,000 Accounts payable for merchandise ( 4,500,000 ) Credit balances in customers’ accounts ( 200,000 ) Cash received in advance from customers for goods not yet shipped ( 100,000 ) Expected bad debts ( 150,000 ) After further analysis of the aged accounts receivable, it is determined that the allowance for doubtful accounts should be P200,000. What amount should be reported as “trade and other receivables” under current assets? A. 8,950,000 C. 8,600,000 B. 8,800,000 D. 8,850,000 25. From inception of operations, C COMPANY provided for uncollectible accounts expense under the allowance method and provisions were made monthly at 2% of credit sales. No year-end adjustments to the allowance account were made. The balance in the allowance for doubtful accounts was P1,000,000 on January 1, Year 2. During Year 2, credit sales totaled P20,000,000, interim provisions for doubtful accounts were made at 2% of credit sales, P200,000 of bad debts were written off, and recoveries of accounts previously written off amounted to P50,000. An aging of accounts receivable was made for the first time on December 31, Year 2 as follows: Classification Balance Uncollectible November – December 6,000,000 10% July – October 2,000,000 20% January – June 1,500,000 30% Prior to January 1, Year 2 500,000 50% Based on the review of collectability of the account balances in the “prior to January 1, Year 2” aging category, additional accounts totaling P100,000 are to be written off on December 31, Year 2. Effective December 31, Year 2, the entity adopted the aging method for estimating the allowance for doubtful accounts. What is the year-end adjustment to the allowance for doubtful accounts on December 31, Year 2? A. 900,000 debit C. 500,000 debit B. 500,000 credit D. 0 26. During the current year, D COMPANY reported beginning allowance for doubtful accounts P200,000, sales P9,500,00, sales returns and allowances P1,000,000, sales discounts P500,000, accounts written off P300,000 and recovery of accounts written off P50,000. It is estimated that 5% of net sales may prove uncollectible. What is the allowance for doubtful accounts at year end? A. 350,000 C. 400,000 B. 375,000 D. 425,000 27. E COMPANY adopted a new method for estimating doubtful accounts at an amount indicated by aging of accounts receivable. Allowance for doubtful accounts, January 1 250,000 Provision for doubtful accounts recorded during the year (2% of credit sales of P10,000,000) 200,000 Accounts written off 205,000 Uncollectible accounts per aging, December 31 220,000 What is the year-end adjustment to the allowance for doubtful accounts? A. 175,000 debit C. 25,000 debit B. 175,000 credit D. 25,000 credit 28. F COMPANY reported accounts receivable on December 31, Year 2 as follows: Aye Company 800,000 Bee Company 2,000,000 Cee Company 1,200,000 Day Company 1,000,000 All other accounts receivable 5,000,000 The entity determined that Aye Company receivable is impaired by P400,000 and Day Company receivable is totally impaired. The other receivables from Bee and Cee are not considered impaired. The entity determined that a composite rate of 5% is appropriate to measure impairment on the remaining accounts receivable. What is the total impairment of accounts receivable for Year 2? A. 1,810,000 C. 1,650,000 B. 1,400,000 D. 1,830,000 29. On December 1, Year 1, G COMPANY assigned on a non-notification basis accounts receivable of P5,000,000 to a bank in consideration for a loan of 80% of the accounts less a 5% service fee on the accounts assigned. The entity signed a note for the bank loan. On December 31, Year 1, the entity collected assigned accounts of P2,000,000 less discount of P200,000. The entity remitted the collections to the bank in partial payment for the loan. The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1% per month on Module 17

Page 6 of 8

Loans and Receivables LVC the loan balance. The entity accepted sales returns of P100,000 on the assigned accounts and wrote off assigned accounts totaling P300,000. What is the balance of accounts receivable assigned on December 31, Year 1? A. 3,000,000 C. 2,400,000 B. 2,600,000 D. 2,900,000 30. Refer to the preceding problem. What is the equity of the assignor in assigned accounts on December 31, Year 1? A. 2,600,000 C. 360,000 B. 2,240,000 D. 0 31. H COMPANY factored P5,000,000 of accounts receivable. Control was surrendered by the entity. The finance company assessed a fee of 5% and retains a holdback equal to 10% of the accounts receivable. In addition, the finance company charged 12% interest computed on a weighted average time to maturity of the accounts receivable for 30 days. What is the amount initially received from the factoring of accounts receivable? A. 4,250,000 C. 4,700,685 B. 4,700,685 D. 4,200,685 32. Refer to the preceding problem. What total amount should be recognized as loss on factoring? A. 299,315 C. 250,000 B. 799,315 D. 0 33. I COMPANY factored P600,000 of accounts receivable on October 1, Year 1. Control was surrendered by I COMPANY. The factor accepted the accounts receivable subject to recourse for non-payment. The factor assessed a fee of 3% and retains a holdback equal to 5% of the accounts receivable. In addition, the factor charged 15% interest computed on a weighted average time to maturity of 54 days. The fair value of the recourse obligation is P9,000. What amount of cash was initially received? A. 529,685 C. 547,685 B. 538,685 D. 556,685 34. On February 1, Year 1, J COMPANY factored receivables with a carrying amount of P2,000,000 to K COMPANY. J COMPANY assesses a finance charge of 3% of the receivables and retains 5% of the receivable. If the factoring is treated as a sale, what amount of loss from sale should J COMPANY report in its Year 1 statement of comprehensive income? A. None C. 100,000 B. 60,000 D. 160,000 35. Refer to the preceding problem. Assume that J COMPANY retained significant amount of risks and rewards of ownership and had a continuing involvement on the factored financial asset, what amount of loss from factoring should J COMPANY recognize? A. None C. 100,000 B. 60,000 D. 160,000 36. On January 1, Year 2, K COMPANY sold equipment with a carrying amount of P4,800,000 in exchange for P6,000,000 noninterest bearing note due January 1, Year 5. There was no established exchange price for the equipment. The prevailing interest rate for this note was 10%. The present value of 1 at 10% for three periods is 0.75. What amount should be reported as gain on sale of equipment? A. 1,200,000 gain C. 300,000 gain B. 2,700,000 gain D. 300,000 loss 37. Refer to the preceding problem. What amount should be reported as interest income for Year 2? A. 600,000 C. 450,000 B. 500,000 D. 90,000 38. On December 31, Year 1, L COMPANY sold used equipment with carrying amount of P2,000,000 in exchange for a noninterest bearing note requiring ten annual payments of P500,000. The first payment was made on December 31, Year 2. The market interest for similar note was 12%. The present value of an ordinary annuity of 1 is 5.65 for ten periods and 5.33 for nine periods. What is the carrying amount of the note receivable on December 31, Year 1? A. 5,000,000 C. 2,665,000 B. 2,825,000 D. 4,500,000 39. On December 1, Year 1, N COMPANY gave O COMPANY a P200,000, 11% loan. The entity paid proceeds of P194,000 after the deduction of a P6,000 nonrefundable loan origination fee. Principal and interest are due in 60 monthly installments of P4,310, beginning January 1, Year 2. The repayments yield an effective interest rate of 11% at a present value of P200,000 and 12.4% at a present value of P194,000. What amount of income from this loan should N report in Year 1? A. 7,833 C. 2,005 B. 1,833 D. 0 40. On December 31, Year 1, Q COMPANY received two P2,000,000 notes receivable from customers. On both notes, interest is calculated on the outstanding principal balance at the annual rate of 3% and payable at maturity. The first note, made under customary trade terms, is due in nine months and the second note is due in five years. The market interest rate for similar notes on December 31, Year 1 was 8%. The PV of 1 at 8% due in nine months is 0.944 and the PV of 1 at 8% due in five years is 0.68. On December 31, Year 1, what total carrying amount should be reported for the two notes receivable? A. 3,248,000 C. 3,360,000 Module 17

Page 7 of 8

Loans and Receivables LVC B. 3,494,400 D. 3,564,000 41. R BANK granted a 10-year loan to a borrower in the amount of P1,500,000 with the stated interest rate of 6%. Payments are due monthly and are computed to be P16,650. The bank incurred P40,000 of direct loan origination cost and P20,000 of indirect loan origination cost. In addition, the bank charged the borrower a 4-point nonrefundable loan origination fee. What is the carrying amount of the loan receivable to be reported initially by the bank? A. 1,440,000 C. 1,500,000 B. 1,480,000 D. 1,520,000 42. On April 1, Year 1, S COMPANY discounted with recourse a nine-month, 10% note dated January 1, Year 1 with face of P6,000,000. The bank discount rate is 12%. The discounting transaction is accounted for as a conditional sale with the recognition of contingent liability. On October 1, Year 1, the maker dishonored the note receivable. The entity paid the bank the maturity value of the note plus protest fee of P50,000. On December 31, Year 1, the entity collected the dishonored note in full plus 12% annual interest on the total amount due. What amount was received from the note discounting on April 1, Year 1? A. 6,063,000 C. 6,150,000 B. 6,450,000 D. 5,963,000 43. Refer to the preceding problem. What amount should be recognized as loss on note discounting on April 1, Year 1? A. 450,000 C. 87,000 B. 387,000 D. 63,000 44. Refer to the preceding problem. What is the total amount collected from the customer on December 31, Year 1? A. 6,450,000 C. 6,662,500 B. 6,500,000 D. 6,695,000 45. Refer to the preceding problem. If the discounting is secured borrowing, what is included in the journal entry to record the transaction? A. Debit loss on discounting P87,000 c. Credit liability for note discounted P6,063,000 B. Debit interest expense P87,000 d. Credit interest income P63,000 46. Q COMPANY loaned P7,500,000 to a borrower on January 1, Year 1. The terms of the loan were payment in full on January 1, Year 5 plus annual interest payment at 12%. The interest payment was made as scheduled on January 1, Year 2. However, due to financial setbacks, the borrower was unable to make the Year 3 interest payment. The bank considered the loan impaired and projected the cash flows from the loan on December 31, Year 3. The bank had accrued the interest on December 31, Year 2 but did not accrue interest for Year 3 due to the impairment of the loan. The projected cash flows are: Date of cash flows Amount projected December 31, Year 4 500,000 December 31, Year 5 1,000,000 December 31, Year 6 2,000,000 December 31, Year 7 4,000,000 The PV of 1 at 12% is 0.89 for one period, 0.80 for two periods, 0.71 for three periods and 0.64 for four periods. What is the loan impairment loss to be recognized on December 31, Year 3? A. 2,275,000 c. 5,225,000 B. 3,175,000 d. 2,175,000 47. Refer to the preceding problem. What is the interest income to be reported by the bank in Year 4? A. 627,000 c. 567,000 B. 900,000 d. 0 48. Refer to the preceding problem. What is the carrying amount of the loan receivable on December 31, Year 4? A. 5,352,000 c. 5,225,000 B. 4,725,000 d. 7,000,000 49. S COMPANY sold its inventory for P300,000 to T COMPANY on January 2, Year 1 and received a one-year note bearing an interest rate of 12% for the full amount. On December 31, Year 1, S determined based on T’s recent financial crisis that the amount of due on January 2, Year 2 will not be collected and that only P210,000 of the principal will be collected with some delay until the end of Year 3. What is the carrying amount of the notes receivable on the Year 1 statement of financial position? A. 167,412 c. 210,000 B. 187,500 d. 300,000 50. What is the amount of impairment loss to be recognized on the receivable as of December 31, Year 1? A. None c. 126,000 B. 90,000 d. 168,588 -

End of discussion

“Excellence is the gradual result of always striving to do better.” Pat Riley

Module 17

Page 8 of 8

LVC

RELATED STANDARDS: IAS 1 - Presentation of Financial Statements; IFRS 9 - Financial Instruments

I. Loans and Receivables Measurement and classification (IFRS 9) IFRS 9 provide guidance on classifying and measuring loan receivables and other financial assets. A debt instrument (i.e., a loan receivable or debt security) that: a) is held within a business model whose objective is to collect the contractual cash flows and b) has contractual cash flows that are solely payments of principal and interest on the principal amount outstanding generally must be classified and measured at amortized cost. All other debt instruments held must be classified and measured at fair value through profit or loss. If the specified condition for election of the fair value option in paragraph 4.1.5 of IFRS 9 is met, an entity may classify and measure the debt instrument at fair value, with changes in fair value recognized in profit or loss, rather than at amortized cost. II. Accounts receivables Presentation (IAS 1) Trade and nontrade receivables which are currently collectible shall be presented in the statement of financial position as one line item called “trade and other receivables” Items under trade and other receivables: - Accounts receivables - Allowance for doubtful accounts as deduction from accounts receivables to arrive at net realizable value - Notes receivable - Accrued income - Short-term advances to (supplier, employees, officers, etc.) - Subscriptions receivable collectible within one year - Creditor’s account with debit balance - Deposits collectible currently - Claims receivables Accounting for bad debts Bad debt is the amount of an account receivable that is considered to be not collectible. This may be computed using two methods: a. Direct write off - This is done when it becomes apparent that a specific customer invoice will not be collected or when accounts proved to be worthless. - This is a debit to the bad debt expense account and a credit to the accounts receivable account. b. Allowance method - This method estimates the portion of the customers’ accounts that are doubtful of collection. - This is recorded as a debit to the bad debt expense account, and a credit to the allowance for doubtful accounts. - The actual elimination of unpaid accounts receivable is later accomplished by drawing down the amount in the allowance account. Methods of estimating bad debts (allowance method): a. Percent of sales (Income statement approach) - Bad debts is computed based on amount of credit sales. - The resulting figure is recorded as the bad debts expense for the period. b. Percent of receivables (Statement of financial position approach) - Bad debts is computed based on the amount of outstanding receivables. - The resulting figure is already the required allowance for bad debts that is deducted from the receivables to arrive at the net realizable value of receivables. c. Aging of accounts receivables (Statement of financial position approach) - Similar to percent of receivables, the computed figure here is already the required allowance for bad debts that is deducted from the accounts receivable balance. Module 17

Page 1 of 8

Loans and Receivables LVC - This requires classification of past due customer accounts in terms of length of time outstanding. Various rates are used to compute the bad debts. Rates used in computation increases as the receivables become “older”. Illustration of trade and other receivables Indicate whether the following items is included or excluded from the trade and other receivables balance at the end of the year. o Accounts receivable o Notes receivable from customer o Customer’s credit balance o Supplier’s debit balance o Allowance for doubtful accounts o Receivable from consignee for the sales price of unsold merchandise o Security deposit for a 3-year rent o Notes receivable discounted o Accounts receivable – assigned o Accounts receivable – pledged o Trade installments receivable o Interest receivable o Dividends receivable o Subscription receivable (due in 18 months) o Advances to supplier o Advances from customer o Advances to affiliates o Postdated checks received from customer o Insolvent customer accounts proved to be uncollectible o Subscription receivable (due in 180 days) o Claims against common carrier o Acquired debt instruments III. Notes and Loans Receivable Measurements Financial instruments (including notes and loans receivable) are initially measured at fair value plus, in the case of a financial asset not at fair value through profit or loss, transaction costs (IFRS 9). Long-term notes and loan receivable shall be subsequently measured at amortized cost using effective interest method. Initial measurement of loan receivable = Principal minus direct origination fees received from borrower plus direct origination costs incurred by the lender. Accounting for amortization of loan receivable: Case Difference Amortization Direct origination fees > Direct origination costs Unearned interest income Increase interest income Direct origination costs > Direct origination fees Direct origination costs Decrease interest income Impairment and credit losses Expected credit losses are required to be measured through a loss allowance at an amount equal to: a. The 12-month expected credit losses (expected credit losses that result from those default events on the financial instrument that are possible within 12 months after the reporting date); or b. Full lifetime expected credit losses (expected credit losses that result from all possible default events over the life of the financial instrument). The preceding IFRS 9 provision is the general approach on impairment with the exception of purchased or originated credit impaired financial assets A loss allowance for full lifetime expected credit losses is required for a financial instrument if the credit risk of that financial instrument has increased significantly since initial recognition, as well as to contract assets or trade receivables that do not constitute a financing transaction in accordance with IFRS 15. Any measurement of expected credit losses under IFRS 9 shall reflect an unbiased and probability-weighted amount that is determined by evaluating the range of possible outcomes as well as incorporating the time value of money. Also, the entity should consider reasonable and supportable information about past events, current conditions and reasonable and supportable forecasts of future economic conditions when measuring expected credit losses. Impairment loss = Carrying amount of loan receivable minus present value of cash flows. Allowance for loan impairment is recorded and the allowance account shall be amortized subsequently to interest income. Module 17

Page 2 of 8

Loans and Receivables

LVC IV. Receivable Financing

Definition Receivable financing is a type of asset-financing arrangement in which a company uses its receivables to raise money. Forms of receivable financing: a. Pledging of accounts receivable - Accounts receivable pledging is when a business uses its accounts receivable as collateral on a loan, usually a line of credit. - No special journal entry is made on the accounts receivable pledged. Disclosure of pledging is sufficient. b. Assignment of accounts receivable - Assignment of accounts receivable is an agreement between a lending company and a borrowing company in which the later assigns its accounts receivable to the former in return for a loan. - By assignment of accounts receivable, the lender gets a right to collect the receivables of the borrowing company if it fails to repay the loan in time. - An entry is made to reclassify the accounts receivables as “accounts receivable –assigned”. - The entity shall disclosed the equity in the assigned accounts. It is computed by deducting the related notes payable from the accounts receivable –assigned. c. Factoring of accounts receivable - A type of debtor finance in which a business sells its accounts receivable to a third party (called a factor) at a discount. - The parties to the factoring agreement assess the recoverability of the accounts receivable. They agree on a suitable discount factor to calculate the amount of fee to be charged by the factor. - After deducting such fee from the value of accounts receivable, the factor pays in cash to originating company. The factor may also withheld an additional amount as a refundable security against bad debts which may arise. - In casual factoring, the accounts receivable is simply credited and the related allowance for bad debts is debited. Gain or loss on factoring is also determined. - In a continuing agreement, the accounts receivable is credited and receivable from factor is debited. d. Discounting of notes receivable - Notes are usually sold (discounted) with recourse, which means the company discounting the note agrees to pay the financial institution if the maker dishonors the note. - When notes receivable are sold with recourse, the company has a contingent liability that must be disclosed in the notes accompanying the financial statements. - The accounting entry include a credit to notes receivable discounted. Notes receivable discounted is deducted from the total notes receivable with disclosure of the contingent liability. ******************************************************* Illustrative Problems 1. Loans and receivables may be classified under IFRS 9 at A. Financial asset at amortized cost B. Financial asset at fair value through profit or loss C. Either A or B D. Neither A nor B 2. Line item classification of short-term receivables under IAS 1 for financial statement presentation. A. Trade receivables C. Trade and nontrade receivables B. Trade and other receivables D. Financial and nonfinancial receivables 3. Method of estimating doubtful accounts which computes for the provision for bad debts for the period. A. Aging of receivables C. Percentage of receivables B. Direct write-off D. Percentage of sales 4. Which of the following will be deducted from the loan receivable on initial recognition? A. Direct origination fees received C. Both A and B B. Direct origination costs incurred D. Neither A nor B 5. Receivable financing scheme that does not require additional journal entry A. Pledging of accounts receivable C. Factoring of accounts receivable B. Assignment of accounts receivable D. Discounting of notes receivable 6. Expected credit losses of loan receivables are required to be measured through a loss allowance at an amount equal to (choose the exception) A. 12-month expected credit losses C. Monthly expected credit losses B. Full lifetime expected credit losses D. None of the foregoing 7. An agreement between a lending company and a borrowing company in which the latter assigns its accounts receivable to the former in return for a loan. Module 17

Page 3 of 8

Loans and Receivables

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

LVC

A. Pledging of accounts receivable C. Factoring of accounts receivable B. Assignment of accounts receivable D. Discounting of notes receivable The note receivable discounted account is A. A contingent liability to be disclosed C. Both A and B B. Deducted from the notes receivable balance D. Presented separately in the liability section of balance sheet Which of the following methods of determining bad debt expense most closely matches expense to revenue? A. Charging bad debts only as accounts are written off as uncollectible. B. Charging bad debts with a percentage of sales for that period. C. Estimating the allowance for doubtful accounts as a percentage of accounts receivable. D. Estimating the allowance for doubtful accounts by aging the accounts receivable. A method of estimating uncollectible accounts that emphasizes asset valuation rather than income measurement is the allowance method based on A. Aging the receivables C. Gross sales B. Direct writeoff D. Credit sales less returns and allowances When a specific customer’s account receivable is written off as uncollectible, what will be the effect on net income under each of the following methods of recognizing bad debt expense? Allowance Direct writeoff A. None Decrease B. Decrease None C. Decrease Decrease D. None None When the allowance method of recognizing uncollectible accounts is used, the entry to record the writeoff of a specific account would A. Decrease both accounts receivable and the allowance for uncollectible accounts. B. Decrease accounts receivable and increase the allowance for uncollectible accounts. C. Increase the allowance for uncollectible accounts and decrease net income. D. Decrease both accounts receivable and net income. An entity uses the allowance method for recognizing uncollectible accounts. Ignoring deferred tax, the entry to record the writeoff of a specific uncollectible account A. Affects neither net income nor working capital. B. Affects neither net income nor accounts receivable. C. Decreases both net income and accounts receivable. D. Decreases both net income and working capital. A company uses the allowance method to recognized uncollectible accounts expense. What is the effect at the time of the collection of an account previously written off on each of the following accounts? Allowance for doubtful accounts Uncollectible accounts expense A. No effect Decrease B. Increase Decrease C. Increase No effect D. No effect No effect When an accounts receivable aging schedule is prepared at the end of the fiscal year, a series of computation like the following is sometimes made: 5% of the total peso balance of accounts from 1-30 days past due, plus 10% of the total peso balance of accounts from 31-60 days past due, and so on. Which of the following statements best describes how the sum of the amounts determined in this series of computation is used? A. When added to the total accounts written off during the year, this new sum is the desired credit balance of the allowance for doubtful accounts to be reported in the year-end financial statements. B. It is the amount of bad debt expense for the year. C. It is the amount that should be added to the allowance for doubtful accounts at year-end. D. It is the amount of desired credit balance of the allowance of doubtful accounts to be reported in the year-end financial statements. Assuming that the ideal measure of short-term receivable in the balance sheet is the discounted value of the cash to be received in the future, failure to follow this practice usually does not make the balance sheet misleading because A. Most short-term receivables are not interest-bearing. B. The allowance for uncollectible accounts includes a discount element. C. The amount of the discount is not material. D. Most receivables can be sold to a bank or factor. After being held for 40 days, a 120-day 12% interest-bearing note receivable was discounted at a bank at 15%. The proceeds received from the bank equal A. Maturity value less the discount at 12%. C. Face value less the discount at 12%. B. Maturity value less the discount at 15%. D. Face value less the discount at 15%.

Module 17

Page 4 of 8

Loans and Receivables LVC 18. A 90-day 15% interest-bearing note receivable is solid to a bank without recourse after being held for 60 days. The proceeds are calculated using a 12% interest rate. The amount credited to note receivable at the date of the discounting transaction would be A. The same as the cash proceeds. C. The face value of the note. B. Less than the face value of the note. D. The maturity value of the note. 19. On July 1 of the current year, an entity received a one-year note bearing interest at the market rate. The face amount of the note receivable and the entire amount of the interest are due in one year. When the note receivable was recorded on July 1, which of the following was debited? I. Interest receivable II. Unearned discount on note receivable A. I only C. Neither I nor II B. Both I and II D. II only 20. On July 1 of the current year, an entity received a one-year note receivable bearing interest at the market rate. The face amount of the note receivable and the entire amount of the interest are due on June 30 next year. At December 31 of the current year, the entity should report in its balance sheet A. A deferred credit for interest applicable to next year B. No interest receivable C. Interest receivable for the entire amount of the interest due on June 30 of next year D. Interest receivable for the interest accruing in the current year 21. Y COMPANY provided the following information for Year 2: Accounts receivable – January 1 2,000,000 Credit sales 10,000,000 Collection from customers, excluding the recovery of accounts written off 8,000,000 Accounts written off as worthless 100,000 Sales returns 500,000 Recovery of accounts written off 50,000 Estimated future sales returns on December 31 150,000 Estimated uncollectible accounts on December 31 per aging 300,000 What is the net realizable value of accounts receivable on December 31, Year 2? A. 3,400,000 C. 2,950,000 B. 3,100,000 D. 2,900,000 22. The following data were taken from the records of Z COMPANY for the year ended December 31, Year 1: Accounts receivable determined to be worthless 25,000 Collections received in settlement of notes 180,000 Collections received to settle accounts 2,450,000 Discounts allowed by creditors 260,000 Discounts taken by customers 40,000 Merchandise returned by customers 15,000 Merchandise returned to suppliers 70,000 Notes given to creditors in settlement of accounts 250,000 Notes received to settle accounts 400,000 Payment to creditors 3,200,000 Payments on notes payable 100,000 Provision for doubtful accounts 90,000 Purchases on account 3,900,000 Sales on account 3,600,000 What is the net realizable value of accounts receivable on December 31, Year 1? A. 605,000 C. 825,000 B. 890,000 D. 670,000 23. A COMPANY reported current net receivables on December 31, Year 2 which consisted of the following: Trade accounts receivable 930,000 Allowance for uncollectible accounts 20,000 Claim against shipper for goods in transit on November Year 1 30,000 Selling price of unsold goods sent by Paolo on consignment at 130% of cost and not included in the ending inventory 260,000 Security deposit on lease of warehouse used in storing inventories 300,000 What is the correct total of current net receivables on December 31, Year 2? A. 1,500,000 C. 1,240,000 B. 1,200,000 D. 940,000 24. When examining the accounts of B COMPANY, it is ascertained that balances relating to both receivables and payables are included in a single controlling account called “receivable control” that has a debit balance of P4,850,000. An analysis of the make-up of this account revealed the following: Debit/(Credit) Module 17

Page 5 of 8

Loans and Receivables LVC Accounts receivable – customers 7,800,000 Accounts receivable – officers 500,000 Debit balances – creditors 300,000 Postdated checks from customers 400,000 Subscription receivable 800,000 Accounts payable for merchandise ( 4,500,000 ) Credit balances in customers’ accounts ( 200,000 ) Cash received in advance from customers for goods not yet shipped ( 100,000 ) Expected bad debts ( 150,000 ) After further analysis of the aged accounts receivable, it is determined that the allowance for doubtful accounts should be P200,000. What amount should be reported as “trade and other receivables” under current assets? A. 8,950,000 C. 8,600,000 B. 8,800,000 D. 8,850,000 25. From inception of operations, C COMPANY provided for uncollectible accounts expense under the allowance method and provisions were made monthly at 2% of credit sales. No year-end adjustments to the allowance account were made. The balance in the allowance for doubtful accounts was P1,000,000 on January 1, Year 2. During Year 2, credit sales totaled P20,000,000, interim provisions for doubtful accounts were made at 2% of credit sales, P200,000 of bad debts were written off, and recoveries of accounts previously written off amounted to P50,000. An aging of accounts receivable was made for the first time on December 31, Year 2 as follows: Classification Balance Uncollectible November – December 6,000,000 10% July – October 2,000,000 20% January – June 1,500,000 30% Prior to January 1, Year 2 500,000 50% Based on the review of collectability of the account balances in the “prior to January 1, Year 2” aging category, additional accounts totaling P100,000 are to be written off on December 31, Year 2. Effective December 31, Year 2, the entity adopted the aging method for estimating the allowance for doubtful accounts. What is the year-end adjustment to the allowance for doubtful accounts on December 31, Year 2? A. 900,000 debit C. 500,000 debit B. 500,000 credit D. 0 26. During the current year, D COMPANY reported beginning allowance for doubtful accounts P200,000, sales P9,500,00, sales returns and allowances P1,000,000, sales discounts P500,000, accounts written off P300,000 and recovery of accounts written off P50,000. It is estimated that 5% of net sales may prove uncollectible. What is the allowance for doubtful accounts at year end? A. 350,000 C. 400,000 B. 375,000 D. 425,000 27. E COMPANY adopted a new method for estimating doubtful accounts at an amount indicated by aging of accounts receivable. Allowance for doubtful accounts, January 1 250,000 Provision for doubtful accounts recorded during the year (2% of credit sales of P10,000,000) 200,000 Accounts written off 205,000 Uncollectible accounts per aging, December 31 220,000 What is the year-end adjustment to the allowance for doubtful accounts? A. 175,000 debit C. 25,000 debit B. 175,000 credit D. 25,000 credit 28. F COMPANY reported accounts receivable on December 31, Year 2 as follows: Aye Company 800,000 Bee Company 2,000,000 Cee Company 1,200,000 Day Company 1,000,000 All other accounts receivable 5,000,000 The entity determined that Aye Company receivable is impaired by P400,000 and Day Company receivable is totally impaired. The other receivables from Bee and Cee are not considered impaired. The entity determined that a composite rate of 5% is appropriate to measure impairment on the remaining accounts receivable. What is the total impairment of accounts receivable for Year 2? A. 1,810,000 C. 1,650,000 B. 1,400,000 D. 1,830,000 29. On December 1, Year 1, G COMPANY assigned on a non-notification basis accounts receivable of P5,000,000 to a bank in consideration for a loan of 80% of the accounts less a 5% service fee on the accounts assigned. The entity signed a note for the bank loan. On December 31, Year 1, the entity collected assigned accounts of P2,000,000 less discount of P200,000. The entity remitted the collections to the bank in partial payment for the loan. The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1% per month on Module 17

Page 6 of 8

Loans and Receivables LVC the loan balance. The entity accepted sales returns of P100,000 on the assigned accounts and wrote off assigned accounts totaling P300,000. What is the balance of accounts receivable assigned on December 31, Year 1? A. 3,000,000 C. 2,400,000 B. 2,600,000 D. 2,900,000 30. Refer to the preceding problem. What is the equity of the assignor in assigned accounts on December 31, Year 1? A. 2,600,000 C. 360,000 B. 2,240,000 D. 0 31. H COMPANY factored P5,000,000 of accounts receivable. Control was surrendered by the entity. The finance company assessed a fee of 5% and retains a holdback equal to 10% of the accounts receivable. In addition, the finance company charged 12% interest computed on a weighted average time to maturity of the accounts receivable for 30 days. What is the amount initially received from the factoring of accounts receivable? A. 4,250,000 C. 4,700,685 B. 4,700,685 D. 4,200,685 32. Refer to the preceding problem. What total amount should be recognized as loss on factoring? A. 299,315 C. 250,000 B. 799,315 D. 0 33. I COMPANY factored P600,000 of accounts receivable on October 1, Year 1. Control was surrendered by I COMPANY. The factor accepted the accounts receivable subject to recourse for non-payment. The factor assessed a fee of 3% and retains a holdback equal to 5% of the accounts receivable. In addition, the factor charged 15% interest computed on a weighted average time to maturity of 54 days. The fair value of the recourse obligation is P9,000. What amount of cash was initially received? A. 529,685 C. 547,685 B. 538,685 D. 556,685 34. On February 1, Year 1, J COMPANY factored receivables with a carrying amount of P2,000,000 to K COMPANY. J COMPANY assesses a finance charge of 3% of the receivables and retains 5% of the receivable. If the factoring is treated as a sale, what amount of loss from sale should J COMPANY report in its Year 1 statement of comprehensive income? A. None C. 100,000 B. 60,000 D. 160,000 35. Refer to the preceding problem. Assume that J COMPANY retained significant amount of risks and rewards of ownership and had a continuing involvement on the factored financial asset, what amount of loss from factoring should J COMPANY recognize? A. None C. 100,000 B. 60,000 D. 160,000 36. On January 1, Year 2, K COMPANY sold equipment with a carrying amount of P4,800,000 in exchange for P6,000,000 noninterest bearing note due January 1, Year 5. There was no established exchange price for the equipment. The prevailing interest rate for this note was 10%. The present value of 1 at 10% for three periods is 0.75. What amount should be reported as gain on sale of equipment? A. 1,200,000 gain C. 300,000 gain B. 2,700,000 gain D. 300,000 loss 37. Refer to the preceding problem. What amount should be reported as interest income for Year 2? A. 600,000 C. 450,000 B. 500,000 D. 90,000 38. On December 31, Year 1, L COMPANY sold used equipment with carrying amount of P2,000,000 in exchange for a noninterest bearing note requiring ten annual payments of P500,000. The first payment was made on December 31, Year 2. The market interest for similar note was 12%. The present value of an ordinary annuity of 1 is 5.65 for ten periods and 5.33 for nine periods. What is the carrying amount of the note receivable on December 31, Year 1? A. 5,000,000 C. 2,665,000 B. 2,825,000 D. 4,500,000 39. On December 1, Year 1, N COMPANY gave O COMPANY a P200,000, 11% loan. The entity paid proceeds of P194,000 after the deduction of a P6,000 nonrefundable loan origination fee. Principal and interest are due in 60 monthly installments of P4,310, beginning January 1, Year 2. The repayments yield an effective interest rate of 11% at a present value of P200,000 and 12.4% at a present value of P194,000. What amount of income from this loan should N report in Year 1? A. 7,833 C. 2,005 B. 1,833 D. 0 40. On December 31, Year 1, Q COMPANY received two P2,000,000 notes receivable from customers. On both notes, interest is calculated on the outstanding principal balance at the annual rate of 3% and payable at maturity. The first note, made under customary trade terms, is due in nine months and the second note is due in five years. The market interest rate for similar notes on December 31, Year 1 was 8%. The PV of 1 at 8% due in nine months is 0.944 and the PV of 1 at 8% due in five years is 0.68. On December 31, Year 1, what total carrying amount should be reported for the two notes receivable? A. 3,248,000 C. 3,360,000 Module 17

Page 7 of 8

Loans and Receivables LVC B. 3,494,400 D. 3,564,000 41. R BANK granted a 10-year loan to a borrower in the amount of P1,500,000 with the stated interest rate of 6%. Payments are due monthly and are computed to be P16,650. The bank incurred P40,000 of direct loan origination cost and P20,000 of indirect loan origination cost. In addition, the bank charged the borrower a 4-point nonrefundable loan origination fee. What is the carrying amount of the loan receivable to be reported initially by the bank? A. 1,440,000 C. 1,500,000 B. 1,480,000 D. 1,520,000 42. On April 1, Year 1, S COMPANY discounted with recourse a nine-month, 10% note dated January 1, Year 1 with face of P6,000,000. The bank discount rate is 12%. The discounting transaction is accounted for as a conditional sale with the recognition of contingent liability. On October 1, Year 1, the maker dishonored the note receivable. The entity paid the bank the maturity value of the note plus protest fee of P50,000. On December 31, Year 1, the entity collected the dishonored note in full plus 12% annual interest on the total amount due. What amount was received from the note discounting on April 1, Year 1? A. 6,063,000 C. 6,150,000 B. 6,450,000 D. 5,963,000 43. Refer to the preceding problem. What amount should be recognized as loss on note discounting on April 1, Year 1? A. 450,000 C. 87,000 B. 387,000 D. 63,000 44. Refer to the preceding problem. What is the total amount collected from the customer on December 31, Year 1? A. 6,450,000 C. 6,662,500 B. 6,500,000 D. 6,695,000 45. Refer to the preceding problem. If the discounting is secured borrowing, what is included in the journal entry to record the transaction? A. Debit loss on discounting P87,000 c. Credit liability for note discounted P6,063,000 B. Debit interest expense P87,000 d. Credit interest income P63,000 46. Q COMPANY loaned P7,500,000 to a borrower on January 1, Year 1. The terms of the loan were payment in full on January 1, Year 5 plus annual interest payment at 12%. The interest payment was made as scheduled on January 1, Year 2. However, due to financial setbacks, the borrower was unable to make the Year 3 interest payment. The bank considered the loan impaired and projected the cash flows from the loan on December 31, Year 3. The bank had accrued the interest on December 31, Year 2 but did not accrue interest for Year 3 due to the impairment of the loan. The projected cash flows are: Date of cash flows Amount projected December 31, Year 4 500,000 December 31, Year 5 1,000,000 December 31, Year 6 2,000,000 December 31, Year 7 4,000,000 The PV of 1 at 12% is 0.89 for one period, 0.80 for two periods, 0.71 for three periods and 0.64 for four periods. What is the loan impairment loss to be recognized on December 31, Year 3? A. 2,275,000 c. 5,225,000 B. 3,175,000 d. 2,175,000 47. Refer to the preceding problem. What is the interest income to be reported by the bank in Year 4? A. 627,000 c. 567,000 B. 900,000 d. 0 48. Refer to the preceding problem. What is the carrying amount of the loan receivable on December 31, Year 4? A. 5,352,000 c. 5,225,000 B. 4,725,000 d. 7,000,000 49. S COMPANY sold its inventory for P300,000 to T COMPANY on January 2, Year 1 and received a one-year note bearing an interest rate of 12% for the full amount. On December 31, Year 1, S determined based on T’s recent financial crisis that the amount of due on January 2, Year 2 will not be collected and that only P210,000 of the principal will be collected with some delay until the end of Year 3. What is the carrying amount of the notes receivable on the Year 1 statement of financial position? A. 167,412 c. 210,000 B. 187,500 d. 300,000 50. What is the amount of impairment loss to be recognized on the receivable as of December 31, Year 1? A. None c. 126,000 B. 90,000 d. 168,588 -

End of discussion

“Excellence is the gradual result of always striving to do better.” Pat Riley

Module 17

Page 8 of 8

Related Documents

Module 17 - Receivables.docx

February 2021 0

169758984-cecil-module-2-lesson-17.pdf

January 2021 1

#17

March 2021 0

Module

February 2021 41

Wayfinder #17

January 2021 0

Postprocessor 17

February 2021 0More Documents from "alexespi"

Book Value And Earnings Per Share

February 2021 0

4. Accounts Receivable And Receivable Financing (1).docx

February 2021 0

2. Statement Of Cash Flows

February 2021 0

2. Financial Statements.docx

February 2021 0