Moneylife 2 February 2017

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Moneylife 2 February 2017 as PDF for free.

More details

- Words: 31,872

- Pages: 68

Loading documents preview...

SUCHETA DALAL ON: DEMONETISATION EFFORT: LEARN FROM FAILURE Personal Finance Magazine

NSE NEEDS DEEP CLEANING Rs 45

20 January-2 February 2017

Pages 68

(SUBSCRIBER COPY NOT FOR RESALE)

www.moneylife.in

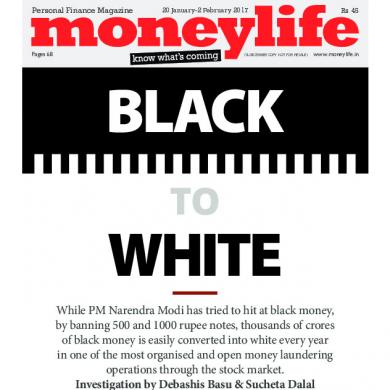

BLACK TO TO

WHITE While PM Narendra Modi has tried to hit at black money, by banning 500 and 1000 rupee notes, thousands of crores of black money is easily converted into white every year in one of the most organised and open money laundering operations through the stock market. Investigation by Debashis Basu & Sucheta Dalal

Cover Page_285.indd 1

13-01-2017 17:26:19

Advertisements.indd 10

12-01-2017 20:34:12

Advertisements.indd 2

10-01-2017 20:12:01

ISSUE CONTENTS

20 Jan-2 Feb 2017 Black-ka-White

BLACK

W

hile the prime minister (PM) Narendra Modi has tried to hit at black money, by banning 500 and 1000 rupee notes, which put the entire country through two months of hardship, one of the most organised and open money laundering operation has been happening right under our nose, in the stock market. And that is, converting black cash into long-term capital gains which are tax free under the current regulations. Regular readers of Moneylife would be aware that, since February 2009, we have been highlighting such pumpand-dump operations in every issue of the magazine in the Unquoted section, hoping that the regulators would be nudged into action. We now know what goes on behind such price-rigging. Through an elaborate network of dummy companies, ‘accommodation entries’ a large number of people are laundering thousands of crores of rupees from black to white. Read our investigation in the Cover Story, to know how this is done. In her crosshairs column, Sucheta says that it is now very clear that demonetisation was a needless, badly planned, poorly executed exercise—but it has thrown up important lessons that need to be learnt. The PM, a quick learner will, hopefully, make the necessary course corrections. In Different Strokes, she says that the National Stock Exchange needs some deep cleaning before it becomes a listed entity. SEBI has, indeed, initiated a lot of action; but some conflicts of interest remain! Our next major article will be on financial hygiene such as keeping your documents safely, ensuring that your loved ones have your passwords, if needed, and putting in place nominations and will. We are doing survey on this. Please do not forget to fill it up. The link is on our website. On 4th February, we celebrate the 7th Anniversary of Moneylife Foundation with a talk by Jay Panda and Rajeev Chandrashekhar, two dynamic members of Parliament, on “Transforming India”. If you are in Mumbai, we would be delighted if you could come and introduce yourself to us. The link for registration is on our website. Debashis Basu

TO

WHITE 32 Cover Story Black to White Thousands of crores of rupees of black money are easily converted into white every year by rigging the prices of listed shell companies. An official report describes the modus operandi. Investigation by Debashis Basu & Sucheta Dalal

12 Your Money

– Consumer Court Slaps Rs10.5 Lakh Penalty on Tata AIG – Aadhaar Is Mandatory for Receiving Benefits under EPS, says Ministry of Labour and Employment – Dosti Vrishti Society Residents Lock Up Builder for Poor Water Supply – Mobile App for Mutual Funds Trading Launched by BSE – Mediclaim Disallowed for Surgery for Morbid Obesity

14 18

MONEYLIFE

QUIZ Demonetisation: Lessons To Be Learnt and Coursecorrection Needed

20 Different Strokes

NSE Needs Deep Cleaning Before Its Public Listing

Disclaimer: Moneylife has a policy of not allowing its editorial staff to buy and sell stocks that are written about in the magazine. All personal transactions in individual stocks are subjected to internal disclosure rules.

MONEYLIFE | 20 Jan-2 Feb 2017 | 4

Content.indd 2

13-01-2017 18:25:35

Advertisements.indd 7

12-01-2017 20:27:02

CONTENTS FUND POINTERS

To Buy or Not To 24 ELSS: Buy?

TAX / FIXED INCOME

Savings ngs 50 Small Schemes’ Rates Unchangedd

– G-Sec Yields Down wn INSURANCE

32 Insurance Trends Accident Insurance – Malaria Death Ruled as Accident Health Insurance – Will Bariatric Surgery Be Covered by Mediclaim? – Keep Emergency Funds for Hospitalisation Fine Print

46

Hot and Cold Stocks of Mutual Funds in December 2016

xSTOCKS

22 Smartrt Moneyy Stockpicking in Good and Bad Times

Angiography, 56 Coronary the Villain of the Piece Pulse Beat: Medical developments from around the world

TAX HELPLINE

at Moneylife 52 Queries Foundation’s Tax Helpline USEFUL APPS

FUND FACTS

HEALTH

Addict:: 54 Podcast An App for All Musical Tastes

– Lumosity: Have Fun, Get Cerebral

– Sudoku Free: Play It on Your Mobile

– Four Letters: Not a Dirty Game at All!

47 Stock Watch

LEGALLY SPEAKING

Dish TV: Is it, at last, at the inflection point?

Need To Give 55 Banks Notice on Loan

YOU BE THE JUDGE

Not 60 Trap, Tempt, a Criminal

TECHNOLOGY

May Need 61 BHIM Government’s Helping Hand

BEYOND MONEY

Social Revolution 66 Athrough Classical Dance

Recovery

SpiceJet: Low-cost Operations

Market Manipulation: Negotium International Trade

Market Trend: Hard Slog Ahead

Content.indd 4

DEPARTMENTS Readers’ Response ........... 8 Book Review ....................62 Money Facts ....................64

13-01-2017 18:25:56

Advertisements.indd 8

12-01-2017 20:27:49

Volume 11, Issue 25 20 January–2 February 2017

Debashis Basu

Editor & Publisher [email protected]

Sucheta Dalal

Managing Editor [email protected]

Editorial Consultant Dr Nita Mukherjee [email protected]

Editorial, Advertisement, Circulation & Subscription Office 315, 3rd Floor, Hind Service Industries Premises, Off Veer Savarkar Marg, Shivaji Park, Dadar (W), Mumbai - 400 028 Tel: 022 49205000 Fax: 022 49205022 E-mail: [email protected]

E-mail:

[email protected]

Subscription e-mail [email protected]

New Delhi

DDA Flats, J-3/66, Kalkaji, New Delhi - 110 019

Bengaluru

1st Floor, 13/1, 7th Main Road, 1 Cross, Saibabanagar, Srirampuram, Bengaluru - 560 021 st

Kolkata

395, Lake Gardens, Kolkata - 700 045 Tel: 033 2422 1173/4064 4318

Moneylife is printed and published by Debashis Basu on behalf of Moneywise Media Pvt Ltd and published at 315, 3rd Floor, Hind Service Industries Premises, Off Veer Savarkar Marg, Shivaji Park, Dadar (W), Mumbai - 400 028 Editor: Debashis Basu

Total no of pages - 68, Including Covers

RNI No: MAHENG/2006/16653

SEARCHES AFTER DEMONETISATION The searches by income-tax (I-T) department and enforcement directorate (ED) after demonetisation have exposed the illegal activities of some individuals, bankers and bureaucrats. It is a good beginning for unearthing black money. However, it is doubtful whether I-T and ED have sufficient personnel to conduct a larger number of searches to book the wrongdoers. Fortunately, there is a large number of retired officers and staff of I-T department, Central government pensioners and retired defence personnel. Suitable and honest personnel from this pool should be recruited quickly to help in such searches. Unless these searches are intensified, it will not be possible to create fear in the minds of wrongdoers without which they will not come forward to deposit their ill-gotten money in the Prime Minister’s Garib Kalyan Yojana. P Sankaran, by post from Chennai

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Write to the Editor!

WIN a prize

SHOULD HEALTHCARE BE IN THE PRIVATE SECTOR? This is with regard to “Ills of Healthcare in India” by Sucheta Dalal. The government has its hands in too many pies. It needs to pull out of many sectors and leave them for the private sector. However, healthcare is NOT to be in the private sector. I have come across an interesting, and shocking, statistic. North America (read USA), with 5% of the world population, is responsible for 45% of the global spend on healthcare. Even with such high costs, the US healthcare industry is also prone to corrupt practices. Read the story of Tenet Healthcare (THC)—once the number two hospital operator in the US. Its chairman was a very high-profile person even on the US President’s advisory committee. When the FBI

MONEYLIFE | 20 Jan-2 Feb 2017 | 8

Letters.indd 2

12-01-2017 20:37:17

Advertisements.indd 5

11-01-2017 20:08:17

LETTERS

the

Best letter

Push towards Less Cash?

T

his is with regard to “5 Hurdles for Cashless Digital Transactions” by Dr Rakesh Goyal in Moneylife (Issue 5 January 2017). I wish to supplement the author’s arguments with the following

points. a. Generally speaking, there is no dearth of laws in our country. The acid test of new laws lies in their effective implementation. Anecdotal evidence suggests failure at the implementation level. A very thorough and comprehensive action is needed to fix the loopholes and lacunae. b. As regards the Internet, the track-record of our existing service-providers has not been exceptionally good when it comes to delivering on their promises, whether it pertains to the robustness of connectivity or inter-operability. In the recent past, we had the case a major player complaining to TRAI (Telecom Regulatory Authority of India) about noncooperation by the other existing players. The largest service-provider, with a pan-India presence even in the remotest corners and the rural hinterland, is still to raise its bar, given that it should have capitalised on the first-mover advantage. Even now, it is only reacting to the competition and is not proactive. The efficiency of service delivery has plummeted. c. Language will be a big barrier in last-mile delivery as well as for developing appropriate content in the local / regional languages.

(Federal Bureau of Investigation) investigated THC,

the truth was exposed. THC was submitting fictitious bills to the government-funded Medicare and Medicaid. What’s even worse, THC was subjecting innocent patients to unnecessary cardiac interventions including angioplasty and stents! Ralph Rau, online comment

DIVIDEND YIELD SHOULD BE MENTIONED This is with regard to “Navneet Education: Slow Learning”. In most company analyses, Moneylife writers keep mentioning dividend payout as a percentage of face value which may not be relevant. Dividend per share is all we need to know. When it comes to the dividend, would it not be better to

d. Another major barrier is dispelling Mutual Fund investments and allaying the are subject to market risks, read all scheme related fear of technology. documents carefully. This apprehension persists even in the metros and other cities. This barrier needs to Dr TV Ananthanarayanan be dismantled by a YOU WIN A vigorous campaign. PERSONALISED e. I have not been CLOCK able to comprehend the rationale for levying a convenience charge on digital transactions. The ‘convenience’ works both ways—for the Dr TV Ananthanarayanan customer as also the merchant. This fees needs to be abolished. f. The affordability of Smartphones and feature phones is another factor which needs to be addressed. Whatever may have been the merits and demerits of demonetisation, one positive fallout has been the nudge, or the push, towards moving to a less cash economy. Dr TV Ananthanarayanan, by email

Congratulations

provide dividend yield and dividend payout ratio instead? Eswar Santhosh, online comment

MORE MUTUAL FUND ARTICLES NEEDED This is with regard to “What To Expect from Smalland Mid-cap Schemes” by Mitul Patel. Moneylife writers are requested to publish more stories regarding investing in mutual funds, as not everyone is wellversed in direct equity investing. Pushpesh Kumar Sharma, online comment

STOCK EXCHANGES SHOULD PUBLISH LISTS OF MANIPULATING COMPANIES This is with regard to “Stock Manipulation: Mipco

MONEYLIFE |20 Jan-2 Feb 2017 | 10

Letters.indd 4

12-01-2017 20:37:41

LETTERS

Seamless Rings”. The stock exchanges should ensure

that they prepare and publish lists of such companies and make them available on their web portal so that investors can have access to the data of such companies and take precautions before making their investments. Jayendra Pandya, online comment

WHY AN 85% SUBSIDIARY? This is with regard to “Premco Global: Promoters Helping Themselves to Loans?”. It is not clear why the company in Vietnam is an 85% subsidiary and has not been made into a 100% subsidiary. Surely, funds were not a problem with the company. The balance 15% is held by a Sindhi non-resident Indian (not by any local Vietnamese partner). Chandragupta Acharya, online comment

glitch where she is shown as the first-holder. How many more such bloomers will happen is anybody’s guess! The corrupt in the I-T department would be rubbing their hands in glee. The tenor of the government’s policies seems to be to compel people to accept its diktats; the government is not allowing people to make their own choices. Whither democracy and free choice? This overbearing attitude to governance —of herding people to adhere to government diktats on cash handling, Aadhaar compulsions, muzzling voices on social media, ostracising NGOs (nongovernment organisations), etc—is hurtling the country towards a stifled democracy. Is this a thought-out political strategy? SA Narayan, online comment

DEMONETISATION IS COINCIDENTAL?

STIFLED DEMOCRACY? This is with regard to “From Noteban to GST, Brace Yourself for a Turbulent 2017” by Sucheta Dalal. Arun Shourie, in an interview, rightly, said that the prime minister embarked on notebandi because it was being felt that this government was not doing enough on the issue of black money and that nothing was done in the past few months. What a Tughlaq-ian move and at what cost to the aam janta! All the sops announced as antidote would need to be funded and, surely, the equity markets would be tapped. Raid-raj would become the order of the day, since it has become a prestige issue with Narendra Modi to book the tax-evaders. But, in the process, carpet-bombing will happen. Take the case of notice to non-filers. My wife, who is a not a taxpayer, received a notice from income-tax (I-T) department for an investment made by me, where she is a joint-holder. Clearly, this is a case of a technical

This is with regard to “Strong Stocks in A Weak Market” by Debashis Basu. This is a good article. A few of the stocks wentup because they were ‘over-sold’ & exhibiting ‘dead cat bounce’. Demonetisation just happened to be coincidental around the same time. One example is MindTree. How do we eliminate such stocks? Kalyanarao Konda, online comment

TURN OF SMALL-SCALE SECTOR TO PAY TAXES This is with regard to “Fortnightly Market View: Slow Realisation for the Bulls” by Debashis Basu. If the unorganised small-scale sector has to now pay taxes, it may actually be good for the listed companies. But, I agree that it is a very complex process and only time will tell how it pans out. Ramesh Mehta, online comment

HOW TO REACH US Letters: Letters to the Editor can be emailed to editor@moneylife. in or can be posted to: The Editor, Moneylife Magazine, Unit No. 316, 3rd Floor, Hind Service Industries, Off Veer Savarkar Marg, Dadar(W),

Mumbai 400 028 or faxed to 02249205022. Letters must include the writer’s full name, address and telephone number and may be edited. Subscription Service: For new subscription requests,

complaints about current subscription and books, write to us at [email protected] or to Subscription Manager, Unit No. 316, 3rd Floor, Hind Service Industries, Off Veer Savarkar Marg, Dadar (W), Mumbai

400 028 or call 022-49205000 or fax to 022-49205022. Advertising: For information and rates, email us at [email protected] or call 91-022-49205000.

11 | 20 Jan-2 Feb 2017 | MONEYLIFE

Letters.indd 5

12-01-2017 20:38:05

Your Money LIFE INSURANCE

REAL ESTATE

Consumer Court Slaps Rs10.5 Lakh Penalty on Tata AIG

Dosti Vrishti Society Residents Lock Up Builder for Poor Water Supply

N

T

iwas Manohar Joshi had secured a housing loan of Rs10.50 lakh from the Federal Bank branch in Pune. He covered the repayment of the total loan amount in 2008 under the ‘Tata AIG life group single premium mortgage reducing term insurance policy’ by paying a onetime premium of Rs57,246. The insurance company issued the policy on 21 November 2008 giving cover against life or total and permanent disability. Mr Joshi died at a hospital in Kolhapur (Maharashtra) on 16 April 2011 and the cause of death was certified by medical authorities as “sudden massive pulmonary embolism with cardio genetic shock.” When his widow, Sandhya, and minor son, Abhishek, moved a death claim, the insurance

company it same on 19 January 2012. The insurer suggested that the information on pre-existing disease and previous treatment had been suppressed by the insured. The claimants then moved a consumer complaint, alleging deficiency in service on the part of the insurance company for wrongful repudiation of the claim. The Pune District Consumer Court observed, “The insurance company has failed miserably to show any nexus between the previous disease and the disease at the time of death of the insured.” It ordered Tata AIG to pay Rs10.5 lakh with 9% per annum interest since January 2012 and Rs15,000 compensation to widow, Sandhya and her minor son, for wrongfully rejecting the claim against the death of her husband.

RETIREMENT

Aadhaar Is Mandatory for Receiving Benefits under EPS, says Ministry of Labour and Employment

I

n a notification dated 4 January 2017, the ministry of labour and employment has made it mandatory to furnish proof of Aadhaar number to receive pension and benefits for members and pensioners under the Employees’ Pension Scheme (EPS), 1995. Those who have enrolled for an Aadhaar number, but are yet to receive it, are to provide the Aadhaar enrolment ID. A member, or a pensioner, who has not enrolled for the Aadhaar number yet is required to enrol for it by 31 January 2017. Any member, or an individual, who has not received the Aadhaar number or is yet to enrol for it can provide the following documents to continue to receive the benefits under the scheme: (a) Identity certificate issued by the employer or the Employees’ Provident Fund Organisation (EPFO) with the universal account number (UAN). (b) Aadhaar enrolment ID of the member/pensioner or a copy of the request made for the Aadhaar enrolment. (c) A copy of any of the following: (i) voter ID card (ii) PAN card (iii) passport (iv) driving licence, etc.

hane city (Maharashtra) is suffering from a severe water crisis. Residents get only 145 litres of water a day, which is 45% less than what residents of Mumbai Metropolitan Region get. Thane police have been sending teams to housing societies fearing fights over water, according to a report in Mumbai Mirror. Residents of flats constructed by Dosti Realty have been among the worst-hit by the water scarcity. They protested against the builders, as they had promised them 24 hours’ water supply. They said that the builders had failed to address the water problem, despite several pleas. The residents reportedly took Rajesh Shah, director of Dosti Realty, to the clubhouse from where he was not allowed to leave until he signed on a paper that said that the builders will ensure that the problem will be solved within 15 days. Rajesh Shah said these were strong-arm tactics and complained to the police. There have been no arrests so far. MUTUAL FUNDS

Mobile App for Mutual Funds Trading Launched by BSE

“A

ll mutual fund investors/ distributors/ registered investment advisers are hereby informed that the exchange is pleased to announce launch of BSE StAR MF mobile application,” BSE said in a circular. “Users can download BSE StAR MF mobile app (beta release) from Google Playstore now,” it said. The platform provides a range of services for easy transactions and seamless order flow for asset management companies. The app is available for Android mobile users.

MONEYLIFE | 20 Jan-2 Feb 2017 | 12

Your Money.indd 2

12-01-2017 20:35:27

MONEYLIFE FOUNDATION THE RIGHT THING TO DO

Moneylife Foundation’s

CREDIT HELPLINE The main objective of this helpline is to provide information, advice and preliminary guidance to indiv individuals needing help in credit-related areas. Our objective is to arrive at a solution that is acc acceptable to both the borrower and the lender. We encourage responsible borrowing.

ATIO

LIC APP

E T C E EJ N

LOA

Supported By

R

OUR EXPERTS

ANIL JALOTA

SURESH PRABHU

HOW IT WORKS

1 2 3 4

R BHUVANESHAWARI

RESHMA SURI

YOGESH SAPKALE

Every new query posted will be sent to our panel of experts When we get the opinion/advice from our expert, we will post the reply You can access similar issues faced by other borrowers Set also up a one-o-one meeting with our counsellors either at Moneylife Foundation’s Mumbai office or by Skype.

www.moneylife.in/credithelp hel To use our credit helpline, please confirm that you have read our terms and conditions.

IncomeTax Helpline.indd 2

17-11-2015 16:55:03

Your Money REAL ESTATE

Mediclaim Disallowed for Surgery for Morbid Obesity

A

Pune housewife had subscribed to a New India Insurance Company’s medical claim insurance policy for the period between 1 March 2012 and 28 February 2013, by paying a onetime premium of Rs17,880 for Rs5 lakh insurance cover. In October 2012, she was admitted to a private hospital for hernia and obesity surgeries and incurred expenses of Rs5.8 lakh. When she submitted her claim, the company sanctioned surgery expenses of Rs2.07 lakh for hernia, rejecting the claim amount for obesity reduction. It informed her that morbid obesity was

excluded from the cover given by the policy. She complained to the Pune District Consumer Court. The substance of her argument was that she had not gone in for

MONEYLIFE QUIZ

cosmetic surgery but had the surgery for medical reasons. The insurance company argued that rejection of her claim was based on a specific clause in the policy agreement that excluded morbid obesity from the reimbursement list. The Consumer Court accepted the insurance company’s argument and rejected the complaint. An insurance company cannot be held liable for deficient service when its policy agreement clearly excludes certain physical conditions from the reimbursement of medical expenses, ruled the Consumer Court.

Moneylife Quiz no

250

Another quiz to tease your brain. The answers are in this very issue. The winner will be chosen by a lucky draw from correct entries and answers published in the issue dated 2nd March. Send in your answers to [email protected] with the Quiz no., name, address & telephone number before 8 February 2017.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Answer Correctly! Win a personalised sed clock with an investment nt quote!

Sudesh Kumar Roy

1. Under which Section of the Income-tax Act do taxpayers start evaluating savings options to reduce their tax liability, when the financial year is nearing its end? a. Section 80D b. Section 80G c. Section 80C d. Section 88A

5. Among doctors, what is meant by ‘door to balloon time’? a. Time taken to assign a bed b. Time taken to check body temperature c. Time taken to check if medical insurance is available d. Time taken for patient to be treated on arrival at the hospital

2. What is the minimum lock-in period from the date of allotment, for mutual fund ELSS? a. 1 year b. 2 years c. 3 years d. 5 years

6. What was the closing value of the 10-year benchmark G-Sec yield on 6 January 2017? a. 7.06% b. 6.39% c. 5.58% d. 4.00%

3. For an individual in the 30% tax slab, what will be the maximum savings in the form of tax exemption in a year on investment in ELSS? a. Rs25,450 b. Rs30,550 c. Rs40,050 d. Rs46,350

7. In which country is the Palance film, The Horseman, set? a. Pakistan b. Bangladesh c. Afghanistan d. Burma

4. When did SREI Equipment Finance’s public issue of secured redeemable non-convertible debentures (NCDs) open? a. 3 January 2017 b. 5 January 2017 c. 10 January 2017 d. 12 January 2017 In all, 6 readers got all the answers right last time. The winner of Quiz-248 is Sudesh Kumar Roy from Hyderabad. Congrats! You win a personalised clock with an investment quote!

8. Which organisation has developed and launched the mobile app Bharat Interface for Money (BHIM)? a. Securities and Exchange Board of India (SEBI) b. National Securities Depository Limited (NSDL) c. Bombay Stock Exchange (BSE) d. National Payment Corp of India (NPCI) The answers to Moneylife Quiz-248 are: • 1- a. 7.50% • 2- b. 9 instances • 3- c. Winston Churchill • 4- c. Pushbullet • 5- b. A measure of calculating risk-adjusted return • 6- a. Edgar Wachenheim • 7- a. 7.7% • 8- a. 6.44%

MONEYLIFE | 20 Jan-2 Feb 2017 | 14

Your Money.indd 4

12-01-2017 20:35:44

HAVE YOU SUBSCRIBED YET? Trusted to keep Your Saving Safe

(Subscription Form overleaf)

Magazine Subscription revised 28 April 15.indd 2

29-07-2016 16:02:58

Our boldness comes at a small price Print + Digital subscription

Guer Ctopy Yo Now!

Here is how you benefit 1. Avoid the traps of mis-selling which w burn a hole in your savings savings 2. Get our ffair ir and unbiased information info mation with no hidden agenda 3. Access the magazine online at the same time it hits the stands 4. Persons of Indian origin have family here who

Period 1Year Subscription

(Please tick)

NEW SUBSCRIBER

need financial hhelp. elp. So, Moneylife is extremely xtremely useful for NRIs too 5. Automatically be be a member of Mone Moneylife ylife Foundation and receive our daily newsletters 6. Automatic basic membership of Moneylife Advisory Services, financial advisory service

No. of Issues 26 Issues

Cover Price Rs1,170

EXISTING SUBSCRIBER YOUR SUBSCRIPTION NO.

BASIC DETAILS

NAME: ______________________________________________________________________________________ GENDER: ___________________ ADDRESS: _____________________________________________________________________________________________________________ _____________________________________________________________________________________________________________________ PHONE: (Office):_______________________Phone (Res): _________________________E-mail address: ______________________________________ DATE OF BIRTH: _______________________(MM) (DD) (YY)

PAYMENT DETAILS

PROFESSION:_________________________DESIGNATION: ________________________ ( ) Please find enclosed ( ) Cash ( ) Cheque / ( ) Demand draft number ____________ Dated: _____________ for Rs1,170 Favouring Moneywise Media Pvt Ltd DATE: _________________ SIGNATURE: ________________________________

Add Rs50 extra for outstation cheques

Please fill in this order form and mail it with your remittance to Moneywise Media Pvt Ltd, 316, 3rd Floor, Hind Service Industries Premises, Off Veer Savarkar Marg, Shivaji Park, Dadar (W), Mumbai 400 028. # Rates and offers are valid in India only. #Please allow 2 weeks for the delivery of your personal copy. #All disputes shall be subject to Mumbai jurisdiction only.

Introduce a friend: Fill in the details below & we will send a free copy to your friend. * Name: ___________________________________________________________________________________________________________________________ Address: __________________________________________________________________________________________________________________________ E-mail: _______________________________________________ Tel: ___________________________ *Free copy will be sent only to addresses which can be verified prior to sending

Magazine Subscription revised 28 April 15.indd 3

25-08-2016 20:49:37

www.moneylife.in News & views with a big difference Insurance: A widow gets justice from the apex court after 11-year battle It took a gusty woman, and a dedicated consumer activist, almost 11 years to fight the giant Life Insurance Corporation, the largest insurance corporation, for the money due to her on the death of her husband. The result: a Rs21-lakh award on

InGovern questions sudden departure of Infosys’ chief compliance officer and his severance package Proxy advisory and corporate governance advisory firm InGovern Research Services Pvt Ltd has said that the sudden departure of David Kennedy, the general counsel and chief compliance officer of Infosys Ltd, raises serious questions about his departure and its consequences on the company

an insurance claim of Rs15 lakh. She owes her success to the help she received from MY Patil, a former assistant commissioner of police, who is now a consumer activist. She finally received a cheque of Rs21.08 lakh, from the consumer forums, bringing to an end a saga which shows that perseverence and a good activist to support you can eventually win the day. However, very few people have the courage to fight all the way to the apex court

EXCLUSIVE VIEWS On issues that matter to you

Chhatrapati Shivaji Maharaj Memorial: No feasibility report, no technical estimate, reveals RTI The project of Chhatrapati Shivaji Maharaj Memorial in the Arabian Sea is without any feasibility report, reveals a reply received under the Right to Information Act

Is RBI responsible for creation of black money and inflation due to high M0? – Dr Rakesh Goyal

No information on appointment of three information commissioners While the state government is taking credit, for appointment state information commissioners in Maharashtra, in January 2017, their selections violate several norms set for such appointments

Air India: SC asks CBI to probe unnecessary purchase of aircraft during UPA regime

Can fintech companies challenge banks? – Ameet Roy

The Supreme Court has asked the Central Bureau of Investigation to look into the allegation of unnecessary purchase of 111 aircrafts and lease of some others by Air India at a cost of Rs67,000 crore between 2004 and 2008 when the Congress-led United Progressive Alliance (UPA) was in office

NBFCs fail to perform in FY15-16, first half FY16-17 The performance of non-banking financial companies will continue to follow a downward trend. The second half of the current year will also remain affected due the government’s demonetisation move

For the latest news, exclusives and reports on our activities twitter.com/MoneylifeIndia

Web Content.indd 1

http://www.facebook.com/moneylife.in

Aerated drinks are banned in Parliament canteens but the public can guzzle them – Vinita Deshmukh TO GET THIS AND MUCH MORE INSTANTLY, SUBSCRIBE TO OUR DAILY & WEEKLY NEWSLETTER FREE

13-01-2017 17:32:40

CROSSHAIRs

Exclusive news, the stories behind the headlines and the truth between the lines by Sucheta Dalal

Demonetisation: Lessons To Be Learnt and Course-correction Needed

T

he New Year began with a sense of relief, after nearly two months of uncertainty and hardship that gripped India since 8 November 2016. The long queues at ATMs have vanished, although the curbs on withdrawal of our own money from banks continue. A New-year Eve scare—that more experimentation would be unleashed on the nation— also turned out to be a damp squib, with the prime minister (PM) merely announcing some recycled sops for the poor without immediate benefits. So, as we head towards an early Union Budget, and elections in several key states and municipalities, the focus is back on the whether the entire demonetisation exercise, and the hardship it caused (mainly to the less privileged), had any tangible benefits at all. Two things are clear. Demonetising currency notes has not eliminated India’s black money; people have found ingenious ways to deposit it in banks. The effort to make them pay will start now. The fact that the Reserve Bank of India (RBI) is dodging answers to questions, about printing of currency and the money deposited, has damaged the central bank’s credibility so much that several of its former governors and deputy governors have felt constrained to speak out. When you have images of the RBI governor

sprinting away from the back door of a public function to avoid the media after such an enormous currency operation, it appears that no lessons are being learnt. This is also damaging to the government. Meanwhile, we know that there is going to be a huge cost attached to demonetisation. The Centre for Monitoring Indian Economy has estimated the transaction cost of the demonetisation exercise was a massive Rs1.28 lakh crore. The is based on the actual cost of printing and supplying new currency, destroying old currency, loss of productive manhours and income—for those at banks and those who stood in queues to exchange or withdraw money. In addition, there is the loss of discretionary spending and its impact on a host of industry sectors, the impact of broken supply chains, etc. While the government has not put out any numbers, we learn from sources in the income-tax (I-T) department that they are under enormous pressure to recover at least this cost of demonetisation through raids on those who deposited tax-evaded money cash. Unfortunately, the government did nothing to plug the big loopholes for laundering money before announcing the demonetisation exercise. Trying to account for three

MONEYLIFE | 20 27 Jan-2 November Feb 2017 2014 | 18 14

Crosshair.indd 2

13-01-2017 16:25:35

to four lakh crore rupees, clearly laundered in six short

be interesting to see how seriously SEBI pursues this investigation which was put up for discussion at its weeks, is an indicator of such gaping loopholes that board meeting on 14th January. it is futile to go into all the little tricks that laundered such huge amounts. Another big chunk of the cash deposited has come Yes, people paid advance salaries to their staff in from agricultural income which cannot be questioned old notes and had them converted. Over Rs16,000 since it is officially tax-exempt. A Right to Information crore was deposited in cooperative bank accounts (RTI) application, filed by a retired tax official, Vijay since demonetisation, says an Economic Times report Sharma (who has gone on to file a public interest quoting I-T sources; a similar amount may have been litigation in the Patna High court asking to reveal the stashed in regional rural banks. According to one names of the top 100 assessees), has some startling estimate, between Rs10,000 crore to Rs12,000 crore data. Data obtained by Mr Sharma showed that was sent in suitcases and chartered flights to Nepal, “agricultural income recorded an exponential increase Bhutan and the north-east tribes who are exempted from 2004 to 2013. It touched an unbelievable Rs2,000 from I-T payments (this recovery will be almost lakh crore at the end of this period. This shameful impossible). Over Rs25,000 crore is understood to record is entirely during the United Progressive Alliance have been deposited in dormant bank accounts. (UPA) government and will turn out to be a hitherto Further, data from the financial intelligence unit hidden scam of that period on the lines of 2G and shows that 21 million new bank accounts have been Coalgate. But why hasn’t this government fixed it yet? opened between 15th November and 25 December In fact, why wasn’t it done before demonetisation was announced, especially when Mr Sharma’s findings have 2016. Over Rs3 lakh crore was deposited in these been in the public domain for a accounts, of which Rs50,000 year. crore was in cash, says a media An I-T official says, “Many of PM Narendra Modi has been report. This data is rather my colleagues are just waiting assuring the faithful that nobody shocking. At a time when bank for the returns to be filed. who deposited tax-evaded cash unions tell us that their staff in banks will be spared. “We will was stressed by the burden They know they will make a of currency exchange and life-time killing on settling the go after every one of them,” he thunders to applause from the distribution, which banks were demonetisation cases crowds. But the government simply running this quiet factory of does not have the manpower, or opening millions of new bank machinery, to go beyond a few well-publicised raids. accounts? Surely, this needs a detailed investigation. Tax-evaders know this better than honest taxpayers I, personally, know that genuine people were being and, by the time returns are filed and assessments come shooed away even at the mention of opening an up for scrutiny, it is between them and their newly account amidst the chaos of currency exchange. empowered assessing officers. Many are betting that Similarly, I-T sources tell us that thousands of the media, and the long-suffering public who stood in new companies were opened overnight and money queues would have forgotten about demonetisation, deposited into their accounts. With automated systems by then. An I-T official says, “Many of my colleagues in place, it easy should be easy for the registrar of companies (RoC) to identify these companies and track are just waiting for the returns to be filed. They know they will make a life-time killing on the demonetisation the deposits. Unfortunately, the ministry of corporate affairs (MCA) under which they function and the RoCs cases.” Finally, we, the people, would like to know why so themselves are extremely slothful, callous and corrupt. many studies and reports about black money are not Such shell companies, which support a massive in the public domain. The Indian Express reports that, laundering operation of converting cash to cheques, in 2011, the UPA government had asked three elite is another big loophole that ought to have been academic institutes in Delhi to conduct a study on the fixed. There are innumerable reports about dodgy businessmen having paid off outstanding bills and loans quantum of black money held by Indians in India and in old currency. Those who were owed the money were abroad. The institutes apparently told an RTI applicant that they were not authorised to share the reports. dumped with the burden of converting it or writing it There is no doubt that the demonetisation exercise off. One media report says that the government has has been the most unplanned, least thought-out and already identified as much as Rs80,000 crore of loan arrogant exercise of power by the State in recent repayments in cash. times. Unlike other politicians, PM Modi has often Our Cover Story this time is about the modus demonstrated that he is quick to learn from his operandi of such laundering, safely conducted under mistakes. Hopefully, there will be a lot of learning from the ineffective market surveillance systems of the this exercise and course-correction as well. Securities & Exchange Board of India (SEBI). It will 19 | 20 Jan-2 Feb 2017 | MONEYLIFE

Crosshair.indd 3

13-01-2017 16:25:54

DIFFERENT STROKES SUCHETA DALAL

NSE Needs Deep Cleaning Before Its Public Listing

O

n 5th January, I forwarded a letter from insiders by SEBI in the multiple applications (to IPOs) scam. The at the National Stock Exchange (NSE), raising matter was eventually buried. Is it any wonder that NSE concerns about conflict of interest at the NSE has got away with a mere warning even in investigations board, to UK Sinha, chairman of the Securities and like fat finger trades and the change of client codes? Exchange Board of India (SEBI). Mr Sinha thanked me This changed in September 2015, after Justice Gautam for drawing his attention to the letter and will, hopefully, Patel’s path-breaking order on the Rs100-crore defamation act on it soon. case filed by NSE against Moneylife. We published the This is the fourth in a series of letters that have exposed exposé by a whistleblower on how NSE’s algo-trading and that the bourse had been functioning like a private fief. co-location system was being rigged, with the connivance The top management comprised a close group that worked of insiders, to ensure substantial profits to a set of brokers. with friends, relatives, useful The NSE management had allegedly papered over the former employees and select issue by sacking those who academics. NSE has never been questioned about this. Nobody were involved. A subsidiary that questions a very profitable provided consultancy services entity that played a pivotal role to brokers for co-location and in transforming India’s capital algo-trading was also quietly market in the 1990s. sold off, at a huge valuation. Over the years, NSE’s rapid Justice Patel dismissed growth to become the fourth NSE’s attempt to gag Moneylife largest exchange in the world, through a hard-hitting order induced awe from those at SEBI and imposed an unprecedented and the finance ministry. This led Rs50-lakh fine. Although NSE to complete ‘regulatory capture’ The top management at National Stock has appealed the order, SEBI’s and, probably, ensured that the technical advisory committee Exchange comprised a close group founding team went on to head confirmed the whistleblower’s that worked with friends, relatives, the exchange in succession for allegations. SEBI has, since, useful former employees and select ensured a change in NSE’s over two decades. The founding academics. NSE has never been managing director (MD), Dr board composition and initiated questioned about this clubbiness RH Patil, made way for the punitive action. It asked the elevation of Ravi Narain as MD bourse to conduct a forensic and he, in turn, passed the baton to Chitra Ramakrishna, audit to pin responsibility on the individuals responsible without the post being advertised or going through a formal for the system’s breach. The consulting firm, Deloitte, selection process. NSE’s selection committee also performed was appointed, and it confirmed SEBI’s finding that a a perfunctory and questionable role, as has been revealed few stockbrokers repeatedly got preferential access to by documents procured by us from SEBI under the Right NSE’s systems. NSE was also asked to deposit the revenue to Information Act on Ms Ramakrishna’s appointment. generated from its co-location business into a separate SEBI officials have rarely dared to question NSE’s bank account and several hundred crore rupees have been clubby senior management or ensured that it complies with set aside for this. the elaborate regulations imposed on listed companies and These actions led to another development. NSE insiders intermediaries. After all, many senior SEBI and finance and employees mustered the courage to write anonymous officials have worked on deputation at the NSE and tend to letters to the SEBI chairman and finance ministry officials. I remain in awe of the bourse. Let’s not forget how CB Bhave have been copied on at least four such letters. The internal was appointed SEBI chairman, despite the National Share rot that they exposed is shocking and, probably, accelerated Depository Ltd, which he founded, having been indicted the revamp at the top.

MONEYLIFE | 20 Jan-2 Feb 2017 | 20

DIFFERENT STROKES.indd 2

13-01-2017 16:19:40

DIFFERENT STROKES SUCHETA DALAL

After the algo-trading scam was established, Ashok Ms Ramakrisha’s action. Instead, he seems to have Chawla became the NSE chairman. Mr Chawla, unlike supported Mr Subramanian’s elevation to GOO and his most of its past chairmen, is not a puppet of senior induction to the board of NSE group companies. Insiders management. The board was also partly revamped. This say that Mr Subramanian was allotted Mr Narain’s former quickly resulted in two important exits—that of Chitra apartment in Mumbai, and that his office was the only Ramakrishna, MD and CEO, and Anand Subramanian, one on the same floor as that of Ms Ramakrishna, with an whom she had appointed as advisor and group operating inter-connecting door. His perks as a consultant included officer (GOO). More on this later. As NSE readies for a first-class international travel and three days every week public listing, investors need to ensure a clean-up of the at NSE’s Chennai office which was headed by his wife irregular appointments and dodgy governance practices that Sunitha Anand. Ms Anand, also appointed as a NSE consultant, drew have crept into what was once an exemplary organisation. When Dr RH Patil passed the baton to Ravi Narain a hefty compensation. But the couple was not among the without a selection process being followed, the then finance 36 key employees listed in the annual report, nor identified minister, Yashwant Sinha, did have some concerns, but as ‘key persons’ for SEBI. Were Mr Narain and NSE’s they were quickly buried. Later, Mr Narain pushed for Ms appointment and compensation committee unaware of this? Ramakrishna’s elevation as MD saying that he did not want A former executive tells us that there was a clear to continue in an executive role. In doing so, he ensured that strategy to appoint semi-retired professionals as consultants he retains power at NSE without to key departments involving accountability. Mr Narain is high security operations rather on all board committees—the than build teams with longaudit committee, nominations term commitments. This is also and remuneration committee, true of NSE group companies. stakeholder relationship In at least two instances, committee as well as the the Exchange skirted the risk assessment and review requirement to advertise a post committee. in order to appoint a ‘favourite’ Importantly, he was the or appointed a ‘consultant’ to executive head of the NSE head it. Other cases of conflict when the algo-trading breach of interest, where spouses of occurred. Yet, Mr Narain was those in key posts at NSE were part of the decision to appoint Mr Ravi Narain was the executive head also consultants, or those Deloitte as the forensic auditor related to influential academics, of NSE when the algo-trading breach and to decide on accountability have been exposed by internal occurred. Yet, Mr Narain was part of of employees! This conflict of whistleblowers in four separate the decision to appoint Deloitte as interest was flagged by the letters. the forensic auditor and to decide on whistleblowers’ letter that I Given how scandalous this accountability of employees! forwarded to the SEBI chairman is, shouldn’t the NSE board on 5th January. Since SEBI has ask for a full review of its HR an elaborate policy to evaluate board members, it will be policies and appointments? NSE’s DRHP reveals that it has interesting to find out what it has to say about Mr Narain’s now decided to observe suitable consultants as employees role in the ongoing upheaval at NSE. and foreclose contracts of others. On 21st October, the NSE board, finally, questioned The SEBI chairman, Mr Sinha, is quoted by the media Anand Subramanian’s appointment, following a SEBI as saying that he is ‘not satisfied’ with NSE’s response to directive on the matter. He abruptly left that day, even the Deloitte report on algo-trading and wants to see action vacating his apartment in a few hours. Mr Subramanian against brokers and employees who colluded with them. was appointed by Ms Ramakrishna, although he had That is necessary, but not sufficient. Investors ought to no technical or financial background for the job. His demand clear evidence of a ‘deep cleaning’ of the bourse, appointment as a consultant also bypassed the appointment before listing. committee of the bourse. As part of the founding team of the Exchange, who has Sucheta Dalal is the managing editor of Moneylife. She was been with the organisation for over two decades, Mr Narain awarded the Padma Shri in 2006 for her outstanding contribution was probably the only person capable of questioning to journalism. She can be reached at [email protected]

21 | 20 Jan-2 Feb 2017 | MONEYLIFE

DIFFERENT STROKES.indd 3

13-01-2017 16:20:50

SMART MONEY R BALAKRISHNAN

Stock-picking in Good and Bad Times

T

here are good businesses and great businesses. And there are industries that are ‘sunrise’ or ‘mature’ or ‘sunset’. There are brands which deliver superior returns year on year. There are new ideas which create initial hype and then run into a sea of competition, as new entrants flood the industry. There are companies that struggle for years and then find their space. There are others that seem to be doing well and, suddenly, stumble. Sometimes, they brush it off and bounce back. As an investor, finding opportunities is the challenge. The space is huge and very few winners will emerge. Keeping our eyes open for opportunities is a must. Beyond that, we also keep looking at young companies and choose those, we think, will make the cut ultimately. Not every idea we back will be a winner. The key is to recognise our mistakes and, at the same time, not give in to knee-jerk reactions. No company will have a smooth and easy ride to the top. Thus, we have to be prepared for speed-bumps and some fatalities in our portfolios as we keep investing into ideas. Within an industry, over time, we will see three or four players dominating the scene. Challenging existing leaders becomes well-nigh impossible. Thus, we rarely see new players come in and do something mething big. However, in a country like ke India, where the per capita income starts from a small base, ase, industry characteristics are different. A new entrant can n become a significant player in five to 10 years. For instance, ance, in FMCG (fast moving consumer goods), there ere was Hindustan Unilever Limited (HUL), Proctor roctor & Gamble (P&G) and the unorganised ed sector. Then came Godrej, Nirma, ITC, etc. And, now, Patanjali is challenging the leaders. What we have to understand stand is that the ‘unorganised’ sector in several eral consumerspend areas is many times es bigger than the organised corporate sector ctor players put together. This evolving industry y structure helps investors pick multi-baggers in the stock markets. What we have to understand nd is that not everyone succeeds in building up profitable itable brands. We have seen brands like BPL and Maharaja raja come and go. And those like Symphony have made the he cut. Some brands like Jockey (Page Industries) just swamped mped the market, leaving old

names, like VIP, struggling. It is true that Jockey has the advantage of being a global brand, but VIP had a huge head-start in terms of time and market acceptance. They seemed to have just not dreamt big. The key thing is to reach the first three or four in the industry. We have seen many Indian players start in a protected environment and then fail to make it big. Hubris, lack of attention to quality, inability to raise resources, technology and lack of business acumen are some of the reasons. Hindustan Motors & Premier Automobiles Limited (PAL) once enjoyed a duopoly in a closed industry. Come liberalisation and they just died. Textiles industry stars went out, once licensing was abolished. The other space is technology. For every survivor, there would be hundreds who did not make it. Recall names like Pentafour, Silverline, etc, that just came and went. What I like to see is whether any company has the potential to keep earning consistently ‘good’ return on capital employed/return on equity (RoCE/RoE). By ‘good’, I generally mean more than 20%. This is a high benchmark to sustain year on year. In a 10-year span, a good company will average more than this, with not more than one or two years’ slippage. Year on year, there should be improvement in a company company’ss health rather than continuing misery. The earnings should be on a business calculation basis and not created because of tax-breaks or fiscal benefits. Mishaps do happen. Let me give you some recent examples. MCX had a problem which led to a crash in its share price. However, the c o m p a n y

MONEYLIFE | 20 Jan-2 Feb 2017 | 22

column_Balakrishnan.indd 2

12-01-2017 20:55:57

SMART MONEY R BALAKRISHNAN

bounced back, with a lot of uncertain moves. If someone

At the same time, there will be temporary bad news and had used that crisis as an opportunity to invest, she would revival in many sectors like real estate, micro-finance, public have been a winner. However, not all companies turn out sector banks, capital goods, infrastructure companies, etc. like that. Similarly, Divi’s Laboratories’ share price has had I will be wary of these, since even on good days I am not a steep fall. If I think that the business model is good and very comfortable owning these. The key thing is to keep that the company will overcome its troubles, I am happy the focus on sectors and companies that will enjoy superior to buy that share. RoCE on a steady state basis. Unfortunately, we are not in a position to participate My normal checklist will not change. I am only looking in the white goods segment that is at events based on temporary fall dominated by foreign brands with Will the cost of a power plant from glory which the markets will punish in the short term. I am not no domestic listing. Or even some come down by 25% simply consumption stories like Coke or going to buy a dud share simply because I think that the world because it fell 50% or 90%. For Pepsi. Many MNCs (multi-national companies) listed in India are also has become more honest since example, I see lot of people again 8 November 2016? Will there talking about a company called shifting to setting up their own subsidiaries that will bypass the listed be an ‘investible’ idea that truly Bartronics. They are saying that this gains from these events? entity. Thus, we are forced to dig in company is now selling point-ofthe Indian company space. sale machines and, given the push Let us take demonetisation. If people are going to to digital India, this company will do well. I am very sure shift discretionary expenditure, there would be some hurt that this is not a sustainable or scalable business that will to companies in that space. For instance, I may put off help the company wipe out all its problems. There will painting my house. Which means that paints companies, be many such stories. One other issue that everyone is debating is whether like Asian Paints, could see a small dip in their sales. The cash crunch also means that there is a slowdown this drive against black money will permanently change in construction-related activities. So, all building materials the fortunes of any company or sector. I prefer to remain supplies would suffer a dip in consumption and sales. The a sceptic and wait for things to actually turn around. impact should be felt most in the quarter ended December Human nature is such that it does not accept defeat easily. 2016. And many would also expect the tempo to be slow Will the cost of a power plant come down by 25% simply in the January to March 2017 quarter. because I think that the world has become more honest So, some great companies could experience a small since 8 November 2016? Will there be an ‘investible’ idea dip in performance. If the market prices of these shares that truly gains from these events? react adversely, I will be happy to pick them up. The I will keep looking for good ideas that will translate to important thing I am betting on is that, once things return market leadership or a niche space over the next few years. to normal, these companies will return to the profits that Maybe, one or two out of five or more ideas will work. The author can be reached at [email protected] are normally expected.

What’s Your Bahana for Not Subscribing? I am not interested in honest & insightful advice on money matters I never have any problems with banks, credit-cards or insurance companies I always invest on the basis of tips from friends and brokers Finance bores me to tears I would rather spend two year’s of knowledge on one evening of eating out I always buy from the newsstands

For subscription offers that are a steal, look for a form elsewhere in this issue or our website at www.moneylife.in

23 | 20 Jan-2 Feb 2017 | MONEYLIFE

column_Balakrishnan.indd 3

12-01-2017 20:56:26

MUTUAL FUNDS POINTERS

ELSS: To Buy or Not To Buy?

Y

ou will see plenty of savvy salesmen, bank messages, help in wealth accumulation and, often, yield negligible heavy product advertisements, claims of best real returns. The least known among these, the awareness financial service-providers and investment gurus of which is increasing, are equity linked savings schemes pitching year-end tax-saving tips which use their products or (ELSSs). An ELSS is your best bet among the tax-saving advice. The January-March period marks the high earning instruments available. season for them. This is also the time when the maximum We picked the top tax-saving investment products wealth-eroding decisions are taken! and compared how your wealth would have grown over Investment products are carefully designed based on time in each of these investment products. A summary is human behaviour which makes them appear attractive. presented in the graph below. It is based on the following assumptions: Salesmen are trained to coax you to buy into one or the other product. You would have, often, been confronted with 1. All future value adjustments are made as per 30% tax slab; a product which demands a higher premium followed by your acceptance of the one that is lower. This is one of the 2. 6% returns on traditional insurance policies; many selling tricks salesmen use to influence and deceive 3. For NPS, 12% returns on the equity portion and 8% returns on fixed-income products; you. The commissions earned are, at times, as high as 40%. Plenty of tax-saving products are available; but 4. For others, 8.5% return on investment; 5. The entire Rs1.50 lakh (available as investing for the sole purpose of saving Section 80C deduction) was invested in tax is dangerous. There has to be a well Outperformers the particular investment product. thought out process, based on certain HDFC Taxsaver The graph shows how your money calculations. You are sometimes better ICICI Prudential Long Term Equity off paying tax than trying to save it. Do would have grown year-on-year since HDFC Long Term Advantage not get lured by the short-term nominal 2000 had you invested in various investment products. It is clear that tax savings you will make on purchasing Sundaram Taxsaver an investment product. ELSS (market-linked) has outperformed The schemes are filtered on the basis of their performance in 16, 5-year rolling With the financial year nearing its every other investment product—and periods. We chose the schemes that end, it is time when taxpayers start by a huge margin. The gains on other were present in most periods investment products (most of them are evaluating various tax-saving options available under Section 80C. Popular fixed-income products) are more or less products that come to mind are: public provident fund similar. However, remember the other aspects of ELSS; these (PPF), five-year bank fixed deposits (FDs), traditional insurance policies and national pension system (NPS). While investments are market-linked and come with additional these are good investments for the risk-averse, they do not risk. Hence, there are ups and downs. The advantage of

Future Value of Investment Rs 1,40,00,000

PPF

1,20,00,000

ELSS

Bank FD NPS

Traditional Insurance Others

1,00,00,000 80,00,000 60,00,000 40,00,000 20,00,000 0 2000-01

2003-04

2006-07

2009-10

2012-13

2015-16

MONEYLIFE | 20 Jan-2 Feb 2017 | 24

ELSS.indd 2

12-01-2017 21:02:59

Advertisements.indd 9

12-01-2017 20:33:12

MUTUAL FUNDS POINTERS

3-year Rolling Returns of ELSSs 71.71%

44.30% 35.81% 29.83%

34.68% 29.18%

28.00%

23.61% 15.85%

12.12%

9.97%

5.60%

-13.14%

4.86%

7.15%

-11.49%

Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16

investing in the other instruments is that they are not see erosion in the value of its portfolio. During a bull run,

volatile and grow constantly over a period, though their an ordinary ELSS will be able to generate returns; but a growth may be slower. Market-linked products are a good bear phase will separate the best from the rest. A list of the option for the aggressive investor while fixed-income ones top consistent performers is shown on the previous page. are suitable for conservative investors.

Seven Points To Remember before Investing in ELSS Aggressive ELSS ELSS is the best performing tax-saving instrument. The primary objective of ELSS is to generate medium- to longterm capital appreciation and provide tax benefit under Section 80C of the Income-tax Act, 1961. The schemes, usually, seek steady growth by maintaining a diversified portfolio of equities across sectors and market-cap ranges. ELSS is not for risk-averse investors. As ELSS investments are, per se, stock market investments, all risks associated with equity investments pertain to ELSS as well. Though these schemes come with a mandatory lock-in period of three years from the date of allotment, don’t be rigid about it. There is a high possibility that yields over three years are low to negative and the timing of investments will determine your future returns. The graph above shows the 3-year rolling returns of ELSS. The simple strategy to overcome the dilemma of balancing higher returns with the inherent risk in ELSS is to increase the tenure of your holdings. Over a long term of 7-10 years, it is reasonably safe to assume that you will not make a loss with equity investments. We believe that equity investment, in any form, should be for a horizon of at least five years, for good results. We worked out the five-year rolling returns of all ELSSs; the results have been summarised in the graph on the next page. You will notice that although the units were held for a relatively longer period, there were occasions when returns were negative. This is the risk with equity investing. If the markets go through a bear phase, even the best ELSS can

1. Risk Profile If an investor’s risk profile is moderately conservative,she should not invest in ELSS, as these are volatile and do not guarantee returns. Even though most people have a low-risk score, they invest in this product. The explanation usually is that they will hold it for long term and, hence, will not lose. While that is true, do not make investments with such a mind-set. Though you may end up accumulating wealth, you will not enjoy peace of mind. Identify your mediumand long-term goals and invest, based on your risk profile. 2. ELSS Do Not Yield Assured Returns By looking at the ups and downs in the total wealth accumulated, the volatility in the three- and five-year rolling returns, you would understand that ELSSs do not yield assured returns. This is the biggest disadvantage of ELSS. Moreover, there is no fixed period over which dividends are paid. If you are looking for fixed income, ELSS is not the right product for you. 3. Returns Are Tax Free ELSS comes with a three-year lock-in period and investments under ELSS are eligible for tax exemptions under Section 80C of the Income-tax Act 1961. An individual in the 30% tax slab can save up to Rs46,350 as tax exemption in a year. If you sell any of your units with gains at the end of the lock-in period, such gains will also not attract any tax liability. 4. ELSS Has Mandatory Three-year Lock-in As specified earlier, ELSSs are market-linked instruments. Given the uncertainty, don’t be under the impression that you will make definite gains at the end of the lock-in

MONEYLIFE | 20 Jan-2 Feb 2017 | 26

ELSS.indd 3

12-01-2017 21:03:18

MUTUAL FUNDS POINTERS

5-year Rolling Returns of ELSSs 80% No of Schemes Minimum

60%

40%

20% 3

6

7

Mar-03

Mar-04

11

13

13

13

13

14

Mar-05

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

24

25

Mar-12

Mar-13

Average Maximum

31

32

32

Mar-14

Mar-15

Mar-16

19

0%

-20% Mar-02

Mar-11

period. There is a high possibility that three-year returns in the scheme and the new units will come with a lock-in

may be negative. You should be flexible in your holding tenure. Although this is an advantage in disguise, ELSS has the shortest lock-in period compared to other investment products. If an investor has a goal which is less than five years, she should ignore ELSS. 5. Plan ELSS Investments in Advance Unlike a tax-saving fixed deposit or a traditional insurance policy, where investors can shell out the entire money as a lump-sum, this product requires a different approach. An equity nvestment is exposed to market risks and its performance depends, to a large extent, on the points of entry and exit. When you invest a lump-sum in an ELSS, the timing of entry will have a bearing on the returns. If you invest when the market is at a peak, you could end up with erosion of capital. The loss could even offset any tax-saving while making the investment. Even if you spread your investment over the last three months of a financial year, it will not reduce the risk greatly. If you end up buying at high market valuations, your overall return will be much lower. To avoid such lump-sum risk, it is advisable to phase out your investments over the year. A good strategy is SIP (systematic investment plan)—investing a certain fixed amount every month. This way, you average out your purchases and eliminate the risk of timing. The only disadvantage of this is that every subsequent instalment gets locked in for three years. However, stick to it. 6. Say No to Dividend Re-investment Options Multiple options are available, once you shortlist your preferred ELSS. You can opt for growth, dividend or dividend re-investment option. When investing in an ELSS, it is better to opt for the growth or dividend option—not the dividend re-investment option. The reason is simple; each instalment of the ELSS will be locked-in for a period of three years. If you choose the re-investment option, any dividend that the scheme declares will be re-invested

period of three years. 7. Performance Matters Over the years, the popularity of ELSS has increased. The factor that differentiates the best from the rest is the performance. It is a fact that the outperformers keep outperforming and underperformers keep underperforming. While we know, by now, which schemes Underperformers have consistently L&T Taxsaver outperformed, Kotak Taxsaver investors need to be wary with the schemes LIC MF Tax Plan listed in the table Escorts Tax Plan alongside. UTI Long Term Equity

The schemes are filtered on the basis of their performance in 16, 5-year rolling periods. We chose the schemes that were present in most periods

Conservative Fixedincome Products

Almost everyone today would persuade you to invest in equity without checking whether it is suitable for you. But, remember, there are aggressive investors and conservative investors. While equity investments are suitable for the former, low-risk fixed-income investments are better for the latter. The best tax-saving option in the conservative space is PPF as it enjoys the ‘exempt, exempt, exempt’ (EEE) status, making it more attractive vis-à-vis other products like NSC, five-year bank FDs and others. While it is true that you will be persuaded by a lot of salesmen to pick up fancy investment products, you need to be aware of your finances and opt for only those which suit your investment style and risk appetite. Do not get lured by the figures quoted by salesmen. Make the effort to calculate the rate of returns generated by the investment. If you are still undecided where to put your money, a combination of ELSS and PPF could be an option. — Mitul Patel

27 | 20 Jan-2 Feb 2017 | MONEYLIFE

ELSS.indd 4

12-01-2017 21:03:35

INSURE CORRECTLY: MAS Benefit #1-3 The Right Life Insurance • Life Insurance Surrender Tool • The Right Health Insurance • Health Insurance Selection Tool • Free Accident Insurance We are not agents, distributors, brokers or lead generators; so, you get ethically correct advice

1. Right Life Insurance Insurance is supposed to protect you. But the real business of insurance companies is pooling money; they earn fees and their agents earn commissions. All their income and expenses come out of your money, ‘invested’ with them. And you get poor returns, after all the costs and charges.

Which insurance product then is right for you? As a member of Moneylife Advisory, you get advice on selected term insurance products, identified after deep, unbiased research. Most importantly, you will get special support during your claims, as long as you make the right declarations. + Tool Advises on Your Existing Insurance Worried that the ‘investment’ you had made in insurance is a dud? You can surrender, go paid-up or continue. What should you do? If you surrender, where do you invest and what new insurance do you buy? What are the tax implications? This tool from Moneylife Advisory will help you decide easily and quickly.

MSSN GB (Insurance 1-3 ).indd 2

16-12-2016 17:29:15

2. Right Health Insurance es differ Health insurance products are complex. Policies in exclusions, conditions and fine print. If you slip up on even one of the conditions, your claim may be rejected or cut down. A large number of cases generate disputes and some end up as complaints with the Insurance Ombudsman or consumer courts. We cut through the hype, hyperbole, duplication and complex fine print to help p you select the most suitable products. To help h you decide quickly, we have launched a health insurance selector tool.

3.Personal Accident Cover of Rs2.5 Lakh Bundled with your MAS membership is a Rs2.5 lakh of accident insurance.

This is all you need on the insurance front. Be an MAS member today and stay safe. MAS is a no-bias, no-conflict platform. We are not in the business of selling any financial product and so can advise you ethically.

Subscription to Moneylife magazine is included in MAS Premium Membership About MAS MAS is a SEBI-registered investment adviser and part of Moneylife, India’s most unbiased and pro-investor research and information group. We run India’s best personal finance magazine, Moneylife. We are not afraid to call a spade a spade. We are India’s only media company to have set up a non-profit trust, Moneylife Foundation, which is now the largest savers’ and investors’ association with more than 35,000 members. MAS was set up to help investors and savers make the right financial decisions and handhold them through the entire process.

MONEYLIFE ADVISORY FIX YOUR FINANCES, FOREVER

advisor.moneylife.in

MSSN GB (Insurance 1-3 ).indd 3

16-12-2016 17:29:45

INSURANCE TRENDS New products, regulations, features and options, interpreted from your perspective A c c i de n t I n s uranc e

Malaria Death Ruled as Accident

T

he National Consumer Disputes Redressal Commission (NCDRC) has ruled that the death of a policyholder due to malaria from a mosquito bite is an accidental death and has allowed an insurance claim. The case was National Insurance vs Mosumi Bhattacharjee whose husband, the insured, died of malaria. The insurer had turned down the claim on the ground that malaria is a disease and not an accident. The Commission, headed by Justice VK Jain, said, “Death of policyholder patient due to malaria after mosquito bite is an accidental death and, hence, insurance company is liable to pay the sum assured. It can hardly be disputed that a mosquito bite is something which no one expects and happens all of a sudden.” The Commission relied upon the earlier judgement in the Matbarsingh vs Oriental Insurance case where it was held that snake bite, dog bite and frostbite are also accidents. All three consumer forums, namely, district, state and national, held the insurance company’s stand to be incorrect. The apex consumer court’s

order can be a cause of worry for insurance companies as it can lead to a similar interpretation of accidental death due to dengue and chikungunya. The reason for the insurance companies’ worry is the large number of deaths from malaria and dengue in recent years.

Health Insurance

Will Bariatric Surgery Be Covered by Mediclaim?

H

ealth insurance companies have done a flip-flop on covering bariatric surgery in the past few years. Some insurers have started granting cover, but on a case-to-case basis, to patients with life-threatening risks. But a recent

district consumer court’s decision says that an insurance company cannot be held liable for deficient service when its policy agreement

clearly excludes certain physical conditions from the reimbursement of medical expenses. The policyholder alleged that New India Assurance wrongfully rejected her claim for expenses incurred on surgery for morbid obesity. The company had rejected the claim based on a specific clause in the policy agreement that excluded morbid obesity from the reimbursement list. The bench said that, as per the insurer’s clause, the expenses incurred for the surgery of obesity are excluded. So, insurers seem to find ways to not cover bariatric surgery. Bariatric surgery may be a life-saving procedure for some patients but is considered a cosmetic surgery by insurance companies. However, in mid-2014, the Central Government Health Scheme (CGHS) approved coverage for bariatric surgery which is similar to weight-loss surgery. The new guidelines provide for reimbursement of surgery charges to patients who have body mass index (BMI) of more than, or equal to, 40kg/m2. If the person has obesity-related co-morbidities, like hypertension, cardio-vascular disease and diabetes, surgery can be considered even if the BMI is 35kg/m2. The government has fixed a package rate of Rs2.25 lakh for such surgery. Any expense above the limit will have to be borne by the consumer. Large private hospitals charge higher rates than the amount approved for bariatric surgery under CGHS. Due to this, many prefer to get the surgeries done at government hospitals. CGHS hospitals also have stringent selection criteria and only those with co-morbid conditions, like uncontrolled diabetes, hypertension, osteoarthritis or back pain, are being extended the cover.

MONEYLIFE | 20 Jan-2 Feb 2017 | 30

Insurance.indd 2

12-01-2017 20:43:30

INSURANCE TRENDS

Consumers with no associated

ailments are not covered. For non-CGHS, coverage for bariatric surgery depends on the insurance company as there are no clear guidelines. Those covering it have their own evaluation and allow it on a case-to-case basis. With the alarming rise in bariatric surgeries in India, there is need for proper guidelines that make the disease notifiable and bring it under the ambit of Insurance Regulatory and Development Authority of India. There is a need to stop misuse of the treatment which is possible only with clear guidelines from government and regulatory authorities. Recently, surgeons from the Obesity and Metabolic Surgery Society of India and All India Association for Advancing Research in Obesity have approached the Indian Council of Medical Research for guidelines to make the disease notifiable which can help mediclaim policyholders.

Fine Print Insurer and Agents Not Trustworthy

N

either insurance companies nor their agents are trustworthy sources for a wide spectrum of people, a study by ASSOCHAM has found. It says, “Among the first set of people with no specific knowledge of insurance and finance and those who fall in the age group of 18 to 60 years, 72% of those covered in the study said their agent/sales person was the least trustworthy source in the sales process of an insurance policy.” The second least trustworthy source in the sales process was the

Health Insurance

Keep Emergency Funds for Hospitalisation

E

mergency funds are important for financial planning. An emergency can happen any time and money may be required instantly. Keep emergency cash at

home as it may be needed even if you have cashless health insurance. For emergency situations, cashless mediclaim may not be approved before hospitalisation; hence, you may be expected to pay some

insurance company itself, though the percentage on this count was much less at 29%. Those who are financially savvy and can better interpret their insurance policies find their agent and sales person the least trustworthy in the sales value chain.

Max Bupa Penalised for Rejecting Claim

T

he Gurgaon District Consumer Dispute Redressal Forum has imposed a penalty of Rs25,000 on Max Bupa Health Insurance for rejecting the claim of a cancer patient. The insurer was ordered to pay Rs3.23 lakh treatment cost along with interest @9%pa (per annum). First, Max Bupa rejected

advance to the hospital (less than 10% of the estimated cost) which will be adjusted after cashless approval. If there is denial of the cashless claim, for some reason, you have to pay the hospital bill and claim the reimbursement later. Be ready to pay for incidentals (that may or may not be reimbursed). Hospitalisation registration and non-medical expenses are not covered. Easy access to Rs25,000 or more can make the difference between life and death. Cash is still king. A savings or current account is your next best bet. Bank FD and liquid mutual funds offer good liquidity and minimal loss for premature withdrawal/ redemption. New modes of payment have become popular after demonetisation; hence these are worth exploring. Having easy access to money is more important than having money which can take time to be accessed.