2018 Coleman Tax Return.pdf

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View 2018 Coleman Tax Return.pdf as PDF for free.

More details

- Words: 29,776

- Pages: 46

Loading documents preview...

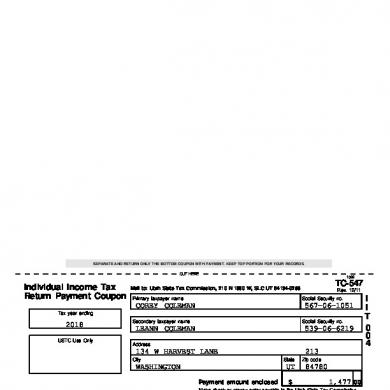

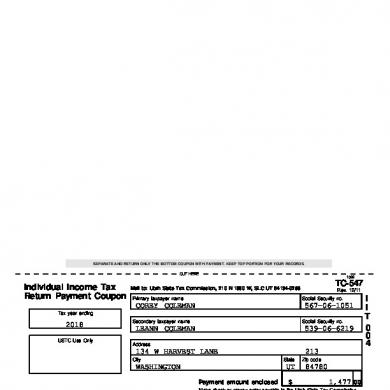

Utah State Tax Commission

TC-547

Individual Income Tax Return Payment Coupon

Rev. 12/11

(on bottom of page)

SEPARATE AND RETURN ONLY THE BOTTOM COUPON WITH PAYMENT. KEEP TOP PORTION FOR YOUR RECORDS. CUT HERE

Individual Income Tax Return Payment Coupon

1022

TC-547

Mail to: Utah State Tax Commission, 210 N 1950 W, SLC UT 84134-0266 Primary taxpayer name

Rev. 12/11 Social Security no.

COREY COLEMAN

567-06-1051

Tax year ending

2018 USTC Use Only

Secondary taxpayer name

Social Security no.

LEANN COLEMAN

539-06-6219

Address

134 W HARVEST LANE City

213 State

WASHINGTON

UT Payment amount enclosed

$

Zip code

84780 1,477 00

Make check or money order payable to the Utah State Tax Commission. Do not send cash. Do not staple check to coupon. Detach check stub.

I I T 0 0 4

2018 TC-40

Utah State Tax Commission

40801

Utah Individual Income Tax Return All State Income Tax Dollars Fund Education

1022 • Amended Return - enter code:

(see instructions) Full-yr Resident?

Your Social Security No.

567061051 Spouse’s Soc. Sec. No.

539066219

Your first name

Your last name

Y/N

COREY

COLEMAN

Y

Spouse's first name

Spouse's last name

LEANN

COLEMAN

Y Telephone number

Address If deceased, complete page 3, Part 1

134 W HARVEST LANE APT 213 City

1 Filing Status - enter code •

2

State

WASHINGTON

UT

•2

1 = Single

a

2 = Married filing jointly

b

3 = Married filing separately

c

ZIP+4

Qualifying Dependents

3 0 3

Foreign country (if not U.S.)

84780 3 Election Campaign Fund

Dependents age 16 and under

Does not increase your tax or reduce your refund.

Other dependents

Enter the code for the

Total (add lines a and b)

party of your choice.

4 = Head of household 5 = Qualifying widow(er)

Dependents must be claimed for the child tax

If using code 2 or 3, enter spouse's name and SSN above

credit on your federal return. See instructions.

Yourself

•

N

Spouse

•

N

See instructions for code letters or go to incometax.utah.gov/elect . If no contribution, enter N.

139562

4

Federal adjusted gross income from federal return

• 4

5

Additions to income from TC-40A, Part 1 (attach TC-40A, page 1)

• 5

6

Total income - add line 4 and line 5

7

State tax refund included on federal form 1040, Schedule 1, line 10 (if any)

• 7

8

Subtractions from income from TC-40A, Part 2 (attach TC-40A, page 1)

• 8

9

Utah taxable income (loss) - subtract the sum of lines 7 and 8 from line 6

• 9

139562

• 10

6908

6

10 Utah tax - multiply line 9 by 4.95% (.0495) (not less than zero) 11 Utah personal exemption (multiply line 2c by $565)

• 11

1695

12 Federal standard or itemized deductions

• 12

112269

13

113964

• 14

0

15

113964

16 Initial credit before phase-out - multiply line 15 by 6% (.06)

• 16

6838

17 Enter: $14,256 (if single or married filing separately); $21,384 (if head

• 17

28512

18

111050

• 19

1444

13 Add line 11 and line 12 14 State income tax deducted on federal Schedule A, line 5a (if any) 15 Subtract line 14 from line 13

139562

Electronic filing is quick, easy and free, and will speed up your refund. To learn more, go to tap.utah.gov

of household); or $28,512 (if married filing jointly or qualifying widower) 18 Income subject to phase-out - subtract line 17 from line 9 (not less than zero) 19 Phase-out amount - multiply line 18 by 1.3% (.013) 20 Taxpayer tax credit - subtract line 19 from line 16 (not less than zero) 21 If you are a qualified exempt taxpayer, enter “X” (complete worksheet in instr.) 22 Utah income tax - subtract line 20 from line 10 (not less than zero)

• 20

5394

• 22

1514

• 21

Utah Individual Income Tax Return (continued)

40802

SSN

567-06-1051

Last name

TC-40 2018

COLEMAN

23 Enter tax from TC-40, page 1, line 22

1514

23

24 Apportionable nonrefundable credits from TC-40A, Part 3 (attach TC-40A, page 1)

• 24

25 Full-year resident, subtract line 24 from line 23 (not less than zero)

• 25

Pg. 2

1022

1514

Non or Part-year resident, complete and enter the UTAH TAX from TC-40B, line 37 • 26

26 Nonapportionable nonrefundable credits from TC-40A, Part 4 (attach TC-40A, page 1) 27 Subtract line 26 from line 25 (not less than zero)

1514

27

28 Voluntary contributions from TC-40, page 3, Part 4 (attach TC-40, page 3)

• 28

29 AMENDED RETURN ONLY - previous refund

• 29

30 Recapture of low-income housing credit

• 30

31 Utah use tax

• 31 32

1514

33 Utah income tax withheld shown on TC-40W, Part 1 (attach TC-40W, page 1)

• 33

37

34 Credit for Utah income taxes prepaid from TC-546 and 2017 refund applied to 2018

• 34

35 Pass-through entity withholding tax shown on TC-40W, Part 3 (attach TC-40W, page 2)

• 35

36 Mineral production withholding tax shown on TC-40W, Part 2 (attach TC-40W, page 2)

• 36

37 AMENDED RETURN ONLY - previous payments

• 37

38 Refundable credits from TC-40A, Part 5 (attach TC-40A, page 2)

• 38

32 Total tax, use tax and additions to tax (add lines 27 through 31)

39

37

• 40

1477

42 TOTAL DUE - PAY THIS AMOUNT - add line 40 and line 41

• 42

1477

43 REFUND - subtract line 32 from line 39 (not less than zero)

• 43

44 Voluntary subtractions from refund (not greater than line 43)

• 44

39 Total withholding and refundable credits - add lines 33 through 38 40 TAX DUE - subtract line 39 from line 32 (not less than zero) 41 Penalty and interest (see instructions)

41

Enter the total from page 3, Part 5 45 DIRECT DEPOSIT YOUR REMAINING REFUND - provide account information (see instructions for foreign accounts) • Routing number

• Account number

checking

Account type: •

savings

•

Under penalties of perjury, I declare to the best of my knowledge and belief, this return and accompanying schedules are true, correct and complete. SIGN

Your signature

Date

Spouse's signature (if filing jointly)

Date

HERE Third Party Designee

Name of designee (if any) you authorize to discuss this return

WADE D. NICHOLS Preparer’s signature

Paid

Firm's name

Section

and address

435-635-4321 Date

Preparer's telephone number

04/13/19 435-635-4321 CHRISTENSEN NICHOLS PLLC, CPA'S 1224 S. RIVER ROAD, SUITE A-10 SAINT GEORGE UT 84790

WADE D. NICHOLS

Preparer's

Designee's telephone number

Designee PIN

•

11111

Preparer’s PTIN

•

P00745888

Preparer’s EIN

•

472443935

Attach TC-40 page 3 if you: are filing for a deceased taxpayer, are filing a fiscal year return, filed IRS form 8886, are making voluntary contributions, want to deposit into a my529 account, want to apply all/part of your refund to next year’s taxes, want to direct deposit to a foreign account, or no longer qualify for a homeowner’s exemption.

Part 1 - Utah Withholding Tax Schedule

40809

SSN

567-06-1051

Last name

COLEMAN

TC-40W 2018

1022

Line Explanations

IMPORTANT

1

Employer/payer ID number from W-2 box “b” or 1099

2

Utah withholding ID number from W-2 box “15” or 1099

Do not send your W-2s or 1099s with your return. Instead enter W-2 or 1099 information below, but only if there is Utah withholding

(14 characters, ending in WTH, no hyphens)

on the form.

3

Employer/payer name and address from W-2 box “c” or 1099

4 5

Enter “X” if reporting Utah withholding from form 1099 Employee’s Social Security number from W-2 box “a” or 1099

6

Utah wages or income from W-2 box “16” or 1099

7

Utah withholding tax from W-2 box “17” or 1099

Pg. 1

Use additional forms TC-40W if you have more than four W-2s and/or 1099s with Utah withholding tax. Enter mineral production withholding from TC-675R in Part 2 of TC-40W; enter pass-through entity withholding in Part 3 of TC-40W.

First W-2 or 1099

Second W-2 or 1099

1

870642345

2

12228933004WTH

3

INDY AUTO CENTER INC 1460 S HILTON DRIVE ST GEORGE

1 (14 characters, no hyphens)

UT 84770 4

567061051

5

6

1350

6

7

37

7

Third W-2 or 1099

Fourth W-2 or 1099

1 2

(14 characters, no hyphens)

3

4 5

2

1 (14 characters, no hyphens)

2

3

3

4

4

5

5

6

6

7

7

Enter total Utah withholding tax from all lines 7 here and on TC-40, page 2, line 33:

Submit page ONLY if data entered. Attach completed schedule to your Utah Income Tax Return. Do not attach W-2s or 1099s to your Utah return.

(14 characters, no hyphens)

37

Form

TC-40

2018

Utah Prepayment Required Payment Worksheet

Name

Taxpayer Identification Number

COREY & LEANN COLEMAN

567-06-1051

Prepayment Worksheet: Use this worksheet to calculate your required prepayment. Pay the amount on line 11 on or before the filing deadline.

1,514

1.

Income tax you expect to owe this year (Form TC-40 line 27 plus line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Rate to determine minimum payment

2.

x .90

3.

Multiply line 1 by rate on line 2

4. 5.

Utah income tax withheld as shown Schedule TC-40W Parts 1, 2, and 3

3. 4.

1,363 37

6.

Total prepayments for this year (Add lines 4 and 5)

.......................................................................

5. 6.

7.

Amount required to equal 90 percent (subtract line 6 from line 3) If less than zero, enter "0" . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. 9.

Utah tax liability for 2017 line 27 plus line 30 of 2017 Form TC-40 (As filed, amended, or audited) . . . . . . . . . . . . . . . . . . . . . . . .

8.

.....................................................................................

............................................................................................ .................................................

Previous tax prepayments and refundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.............................................

9. 10.

.................................................................................................

11.

Prepayments from line 6 above

...........................................................................................

10.

Amount required to equal previous year's liability (Subtract line 9 from line 8)

11.

Lesser of line 7 or line 10

If line 11 is greater than zero then a prepayment penalty is due if this amount is not paid by the original due date of the return. See the interest and penalty worksheet for the calculation of penalty.

37 1,326 637 37 600 600

Form

TC-40

2017 & 2018

Utah Two Year Comparison Report

Name

Taxpayer Identification Number

COREY & LEANN COLEMAN

567-06-1051 2017

1. Federal adjusted gross income Income

2. Lump sum distribution

..................................

2.

3. Medical savings account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Utah educational savings plan

4.

..........................

5. Child's income excluded from parents' return 6. Municipal bond interest

...........

5.

.................................

6.

7. Untaxed income of a trust

..............................

Deductions

8. Equitable adjustment additions

.........................

8. 9.

10. US obligations

..........................................

10.

11. Native American income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. Railroad retirement income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. Equitable adjustments deductions . . . . . . . . . . . . . . . . . . . . . .

12.

14. State tax refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

15. Non-resident active duty military pay . . . . . . . . . . . . . . . . . . . . 16. State refund distributed to beneficiary of trust . . . . . . . . . . . 17. Total deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

18. Taxable income

18.

19. Tax calculation

19.

.........................................

21.

22. State income tax deducted on federal Schedule A

......

22.

23. Exemptions plus deductions minus state income tax . . . .

23.

24. Taxpayer credit base (6% of line 23) . . . . . . . . . . . . . . . . . . . .

24.

25. Phase out income based on filing status

................

25.

26. Taxable income minus phase out income . . . . . . . . . . . . . . .

26.

27. Credit limit (Income after phase out x 1.3%)

............

27.

.....................................

28.

29. Income Tax

29.

30. Apportionable nonrefundable credits . . . . . . . . . . . . . . . . . . . .

30.

31. Nonapportionable nonrefundable credits . . . . . . . . . . . . . . . .

31.

32. Tax after nonrefundable credits . . . . . . . . . . . . . . . . . . . . . .

32.

33. Contributions

33.

................

34.

...........................

35.

...........................................

36.

Tax Computation

35. Tax from recapture of credits 36. Sales/use tax

37. Total tax, use tax and additions to tax

...............

37.

....................................

38.

...........................................

39.

38. Income tax withheld 39. Prepayments

40. Other payments

........................................

40.

41. Previous payments from amended returns . . . . . . . . . . . . . .

41.

42. Refundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42.

43. Total withholding and credits

........................

43.

.......................................

44.

44. Tax due/-refund

45. Penalty and Interest

....................................

45.

46. Net tax due/-refund

...................................

46.

47. Effective tax rate

42,448

139,562

97,114

42,448 2,122 15,190 12,700

139,562 6,908 1,695 112,269

97,114 4,786 -13,495 99,569

27,890 1,673 27,956 14,492 188 1,485 637

113,964 6,838 28,512 111,050 1,444 5,394 1,514

86,074 5,165 556 96,558 1,256 3,909 877

637

1,514

877

637 510

1,514 37

877 -473

510 127

37 1,477

-473 1,350

127 1.50 %

1,477 1.08 %

1,350

17.

20.

...........................................

97,114

16.

...................................

34. Previous refunds from amended returns

139,562

13.

21. Federal standard or itemized deduction . . . . . . . . . . . . . . . . .

28. Taxpayer tax credit

Differences

42,448

7.

9. Total income

20. Personal exemptions Adjustments

.........................

1.

2018

47.

Form

OMB No. 1545-0074

IRS e-file Signature Authorization

8879

2018

u Return completed Form 8879 to your ERO. (Don’t send to the IRS.) u Go to www.irs.gov/Form8879 for the latest information.

Department of the Treasury Internal Revenue Service

Submission Identification Number (SID) Social security number

Taxpayer's name

COREY

COLEMAN

567-06-1051 Spouse's social security number

Spouse's name

LEANN Part I

COLEMAN

539-06-6219

Tax Return Information — Tax Year Ending December 31, 2018 (Whole dollars only)

1

Adjusted gross income (Form 1040, line 7; Form 1040NR, line 35)

2

Total tax (Form 1040, line 15; Form 1040NR, line 61)

.......................................................

1

.....................................................................

2

3

Federal income tax withheld from Forms W-2 and 1099 (Form 1040, line 16; Form 1040NR, line 62a) . . . . . . . . . . . . . . . . . . . .

4 5

Refund (Form 1040, line 20a; Form 1040-SS, Part I, line 13a; Form 1040NR, line 73a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Amount you owe (Form 1040, line 22; Form 1040NR, line 75) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 4

Part II

139,562 4,542 943

5

Taxpayer Declaration and Signature Authorization (Be sure you get and keep a copy of your return)

Under penalties of perjury, I declare that I have examined a copy of my electronic individual income tax return and accompanying schedules and statements for the tax year ending December 31, 2018, and to the best of my knowledge and belief, they are true, correct, and complete. I further declare that the amounts in Part I above are the amounts from my electronic income tax return. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send my return to the IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund. If applicable, I authorize the U.S. Treasury and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of my federal taxes owed on this return and/or a payment of estimated tax, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke (cancel) a payment, I must contact the U.S. Treasury Financial Agent at 1-888-353-4537 . Payment cancellation requests must be received no later than 2 business days prior to the payment (settlement) date. I also authorize the financial institutions involved in the processing of the electronic payment of taxes to receive confidential information necessary to answer inquiries and resolve issues related to the payment. I further acknowledge that the personal identification number (PIN) below is my signature for my electronic income tax return and, if applicable, my Electronic Funds Withdrawal Consent. Taxpayer’s PIN: check one box only

X

I authorize

CHRISTENSEN NICHOLS PLLC, CPA'S

61051

to enter or generate my PIN

ERO firm name

Enter five digits, but

as my signature on my tax year 2018 electronically filed income tax return.

don’t enter all zeros

I will enter my PIN as my signature on my tax year 2018 electronically filed income tax return. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below. Your signature u

Date u

04/13/19

Spouse’s PIN: check one box only

X

I authorize

CHRISTENSEN NICHOLS PLLC, CPA'S

66219

to enter or generate my PIN

ERO firm name

Enter five digits, but

as my signature on my tax year 2018 electronically filed income tax return.

don’t enter all zeros

I will enter my PIN as my signature on my tax year 2018 electronically filed income tax return. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below. Spouse’s signature u

Part III

Date u

04/13/19

Practitioner PIN Method Returns Only—continue below Certification and Authentication — Practitioner PIN Method Only

ERO's EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN.

87453011111 Don’t enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the tax year 2018 electronically filed income tax return for the taxpayer(s) indicated above. I confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method and Pub. 1345, Handbook for Authorized IRS e-file Providers of Individual Income Tax Returns. ERO’s signature u

WADE D. NICHOLS

Date u

04/13/19

ERO Must Retain This Form — See Instructions Don’t Submit This Form to the IRS Unless Requested To Do So For Paperwork Reduction Act Notice, see your tax return instructions.

DAA

Form

8879 (2018)

Christensen Nichols PLLC, CPA's 1224 S. River Road, Suite A-104 Saint George, UT 84790-8313 435-635-4321 April 13, 2019 CONFIDENTIAL COREY & LEANN COLEMAN 134 W HARVEST LANE Apt. 213 WASHINGTON, UT 84780

For professional services rendered in connection with the preparation of your 2018 individual federal and state(s) income tax returns, including accompanying schedules: Form 1040 (Individual Income Tax Return) Form 1040, Schedule 1 (Additional Income and Adj) Form 1040, Schedule 4 (Other Taxes) Schedule A (Itemized Deductions) Schedule C (Profit or Loss from Business) Schedule SE (Self-Employment Tax) Schedule 8812 (Additional Child Tax Credit) Form 8867 (Paid Preparer's Due Diligence) Form 4562 (Depreciation and Amortization) Auto Worksheet Child Tax Credit & Credit for Other Dep Wrks Health Care: Individual Responsibility Worksheet Home Office Expense Worksheet Qualified Business Income Deduction Wrks UT Form TC-40 (Income Tax Return) Tax Return ...................................................................................................... Reprocessing fee for additional expenses provided .........................................

440.00 35.00

Preparation fee

475.00

Received on account Amount due

-440.00 $

35.00

Christensen Nichols PLLC, CPA's 1224 S. River Road, Suite A-104 Saint George, UT 84790-8313 435-635-4321

April 13, 2019 CONFIDENTIAL COREY & LEANN COLEMAN 134 W HARVEST LANE Apt. 213 WASHINGTON, UT 84780 Dear COREY & LEANN: We have prepared the following returns from information provided by you without verification or audit: U.S. Individual Income Tax Return (Form 1040) Utah Individual Income Tax Return (Form TC-40)

We suggest that you examine these returns carefully to fully acquaint yourself with all items contained therein to ensure that there are no omissions or misstatements. Federal Filing Instructions Your 2018 Form 1040 shows an amount due of $943. A check in the amount of $943 should be made payable to the United States Treasury and included with the voucher. Write "S.S.N. 56706-1051, 2018 Form 1040" and your daytime phone number on the check. Mail the Form 1040-V and the check by October 15, 2019 to: Internal Revenue Service P.O. Box 7704 San Francisco, CA 94120-7704 Do not attach your payment to Form 1040-V. Instead place them loose in the envelope. Your return is being filed electronically with the IRS and is not required to be mailed. If you mail a paper copy of Form 1040 to the IRS it will delay processing of your return. Form 8879 IRS e-file Signature Authorization authorizes your electronically filed return to be signed with a Personal Identification Number (PIN) and certifies that Part I amounts are from your tax return. Review and sign the Form 8879 IRS e-file Signature Authorization and mail it as soon as possible to: Christensen Nichols PLLC, CPA's 1224 S. River Road, Suite A-104 Saint George, UT 84790-8313

Important : Your return will not be filed with the IRS until the signed Form 8879 IRS e-file Signature Authorization has been received by this office. Retain a copy of the signed and dated Form 8879 for your records. Utah Filing Instructions Your 2018 Form TC-40 shows an amount due of $1,477. A check in the amount of $1,477 should be made payable to the Utah State Tax Commission. Write "S.S.N. 567-06-1051, 2018 Form TC-40" on the check. Mail the check and Form TC-547 by October 15, 2019 to: Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134-0266 Utah does not require an additional electronic filing signature document. Your return is being filed electronically. Do not mail Form TC-40. Also enclosed is any material you furnished for use in preparing the returns. If the returns are examined, requests may be made for supporting documentation. Therefore, we recommend that you retain all pertinent records for at least seven years. This office is committed to using safeguards that protect your information from data theft. To further protect your identity, you can also take steps to stop thieves. IRS Publication 4524 (www.irs.gov/pub/irs-pdf/p4524.pdf ) outlines simple steps that help you keep your computer secure, avoid phishing and malware, and protect your personal information. In order that we may properly advise you of tax considerations, please keep us informed of any significant changes in your financial affairs or of any correspondence received from taxing authorities. If you have any questions, or if we can be of assistance in any way, please do not hesitate to call. Sincerely, Christensen Nichols PLLC, CPA's

Department of the Treasury Internal Revenue Service

2018 Form 1040-V What Is Form 1040-V

•

To help us process your payment, enter the amount on the right side of your check like this: $ XXX.XX. Don't use dashes or lines (for example, don't enter "$ XXX—" or "$ XXX XX/100 ").

It's a statement you send with your check or money order for any balance due on the "Amount you owe" line of your 2018 Form 1040 or Form 1040NR.

No checks of $100 million or more accepted. The IRS can't accept a single check (including a cashier's check) for amounts of $100,000,000 ($100 million) or more. If you are sending $100 million or more by check, you will need to spread the payments over two or more checks, with each check made out for an amount less than $100 million.

Consider Making Your Tax Payment Electronically — It's Easy You can make electronic payments online, by phone, or from a mobile device. Paying electronically is safe and secure. When you schedule your payment you will receive immediate confirmation from the IRS. Go to www.irs.gov/ Payments to see all your electronic payment options.

Pay by cash. This is an in-person payment option for individuals provided through retail partners with a maximum of $1,000 per day per transaction. To make a cash payment, you must first be registered online at www.officialpayments.com/fed , our Official Payment provider.

How To Fill In Form 1040-V Line 1. Enter your social security number (SSN). If you are filing a joint return, enter the SSN shown first on your return. Line 2. If you are filing a joint return, enter the SSN shown second on your return. Line 3. Enter the amount you are paying by check or money order. If paying at IRS.gov don't complete this form. Line 4. Enter your name(s) and address exactly as shown on your return. Please print clearly.

How To Send In Your 2018 Tax Return, Payment, and Form 1040-V • Don't staple or otherwise attach your payment or Form 1040-V to your return. Instead, just put them loose in the envelope.

•

Mail your 2018 tax return, payment, and Form 1040-V to the address shown on the back that applies to you.

How To Prepare Your Payment • Make your check or money order payable to "United

How To Pay Electronically

States Treasury." Don't send cash. If you want to pay in cash, in person, see Pay by cash.

Pay Online Paying online is convenient, secure, and helps make sure we get your payments on time. You can pay using either of the following electronic payment methods. To pay your taxes online or for more information, go to www.irs.gov/Payments.

•

Make sure your name and address appear on your check or money order.

•

Enter your daytime phone number and your SSN on your check or money order. If you have an Individual Taxpayer Identification Number (ITIN), enter it wherever your SSN is requested. If you are filing a joint return, enter the SSN shown first on your return. Also enter "2018 Form 1040" or "2018 Form 1040NR," whichever is appropriate.

IRS Direct Pay Pay your taxes directly from your checking or savings account at no cost to you. You receive instant confirmation that your payment has been made, and you can schedule your payment up to 30 days in advance. Debit or Credit Card The IRS doesn't charge a fee for this service; the card processors do. The authorized card processors and their phone numbers are all on www.irs.gov/Payments.

Mail To: Internal Revenue Service

P.O. BOX 7704 SAN FRANCISCO, CA 94120-7704

Form

1040-V (2018)

q Detach Here and Mail With Your Payment and Return q

Form

CUT HERE

Payment Voucher

1040-V

Department of the Treasury Internal Revenue Service

(99)

1 Your social security number (SSN) (if a joint return, SSN shown first on your return)

Print or type

567-06-1051

2018

u Do not staple or attach this voucher to your payment or return. 2

If a joint return, SSN shown second on your return

539-06-6219

3 Amount you are paying by check or money order. Make your check or money order payable to "United States Treasury"

4 Your first name and initial

COREY

134 W HARVEST LANE For Paperwork Reduction Act Notice, see your tax return instructions.

943

COLEMAN Last name

LEANN Home address (number and street)

Cents

Dollars

Last name

If a joint return, spouse's first name and initial

Foreign country name

DAA

OMB No. 1545-0074

COLEMAN Apt. no.

213 Foreign province/state/county

City, town or post office, state, and ZIP code (If a foreign address, also complete spaces below.)

WASHINGTON

UT 84780 Foreign postal code

Form

1040

2018

Form 1040 Reconciliation Worksheet

1 Single

Filing Status:

X

2 Married filing jointly

3 Married filing separately

4 Head of household*

5 Qualifying widow(er)*

*Qualifying person that is a child but not a dependent:

MFS spouse name: Taxpayer first name and initial

Last name

COREY

Taxpayer social security number

COLEMAN

If a joint return, spouse's first name and initial

567-06-1051

Last name

LEANN

Spouse's social security number

COLEMAN

539-06-6219

Home address (number and street). If you have a P.O. box, see instructions.

Presidential Election Campaign

Apt. no.

134 W HARVEST LANE

213

Taxpayer

Spouse

City, town or post office, state, and ZIP code.

WASHINGTON Foreign country name

6a b

X X

UT 84780 Foreign postal code

Foreign province/state/county

Taxpayer. If someone can claim you as a dependent, do not check box 6a

Boxes checked on 6a and 6b . . . . . . . . . . . . . .

Spouse

Children on 6c who lived with you . . . . . . . . . .

2 3

Children on 6c who did not live with you . . . . . . Dependents on 6c not entered above . . . . . . .

5

Total. Add lines above

(4) ü if qualifies for

6c Dependents: (1) First name

Income

BRINTON BRINTON COLEMAN 7 8a

(Schedule 1)

b 9a b

Adjusted

(Schedule 1)

(3) Relationship to you

646-04-2805 647-15-4364 646-74-6991

Child tax credit

Other dependents

X X X

SON DAUGHTER DAUGHTER

ü here

Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxable interest. Attach Schedule B if required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Tax-exempt interest. Do not include on line 8a

.....................

Ordinary dividends. Attach Schedule B if required Qualified dividends

11 12

Alimony received

13

Capital gain or (loss). Attach Schedule D if required. If not required, check here u . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15a 16a

IRA distributions . . . . . . . . . . . . . . Pensions and annuities . . . . . . .

....................................

...................................................................................... ................................................

9a 10 11 12 14 15b 16b

17

b Taxable amount . . . . . . . . . . . . . b Taxable amount . . . . . . . . . . . . . Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . . . . . . . . . . . . .

18

Farm income or (loss). Attach Schedule F

18

19

Unemployment compensation

20a

Social security benefits

21

Other income. List type and amount

22

Combine the amounts in the far right column for lines 7 through 21. This is your total income

23 24

Educator expenses

.............................................................

.........................................................................

..........

b Taxable amount

.............

SEE SCH 1 LN 21 STMT

...................................................................

..................................................

.....

27,034

13

15a 16a

20a

1,370

9b

Taxable refunds, credits, or offsets of state and local income taxes Business income or (loss). Attach Schedule C or C-EZ

7 8a

8b

.....................................................

..................................................

If more than four dependents,

10

u

17 19 20b 21 22

113,068 141,472

23

Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ

Gross Income

(2) Social security number

Last name

BENJAMIN ELIZA CALLI

.......

24

25 26

Health savings account deduction. Attach Form 8889 . . . . . . . . . . . . . . . Moving expenses. Attach Form 3903 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25 26

27

Deductible part of self-employment tax. Attach Schedule SE

........

27

28

Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . . .

28

29

Self-employed health insurance deduction

...........................

29

30

Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

31a 32

Alimony paid IRA deduction

33 34

Student loan interest deduction Reserved

............................................................

33 34

35

Reserved

............................................................

35

36

Add lines 23 through 35

37

Subtract line 36 from line 22. This is your adjusted gross income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Recipient's SSN u ....................................................... ......................................

1,910

31a 32

...............................................................................

u

36 37

1,910 139,562

Form

1040

2018

Form 1040 Reconciliation Worksheet, Page 2

Name

Taxpayer Identification Number

COREY & LEANN COLEMAN Tax and Credits

38 39a

(Schedules 2, 3)

b

Standard Deduction for— • People who check any box on line 39a or 39b or who can be claimed as a dependent, see instructions. • All others: Single or Married filing separately, $12,000 Married filing jointly or Qualifying widow(er), $24,000

42 43

Qualified business income deduction (see instructions)

................................................

49 50 51

Credit for child and dependent care expenses. Attach Form 2441

Add lines 44, 45, and 46

Education credits from Form 8863, line 19

...................... ....

............................

Retirement savings contributions credit. Attach Form 8880 . . . . . . . . . . . Child tax credit/credit for other dependents . . . . . . . . . . . . . . . . . . . . . . . . . . .

u

51

2,292

52 53 54

Add lines 48 through 54. These are your total credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

55

Subtract line 55 from line 47. If line 55 is more than line 47, enter -0-

56 57 58

3800 b

8801 c

.............................. u Self-employment tax. Attach Schedule SE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Unreported social security and Medicare tax from Form: a 4137 b 8919 . . . . . . . . . . . . .............

59

Household employment taxes from Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

60a

First-time homebuyer credit repayment. Attach Form 5405 if required

60b 61

59 60a b 61

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required

62 63

Taxes from:

65 66

.................................

Health care: individual responsibility (see instructions) Full-year coverage or exempt

.............

a Form 8959 b Form 8960 c Instructions; enter code(s) Section 965 net tax liability installment from Form 965-A . . . . . . . . . . . . . . . . . . . . 63 Add lines 56 through 62. This is your total tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Federal income tax withheld from Forms W-2 and 1099

.............

u

68 69

Additional child tax credit. Attach Schedule 8812 . . . . . . . . . . . . . . . . . . . . . . . . ..................

68 69

70

Net premium tax credit. Attach Form 8962

...........................

70

71

Amount paid with request for extension to file

72

Excess social security and tier 1 RRTA tax withheld

73

Credit for federal tax on fuels. Attach Form 4136

74 75

Credits from Form: a

76 77a

If line 75 is more than line 64, subtract line 64 from line 75. This is the amount you overpaid . . . . . . . . . .

2439

b

Reserved c

........................ .................

....................

8885

d

3,599

73 74

Checking

u

76 77a

Savings

78

Amount of line 76 you want applied to your 2019 estimated tax u

79

Amount you owe. Subtract line 75 from line 64. For details on how to pay, see instructions . . . . . . . Estimated tax penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

Interest

Date Return filed

Late filing Interest (INT)

75

72

Amount You Owe

80

4,542

71

Amount of line 76 you want refunded to you. If Form 8888 is attached, check here . . . . . . . . . . . u Type:

64

3,599

Add lines 65, 66, 67a, and 68 through 74. These are your total payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

u c

722

65 66 67a

American opportunity credit from Form 8863, line 8

2,292 0 3,820

62

2018 estimated tax payments and amount applied from 2017 return . . . . . . . . . . Earned income credit (EIC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Nontaxable combat pay election . . . . 67b

67a b

2,292

49 50

55 56

Other credits from Form: a

112,269 27,293 5,025 22,268 2,292

48

Residential energy credits. Attach Form 5695 . . . . . . . . . . . . . . . . . . . . . . . . .

u b Routing number u d Account number

78

Failure to file

u

943

79 Failure to pay

Penalties

Total

X

Paid Preparer is 3rd Party Designee, Third Party Designee information not required Do you want to allow another person to discuss this return with the IRS (see instructions)?

Yes. Complete below.

Personal identification number (PIN)

Designee's name

Other Info

46 47

....................................

...........................................................................

53 54

64

(Schedule 6)

43 44 45

Alternative minimum tax (see instructions). Attach Form 6251 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Foreign tax credit. Attach Form 1116 if required

58

Third Party Designee

40 41 42

..............

Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Form(s) b Form c Tax (see instr.). Check if any from: a . ........................ 8814 4972

48

(Schedule 4)

Refund

39b

...........................................................................

Excess advance premium tax credit repayment. Attach Form 8962

57

(Schedule 5)

Subtract line 40 from line 38

46 47

Other Taxes

Payments

}

Itemized deductions (from Schedule A) or your standard deduction (see left margin)

52

Head of household, $18,000

{

If your spouse itemizes on a separate return or you were a dual-status alien, check here u

40 41

44 45

567-06-1051 139,562

38

Amount from line 37 (adjusted gross income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . You were born before January 2,1954, Check Blind. Total boxes if: checked u Spouse was born before January 2,1954, Blind. 39a

u

Taxpayer Daytime phone number

Phone no. Taxpayer: Occupation Spouse: Occupation

SALES INSTRUCTOR

u u IRS Identity Protection PIN IRS Identity Protection PIN

No

Form

1040

Filing status:

Department of the Treasury—Internal Revenue Service

(99)

2018

U.S. Individual Income Tax Return

X

Single

Married filing jointly

Married filing separately

Head of household

OMB No. 1545-0074

IRS Use Only–Do not write or staple in this space.

Qualifying widow(er)

Your first name and initial

Last name

Your social security number

COREY

COLEMAN

567-06-1051

Your standard deduction:

Someone can claim you as a dependent

You were born before January 2, 1954

If joint return, spouse's first name and initial

Last name

LEANN

COLEMAN

Spouse standard deduction:

Spouse's social security number

539-06-6219

Someone can claim your spouse as a dependent

Spouse is blind

You are blind

Full-year health care coverage

Spouse was born before January 2, 1954

or exempt (see instr.)

Spouse itemizes on a separate return or you were a dual-status alien

Home address (number and street). If you have a P.O. box, see instructions.

Presidential Election Campaign

Apt. no.

134 W HARVEST LANE

213

(see instr.)

City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6.

WASHINGTON

UT 84780

(1)

First name

Social security number

(3)

Relationship to you

BRINTON BRINTON COLEMAN

Spouse

Child tax credit

646-04-2805 647-15-4364 646-74-6991

SON DAUGHTER DAUGHTER

u

ü if qualifies for (see instr.) Credit for other dependents

X X X

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Joint return? See instructions. Keep a copy for your records.

Paid Preparer Use Only

Your signature

Date

Spouse's signature. If a joint return, both must sign.

Date

Your occupation

SALES Spouse's occupation

INSTRUCTOR

If the IRS sent you an Identity Protection PIN, enter it here (see instr.) If the IRS sent you an Identity Protection PIN, enter it here (see instr.) Check if:

Preparer's name

Preparer's signature

PTIN

WADE D. NICHOLS

WADE D. NICHOLS

P00745888

Firm's name

X

3rd Party Designee

u

Firm's address

CHRISTENSEN NICHOLS PLLC, CPA'S 1224 S. RIVER ROAD, SUITE A-104 UT 84790-8313 u SAINT GEORGE

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

DAA

(4)

Last name

BENJAMIN ELIZA CALLI Sign Here

see instr. and ü here

(2)

Dependents (see instructions):

You

If more than four dependents,

Firm's EIN Phone no.

Self-employed

47-2443935 435-635-4321 Form

1040 (2018)

Form 1040 (2018)

COREY & LEANN COLEMAN

Attach Form(s) W-2. Also attach Form(s) W-2G and 1099-R if tax was withheld.

• Married filing jointly or Qualifying widow(er), $24,000 • Head of household, $18,000 • If you checked any box under Standard deduction, see instructions.

Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2a

Tax-exempt interest

3a

Qualified dividends

4a

IRAs, pensions, and annuities

5a

Social security benefits

6

8

140,102 . . . . . . Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 Adjusted gross income. If you have no adjustments to income, enter the amount from line 6; otherwise subtract Schedule 1, line 36, from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Standard deduction or itemized deductions (from Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Qualified business income deduction (see instructions)

7

Standard Deduction for – • Single or married filing separately, $12,000

1

567-06-1051 Page 2 1,370 1

..........

2a

b

Taxable interest

............

2b

...........

3a

b

Ordinary dividends . . . . . . . . . .

3b

4a 5a

b

Taxable amount

............

4b

b

Taxable amount

............

5b

............

................................................

10

Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter -0-

11

a Tax (see instr.)

...........................................

12

(check if any from: 1 Form(s) 8814 2 Form 4972 3 ) b Add any amount from Schedule 2 and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . u 2,292 b Add any amount from Schedule 3 and check here u a Child tax credit/credit for other dependents

13

Subtract line 12 from line 11. If zero or less, enter -0-

14

Other taxes. Attach Schedule 4

15

Total tax. Add lines 13 and 14

16

Federal income tax withheld from Forms W-2 and 1099

17

Refundable credits:

6

141,472

7

139,562 112,269 5,025 22,268

8 9 10

2,292

12

..................................................

13

........................................................................

14

.........................................................................

15

...............................................

a EIC (see instr.)

2,292 2,292 0 4,542 4,542

11

16

3,599

b Sch 8812

c Form 8863 Add any amount from Schedule 5

Refund Direct deposit? See instructions.

18

19

If line 18 is more than line 15, subtract line 15 from line 18. This is the amount you overpaid . . . . . . . . . .

20a

Amount of line 19 you want refunded to you. If Form 8888 is attached, check here

u u

b d

22 23

Routing number

uc

Type:

Checking

...........

u

3,599 3,599

19 20a

Savings

Account number

Amount of line 19 you want applied to your 2019 estimated tax . . . . . . . u 21 Amount you owe. Subtract line 18 from line 15. For details on how to pay, see instructions Estimated tax penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . u 23

Go to www.irs.gov/Form1040 for instructions and the latest information.

DAA

17

Add lines 16 and 17. These are your total payments

21 Amount You Owe

......................................... ...................................................

18

......

u

943

22 Form

1040 (2018)

Additional Income and Adjustments to Income

SCHEDULE 1

OMB No. 1545-0074

2018

(Form 1040)

u Attach to Form 1040.

Department of the Treasury Internal Revenue Service

u Go to www.irs.gov/Form1040 for instructions and the latest information.

Name(s) shown on Form 1040

Your social security number

COREY & LEANN COLEMAN Additional Income

1-9b Reserved

567-06-1051

............................................................................................

Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

Alimony received

11

12

Business income or (loss). Attach Schedule C or C-EZ

13

Capital gain or (loss). Attach Schedule D if required. If not required, check here u

14

Other gains or (losses). Attach Form 4797

.................................................................................... ..............................................

27,034

13

..........................................................

14

............................................................................................

15b

16a Reserved

............................................................................................

16b

17

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . . . . . . . . . . .

17

18

Farm income or (loss). Attach Schedule F

18

19

Unemployment compensation

...........................................................

.......................................................................

19 20b 21

113,068

22

140,102

Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, go to line 23

23

Educator expenses

24

Certain business expenses of reservists, performing artists,

................................................

and fee-basis government officials. Attach Form 2106

.............

24

Health savings account deduction. Attach Form 8889

.............

25

26

Moving expenses for members of the Armed Forces. .................................................

26

27

Deductible part of self-employment tax. Attach Schedule SE

28

Self-employed SEP, SIMPLE, and qualified plans

29

Self-employed health insurance deduction . . . . . . . . . . . . . . . . . . . . . . . . .

30

Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31a Alimony paid

......

...............

b Recipient's SSN u

27

1,910

28 29 30 31a

32

IRA deduction

33

Student loan interest deduction

....................................

33

34

Reserved

..........................................................

34

35

Reserved

..........................................................

35

.....................................................

......................

23

25

Attach Form 3903

32

36 Add lines 23 through 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . For Paperwork Reduction Act Notice, see your tax return instructions.

. DAA

12

15a Reserved

22

.

1-9b

10

20a Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 Other income. List type and amount u . . .SEE . . . . . . . . .STATEMENT . . . . . . . . . . . . . . . . . . . . .1 .............................

Adjustments to Income

Attachment Sequence No. 01

1,910 36 Schedule 1 (Form 1040) 2018

Other Taxes

SCHEDULE 4

OMB No. 1545-0074

2018

(Form 1040)

u Attach to Form 1040.

Department of the Treasury Internal Revenue Service

u Go to www.irs.gov/Form1040 for instructions and the latest information.

Name(s) shown on Form 1040

Your social security number

COREY & LEANN COLEMAN Other Taxes

567-06-1051

57

Self-employment tax. Attach Schedule SE

58

Unreported social security and Medicare tax from: Form

59

Additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required

60a b

...........................................................

a

b

4137

8919

...............

..............................................................

Household employment taxes. Attach Schedule H

...................................................

.............................................................................................

61

Health care: individual responsibility (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

62

Taxes from:

63

Section 965 net tax liability installment from Form

c 965-A

64

a

8959

b

3,820

58 59 60a 60b 61

722

8960

62

Instructions; enter code(s)

..............................................................

63

Add the amounts in the far right column. These are your total other taxes. Enter

here and on Form 1040, line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . For Paperwork Reduction Act Notice, see your tax return instructions.

. DAA

57

Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if required

.

Attachment Sequence No. 04

4,542 64 Schedule 4 (Form 1040) 2018

Itemized Deductions

SCHEDULE A (Form 1040)

u Go to www.irs.gov/ScheduleA for instructions and the latest information.

Department of the Treasury Internal Revenue Service

(99)

Attach to Form 1040. Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16.

Name(s) shown on Form 1040

07

567-06-1051

Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions) . . . . . . . . . . . . . . . . . . . . . . 2 Enter amount from Form 1040, line 7 139,562 2

1

3 Multiply line 2 by 7.5% (0.075)

3

.........................................

4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0-

Taxes You Paid

2018 Attachment Sequence No.

Your social security number

COREY & LEANN COLEMAN Medical and Dental Expenses

OMB No. 1545-0074

10,467

.......................................

4

5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead

X

5a

b State and local real estate taxes (see instructions) . . . . . . . . . . . . . . . . . . . c State and local personal property taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5b 5c

d Add lines 5a through 5c

.............................................

5d

1,269

e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5e

1,269

of income taxes, check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Other taxes. List type and amount u

u

1,269

................................

.......................................................................

6

7 Add lines 5e and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest You Paid Caution: Your mortgage interest deduction may be limited (see instructions).

7

1,269

8 Home mortgage interest and points. If you didn't use all of your home mortgage loan(s) to buy, build, or improve your home, see instructions and check this box . . . . . . . . . . . . . . . . . . . . . . . . . a Home mortgage interest and points reported to you on Form 1098

u

.................................................................

8a

b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address u . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.......................................................................

8b

c Points not reported to you on Form 1098. See instructions for .........................................................

8c

............................................................

8d

special rules

d Reserved

e Add lines 8a through 8c

.............................................

8e

9 Investment interest. Attach Form 4952 if required. See instructions

..........................................................

9

10 Add lines 8e and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gifts to Charity If you made a gift and got a benefit for it, see instructions.

see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Other than by cash or check. If any gift of $250 or more, see instructions. You must attach Form 8283 if over $500

13 Carryover from prior year 14 Add lines 11 through 13

...............

12

............................................

13

...............................................................................

Casualty and Theft Losses

15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified

Other Itemized Deductions

16 Other—from list in instructions. List type and amount u

Total Itemized Deductions

17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Form 1040, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 If you elect to itemize deductions even though they are less than your standard

14

disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions

............................................................................................

15

...............................................

GAMBLING LOSSES

.........................................................................................................

deduction, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . u For Paperwork Reduction Act Notice, see the Instructions for Form 1040. DAA

10

11 Gifts by cash or check. If you made any gift of $250 or more,

16

111,000

17

112,269

Schedule A (Form 1040) 2018

Profit or Loss From Business

SCHEDULE C (Form 1040)

OMB No. 1545-0074

(Sole Proprietorship)

Department of the Treasury Internal Revenue Service

567-06-1051 B

Principal business or profession, including product or service (see instructions)

Enter code from instructions

ART

u

C

Business name. If no separate business name, leave blank.

E

Business address (including suite or room no.) u

X

D

134 W HARVEST LANE 213 WASHINGTON UT 84780

Other (specify) u . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F

Accounting method:

G H

Did you “materially participate” in the operation of this business during 2018? If “No,” see instructions for limit on losses

I

Did you make any payments in 2018 that would require you to file Form(s) 1099? (see instructions)

J

If "Yes," did you or will you file required Forms 1099?

(1)

Cash

711510

Employer ID number (EIN) (see instr.)

............................................................................................................

City, town or post office, state, and ZIP code

(2)

(3)

Accrual

If you started or acquired this business during 2018, check here

1

............

.................................................................

X

Yes

No

u

.................................

Yes

................................................................................

Yes

X

No No

Income

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the “Statutory employee” box on that form was checked . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . u

1

2

Returns and allowances

2

3 4

Subtract line 2 from line 1

Cost of goods sold (from line 42) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 4

5

Gross profit. Subtract line 4 from line 3

5

6

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Gross income. Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . u

7

09

Social security number (SSN)

COREY COLEMAN

Part I

Attachment Sequence No.

u Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065.

(99)

Name of proprietor

A

2018

u Go to www.irs.gov/ScheduleC for instructions and the latest information.

Part II

.................................................................................................. .................................................................................................

..................................................................................

53,148 53,148 13,466 39,682

6

39,682

7

Expenses. Enter expenses for business use of your home only on line 30.

8

Advertising

9

Car and truck expenses (see

........................

instructions)

.......................

8

1,472

9

18

Office expense (see instructions)

........

18

19

Pension and profit-sharing plans . . . . . . . . .

19

20

Rent or lease (see instructions):

10

Commissions and fees . . . . . . . . . . . .

10

a

Vehicles, machinery, and equipment

11

Contract labor (see instructions) . . . . . . .

11

b

Other business property

12 13

Depletion

12

.........................

14

Depreciation and section 179 expense deduction (not included in Part III) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . Employee benefit programs

15

(other than on line 19) . . . . . . . . . . . . Insurance (other than health) . . . . .

16

Interest (see instructions):

a

Mortgage (paid to banks, etc.)

b

Other

13 14 15

....

16a

.............................

16b

....

20a

.................

20b

21 22

Repairs and maintenance

........

21 22

23

Taxes and licenses

......................

23

24

Travel and meals:

...............

Supplies (not included in Part III)

a

Travel

b

Deductible meals (see instructions)

24b 25

.............................

Utilities

26

Wages (less employment credits)

27a

Other expenses (from line 48)

646

24a

...................................

25

1,630

..................................

26

.......

2,600

27a

...........

17 28

Legal and professional services . . .

17 4,800 b Reserved for future use . . . . . . . . . . . . . . . Total expenses before expenses for business use of home. Add lines 8 through 27a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . u

27b 28

29

Tentative profit or (loss). Subtract line 28 from line 7

29

11,148 28,534

30

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829

30

1,500

31

27,034

......................................................................

unless using the simplified method (see instructions).

Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business:

300

Method Worksheet in the instructions to figure the amount to enter on line 30

31

1400

. Use the Simplified ............................................

Net profit or (loss). Subtract line 30 from line 29.

•

If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3.

• 32

If you have a loss, check the box that describes your investment in this activity (see instructions).

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3.

•

32a

All investment is at risk.

} 32b

Some investment is not at risk.

If you checked 32b, you must attach Form 6198. Your loss may be limited.

For Paperwork Reduction Act Notice, see the separate instructions. DAA

}

If a loss, you must go to line 32.

Schedule C (Form 1040) 2018

COREY COLEMAN

567-06-1051 ART

Schedule C (Form 1040) 2018

Part III 33

Method(s) used to value closing inventory:

34

Page 2

Cost of Goods Sold (see instructions) a

b

Cost

X

c

Lower of cost or market

Other (attach explanation)

Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

35

Inventory at beginning of year. If different from last year's closing inventory, attach explanation

36

Purchases less cost of items withdrawn for personal use

X

Yes

If "Yes," attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

No

0

.......................................

35

.................................................................

36

37

Cost of labor. Do not include any amounts paid to yourself . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

38

Materials and supplies

38

10,950

39

Other costs

...............................................................................................................

39

2,516

40

Add lines 35 through 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40

13,466

41

Inventory at end of year

...................................................................................................

41

0

42

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42

13,466

Part IV

....................................................................................................

SEE STATEMENT 2

Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562.

01/01/17

43

When did you place your vehicle in service for business purposes? (month, day, year) u

44

Of the total number of miles you drove your vehicle during 2018, enter the number of miles you used your vehicle for:

a Business

2,700

..................

b Commuting (see instructions)

45

Was your vehicle available for personal use during off-duty hours?

46

Do you (or your spouse) have another vehicle available for personal use?

47a

Do you have evidence to support your deduction?

b If "Yes," is the evidence written?

Part V

................................

..................

c Other

12,300

..................

................................................................ .........................................................

.................................................................................

...................................................................................................

X X X

Yes

No

Yes

No

Yes Yes

No

X

No

Other Expenses. List below business expenses not included on lines 8-26 or line 30.

CELL PHONE . . INTERNET ....................................................................................................................................... . . AMORTIZATION ....................................................................................................................................... . ........................................................................................................................................

1,800 600 200

. ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................ . ........................................................................................................................................

48 DAA

Total other expenses. Enter here and on line 27a

.......................................................................

48

2,600

Schedule C (Form 1040) 2018

SCHEDULE SE (Form 1040)

OMB No. 1545-0074

Self-Employment Tax

2018

u Go to www.irs.gov/ScheduleSE for instructions and the latest information.

Attachment Sequence No.

Department of the Treasury u Attach to Form 1040 or Form 1040NR. Internal Revenue Service (99) Name of person with self-employment income (as shown on Form 1040 or Form 1040NR) Social security number of person

COREY

with self-employment income u

COLEMAN

17

567-06-1051