Answer Key Week 3

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Answer Key Week 3 as PDF for free.

More details

- Words: 5,357

- Pages: 14

Loading documents preview...

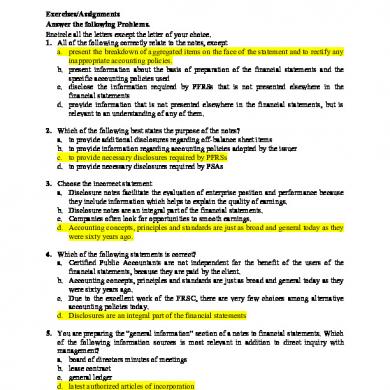

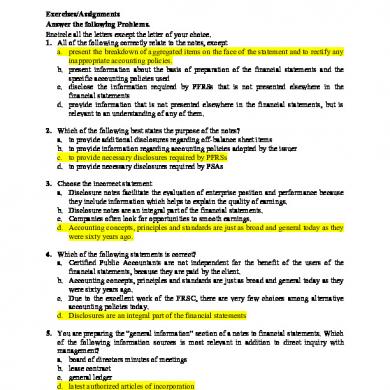

Related Party Disclosures and Events After the Reporting period Exercises/Assignments Answer the following Problems. Encircle all the letters except the letter of your choice. 1. All of the following correctly relate to the notes, except a. present the breakdown of aggregated items on the face of the statement and to rectify any inappropriate accounting policies. b. present information about the basis of preparation of the financial statements and the specific accounting policies used c. disclose the information required by PFRSs that is not presented elsewhere in the financial statements d. provide information that is not presented elsewhere in the financial statements, but is relevant to an understanding of any of them. 2. Which of the following best states the purpose of the notes? a. to provide additional disclosures regarding off-balance sheet items b. to provide information regarding accounting policies adopted by the issuer c. to provide necessary disclosures required by PFRSs d. to provide necessary disclosures required by PSAs 3. Choose the incorrect statement a. Disclosure notes facilitate the evaluation of enterprise position and performance because they include information which helps to explain the quality of earnings. b. Disclosure notes are an integral part of the financial statements. c. Companies often look for opportunities to smooth earnings. d. Accounting concepts, principles and standards are just as broad and general today as they were sixty years ago. 4. Which of the following statements is correct? a. Certified Public Accountants are not independent for the benefit of the users of the financial statements, because they are paid by the client. b. Accounting concepts, principles and standards are just as broad and general today as they were sixty years ago. c. Due to the excellent work of the FRSC, there are very few choices among alternative accounting policies today. d. Disclosures are an integral part of the financial statements 5. You are preparing the “general information” section of a notes to financial statements. Which of the following information sources is most relevant in addition to direct inquiry with management? a. board of directors minutes of meetings b. lease contract c. general ledger d. latest authorized articles of incorporation

6. Which is not a required disclosure? a. the key assumption concerning the future, and other key sources of estimation uncertainty at the balance sheet date b. the judgment management has made in the process of applying the accounting policies c. a and b d. the number of the entity’s employees 7. Which of the following information should be disclosed in the summary of significant accounting policies? a. Refinancing of debt subsequent to end of reporting period. b. Guarantees of indebtedness of others. c. Criteria for determining which investments are treated as cash equivalents. d. Adequacy of pension plan assets relative to vested benefits. 8. Which of the following facts concerning fixed assets should be included in the summary of significant accounting policies? (Item #1) Depreciation method (Item #2) Composition a. No, Yes b. Yes, Yes c. Yes, No d. No, No 9. Under PAS 10, these refer to those events that provide evidence of conditions that existed at the reporting period. a. Events after the reporting period b. Type I events c. Adjusting events after the reporting period d. Non-adjusting events after the reporting period 10. Under PAS 10, these refer to those that are indicative of conditions that arose after the reporting period. a. Events after the reporting period b. Type I events c. Adjusting events after the reporting period d. Non-adjusting events after the reporting period 11. Which of the following statements is correct? a. An entity should prepare its financial statements on a going concern basis even if events after the reporting period indicate that the going concern assumption is not appropriate. b. When an entity’s management is required to submit its financial statements to its shareholders for approval after the financial statements have been issued, for purposes of determining the events after the reporting period, the financial statements are deemed authorized for issue on the date when shareholders approve the financial statements. c. When an entity’s management is required to issue its financial statements to a supervisory board (made up solely of non-executives) for approval, for purposes of determining the events after the reporting period, the financial statements are deemed authorized for issue when the supervisory board approves the financial statements. d. Events after the reporting period include all events up to the date when the financial statements are authorized for issue, even if those events occur after the public announcement of profit or of other selected financial information.

12.

PAS 10 Events after the Financial Reporting Period defines the extent to which events after the balance sheet date should be reflected in financial statements. Five such events are listed below. 1. Merger with another company. 2. Insolvency of a customer. 3. Destruction of a major non-current asset. 4. Sale of inventory held at the balance sheet date for less than cost. 5. Discovery of fraud. Which of the listed items are, according to PAS 10, normally to be classified as adjusting? a. 1, 2 and 3

b. 2, 4 and 5

c. 1, 2 and 5

d. 1, 4 and 5

13.

VOCATION OCCUPATION Company decided to operate a new amusement park that will cost ₱1 million to build in the year 20x1. Its financial year-end is December 31, 20x1. VOCATION has applied for a letter of guarantee for ₱700,000. The letter of guarantee was issued on March 31, 20x2. The audited financial statements have been authorized to be issued on April 18, 20x2. The adjustment required to be made to the financial statement for the year ended December 31, 20x1, should be a. Booking a ₱700,000 long-term payable. b. Disclosing ₱700,000 as a contingent liability in 2005 financial statement. c. Increasing the contingency reserve by ₱700,000. d. Do nothing.

14.

A new drug was introduced by OBNOXIOUS HARMFUL Inc. in the market on December 1, 20x1. OBNOXIOUS’ financial year ends on December 31, 20x1. It was the only company that was permitted to manufacture this patented drug. The drug is used by patients suffering from an irregular heartbeat. On March 31, 20x2, after the drug was introduced, more than 1,000 patients died. After a series of investigations, authorities discovered that when this drug was simultaneously used with another drug used to regulate hypertension, the patient’s blood would clot and the patient suffered a stroke. A lawsuit for ₱100,000,000 has been filed against OBNOXIOUS Inc. The financial statements were authorized for issuance on April 30, 20x2. Which of the following options is the appropriate accounting treatment for this post–balance sheet event under PAS 10? a. The entity should provide ₱100,000,000 because this is an “adjusting event” and the financial statements were authorized to be issued after the accident. b. The entity should disclose ₱100,000,000 as a contingent liability because it is an “adjusting event.” c. The entity should disclose ₱100,000,000 as a “contingent liability” because it is a present obligation with an improbable outflow. d. Assuming the probability of the lawsuit being decided against OBNOXIOUS Inc. is remote, the entity should disclose it in the footnotes, because it is a nonadjusting material event. 15. At the balance sheet date, December 31, 2005, BELIE Inc. carried a receivable from TO DISGUISE Corporation, a major customer, at ₱10 million. The “authorization date” of the financial statements is on February 16, 2006. TO DISGUISE Corporation declared bankruptcy on Valentine’s Day (February 14, 2006). BELIE Inc. will

a. Disclose the fact that TO DISGUISE Corporation has declared bankruptcy in the notes. b. Make a provision for this post–balance sheet event in its financial statements (as opposed to disclosure in notes). c. Ignore the event and wait for the outcome of the bankruptcy because the event took place after the year-end. d. Reverse the sale pertaining to this receivable in the comparatives for the prior period and treat this as an “error” under PAS 8. 16. TITTILLATE TO TICKLE Inc. built a new factory building during 20x1 at a cost of ₱20 million. At December 31, 20x1, the net book value of the building was ₱19 million. Subsequent to year-end, on March 15, 20x2, the building was destroyed by fire and the claim against the insurance company proved futile because the cause of the fire was negligence on the part of the caretaker of the building. If the date of authorization of the financial statements for the year ended December 31, 20x1, was March 31, 20x2, TITTILLATE. should a. Write off the net book value to its scrap value because the insurance claim would not fetch any compensation. b. Make a provision for one-half of the net book value of the building. c. Make a provision for three-fourths of the net book value of the building based on prudence. d. Disclose this nonadjusting event in the footnotes. 17. DERELICT VAGRANT BUM Inc. deals extensively with foreign entities, and its financial statements reflect these foreign currency transactions. Subsequent to the balance sheet date, and before the “date of authorization” of the issuance of the financial statements, there were abnormal fluctuations in foreign currency rates. DERELICT Inc. should 18 a. Adjust the foreign exchange year-end balances to reflect the abnormal adverse fluctuations in foreign exchange rates. b. Adjust the foreign exchange year-end balances to reflect all the abnormal fluctuations in foreign exchange rates (and not just adverse movements). c. Disclose the post–balance sheet event in footnotes as a nonadjusting event. d. Ignore the post–balance sheet event. 18. On January 12, 20x2, a fire at a production facility of DUB TO NAME Company damaged a number of adjacent buildings (owned by other businesses). DUB’s insurance policy does not cover damage to the property of others. Insurance companies for those other businesses have billed DUB Company for the estimated cost of ₱2.4 million required to restore the damaged buildings. DUB’s legal counsel believed that it is reasonably possible that DUB will be held liable for damages but was uncertain as to the amount. In its 20x1 financial statements authorized for issue on February 1, 20x2, DUB Company should report a. An accrued liability of ₱2,400,000 b. An accrued liability of ₱2,400,000 and necessary disclosure in the notes to financial statements c. Only a note disclosure is required

d. No information about the damaged buildings 19. NOTION Co. guaranteed a loan of ₱200,000 granted to IDEA Co. by a bank. At the time when the financial statements of NOTION are being finished, it is clear that IDEA is in financial difficulties and it is probable that NOTION will meet the guarantee. In the financial statements, NOTION should a. Only disclose in the notes the amount of the guarantee b. Recognize a provision for liability of ₱200,000 c. Not recognize and need not disclose the guarantee d. Recognize a provision for liability of ₱200,000 and also disclose in the notes to financial statements. 20. Are the following statements in relation to compensation true or false, according to PAS 24 Related Party Disclosures? I. Compensation includes social security contributions paid by the entity. II. Compensation includes post-employment benefits paid on behalf of a parent of the entity in respect of the entity. a. False, False b. False, True c. True, False d. True, True 21. The minimum disclosures prescribed under PAS 24 are to be made separately for certain categories of related parties. Which of the following is not among the list of categories specified under the Standard for the purposes of separate disclosure? a. Entities with joint control or significant influence over the entity. b. The parent company of the entity. c. An entity that has a common director with the entity. d. Joint ventures in which the entity is a venturer. 22. CUPIDITY GREED Company completed the following transactions in the year to December 31, 20x1: I. Sold a car for P9,250 to the uncle of CUPIDITY's finance director. II. Sold goods to the value of P12,400 to AVARICE, a company owned by the daughter of CUPIDITY's managing director. AVARICE has no other connection with CUPIDITY. Which transactions, if any, require disclosure in the financial statements of CUPIDITY under PAS 24 Related Party Disclosures? a. Neither transaction b. Transaction (1) only

c. Transaction (2) only d. Both transactions

23. STEAD Company has a wholly-owned subsidiary, AVAILABLE TO HELP Corporation. During the year to June 30, 20x1, STEAD sold goods to AVAILABLE totaling ₱250,000. AVAILABLE paid ₱135,000 of this debt before year-end and then encountered financial difficulties. AVAILABLE is not expected to be able to pay the remainder of the balance and therefore it has been provided against as uncollectible. Administration costs incurred as a result of STEAD 's credit controllers chasing the debt by AVAILABLE have been calculated as ₱600. Under the minimum disclosure requirements of PAS 24 Related Party Disclosures, which of the following are required to be disclosed in relation to this arrangement? I. The costs of the credit control department incurred in pursuing the debt II. Details of any guarantees received in relation to the outstanding balance

III. IV.

The provision in relation to the debt being uncollectible Future plans regarding trading arrangements with this subsidiary a. II and III c. II, III and IV b. I, II and III d. all of these

24. Which of the following statements is true? Disclosures of material related party transactions that are eliminated in the preparation of consolidated financial statements is required in those consolidated combined financial statements. II. An associate’s subsidiary and the investor that has significant influence over the associate are related to each other. a. True, False b. False, True c. True, True d. False, False I.

25. IMMANENT INHERENT Company carried out the following four transactions during the year ended March 31, 20x1. Which of the following are related party transactions according to PAS 24 Related Party Disclosures? I. Transferred goods from inventory to a shareholder owning 40% of the company's ordinary shares II. Sold a company car to the wife of the managing director III. Sold an asset to TRANSCENDENT Company, a sales agent IV. Took out a ₱1 million bank loan a. I and II b. I, II and III c. II and III d. all of these 26. Which of the following related party transactions by a company should be disclosed in the notes to the financial statements? I. Payment of per diem expenses to members of the board of directors. II. Consulting fees paid to a marketing research firm, one of whose partners is also a director of the company. a. I only. b. II only. c. Both I and II. d. Neither I nor II. 27. VERSANT EXPERIENCED Co. has entered into a joint venture with an affiliate to secure access to additional inventory. Under the joint venture agreement, VERSANT will purchase the output of the venture at prices negotiated on an arms-length basis. Which of the following is(are) required to be disclosed about the related party transaction? I. The amount due to the affiliate at the balance sheet date. II. The monetary amount of the purchases during the year. a. I only b. II only c. Both I and II d. Neither I nor II. 28. Consolidated financial statements shall include disclosures of material transactions between related parties except a. Nonmonetary exchanges between the reporting entity and its director. b. Sales of inventory by a subsidiary to its parent. c. Expense allowance for executives which exceed normal business practice. d. A company’s agreement to act as surety for a loan to its chief executive officer. 29. APATHETIC Company has a 70% subsidiary, INDIFFERENT, Inc. and is a venturer in IMPARTIAL, a joint venture company. During the financial year to December 31, 20x1, APATHETIC sold goods to both companies. Consolidated financial statements are

prepared combining the financial statements of APATHETIC and INDIFFERENT. The investment in IMPARTIAL is accounted for under the equity method. Under PAS 24 Related Party Disclosures, in the combined financial statements of APATHETIC for 20x1, disclosure is required of transactions with a. neither INDIFFERENT nor IMPARTIAL c. IMPARTIAL only b. INDIFFERENT only d. both INDIFFERENT and IMPARTIAL 30. Which of the following statements are true? Rex Corporation has a 25% interest in Darrell Company. Munda, Inc. is a subsidiary of Darrell. Rex and Munda are related parties. II. Rhad Corporation is a venturer of Andrix Company. Renante, Inc. is a subsidiary of Andrix. Rhad and Renanted are related parties. III. NCPAR Corporation is a venturer of Session Road Joint Venture and a 25% interest investor of Pelizloy Fourth Floor Company. Session Road and Pelizloy Company are related parties. IV. Chowking Company and DBP Company are under the common control of St. Joseph Corporation. Chowking and DBP are related parties 32 a. True, True, True, True c. True, False, False, True b. False, True, False, True d. False, False, False, True I.

Answer as required. 1. 800,000 probable loss on litigation 2. Solution:

Unadjusted profit, December 31, 20x1 8,800,000 (a) Reduction in provision for loss on pending litigation (480K – 400K) 80,000 (b) Reduction in NRV of inventories [3.6M - (3.52M –120K)] (200,000) (c) Impairment loss on receivables (400,000) Adjusted profit, December 31, 20x1 8,280,000 3. 1. C Key management personnel compensation (8M + 800K + 20M + 1.2M) + Related party transactions (12M + 40M) = 82M 2. D Key management personnel compensation (8M + 800K + 20M + 1.2M) + Related party transactions (12M) = 42M

DISCLOSURES OF OPERATING SEGMENT Exercises/Assignments Answer the following Problems. 1. EMBOSOM CHERISH Co. engages in five diversified operations namely, operations A, B, C, D, and E. Information on these segments are shown below: Segments Revenues Profit (loss) Assets A

3,200

800

40,000

B

3,200

400

8,000

C

200

40

4,000

D

600

80

8,000

E

800

280

24,000

Totals

8,000

1,600

84,000

Additional information: a. For internal reporting purposes, segments A and B are considered as one operating segment. b. Segment E is considered as an operating segment for internal decision making purposes. c. Segments C and D have similar economic characteristics and share a majority of the aggregation criteria. What are the reportable segments? a. A, B, C, D and E b. A, B and E c. A and B as one segment and E d. A and B as one segment, E, and C and D as one segment 2. SORDID DIRTY Co. is preparing its year-end financial statements and has identified the following operating segments: InterExternal segment Total Segments revenues revenues revenues Profit Assets A

4,800,000

2,400,000

7,200,000

2,800,000

48,000,000

B

1,600,000

400,000

2,000,000

1,600,000

28,000,000

C

1,000,000

-

1,000,000

400,000

4,000,000

D

800,000

-

800,000

320,000

3,200,000

E

600,000

-

600,000

280,000

2,800,000

F Totals

400,000

-

400,000

200,000

2,000,000

9,200,000

2,800,000

12,000,000

5,600,000

88,000,000

Management believes that between segments C, D, E and F, segment C is most relevant to external users of financial statements. What are the reportable segments? a. A and B b. A, B, C and D

c. A, B and C

d. A, B, C, D, E and F

3. Which of the following statements is/(are) correct? I. If an entity that is not required to apply PFRS 8 Operating Segments chooses to disclose information about segments that does not comply with PFRS 8, it shall not describe the information as segment information. II. PFRS 8 does not require an entity to report information that is not prepared for internal use if the necessary information is not available and the cost to develop it would be excessive. III. If a financial report contains both the consolidated financial statements of a parent that is within the scope of PFRS 8 as well as the parent’s separate financial statements, segment information is required only the consolidated financial statements. IV. PFRS 8 requires an entity to report interest revenue separately from interest expense for each reportable segment unless a majority of the segment’s revenues are from interest and the chief operating decision maker relies primarily on net interest revenue to assess the performance of the segment and to make decisions about resources to be allocated to the segment. PAS 14, the predecessor of PFRS 8, did not require such disclosure. V. Generally, an operating segment has a segment manager who is directly accountable to and maintains regular contact with the chief operating decision maker to discuss operating activities, financial results, forecasts, or plans for the segment. VI. The term “segment manager” identifies a function which should be a segment manager with a specific title. a. VI only b. I and II c. all except VI d. all of the statements 4. Danggit, a company listed on a recognized stock exchange, reports operating results from its Cebu activities to its chief operating decision maker. The segment information for the year is: Revenue ₱3,675,000 Profit 970,000 Assets 1,700,000 Number of employees 2,500 Danggit 's results for all of its segments in total are: Revenue ₱39,250,000 Profit 9,600,000 Assets 17,500,000 Number of employees 18,500

According to PFRS 8 Operating Segments, which piece of information determines for Danggit that the Cebu activities are a reportable segment? a. Revenue b. Profit c. Assets d. Number of employees 5. According to PFRS 8, external revenue reported by reportable operating segments must be at least a. 75% of the total revenue of the entity including both internal and external revenues b. 75% of the total external revenue of the entity c. 10% of the total external revenue of the entity d. a majority of the total revenue of the entity including both internal and external revenues 6. Alexander Company has three business segments with the following information: One Two Three Sales to P8,000,000 P4,000,000 P6,000,000 outsiders Intersegment 600,000 1,000,000 1,400,000 transfers Interest income 400,000 500,000 600,000 – outsiders Interest income – intersegment 300,000 400,000 500,000 loans What is the minimum amount of revenue that each of those segments must have to be considered reportable? a. P1,950,000 c. P2,250,000 b. P2,100,000 d. P2,370,000 7. In preparing its segment-reporting schedule, the Lorna Corporation has developed the following information for each of its 5 segments: Segment Revenue Expenses 1 P1,400,000 P800,000 2 1,200,000 1,300,000 3 900,000 750,000 4 1,500,000 1,900,000 5 500,000 220,000 Total P5,500,000 P4,970,000 The reportable business segment(s) using the segment result test is (are) a. Segment 1, 2, 3, 4 & 5 b. Segment 1, 2, 3 & 4 c. Segment 1, 3 & 5 d. Segment 1, 3, 4 & 5 8. Louie Corporation and its division are engaged solely in manufacturing. The following data pertain to the industries in which operations were conducted for current year: Segment Operating Profit (Loss) 1 P8,000,000

2 2,000,000 3 (1,300,000) 4 3,000,000 5 (1,000,000) In its segment information, which is (are) reportable segment/s? a. Segments 1, 2, 3, 4 & 5 b. Segments 1, 2, 3 & 4 c. Segments 1,2 & 4 d. Segments 3 & 5 10. Which of the following statements is incorrect? a. A “management approach” is used in identifying operating segments. b. A reportable operating segment is one which management uses in making decisions about operating matters or results from aggregation of two or more segments and qualify under any of the quantitative thresholds. c. Even if an operating segment does not qualify in any of the quantitative thresholds, such operating segment may still be reportable if management believes that information about the segment would be useful to users of the financial statements. d. Disclosures for major customer shall be provided if revenues from transactions with a single external customer amount to 75% or more of the entity’s external revenues. 11. Operating segments that may be aggregated are those which exhibit similar economic characteristics and are similar in the following, except a. the nature of the products and services, their production processes, and distribution methods b. the type or class of customer for their products and services c. their financial position, financial performance, and cash flows d. regulatory environment 12. According to PFRS 8, the quantitative thresholds are I. at least 10% of total revenues (external and internal), II. at least 10% of the higher of total profits of segments reporting profits and total losses of segments reporting losses, in absolute amount (i.e., disregarding negative amounts. III. at least 10% of total assets (inclusive of intersegment receivables). a. I only b. II only c. III only d. I, II and III 13. Disclosures for major customer shall be provided if revenues from transactions with a single external customer amount to a. 10% or more of the entity’s external revenues. b. 10% or more of the entity’s external and internal revenues. c. 75% or more of the entity’s external revenues. d. 75% or more of the entity’s external and internal revenues. 14. For segment reporting, interest revenue and interest expense a. are reported separately for each reportable segment

b. may be presented at net amount if the chief operating decision maker relies primarily on net interest revenue to assess the performance of the segment c. are not reported d. a or b 15. OBLITERATE TO ERASE Co. included interest expense in its determination of segment profit, which OBLITERATE's chief financial officer considered in determining the segment's operating budget. OBLITERATE is required to report the segment's financial data under PFRS 8. Which of the following items should OBLITERATE disclose in reporting segment data? (Item #1) Interest expense; (Item #2) Segment revenues a. No, No b. No, Yes c. Yes, No d. Yes, Yes (AICPA) 16. Which of the following statements is/(are) correct? VII. If an entity that is not required to apply PFRS 8 Operating Segments chooses to disclose information about segments that does not comply with PFRS 8, it shall not describe the information as segment information. VIII. PFRS 8 does not require an entity to report information that is not prepared for internal use if the necessary information is not available and the cost to develop it would be excessive. IX. If a financial report contains both the consolidated financial statements of a parent that is within the scope of PFRS 8 as well as the parent’s separate financial statements, segment information is required only the consolidated financial statements. X. PFRS 8 requires an entity to report interest revenue separately from interest expense for each reportable segment unless a majority of the segment’s revenues are from interest and the chief operating decision maker relies primarily on net interest revenue to assess the performance of the segment and to make decisions about resources to be allocated to the segment. PAS 14, the predecessor of PFRS 8, did not require such disclosure. XI. Generally, an operating segment has a segment manager who is directly accountable to and maintains regular contact with the chief operating decision maker to discuss operating activities, financial results, forecasts, or plans for the segment. XII. The term “segment manager” identifies a function which should be a segment manager with a specific title. a. VI only b. I and II c. all except VI d. all of the statements 17. PFRS 8 aims to help users of financial statements a. Better understand enterprise performance b. Better assess its prospects for future net cash flows c. Make more informed judgments about the entity as a whole d. all of the choices 18. PFRS 8 is required to be applied by a. entities whose equity securities are traded in a public market and those entities who are in the process of filing its financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market

b. entities whose debt and equity securities are traded in a public market. c. entities whose debt and equity securities are traded in a public market and those entities who are in the process of filing its financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market d. all entities regardless of whether their securities are being traded or not 19. PFRS 8 Operating Segments is applied in I. Separate or individual financial statements II. Consolidated financial statements a. I only b. I and II c. II only

d. neither I nor II

20. Which of the following may not be considered as the chief operating decision maker of an entity? a. Chief Executive Officer (CEO) c. Chief Operating Officer (COO) b. Executive Committee d. Shareholders 21. The following are required under PFRS 8 Operating Segments to disclose segment information in its financial statements. I. entities whose equity or debt securities are publicly traded II. entities that are in the process of issuing equity or debt securities in public securities markets III. entities whose securities are not publicly traded or not in the process of issuing securities to the public. a. I and II b. I only c. II only d. None of these 22. A non-publicly listed entity may be required to comply with PFRS 8 Operating Segment if a. the entity is a subsidiary whose parent is a listed entity or in the process of issuing securities to the public even in the entity’s individual (separate) financial statements b. the entity has a foreign operation c. at least majority of its revenues comes from intercompany transactions d. it discloses segment information in its general-purpose financial statements 23. In financial reporting for segments of a business enterprise, which of the following should be taken into account in computing the amount of an industry segment's identifiable assets? (Item #1) Accumulated depreciation; (Item #2) Marketable securities valuation allowance a. No, No b. No, Yes c. Yes, Yes d. Yes, No (AICPA) 24. According to PFRS 8, how do firms identify reportable segments? a. By geographic regions c. By industry classification b. By product lines d. By designations used inside the firm 25. An entity shall report separately information about each operating segment that: I. Management deems relevant to external users II. Meets the quantitative thresholds

a. I

b. I or II

c. II

d. neither I nor II

26. Operating segments may be aggregated if a. they have similar economic characteristics b. they have different economic characteristics c. they have the same chief operating decision maker d. the entity has a matrix organization 27. Which of the following tests may be used to determine if an operating segment of an entity is a reportable segment under the provision of PFRS 8 regarding quantitative thresholds? a. Its revenue (both from external customers and internal segments) is equal to or greater than 10 percent of total revenue (external and external). b. The absolute value of its operating profit or loss is equal to or greater than 10 percent of the higher of the total of the operating profit for all segments that reported profits and the total of the losses for all segments that reported losses. c. The segment contains 10 percent or more of the combined assets of all operating segments. d. All of the above. 28. SUBJUGATE CONQUER Corporation sells 5 different types of products. The company is divided for internal reporting purposes into 5 different divisions based on these 5 different product lines. The company should prepare the note disclosure for disaggregated information based upon a. the 5 types of products. b. the 5 different divisions. c. the materialty of each product line based on the revenue or operating profits generated by each product line or the assets utilized by each product line. d. the geographic areas in which the 5 products are sold. (Adapted) 29. Nonreportable segments should a. be aggregated and reported as “all other segments.” b. be aggregated but neither reported nor disclosed c. not reported but may be disclosed if included in the necessary reconciliation of segment assets, liabilities, or profit or loss d. not reported but may be disclosed whether or not included in the necessary reconciliation of segment assets, liabilities, or profit or loss 30. Total external revenue reported by operating segments should a. at least be 75 per cent of the entity’s revenue b. not be more than 75% of the entity’s revenue c. at least be 90% of the entity’s revenue d. no limit set by PFRS 8

6. Which is not a required disclosure? a. the key assumption concerning the future, and other key sources of estimation uncertainty at the balance sheet date b. the judgment management has made in the process of applying the accounting policies c. a and b d. the number of the entity’s employees 7. Which of the following information should be disclosed in the summary of significant accounting policies? a. Refinancing of debt subsequent to end of reporting period. b. Guarantees of indebtedness of others. c. Criteria for determining which investments are treated as cash equivalents. d. Adequacy of pension plan assets relative to vested benefits. 8. Which of the following facts concerning fixed assets should be included in the summary of significant accounting policies? (Item #1) Depreciation method (Item #2) Composition a. No, Yes b. Yes, Yes c. Yes, No d. No, No 9. Under PAS 10, these refer to those events that provide evidence of conditions that existed at the reporting period. a. Events after the reporting period b. Type I events c. Adjusting events after the reporting period d. Non-adjusting events after the reporting period 10. Under PAS 10, these refer to those that are indicative of conditions that arose after the reporting period. a. Events after the reporting period b. Type I events c. Adjusting events after the reporting period d. Non-adjusting events after the reporting period 11. Which of the following statements is correct? a. An entity should prepare its financial statements on a going concern basis even if events after the reporting period indicate that the going concern assumption is not appropriate. b. When an entity’s management is required to submit its financial statements to its shareholders for approval after the financial statements have been issued, for purposes of determining the events after the reporting period, the financial statements are deemed authorized for issue on the date when shareholders approve the financial statements. c. When an entity’s management is required to issue its financial statements to a supervisory board (made up solely of non-executives) for approval, for purposes of determining the events after the reporting period, the financial statements are deemed authorized for issue when the supervisory board approves the financial statements. d. Events after the reporting period include all events up to the date when the financial statements are authorized for issue, even if those events occur after the public announcement of profit or of other selected financial information.

12.

PAS 10 Events after the Financial Reporting Period defines the extent to which events after the balance sheet date should be reflected in financial statements. Five such events are listed below. 1. Merger with another company. 2. Insolvency of a customer. 3. Destruction of a major non-current asset. 4. Sale of inventory held at the balance sheet date for less than cost. 5. Discovery of fraud. Which of the listed items are, according to PAS 10, normally to be classified as adjusting? a. 1, 2 and 3

b. 2, 4 and 5

c. 1, 2 and 5

d. 1, 4 and 5

13.

VOCATION OCCUPATION Company decided to operate a new amusement park that will cost ₱1 million to build in the year 20x1. Its financial year-end is December 31, 20x1. VOCATION has applied for a letter of guarantee for ₱700,000. The letter of guarantee was issued on March 31, 20x2. The audited financial statements have been authorized to be issued on April 18, 20x2. The adjustment required to be made to the financial statement for the year ended December 31, 20x1, should be a. Booking a ₱700,000 long-term payable. b. Disclosing ₱700,000 as a contingent liability in 2005 financial statement. c. Increasing the contingency reserve by ₱700,000. d. Do nothing.

14.

A new drug was introduced by OBNOXIOUS HARMFUL Inc. in the market on December 1, 20x1. OBNOXIOUS’ financial year ends on December 31, 20x1. It was the only company that was permitted to manufacture this patented drug. The drug is used by patients suffering from an irregular heartbeat. On March 31, 20x2, after the drug was introduced, more than 1,000 patients died. After a series of investigations, authorities discovered that when this drug was simultaneously used with another drug used to regulate hypertension, the patient’s blood would clot and the patient suffered a stroke. A lawsuit for ₱100,000,000 has been filed against OBNOXIOUS Inc. The financial statements were authorized for issuance on April 30, 20x2. Which of the following options is the appropriate accounting treatment for this post–balance sheet event under PAS 10? a. The entity should provide ₱100,000,000 because this is an “adjusting event” and the financial statements were authorized to be issued after the accident. b. The entity should disclose ₱100,000,000 as a contingent liability because it is an “adjusting event.” c. The entity should disclose ₱100,000,000 as a “contingent liability” because it is a present obligation with an improbable outflow. d. Assuming the probability of the lawsuit being decided against OBNOXIOUS Inc. is remote, the entity should disclose it in the footnotes, because it is a nonadjusting material event. 15. At the balance sheet date, December 31, 2005, BELIE Inc. carried a receivable from TO DISGUISE Corporation, a major customer, at ₱10 million. The “authorization date” of the financial statements is on February 16, 2006. TO DISGUISE Corporation declared bankruptcy on Valentine’s Day (February 14, 2006). BELIE Inc. will

a. Disclose the fact that TO DISGUISE Corporation has declared bankruptcy in the notes. b. Make a provision for this post–balance sheet event in its financial statements (as opposed to disclosure in notes). c. Ignore the event and wait for the outcome of the bankruptcy because the event took place after the year-end. d. Reverse the sale pertaining to this receivable in the comparatives for the prior period and treat this as an “error” under PAS 8. 16. TITTILLATE TO TICKLE Inc. built a new factory building during 20x1 at a cost of ₱20 million. At December 31, 20x1, the net book value of the building was ₱19 million. Subsequent to year-end, on March 15, 20x2, the building was destroyed by fire and the claim against the insurance company proved futile because the cause of the fire was negligence on the part of the caretaker of the building. If the date of authorization of the financial statements for the year ended December 31, 20x1, was March 31, 20x2, TITTILLATE. should a. Write off the net book value to its scrap value because the insurance claim would not fetch any compensation. b. Make a provision for one-half of the net book value of the building. c. Make a provision for three-fourths of the net book value of the building based on prudence. d. Disclose this nonadjusting event in the footnotes. 17. DERELICT VAGRANT BUM Inc. deals extensively with foreign entities, and its financial statements reflect these foreign currency transactions. Subsequent to the balance sheet date, and before the “date of authorization” of the issuance of the financial statements, there were abnormal fluctuations in foreign currency rates. DERELICT Inc. should 18 a. Adjust the foreign exchange year-end balances to reflect the abnormal adverse fluctuations in foreign exchange rates. b. Adjust the foreign exchange year-end balances to reflect all the abnormal fluctuations in foreign exchange rates (and not just adverse movements). c. Disclose the post–balance sheet event in footnotes as a nonadjusting event. d. Ignore the post–balance sheet event. 18. On January 12, 20x2, a fire at a production facility of DUB TO NAME Company damaged a number of adjacent buildings (owned by other businesses). DUB’s insurance policy does not cover damage to the property of others. Insurance companies for those other businesses have billed DUB Company for the estimated cost of ₱2.4 million required to restore the damaged buildings. DUB’s legal counsel believed that it is reasonably possible that DUB will be held liable for damages but was uncertain as to the amount. In its 20x1 financial statements authorized for issue on February 1, 20x2, DUB Company should report a. An accrued liability of ₱2,400,000 b. An accrued liability of ₱2,400,000 and necessary disclosure in the notes to financial statements c. Only a note disclosure is required

d. No information about the damaged buildings 19. NOTION Co. guaranteed a loan of ₱200,000 granted to IDEA Co. by a bank. At the time when the financial statements of NOTION are being finished, it is clear that IDEA is in financial difficulties and it is probable that NOTION will meet the guarantee. In the financial statements, NOTION should a. Only disclose in the notes the amount of the guarantee b. Recognize a provision for liability of ₱200,000 c. Not recognize and need not disclose the guarantee d. Recognize a provision for liability of ₱200,000 and also disclose in the notes to financial statements. 20. Are the following statements in relation to compensation true or false, according to PAS 24 Related Party Disclosures? I. Compensation includes social security contributions paid by the entity. II. Compensation includes post-employment benefits paid on behalf of a parent of the entity in respect of the entity. a. False, False b. False, True c. True, False d. True, True 21. The minimum disclosures prescribed under PAS 24 are to be made separately for certain categories of related parties. Which of the following is not among the list of categories specified under the Standard for the purposes of separate disclosure? a. Entities with joint control or significant influence over the entity. b. The parent company of the entity. c. An entity that has a common director with the entity. d. Joint ventures in which the entity is a venturer. 22. CUPIDITY GREED Company completed the following transactions in the year to December 31, 20x1: I. Sold a car for P9,250 to the uncle of CUPIDITY's finance director. II. Sold goods to the value of P12,400 to AVARICE, a company owned by the daughter of CUPIDITY's managing director. AVARICE has no other connection with CUPIDITY. Which transactions, if any, require disclosure in the financial statements of CUPIDITY under PAS 24 Related Party Disclosures? a. Neither transaction b. Transaction (1) only

c. Transaction (2) only d. Both transactions

23. STEAD Company has a wholly-owned subsidiary, AVAILABLE TO HELP Corporation. During the year to June 30, 20x1, STEAD sold goods to AVAILABLE totaling ₱250,000. AVAILABLE paid ₱135,000 of this debt before year-end and then encountered financial difficulties. AVAILABLE is not expected to be able to pay the remainder of the balance and therefore it has been provided against as uncollectible. Administration costs incurred as a result of STEAD 's credit controllers chasing the debt by AVAILABLE have been calculated as ₱600. Under the minimum disclosure requirements of PAS 24 Related Party Disclosures, which of the following are required to be disclosed in relation to this arrangement? I. The costs of the credit control department incurred in pursuing the debt II. Details of any guarantees received in relation to the outstanding balance

III. IV.

The provision in relation to the debt being uncollectible Future plans regarding trading arrangements with this subsidiary a. II and III c. II, III and IV b. I, II and III d. all of these

24. Which of the following statements is true? Disclosures of material related party transactions that are eliminated in the preparation of consolidated financial statements is required in those consolidated combined financial statements. II. An associate’s subsidiary and the investor that has significant influence over the associate are related to each other. a. True, False b. False, True c. True, True d. False, False I.

25. IMMANENT INHERENT Company carried out the following four transactions during the year ended March 31, 20x1. Which of the following are related party transactions according to PAS 24 Related Party Disclosures? I. Transferred goods from inventory to a shareholder owning 40% of the company's ordinary shares II. Sold a company car to the wife of the managing director III. Sold an asset to TRANSCENDENT Company, a sales agent IV. Took out a ₱1 million bank loan a. I and II b. I, II and III c. II and III d. all of these 26. Which of the following related party transactions by a company should be disclosed in the notes to the financial statements? I. Payment of per diem expenses to members of the board of directors. II. Consulting fees paid to a marketing research firm, one of whose partners is also a director of the company. a. I only. b. II only. c. Both I and II. d. Neither I nor II. 27. VERSANT EXPERIENCED Co. has entered into a joint venture with an affiliate to secure access to additional inventory. Under the joint venture agreement, VERSANT will purchase the output of the venture at prices negotiated on an arms-length basis. Which of the following is(are) required to be disclosed about the related party transaction? I. The amount due to the affiliate at the balance sheet date. II. The monetary amount of the purchases during the year. a. I only b. II only c. Both I and II d. Neither I nor II. 28. Consolidated financial statements shall include disclosures of material transactions between related parties except a. Nonmonetary exchanges between the reporting entity and its director. b. Sales of inventory by a subsidiary to its parent. c. Expense allowance for executives which exceed normal business practice. d. A company’s agreement to act as surety for a loan to its chief executive officer. 29. APATHETIC Company has a 70% subsidiary, INDIFFERENT, Inc. and is a venturer in IMPARTIAL, a joint venture company. During the financial year to December 31, 20x1, APATHETIC sold goods to both companies. Consolidated financial statements are

prepared combining the financial statements of APATHETIC and INDIFFERENT. The investment in IMPARTIAL is accounted for under the equity method. Under PAS 24 Related Party Disclosures, in the combined financial statements of APATHETIC for 20x1, disclosure is required of transactions with a. neither INDIFFERENT nor IMPARTIAL c. IMPARTIAL only b. INDIFFERENT only d. both INDIFFERENT and IMPARTIAL 30. Which of the following statements are true? Rex Corporation has a 25% interest in Darrell Company. Munda, Inc. is a subsidiary of Darrell. Rex and Munda are related parties. II. Rhad Corporation is a venturer of Andrix Company. Renante, Inc. is a subsidiary of Andrix. Rhad and Renanted are related parties. III. NCPAR Corporation is a venturer of Session Road Joint Venture and a 25% interest investor of Pelizloy Fourth Floor Company. Session Road and Pelizloy Company are related parties. IV. Chowking Company and DBP Company are under the common control of St. Joseph Corporation. Chowking and DBP are related parties 32 a. True, True, True, True c. True, False, False, True b. False, True, False, True d. False, False, False, True I.

Answer as required. 1. 800,000 probable loss on litigation 2. Solution:

Unadjusted profit, December 31, 20x1 8,800,000 (a) Reduction in provision for loss on pending litigation (480K – 400K) 80,000 (b) Reduction in NRV of inventories [3.6M - (3.52M –120K)] (200,000) (c) Impairment loss on receivables (400,000) Adjusted profit, December 31, 20x1 8,280,000 3. 1. C Key management personnel compensation (8M + 800K + 20M + 1.2M) + Related party transactions (12M + 40M) = 82M 2. D Key management personnel compensation (8M + 800K + 20M + 1.2M) + Related party transactions (12M) = 42M

DISCLOSURES OF OPERATING SEGMENT Exercises/Assignments Answer the following Problems. 1. EMBOSOM CHERISH Co. engages in five diversified operations namely, operations A, B, C, D, and E. Information on these segments are shown below: Segments Revenues Profit (loss) Assets A

3,200

800

40,000

B

3,200

400

8,000

C

200

40

4,000

D

600

80

8,000

E

800

280

24,000

Totals

8,000

1,600

84,000

Additional information: a. For internal reporting purposes, segments A and B are considered as one operating segment. b. Segment E is considered as an operating segment for internal decision making purposes. c. Segments C and D have similar economic characteristics and share a majority of the aggregation criteria. What are the reportable segments? a. A, B, C, D and E b. A, B and E c. A and B as one segment and E d. A and B as one segment, E, and C and D as one segment 2. SORDID DIRTY Co. is preparing its year-end financial statements and has identified the following operating segments: InterExternal segment Total Segments revenues revenues revenues Profit Assets A

4,800,000

2,400,000

7,200,000

2,800,000

48,000,000

B

1,600,000

400,000

2,000,000

1,600,000

28,000,000

C

1,000,000

-

1,000,000

400,000

4,000,000

D

800,000

-

800,000

320,000

3,200,000

E

600,000

-

600,000

280,000

2,800,000

F Totals

400,000

-

400,000

200,000

2,000,000

9,200,000

2,800,000

12,000,000

5,600,000

88,000,000

Management believes that between segments C, D, E and F, segment C is most relevant to external users of financial statements. What are the reportable segments? a. A and B b. A, B, C and D

c. A, B and C

d. A, B, C, D, E and F

3. Which of the following statements is/(are) correct? I. If an entity that is not required to apply PFRS 8 Operating Segments chooses to disclose information about segments that does not comply with PFRS 8, it shall not describe the information as segment information. II. PFRS 8 does not require an entity to report information that is not prepared for internal use if the necessary information is not available and the cost to develop it would be excessive. III. If a financial report contains both the consolidated financial statements of a parent that is within the scope of PFRS 8 as well as the parent’s separate financial statements, segment information is required only the consolidated financial statements. IV. PFRS 8 requires an entity to report interest revenue separately from interest expense for each reportable segment unless a majority of the segment’s revenues are from interest and the chief operating decision maker relies primarily on net interest revenue to assess the performance of the segment and to make decisions about resources to be allocated to the segment. PAS 14, the predecessor of PFRS 8, did not require such disclosure. V. Generally, an operating segment has a segment manager who is directly accountable to and maintains regular contact with the chief operating decision maker to discuss operating activities, financial results, forecasts, or plans for the segment. VI. The term “segment manager” identifies a function which should be a segment manager with a specific title. a. VI only b. I and II c. all except VI d. all of the statements 4. Danggit, a company listed on a recognized stock exchange, reports operating results from its Cebu activities to its chief operating decision maker. The segment information for the year is: Revenue ₱3,675,000 Profit 970,000 Assets 1,700,000 Number of employees 2,500 Danggit 's results for all of its segments in total are: Revenue ₱39,250,000 Profit 9,600,000 Assets 17,500,000 Number of employees 18,500

According to PFRS 8 Operating Segments, which piece of information determines for Danggit that the Cebu activities are a reportable segment? a. Revenue b. Profit c. Assets d. Number of employees 5. According to PFRS 8, external revenue reported by reportable operating segments must be at least a. 75% of the total revenue of the entity including both internal and external revenues b. 75% of the total external revenue of the entity c. 10% of the total external revenue of the entity d. a majority of the total revenue of the entity including both internal and external revenues 6. Alexander Company has three business segments with the following information: One Two Three Sales to P8,000,000 P4,000,000 P6,000,000 outsiders Intersegment 600,000 1,000,000 1,400,000 transfers Interest income 400,000 500,000 600,000 – outsiders Interest income – intersegment 300,000 400,000 500,000 loans What is the minimum amount of revenue that each of those segments must have to be considered reportable? a. P1,950,000 c. P2,250,000 b. P2,100,000 d. P2,370,000 7. In preparing its segment-reporting schedule, the Lorna Corporation has developed the following information for each of its 5 segments: Segment Revenue Expenses 1 P1,400,000 P800,000 2 1,200,000 1,300,000 3 900,000 750,000 4 1,500,000 1,900,000 5 500,000 220,000 Total P5,500,000 P4,970,000 The reportable business segment(s) using the segment result test is (are) a. Segment 1, 2, 3, 4 & 5 b. Segment 1, 2, 3 & 4 c. Segment 1, 3 & 5 d. Segment 1, 3, 4 & 5 8. Louie Corporation and its division are engaged solely in manufacturing. The following data pertain to the industries in which operations were conducted for current year: Segment Operating Profit (Loss) 1 P8,000,000

2 2,000,000 3 (1,300,000) 4 3,000,000 5 (1,000,000) In its segment information, which is (are) reportable segment/s? a. Segments 1, 2, 3, 4 & 5 b. Segments 1, 2, 3 & 4 c. Segments 1,2 & 4 d. Segments 3 & 5 10. Which of the following statements is incorrect? a. A “management approach” is used in identifying operating segments. b. A reportable operating segment is one which management uses in making decisions about operating matters or results from aggregation of two or more segments and qualify under any of the quantitative thresholds. c. Even if an operating segment does not qualify in any of the quantitative thresholds, such operating segment may still be reportable if management believes that information about the segment would be useful to users of the financial statements. d. Disclosures for major customer shall be provided if revenues from transactions with a single external customer amount to 75% or more of the entity’s external revenues. 11. Operating segments that may be aggregated are those which exhibit similar economic characteristics and are similar in the following, except a. the nature of the products and services, their production processes, and distribution methods b. the type or class of customer for their products and services c. their financial position, financial performance, and cash flows d. regulatory environment 12. According to PFRS 8, the quantitative thresholds are I. at least 10% of total revenues (external and internal), II. at least 10% of the higher of total profits of segments reporting profits and total losses of segments reporting losses, in absolute amount (i.e., disregarding negative amounts. III. at least 10% of total assets (inclusive of intersegment receivables). a. I only b. II only c. III only d. I, II and III 13. Disclosures for major customer shall be provided if revenues from transactions with a single external customer amount to a. 10% or more of the entity’s external revenues. b. 10% or more of the entity’s external and internal revenues. c. 75% or more of the entity’s external revenues. d. 75% or more of the entity’s external and internal revenues. 14. For segment reporting, interest revenue and interest expense a. are reported separately for each reportable segment

b. may be presented at net amount if the chief operating decision maker relies primarily on net interest revenue to assess the performance of the segment c. are not reported d. a or b 15. OBLITERATE TO ERASE Co. included interest expense in its determination of segment profit, which OBLITERATE's chief financial officer considered in determining the segment's operating budget. OBLITERATE is required to report the segment's financial data under PFRS 8. Which of the following items should OBLITERATE disclose in reporting segment data? (Item #1) Interest expense; (Item #2) Segment revenues a. No, No b. No, Yes c. Yes, No d. Yes, Yes (AICPA) 16. Which of the following statements is/(are) correct? VII. If an entity that is not required to apply PFRS 8 Operating Segments chooses to disclose information about segments that does not comply with PFRS 8, it shall not describe the information as segment information. VIII. PFRS 8 does not require an entity to report information that is not prepared for internal use if the necessary information is not available and the cost to develop it would be excessive. IX. If a financial report contains both the consolidated financial statements of a parent that is within the scope of PFRS 8 as well as the parent’s separate financial statements, segment information is required only the consolidated financial statements. X. PFRS 8 requires an entity to report interest revenue separately from interest expense for each reportable segment unless a majority of the segment’s revenues are from interest and the chief operating decision maker relies primarily on net interest revenue to assess the performance of the segment and to make decisions about resources to be allocated to the segment. PAS 14, the predecessor of PFRS 8, did not require such disclosure. XI. Generally, an operating segment has a segment manager who is directly accountable to and maintains regular contact with the chief operating decision maker to discuss operating activities, financial results, forecasts, or plans for the segment. XII. The term “segment manager” identifies a function which should be a segment manager with a specific title. a. VI only b. I and II c. all except VI d. all of the statements 17. PFRS 8 aims to help users of financial statements a. Better understand enterprise performance b. Better assess its prospects for future net cash flows c. Make more informed judgments about the entity as a whole d. all of the choices 18. PFRS 8 is required to be applied by a. entities whose equity securities are traded in a public market and those entities who are in the process of filing its financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market

b. entities whose debt and equity securities are traded in a public market. c. entities whose debt and equity securities are traded in a public market and those entities who are in the process of filing its financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market d. all entities regardless of whether their securities are being traded or not 19. PFRS 8 Operating Segments is applied in I. Separate or individual financial statements II. Consolidated financial statements a. I only b. I and II c. II only

d. neither I nor II

20. Which of the following may not be considered as the chief operating decision maker of an entity? a. Chief Executive Officer (CEO) c. Chief Operating Officer (COO) b. Executive Committee d. Shareholders 21. The following are required under PFRS 8 Operating Segments to disclose segment information in its financial statements. I. entities whose equity or debt securities are publicly traded II. entities that are in the process of issuing equity or debt securities in public securities markets III. entities whose securities are not publicly traded or not in the process of issuing securities to the public. a. I and II b. I only c. II only d. None of these 22. A non-publicly listed entity may be required to comply with PFRS 8 Operating Segment if a. the entity is a subsidiary whose parent is a listed entity or in the process of issuing securities to the public even in the entity’s individual (separate) financial statements b. the entity has a foreign operation c. at least majority of its revenues comes from intercompany transactions d. it discloses segment information in its general-purpose financial statements 23. In financial reporting for segments of a business enterprise, which of the following should be taken into account in computing the amount of an industry segment's identifiable assets? (Item #1) Accumulated depreciation; (Item #2) Marketable securities valuation allowance a. No, No b. No, Yes c. Yes, Yes d. Yes, No (AICPA) 24. According to PFRS 8, how do firms identify reportable segments? a. By geographic regions c. By industry classification b. By product lines d. By designations used inside the firm 25. An entity shall report separately information about each operating segment that: I. Management deems relevant to external users II. Meets the quantitative thresholds

a. I

b. I or II

c. II

d. neither I nor II

26. Operating segments may be aggregated if a. they have similar economic characteristics b. they have different economic characteristics c. they have the same chief operating decision maker d. the entity has a matrix organization 27. Which of the following tests may be used to determine if an operating segment of an entity is a reportable segment under the provision of PFRS 8 regarding quantitative thresholds? a. Its revenue (both from external customers and internal segments) is equal to or greater than 10 percent of total revenue (external and external). b. The absolute value of its operating profit or loss is equal to or greater than 10 percent of the higher of the total of the operating profit for all segments that reported profits and the total of the losses for all segments that reported losses. c. The segment contains 10 percent or more of the combined assets of all operating segments. d. All of the above. 28. SUBJUGATE CONQUER Corporation sells 5 different types of products. The company is divided for internal reporting purposes into 5 different divisions based on these 5 different product lines. The company should prepare the note disclosure for disaggregated information based upon a. the 5 types of products. b. the 5 different divisions. c. the materialty of each product line based on the revenue or operating profits generated by each product line or the assets utilized by each product line. d. the geographic areas in which the 5 products are sold. (Adapted) 29. Nonreportable segments should a. be aggregated and reported as “all other segments.” b. be aggregated but neither reported nor disclosed c. not reported but may be disclosed if included in the necessary reconciliation of segment assets, liabilities, or profit or loss d. not reported but may be disclosed whether or not included in the necessary reconciliation of segment assets, liabilities, or profit or loss 30. Total external revenue reported by operating segments should a. at least be 75 per cent of the entity’s revenue b. not be more than 75% of the entity’s revenue c. at least be 90% of the entity’s revenue d. no limit set by PFRS 8

Related Documents

Answer Key Week 3

January 2021 0

Unit 3 Progress Test Answer Key

March 2021 0

Gab Level 3 Workbook Answer Key

February 2021 0

Proficient Studentsbook Answer Key

January 2021 1

B2 Workbook Answer Key

January 2021 1

Answer Key 1st Periodical

February 2021 0More Documents from "IP G"

Answer Key Week 3

January 2021 0

Devega - More Selected Secrets.pdf

January 2021 1

Nuovo Pozzoli Vol.3

February 2021 1

Studies In Musical Composition

March 2021 0