Cement Elra

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Cement Elra as PDF for free.

More details

- Words: 37,239

- Pages: 89

Loading documents preview...

Closer to dawn Ravindra Deshpande [email protected] +91 22 4062 6805 Ravi Sodah [email protected] +91 22 4062 6817

India Cement 9 November 2010 Elara Securities (India) Private Limited

9 November 2010

India | Cement

Initiating Coverage

Cement Closer to dawn

Sluggish capacity additions 18

300

15

250

12

200

9

150

6

100

FY13E

FY12E

FY10

FY11E

FY09

FY08

0 FY07

0 FY06

3

FY05

50

FY04

(Million tonne )

Indian cement industry witnessed massive capacity additions during the past three to four years on the back of a strong pricing regime. The nameplate cement capacity in the country went up by nearly 38% from FY08 till FY10. However, the same was reciprocated by a demand growth of only 20% which pulled down utilizations and therefore, the cement pricing as well as profitability of the industry. Lower profitability and cash inflows slowed down the capacity additions. Besides, the hurdles in acquiring land for greenfield projects as well as obtaining approvals and clearances for mining have taken a toll on capacity additions. Therefore, we believe, capacity utilizations in the sector would start improving post FY12 with the decelerating pace of capacity additions.

350

(Million tonne )

Effective capacity (LHS) Increase in effective capacity (RHS) Source: CMA, Elara Securities Estimates

All India Demand & Supply(mn tonnes)

Pricing: The worst is behind us

All India

We believe the actual cement pricing will depend upon the demand supply equations in the region, actual cost of production and players’ individual as well as collective actions. However, we expect the worst to be over for the cement pricing considering the improving demand supply equations and the resultant utilization levels in the industry. Although, we expect utilization levels to drop again in the Q2&Q3 FY12, we also assume that the higher cost push might arrest the fall in prices. Our RoCE based methodology to forecast prices, denotes that prices will rise the maximum in the Western region.

FY09 FY10 FY11E FY12E FY13E

Year end capacity

212

247

276

301

318

Effective Capacity

205

232

270

296

310

Dispatches

181

200

216

238

263

89

86

80

81

85

Capacity utilization (%)

Source: CMA, Elara Securities Estimates

Cement prices improve in major cities (INR per bag)

330

Upside in large caps limited, mid-caps flaunt superior potential We expect the upcycle in the cement cycle to be at least one year away. Our historical valuation analysis as well as comparative analysis suggests that current valuations enjoyed by large cap players are close to the discounted upcycle valuations. Hence, we believe the upside in these large cap stocks will be limited. However, mid-cap players are trading way below their distress case valuations hence warrant a favorable risk reward ratio even considering the regional risk.

280 230 180

Mumbai Chennai

Delhi Hyderabad

Oct-10

Jul-10

Apr-10

Jan-10

Oct-09

Jul-09

Apr-09

Jan-09

Oct-08

Jul-08

Apr-08

130

Kolkata

Source: CMIE, Elara Securities Research

Valuation FY12

FY11

FY10

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

Mid caps: Valuation gap swells FY01

With a sharp increase in cement prices in past two months, we believe that earnings of cement companies will bottom out in Q2FY11. We also expect the cement demand to gradually improve on the back of a strong construction and infrastructure demand. However, we believe the valuations of frontline stocks have already factored in the potential up-cycle in the sector. Yet `value buy opportunities’ are still available among mid-cap cement stocks.

20 0 (20) (40) (60) (80) (100)

(%)

Global Markets Research

Slower capacity addition to maintain demand-supply balance

Valuation disc for mid caps EBITDA/tonne disc Source: Elara Securities Estimates

Key Financials MCAP CMP Target Upside INR bn USD mn (INR) (INR) (%) UltraTech Reduce 310 6,976 1,122 1,139 1.5 Ambuja Sell 226 5,099 148 119 (19.8) ACC Accumulate 200 4,495 1,062 1,123 5.7 India Cements Accumulate 36 803 116 131 12.5 Shree Cem Accumulate 75 1,698 2,165 2,501 15.5 JK Cement Buy 12 264 168 220 31.4 Orient paper Buy 12 265 61 87 41.7 JK Lakshmi Buy 8 174 63 78 24 Source: Company, Elara Securities Estimates 1 USD= INR44.4 Company

Rating

EV/EBITDA(x) FY11E FY12E 10.4 8.5 9.8 9.2 10.2 8.0 7.9 4.2 6.6 4.8 6.7 5.2 3.4 2.9 3.8 3.6

P/E(X) FY11E FY12E 17.5 15.3 17.2 16.9 16.7 15.0 18.4 10.7 19.2 12.6 16.1 8.9 6.0 5.8 6.4 4.8

EV/tonne(USD) FY11E FY12E 144 138 184 180 131 122 62 56 98 82 54 51 50 40 47 55

RoE(%) FY11E FY12E 20.9 18.4 18.8 16.8 18.5 17.9 5.2 7.8 19.4 24.1 6.5 10.8 23.2 19.7 11.1 13.8

Ravindra Deshpande • [email protected] • +91 22 4062 6805 Ravi Sodah • [email protected] • +91 22 4062 6817 Elara Securities (India) Private Limited

Cement

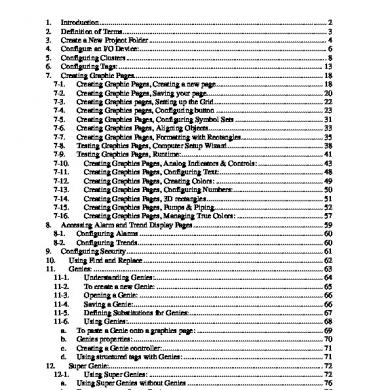

Table of Content Executive Summary………………………………………………………………………………………………………………

3

The worst is behind us…………………………………………………………………………………………………………

5

Demand to quicken from H2FY11……………………………………………………………………………………..

7

Pricing: Downside remains limited…………………………………………………………………………………….

10

Comparative analysis……………………………………………………………………………………………………………

12

Valuation & Recommendation……………………………………………………………………………………………

20

Company Section Ultratech Cement Restructuring priced in………………………………………………………………………………………………………..

23

Ambuja Cements Melody from clinker……………………………………………………………………………………………………………..

33

ACC In the region of comfort………………………………………………………………………………………………………

43

India Cement Warming South winds…………………………………………………………………………………………………………

53

Shree Cement Regional champ at reasonable value…………………………………………………………………………………

63

JK Cement

Grey eminence……………………………………………………………………………………………………………………..

69

Orient Paper Lord of low cost, master in a downturn…………………………………………………………………………….

75

JK Lakshmi Cement Cementing its true place……………………………………………………………………………………………………..

81

2

Elara Securities (India) Private Limited

Executive summary Capacity additions to slowdown on lower prices After adding record capacities addition of a ~ 87mn tonnes between FY07 and FY10, the country has witnessed a marginal slowdown in the pace of addition. Primarily, the capacity additions were the result of higher operating cash flows on the back of high cement pricing regime. However, due to cost push and low cement prices, operating cash flows of cement companies have come under pressure resulting in a slowdown in new project announcement. Besides, long procedures related to the acquisition of land and obtaining environment clearances have delayed the commissioning of many cement plants. Thus, after capacity additions of whooping ~35mn tonnes by FY10, the cement industry is expected to add ~29mn tonnes in FY11, ~24mn tonnes in FY12 and 17mn tonnes in FY13. Between FY10FY13, the industry is expected to add 71mn tonnes while in the same period, the demand is expected to increase by only 63mn tonnes. Demand to accelerate in second half Growth in cement demand has been sluggish (4.9%) during the first half of FY11 due to heavy monsoons and a higher base effect. We believe the demand will accelerate from H2FY11 onwards on the back of a higher demand from infrastructure and construction sectors. As we approach the last two years of XIth Five Year Plan, we believe there will be a higher thrust on the infrastructure since the Government plans to spend ~52% of the target expenditure in the last two years. Buoyant order book of construction companies also indicate that construction activities will pick up in the near future. On the back of the firm demand from the user industry, we expect the demand to grow at 8% in FY11, followed by 10.4% in FY12 as well as in FY13. Therefore with the moderating pace of capacity additions and a steady demand growth, we expect capacity utilizations in the industry to gradually improve going ahead. We consider that the pan India capacity utilizations will improve to 81% in FY12 only to better to 85% in FY13. However, we expect a dip in capacity utilizations in monsoons of FY12 (Q2 & Q3 of FY12). Pricing : The worst seems to be over We believe that in terms of pricing, the worst is behind us. A gradual improvement in utilization levels on the back of an enhancement in cement demand (supported by an increase in cost of production) will prevent a sharp fall in prices in future. We believe, Q2FY11 is likely to be the worst quarter for cement producers as low cement prices in Q2FY11 had resulted in a negative EBITDA/tonne for some Southern

Elara Securities (India) Private Limited

players and an RoCE of well below WACC for majority of players. Therefore, we expect things to perk up going ahead as cement companies are likely to opt for price increases rather than higher volumes. Earnings of cement companies are more sensitive to pricing changes (~4% variation with 1% change in pricing) than volume changes (~2% change with a 1% change in volume sales). Due to the mature behavior of cement players, prices have already gone up by INR20 -100 per bag in the past two months. Further, discount in the cement price in trade and non-trade has also been reduced from INR40 per bag to INR20/bag. We believe, the concerted action of the players might not be a long term phenomenon, but with improving capacity utilizations and a strong cost push, cement prices might have a little downside from the current levels. We have built in our estimates, a price increase of ~INR25/bag in H2FY11 from Q2FY11 levels. For FY12, we have built in a decline of ~INR17/bag over H2FY11 levels (On annual basis, our cement prices for FY12 are 23% higher than FY11).

Cement

Cement

Scenario to look up from FY13; Upcycle a year away As discussed earlier, we expect utilizations to gradually improve from FY12 before reaching a level of 85% in FY13. The demand on the other hand, is expected to grow at a steady pace after suffering hiccups in the first half of FY11. The XIth 5 Year Plan envisages an investment of INR 10,750 bn with a focus on infrastructure activities which will ensure a steady demand growth for cement. Therefore, we believe that the stable pace in demand and lack of strong capacity additions will create a healthy cement market in the country. Little upside in large caps, value lies in midcaps For valuation of cement companies, we have used EV/tonne based methodology as the earnings based valuations have historically failed to provide a fair picture of the stock performance. The entire large cap pack is already trading at a premium to its replacement cost as well as close to its peak cycle EV/tonne valuations. As we believe, the upcycle is still one year away, for valuing large cap players, we have discounted the average bull cycle EV/tonne multiples at a WACC of 13%. However, for mid cap players, we have used a distress case EV/tonne valuation of USD62/tonne, considering the regional risk. Historically, mid cap players have traded at a discount to the large cap peers as the profitability of mid caps too was lower than their large cap counterparts. But due to the cost cutting initiative undertaken by mid cap cement 3

Cement players, the EBITDA/tonne discount of these companies has gone down from 63% in the last down cycle to 10% in FY10. However, the valuation gap has increased from 30% to 56% during the same period. We believe that the sharp valuation gap between frontline and midcap cement companies is unjustified. Hence, we believe the mid cap players offer more upside than their large cap peers while the risk reward ratio is more favorable to mid caps as these are trading at a significant discount to their large cap peers as well as the replacement cost of cement assets. We initiate our coverage on large cap cement stocks with Accumulate rating on ACC (TP: INR1,123;Upside:6% ) Sell rating on Ambuja (TP: INR119;Upside:-20% ) and Reduce on UltraTech (TP: INR1,1139; Upside: 2% ). Considering

the potential upside, the IPL franchise might hold for India Cements, we initiate our coverage with a Accumulate recommendation (TP: INR136; Upside: 13%). We have considered the minimum bid price for Indian Premier League (IPL) 4 franchise as a valuation for Chennai Super Kings team. Any upside in the same will warrant an upside for the India cements stock. We continue to maintain our Buy rating on Orient Paper (TP: INR87; Upside: 42%), JK Lakshmi (TP: INR78; Upside: 24% ), JK Cement (TP: INR220; Upside: 31%), considering the below distress case valuations the stocks are currently trading at and the favorable risk reward ratio these stocks offer. We have assigned Accumulate rating on Shree Cements (TP: INR2,501; Upside: 16%), taking into account its superior fundamentals and low valuations.

4

Elara Securities (India) Private Limited

Cement

The worst is behind us

Capacity addition in listless mode Riding on the firm cement prices during the FY06 to FY08, cement companies had generated huge operating cash flows. The period witnessed a demand growth of ~10% CAGR, matched by only ~6% CAGR in capacity additions. The increased capacity utilizations during the period augured well for a high cement pricing regime. Cement prices in fact surpassed the inflation during the period. Exhibit 1: Cement prices shoot up during FY06-10

(INR per bag)

260 220 180 140

2009-10

2008-09

2007-08

2006-07

2005-06

2004-05

2003-04

2002-03

2001-02

2000-01

1999-00

1998-99

1997-98

1996-97

1995-96

1994-95

100

Source: CMA, Elara Securities Research

On the back of huge increase in the operating cash flows and favorable demand supply scenario, the industry lined up huge capacity addition programs. As was evident, the country witnessed highest capacity additions during FY09 and FY10. The country added a total capacity of ~63 mn tonnes in these two years. Exhibit 2: Operating cash flows step up in FY07-10 50 Strong operating cash flows generated by the industry

(INR bn)

40 30

in the domestic cement market in the medium term. Hence, companies have been cautious in going ahead with the cement capex which curtailed the pace of capacity additions in the country. Some of the cement companies (like Shree Cement, JK Lakshmi and Orient Paper) have utilized their accumulated cash flows to diversify into other businesses like merchant power. This was reflected in the capacity addition announcements as the industry passed the euphoria stage. Besides the land acquisition, procedures related to forest as well as environment clearances are likely to delay the implementation of the already announced greenfield projects. Even brownfield projects have faced delays of at least three to six months as seen by the precedents. After record nameplate capacity additions of ~35mn tonnes in FY10, the industry is expected to add ~29mn tonnes in FY11 followed by ~24 mn tonnes in FY12 and 17 mn tonnes in FY13. Going forward, the industry will add another ~46 mn tonnes of capacity over next 32 months (ie: from August 2010 till March 2013), putting the total capacity at 318 mn tonnes by the end of FY13. So considering the slowing pace of capacity additions, increasing timelines for completion of greenfield as well as brownfield projects and the current depressed profitability enjoyed by the sector, we believe the capacity additions will not reach the peak levels of FY09 to FY11. We believe any new plant announcement will take at least two years (for brownfield) and at least three to four years (for greenfield) to come on stream. Therefore, we believe the demand supply equations will improve only gradually. Exhibit 3: Capacity addition - Missed deadlines Company

20 10

Orient Paper

Capacity Type (mn tonnes) 2.4

FY10

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

FY01

FY00

Source: Capitaline, Elara Securities Research

The higher capacity additions coupled with financial slowdown, led to subdued cement pricing. With such a subdued cement pricing and high cost regime, operating cash flows of cement companies have been under pressure since FY10. Despite a steady growth in the demand, the oversupply scenario has become inevitable Elara Securities (India) Private Limited

Madras Cement GrasimShambhupura:

State

Initial Actual timeline

Brownfield Maharashtr Mar-10 a /Andhra Pradesh

Sep-10

4,000 TPD Brownfield Jayanthipur Sep-09 kiln. am

Jan-10

0

Cement

Capacity additions decline as unfavorable pricing, land acquisition issues crop up Demand subdued in H1FY11; to firm up from H2FY11 on higher infra spend Large caps not attractive, but mid caps in favorable risk reward zone

4.4

Brownfield Rajasthan

Q4FY08 Q1FY10

Clinker

Q4FY08 Q2FY09

Grinding

Q4FY08 Q1FY10

Source: Elara Securities Research

5

Cement Exhibit 4: Capacity addition momentum down 18

Pace of capacity addition slows down

300 250

15 12

200

9

150

6

100

Effective capacity (LHS) Increase in effective capacity (RHS)

FY13E

FY12E

FY11E

FY10

FY09

FY08

FY07

FY06

0 FY05

3

0 FY04

50

(Million s tonnes)

(Million tonne s)

350

prices crashed in Hyderabad and Chennai, down from the peak by ~40% and 35% respectively in Aug’10 before recovering sharply in month of September and October. Due to the oversupply scenario in the region and reduced profitability of cement players, the pace of new capacity additions has slowed down. Hence, out of new capacities that are expected to hit the market by FY13, the share of South has reduced to mere 25%. Hence, we believe capacity utilization in South will increase to 77% in FY13. Exhibit 6: Capacity adds more secular by FY13 North 22%

South 25%

Source: CMA, Elara Securities Estimates

South to witness massive capacity additions The new supply coming on stream has been skewed towards the Sothern region due to huge limestone reserves, strong demand growth between FY06 to FY09, particularly in Andhra Pradesh (South grew at a CAGR of 12.8%, Andhra Pradesh grew at CAGR of 20.4%), and larger size of the market (south is the largest market in India and even bigger than Russia, Brazil. Japan, and South Korea). Exhibit 5: South faces brunt of excess supply North 26%

East 10%

West 7% Central 6%

Source: CMA, Elara Securities Research

During Apr’08-Aug’10, a whopping 51% of new capacities that came on stream were in South India. Due to such massive capacity additions, utilizations in South has declined from 94% in FY08 to 74% in FY10. Cement

6

Central 20% Source: Elara Securities Estimates

Exhibit 7: Region wise capacity additions (mn tonnes) Year end capacity FY10

North Eastern Southern

Western Central

All India

54

35

93

37

29

247

13.8

2.2

9.3

1.0

3.0

29.1

FY11

68

37

102

38

32

276

+Capacity additions

1.8

2.1

8.3

5.9

6.4

24.4

FY12

70

39

110

43

38

301

+Capacity additions

4.5

4.8

2.5

2.5

2.9

17.2

FY13

74

44

113

46

41

318

Total

20.0

9.0

20.0

9.0

12.0

71.0

+Capacity additions

South 51%

West 18%

East 15%

Source: Elara Securities Estimates

Elara Securities (India) Private Limited

Cement Demand to quicken from H2FY11

We believe the cement demand will accelerate from H2FY11 onwards, driven by infra spend and a recovery in the real estate sector. We believe the last two years of the current Five Year Plan (FY11 and FY12) will provide enough impetus to infrastructure investments. Similarly, higher residential as well as commercial construction activities backed by Government schemes like Indira Away Yojana (IAY) and Interest Subsidy scheme will consume higher cement in the next two years to come. As we approach the last two years of XIth Five Year Plan (FY11 & FY12), we expect nearly INR10,750bn to be spent on infrastructure activities. The total planned expenditure of the entire XIth Plan is INR20,562bn and nearly 52% of the same will be spent in the last two years. Hence assuming that only 70% of the target expenditures materialize in the last two years (FY11 & FY12) of the Plan, we expect cement demand of ~154mn tonnes to be generated due to infrastructure activities. Exhibit 8: Infra spending to sustain high consumption 12,000

8,000

6

7

7

8

9

10 10 10 10

12 10 8 6

(%)

FY17E

FY16E

0 FY15E

0 FY14E

10

FY13E

50

FY12E

20

FY11E

100

FY10

30

FY09

150

Projected cement demand (LHS) % of total Infra spending projected each year (RHS) Source: Planning Commission, Elara Securities Research

Exhibit 10: Share of infra in total demand to go up Projected cement demand from infra (mn tonnes)

Total projected cement demand (mn tonnes)

% of total

FY11E

69

216

32

FY12E

85

238

36

FY13E

92

263

35

Year

Source: Planning Commission, Elara Securities Research

A sizable chunk of these infrastructure investments has been on roads in these five year plans. The Government has planned to invest INR3,141.5bn (USD69.8bn) on roads and bridges in the XIth Five Year Plan. Of the total investments, ~47% is planned to be spent in the last two years (FY11 and FY12) of the plan. A major thrust has been on building national highways which consume higher cement than other roads. A sum of 22,921km of national highways are being planned to be built in three years from FY10 to FY12. We believe, the average execution per day of national highways will increase as we approach the end of the XIth Plan. According to our infrastructure analyst, the execution per day is likely to be ~15.2km/day in FY11 which will increase to 16.8km/day in FY12 and 19.2km/day in FY13.

4

XIth Plan: Investments in road sector

4,000

2

Exhibit 11: Roads to gather momentum (INR bn)

2,000

0

INR bn

FY17E

FY16E

FY15E

FY14E

FY13E

FY12E

FY11E

FY10

FY09

6,000

FY08

(INR bn)

10,000

9

40

Investment in infrastructurein (LHS) Investment as % of GDP(RHS)

Centre

State

Private

Total

FY08

183.2

175.3

159.7

518.2

FY09

194.5

181.5

171.9

547.9

FY10

206.7

188.9

196.4

592.0

Source: Planning Commission, Elara Securities Estimates

FY11E

226.2

206.1

251.4

683.7

In the XIIth Five Year Plan, the Government has planned to spend ~INR40,750bn on infrastructure activities. Hence even post FY12, we expect the infra related cement consumption to remain strong.

FY12E

263.0

248.2

288.5

799.7

Elara Securities (India) Private Limited

Cement

Scenario brighten up on infra, real estate push

200

FY08

After reporting an impressive growth of 10.1% in FY10, the cement demand has decelerated to only 4.8% YoY in Apr –Sep’10 period due to seasonal weakness and a higher base. The delayed monsoons last year accounted for the higher base in Q2FY10 as compared to the Q2FY11 consumption. Apart from this, flood like situation in few states and near completion of some of the major projects (such as Common Wealth) also impacted the cement demand.

(mn tonne)

First two quarters register below average growth

(%)

Exhibit 9: Infra-related spending to be strong

Total

3,141.5

Source: Planning Commission, Elara Securities Research

7

Cement

460

8.7

440

FY11E

15.2

420

FY12E

16.8

FY13E

19.2

FY14E

19.5

360

FY15E

16.1

340

FY16E

4.5

FY17E

1.6

4,500 4,000

400

3,500

380

3,000

Exhibit 16: Real estate revenues recover 40

1050

Exhibit 14: Build-up in order-book seen for majors

1000 (INR bn)

3.4

3.2 3.1

3.2

950 900

2.8

2.8

2.2

Sep-10

Jul-10

May-10

Mar-10

Jan-10

Nov-09

Sep-09

2.4

Jul-09

2.6

May-09

850 2.5

Mar-09

Order book to sales ratio(x)

Q1FY11

Exhibit 17: HDFC’s loan book remains buoyant

Source: CMIE, Elara Securities Research

2.4

Q4FY10

Source: Capitaline, Elara Securities Research

New order during the quarter (LHS) Total order book (RHS)

3.0

Q3FY10

1,000 Q1FY10 Q2FY10 Q3FY10 Q4FY10 Q1FY11

Q2FY10

0

Q1FY10

0 Q4FY09

1,500

10

Q3FY09

100

20

Q2FY09

2,000

(INR bn)

200

30

Q1FY09

(INR bn)

2,500

26-Feb-10

The real estate sector is also showing signs of recovery which has been visible from the revenue trends of real estate majors which has increased 65% YoY in Q1FY11. The credit flow to the housing sector also indicates improvement in the housing volume. An indication of this can be seen from the Q2FY11 outstanding loan book of HDFC Limited which was up 19% YoY.

300

Infrastructure(RHS)

Source: CMIE, Elara Securities Research

(INR bn)

3,000

20-Nov-09

22-May-09

Construction(LHS)

Exhibit 13: Construction order book on an uptick 400

21-May-10

2,500

Source: Planning Commission, Elara Securities Estimates

Leading indicators show that construction activities will pick up sharply in years to come. The total outstanding order book of the major construction players was up 40% YoY at the end of Q1FY11. The order book to bill ratio has also been consistently on an uptrend. At the end of Q1FY11, the average order book to bill ratio of major construction players stood at 3.2x (as compared to last year’s average of 2.4x). Furthermore, credit flow to construction and infrastructure sectors has shown a positive trend. As of 22nd May, 2010, the total loans outstanding to construction and infrastructure sectors were up (YoY) 16% and 44% respectively.

(INR bn)

KM/day

FY10

(INR bn)

Average Execution per day

Exhibit 15: Credit flow to infra, construction soars

28-Aug-09

Exhibit 12: Execution visibility high till FY15

Source: HDFC, Elara Securities Research

Q1FY10

Q2FY10

Q3FY10

Q4FY10

Q1FY11

Source: CMIE, Elara Securities Research

8

Elara Securities (India) Private Limited

Cement

Exhibit 18: Shift to Pucca houses gathers speed Year

Households Total Housing (mn) Stock (mn)

Pucca Semi-pucca (mn) (mn)

Kutcha (mn)

1961

14.9

13.3

6.44

4.9

1.96

1971

19.1

18.5

11.8

4.35

2.35

1981

29.3

28

18.09

6.8

3.11

1991

40.7

39.3

29.79

6.21

3.3

2001

55.8

50.95

41.17

8.08

1.7

Source: Planning Commission, Elara Securities Research

The private sector has also maintained its capex buoyant. At the end of Q1FY11, value of projects under implementation in the private sector stood at 59 trillion, up by 17% (YoY). Exhibit 19: Pvt capex growing rapidly 59

60 55 (INR trillion)

55 50

50 45

51

52

53

44

Exhibit 20: Cement to GDP multiple to stay constant

20

4

r=0.94

15

3

10 5 0

2 1.11.51.02.01.22.4

1.72.30.71.11.11.01.11.21.4

(0.4)

0 (1)

FY95 FY96 FY97 FY98 FY99 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

(5)

1

Cement consumption growth to GDP multiple (RHS) GDP Growth (LHS) Cement Consumption Growth (LHS)

Cement

Avg. GDP to cement consumption multiple of last 15 years is 1.3X GDP YoY Growth(%)

With the Government’s extension of the 1% interest subvention on a housing loan of INR1mn (where the cost of the house does not exceed INR2mn) and increased spending in the Rajeev Awaas Yojana (RAY) by 700% from the last the financial year to INR12.7bn for FY11, we believe that housing demand will continue to remain strong in rural areas.

have depended upon the GDP multiplier factor to estimate the cement demand in the country. For the last five years, the cement consumption in India has grown at an average multiplier of 1.3 x GDP growth. Over the past ten years, the same has shown a growth of 1.1x GDP, which was due to a negative growth in cement consumption in FY01.

Cement consumption to GDP Multiple

Past trends indicate that with rising income levels, people are shifting from semi-pucca and kutccha houses to pucca houses which create demand for cement. Besides, incentives provided by the Central as well as state Governments are likely to provide an impetus for the rural and semi-urban housing. The Planning Commission estimates a growth of ~4% CAGR (2001 to 2012) in pucca houses denoting higher cement consumption. Central Government initiatives like Indira Away Yojana (IAY) and several state Government initiatives like construction subsidy (Gujarat, Himachal Pradesh, Punjab, Jharkhand etc) have provided incentives for pucca houses which is evident from the trends witnessed in the past.

Source: CMA, CMIE,Elara Securities Research

Considering the slowdown in the cement demand due to factors mentioned earlier in this report, we have used the GDP multiplier of 1.0x for FY11. However, taking into account the fact that we are approaching last two years of XIth Plan and the buoyant activities expected in the commercial as well as residential construction spaces, we have relied on a multiplier factor 1.3x GDP for estimating the demand growth in FY12 and FY13. Accordingly, we expect the cement demand to grow by 8% in FY11 and 10.4% in FY12 -FY13 period. Hence, we estimate the cement consumption to reach a level of 263mn tonnes by the end of FY13, registering a CAGR of 9.6% over the next three years. Exhibit 21: Demand estimates at different multiples Real GDP YoY growth (%)

FY11E

FY12E

FY13E

8.0

8.0

8.0

Bull Case Multiple Cement to GDP Multiple (x)

1.2

1.5

1.5

Cement Demand growth (%)

9.2

12.0

12.0

Capacity utilization (%)

81

83

88

Cement to GDP Multiple (x)

1.0

1.3

1.3

Cement Demand growth (%)

8.0

10.4

10.4

Capacity utilization (%)

80

81

85

Base case Multiple 40 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Source: CMIE, Elara Securities Research

Bear Case Multiple

Domestic demand to grow at a CAGR of 9.6%

Cement to GDP Multiple (x)

0.9

1.1

1.1

Historically, the cement consumption has shown a strong direct co-relation with the country’s GDP growth. The correlation between the two was as high as 94% between FY05 to FY09. Due to lack of reliable data, we

Cement Demand growth (%)

6.8

8.8

8.8

Capacity utilization (%)

79

78

81

Elara Securities (India) Private Limited

Source: Elara Securities Research

9

Cement Capacity utilization rebound in FY12

Exhibit 25: Monsoon utilization to remain low 90

93

90

89

90 85

89

87

83

80

82

84

81

79

75

74

70

81

78

76

Q3FY13

Q1FY13

Q1FY12

Q1FY11

Q3FY10

Q1FY10

65

Q3FY11

69 Q3FY12

95

(%)

In first eight months of CY10 (Jan- Aug’10), the industry added 38mn tonnes of capacity, (16.4% increase over CY09). However, during the same period (Jan- Aug’10) cement demand grew by only 6.3%. Considering the demand slowdown in FY11 and higher capacity additions in the last two to three years, we expect capacity utilizations to come down to 80% (7-year low) from 86% in FY10. However, we expect the demand to revive in FY12 and FY13 and with the slowing down pace of capacity additions, we expect utilizations to improve to 81% in FY12 and 85% in FY13. Exhibit 22: Capacity utilization: Gradually improving

Source: CMA, Elara Securities Estimates

All India Year end capacity Effective Capacity Dispatches Capacity utilization (%)

Pricing: Downside remains limited

FY13E 318 310 263 85

Source: CMA, Elara Securities Estimates

Quarter wise analysis Due to the sharp increase in supply and moderate growth in demand, capacity utilization of the industry has declined from 90% in Q4FY10 to 69% in Q2FY11, lowest since Q2FY99. We expect capacity utilization to improve in FY12 except the monsoon period when we anticipate the same to drop to 74% in Q2FY12 and 76% in Q3FY12. However, we see the same to remain close to 80% levels or above in the FY13. Exhibit 23: Peak capacity addition behind us 10

Exhibit 26: ACC: Higher costs pump up realizations

% increase in capacity (RHS)

60 50

All India Cement Despatches (LHS)

Q3FY13E

Q1FY13E

Q3FY12E

Q1FY12E

Q3FY11E

Q1FY11

Q3FY10

Q1FY10

40

Cost

Source: Capitaline, Company, Elara Securities Research

(%)

(Mn tonnes)

Relisation 18 15 12 9 6 3 0

CY09

FY96

Exhibit 24: Steady growth in cement dispatches 70

2,000 1,500

Source: CMA, Elara Securities Estimates

80

2,500

CY08

Capacity addition (LHS)

3,000

CY07

0

CY06

0

3,500

CY05

2

FY05

5

4,000

FY04

4

FY03

6

10

Q1FY10 Q2FY10 Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11E Q4FY11E Q1FY12E Q2FY12E Q3FY12E Q4FY12E Q1FY13E Q2FY13E Q3FY13E Q4FY13E

15

FY02

8

FY01

(Mn tonnes)

20

12

(INR per tonne)

Capacity additions bunch up in H1CY10

25

Prices of key raw material (imported coal as well as petcoke) have been on a consistent uptrend. Diesel prices have recently gone up thereby raising the transport cost for players. Hence we believe the cost push factor will arrest the cement pricing fall as we go ahead. Historical data too indicates that higher costs have supported higher cement prices.

(%)

30

We believe the actual cement pricing will depend upon the demand supply equations in the region, actual cost of production and players’ individual as well as consolidated actions. However, we anticipate the downside for cement prices to be restricted mainly due to the rising cost of production, increasing levels of consolidation in the industry, better financial position of the industry players and the bettering demand supply equations post H2FY12.

FY00

FY12E 301 296 238 81

FY99

FY11E 276 270 216 80

FY98

FY10 247 232 200 86

FY97

FY09 212 205 181 89

YoY (RHS)

Source: CMA, Elara Securities Estimates

10

Elara Securities (India) Private Limited

Cement

1,500

an average net debt equity ratio of ~2.6x in FY03 when the industry witnessed a steep ~7.4% price decline. The last few years of the `Bull Run’ had transformed the balance sheets of these companies which now have 0.4x debt equity ratios. Besides, the companies are almost in the final leg of their capacity additions which might not put a stress on the operating cash flows for the company in the period of stress.

1,000

Exhibit 30: Industry’s balance sheet improves

4,000

3,000 2,500

CY09

CY08

CY07

CY06

FY05

Cost (x) INR per tonne

Limestone Royalty

20

Increase in other raw material cost

45

Fuel

138

Electricity

41

Freight

54

Excise duty

83

Total

380

Source: Elara Securities Estimate

The consolidation levels in the industry have increased as compared to the last downcycle with top five players now controlling close to ~54% of capacities as compared to 31.3% in 2000 (the last downcycle). The consolidated action of players was visible recently in South where despite lowest capacity utilizations in the region, cement prices increased in the range of INR75 – 100/bag. Historically as well, benefits of consolidation were witnessed in the Northern region, where players resorted to lower production to control the prices during the initial part of FY09. Hence, we believe, the increased consolidation in the industry will negate any significant price falls in the cement industry. Exhibit 29: Industry consolidation increases 100

(%)

60

46.0 68.7

40 20

54.0 31.3

0 FY2000 Share of top 5 players

At present Others

Source: CMA, Elara Securities Research

Besides, the companies have better balance sheets now as compared to the earlier downturn. The industry had

Elara Securities (India) Private Limited

15

2.0

10

1.5 1.0

(%)

Exhibit 28: Reliance on imported coal to increase cost

80

20

2.5

Source: Capitaline, Company, Elara Securities Research

Cost Item

3.0

5

0.5

0

0.0 FY95 FY96 FY97 FY98 FY99 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

Realizations

CY05

FY04

FY03

FY01

FY00

FY99

FY98

FY97

2,000

FY96

(INR per tonne)

3,500

Net debt equity ratio (LHS) % increase in Effective Capacity (RHS)

Cement

Exhibit 27: Ambuja: Costs inflate realizations

Source: CMA,Capitaline, Elara Securities Research

We have tried to compute the cement pricing based on the minimum RoCE the players would desire in the coming years. Accordingly, we have considered Southern companies to desire at least 8% (equal to risk free rate of return) RoCE in the years to come considering the looming oversupply concerns in the region. Similarly, we have assumed a desired RoCE of 12% for Western players as excess capacities in the Southern market are likely to spoil equations in the Western region. In the northern region, we have assumed desired RoCE of 10% considering the possible slowdown in demand post the Common Wealth Games. Apart from this, among the major regions, Northern region is expected to witness the second highest capacity addition (ie: 22%). For the Eastern as well as Central regions, we have assumed the highest desired RoCE of 14% as the demand supply equations in these regions are likely to be more favorable as compared to other regions in the country. Accordingly, the prices are expected to rise the most in the Western region, where the prices were depressed due to spillover effect of low prices in Southern region. However, we expect the pricing in the Eastern region to remain flat as the same had not declined sharply. We expect the prices in the Southern region to have risk of downside than upside considering the unfavorable demand supply equations and the quantum of hikes taken recently. For rest of the country, we expect prices to increase ~4% in the coming years. Despite higher cement prices, the profitability of cement players may come under pressure in Q2 and Q3FY12 when the capacity utilization is expected to reach 74% 11

Cement and 76% respectively. Post these quarters, the capacity utilization is expected to bounce back in Q4FY12 to 89%. Exhibit 31: Cement prices bounce back

(INR per bag)

330 280 230 180

Mumbai Chennai

Delhi Hyderabad

Oct-10

Jun-10

Aug-10

Apr-10

Feb-10

Oct-09

Dec-09

Jun-09

Aug-09

Apr-09

Feb-09

Dec-08

Oct-08

Jun-08

Aug-08

Apr-08

130

Kolkata

Source: CMIE, Elara Securities Research

Exhibit 32: Implied cement price increase from RoCE (%)

The nature of the cement industry does not provide any barriers to entry; companies gain an edge over peers due to the inherent characteristics like plant location, sourcing of key raw material and capital structure etc. We have tried to analyze few of the key parameters which have a significant bearing on the profitability of these companies. We have tried to rank the large cap companies on different parameters with 1 being lowest and 3 being the highest rating. Regional presence: The cement industry is characterized by regional demand supply as it is uneconomical to transport cement over long distances, being a low priced commodity. Our analysis shows that if cement companies transport outside the radius of ~1,000- 1,200 kms by rail and/or road, these players would not be making profits at the EBITDA level. Therefore, the regional demand supply equations play an important role in the pricing dynamics and profitability of the cement players.

INR

South Central

East

West

North

Realization per tonne (present)

4,292

3,712

3,644

3,570

3,661

Greenfield capex cost per ton

5,000

5,000

5,000

5,000

5,000

400

700

700

600

500

Average Q1FY11 EBITDA/tonne prior to Freight expenses

8.0

14.0

14.0

12.0

10.0

Transport cost per tonne per km by road

100

100

100

100

100

Maximum distances viable by road

Cost (inc dep) per tonne

2,949

3,096

2,672

2,979

3,108

EBIT / tonne

1,343

617

972

591

553

26.9

12.3

19.4

11.8

11.1

Implied Realization per tonne

3,349

3,796

3,372

3,579

3,608

Implied price change (INR)

(943)

83

(272)

9

(53)

% change

(22.0)

2.2

(7.5)

0.2

(1.5)

72

98

89

84

85

Cost (inc dep) per tonne

3,244

3,158

2,806

3,128

3,263

EBIT per tonne

1,048

555

838

442

398

15.1

10.9

15.0

7.4

6.8

Implied Realization per tonne

3,937

3,869

3,595

3,797

3,822

Implied price increase (INR)

(355)

157

(49)

228

161

(8.3)

4.2

(1.3)

6.4

4.4

Target EBIT/tonne Target RoCE(%) At Capacity utilization (%)

RoCE(%)

Comparative analysis

At Capacity utilization (%)

RoCE(%)

% change

Exhibit 33: EBITDA neutral lead distances

Transport cost per tonne per km by road

Source: Elara Securities Estimates

Maximum distances viable by rail

1,506 1.5 1,004 1.35 1,115

Source: Elara Securities Estimates

We expect the capacity utilization in the South to decline from 74% in FY10 to 69% in FY11 due to an increase in capacity and subdued demand. However, this situation is likely to improve to 72% in FY12 and 77% in FY13 due to the slower pace of capacity additions. Despite improving capacity utilizations, the same will be the lowest in the Southern region hence, we prefer companies having minimum presence in this region. In the case of East, we expect the capacity utilization to increase from 86% in FY10 to 88% in FY11, 90% in FY12 and 93% in FY13. The capacity additions in this region have been low while the demand has remained strong. In the Central region, the utilizations are expected to decline due to capacity additions. Capacity utilization is likely to decline from 104% in FY10 to 100% in FY11 and further to 92% in FY12. However in FY13, capacity utilization is expected to improve to 96%.The scenario in the Northern and Western regions might remain close to the all India average.

12

Elara Securities (India) Private Limited

Cement

Exhibit 34: Region wise yearly capacity utilization (%) 110 100 90 80 70 60 FY19 North Eastern

FY10

FY11E

FY12E

Western Southern

FY13E Central All India

83

85

82

82

80 73

75 70 Central Eastern Western All India

North Southern

(Average for FY11-FY13)

Exhibit 36: Region wise capacity break-up (%) North

East South

West Central

UltraTech Cement post merger

26

14

23

26

11

UltraTech Cement pre merger

0

18

35

48

0

Ambuja

42

14

0

37

7

ACC

24

18

36

4

18

India Cements

0

0

92

8

0

Shree Cement

100

0

0

0

0

JK Cement

62

0

38

0

0

JK Lakshmi

88

0

0

12

0

0

0

60

40

0

Orient Paper

Cement

Source: Elara Securities Estimate

Source: Company, Elara Securities Research

Exhibit 37: India Cements leads Southern capacity 100

90

75

60 38

50

35

32

26 0

0

0

JK Lakshmi

Ambuja

UltraTech Cement post merger

ACC

0

Shree Cement

25

UltraTech Cement pre merger

India Cements has the worst regional mix in mid-cap cement companies as ~92% of its capacity is in South India. Players such as Shree Cement and JK Lakshmi Cement have restricted presence in the Northern region. We do not expect Northern region to be hit as badly as the South.

90

90

JK Cement

Due to Ambuja’s superior regional mix in frontline cement players, we have assigned it the highest rating of 3. The other two frontline players UltraTech and ACC too do not have very high regional risk due to pan-India presences. However, due to ACC’s relatively higher capacity in low priced Southern market (ACC has 36% of its capacity in South as compared to 23% for UltraTech), we have assigned it the lowest rating 1 while UltraTech gets a rating of 2.

96

95

Orient Paper

In our coverage universe, Ambuja has the best regional mix as it does not have presence in the Southern region. Apart from this, about 14% of the capacity of the company is in the Eastern region and 7% in the Central region. We expect these regions to have better pricing environments as compared to other regions in India. The average capacity utilization of Eastern and Central region is likely to be ~1,400bps and ~900bps higher than pan India. We expect players having presences in Central and Eastern region to earn ~21% higher EBIT per tonne as compared to players having pan-India presences.

100

India Cement

Due to supply overhang, we expect cement players in the South to earn ~36% lower EBIT per tonne than players in other regions. Players having higher presence in the Southern region will continue to earn lower return ratios and margins as compared to players having presences in other regions.

Exhibit 35: Utilization to stay firm in Central India

(%)

As mentioned earlier, we expect cement prices to remain firm in H2FY11. The price increase is expected to be sharper in the western region, as the prices in western region were depressed by low prices in south. Though among all regions cement prices are highest in the southern region, we expect cement prices in south to fall by 8%.

Source: Company, Elara Securities Research

Power and fuel cost: Power and fuel constitutes 25-35% of the total expenditure for cement manufacturers who mainly use coal and petcoke as fuel for manufacturing cement. The coal is usually sourced from three sources viz linkage coal, open market purchases in domestic market and imports. Prices of petcoke and imported coal are presently hovering around INR7,250/tonne and INR5,175/tonne respectively. Prices of domestic coal vary, depending on its calorific values. Players having presence in the Southern region (particularly Tamil Nadu) are likely to have the cost disadvantage due to higher dependence on imported

Source: CMA, Elara Securities Estimates

Elara Securities (India) Private Limited

13

Cement Exhibit 38: Power and fuel cost per tonne of cement manufactured using different fuels Fuel cost

Electricity Power & Electricity consumption Electricity cost Fuel cost per per tonne tonne of cement (h) (i) J=f+i

(a)

(b)

c=b/a

(d)

kcalry per tonne of cement (e)

f=a*d

Per unit Electricity VC cost INR (g)

Domestic

3,000

4,000

0.75

18.5%

740

555

2.3

85

198

753

Imported

5,175

6,000

0.86

12.3%

740

639

2.7

85

227

866

Pet Coke

7,250

8,000

0.91

8.8%

740

634

2.8

85

239

873

Fuel

INR Per Calorific INR per tonne Values kcalry

Input out put ratio

Fuel cost

Source: Elara Securities Research

coal. As these are located distantly from mines, players with plants in Tamil Nadu (such as India Cements, Madras Cement, Dalmia Cement) are heavily dependent on imported coal.

The price of imported coal has increased 42% YoY due to the improvement in global sentiment while petcoke has also gone up ~100% YoY in line with a hike in crude oil prices. Going ahead, we do not expect the price of pet coke to soften as RIL (the largest manufacturer of pet coke in India) has reduced the sale of petcoke in the open market as it has started using petcoke for captive power and petrochemical products manufacturing. As far as the linkage coal is concerned, Coal India has increased coal prices by ~10% to 11% in Q3FY10. At present prices, we expect power and fuel cost for players dependent on the domestic coal, imported coal and petcoke to be approximately INR753, INR 856 and INR 873 respectively for every tonne of cement produced. The player dependent on domestic coal is likely to have cost advantage of INR 113 per tonne as compared to player using imported coal and INR 121 as compared to player using petcoke. Thus, players dependent on domestic coal such as Orient Paper and ACC are likely to have lowest power and fuel cost per tonne of cement. Historically, petcoke prices (adjusted for differences in the kcalr) have been cheaper by 20-30% as compared to imported coal. However, due to supply disturbances as mentioned above, current prices of petcoke are at a marginal premium to landed price of imported coal. If this premium increases, we expect cement players dependent on petcoke such as Shree Cement, JK Cement and JK Lakshmi Cement to gradually shift towards imported coal.

Exhibit 39: Fuel mix of cement players Imported Petcoke Other P&F cost Coal (%) (%) (%) FY10/CY09

Company

Domestic Coal (%)

UltraTech

62

29

9

0

711

JK Lakshmi

0

0

90

10

633

ACC

85

15

0

0

715

India Cements

45

55

0

0

913

Shree Cement

0

0

100

0

544

JK Cement

10

0

90

0

*903

JK Lakshmi

0

0

90

10

633

100

0

0

0

635

Orient Paper

Source: Company, Elara Securities Research *Higher as compared to peers due to production of white cement

As ACC meets only 15% of its fuel requirements through imports we have assigned it a rating of 3 on this parameter. We have assigned UltraTech 2 rating and Ambuja 1 due to their relatively higher dependence on imported coal (UltraTech 29% and Ambuja 30%). Players dependent on grid for power, such as India Cements, are likely to have cost disadvantage of INR161 per tonne as compared to player dependent on CPP for power such as Shree Cement. Apart from this, players dependent on grid also run the risk of loss of production due to power cuts which have curtailed cement production particularly in the states of AP and TN in last few years during the summer. Exhibit 40: Savings from CPP INR Grid cost

4.5

Average variable cost

2.6

Electricity consumption per tonne of cement Saving per tonne

85 161

Source: Elara Securities Estimates

14

Elara Securities (India) Private Limited

Cement

9

9

37

Shree Cement

97

97

97

JK Cement

83

97

97

Orient Paper

24

94

97

JK Lakshmi

70

95

95

Source: Company, Elara Securities Estimates

In frontline players, UltraTech meets about 90% of its electricity needs through CPP as compared to 68% for ACC and 65% for Ambuja. Thus we have assigned rating of 3 to UltraTech, 2 for ACC and 1 for Ambuja. Transport mix/freight costs: Freight costs constitute ~25– 30% of the total cost of sales for cement companies who normally dispatch through rail and/or road. Rail transport is cheaper as compared to road transport as it warrants a saving of 0.25paise/tonne/km. Assuming an average lead distances of 600kms, the rail transport generates savings of INR150/tonne vis a vis road. Thus in the downturn, when lead distances to market are expected to increase and in the scenario of high crude prices, a player having a higher dependence on rail as a mode of transport such as ACC is likely to have an edge over others. Exhibit 42: Road dominates transport mix (%)

Exhibit 43: OPI least sensitive to price decline (%) 7.5 6.5 4.5 3.5

2.7

2.9

3.4

3.5

5.5

3.8

2.5

Source: Elara Securities Estimates

Fixed cost: Players having lower fixed cost will be betteroff than peers in the downturn as this edge ensures a lower breakeven point. In our coverage universe of large caps, UltraTech has the lowest fixed cost (20%) and ACC has the highest (25%). Thus we have assigned a rating of 3 for UltraTech, 2 for Ambuja and 1 for ACC. In the midcaps, Shree Cement (12%) and OPI (15%) have the lowest fixed cost while JK Cement (24%) has the highest.

Rail

Ultra Tech Cement

62

35

3

Ambuja Cement

55

30

15

ACC

50

50

0

India Cements

46

54

0

30

Shree Cement

77

23

0

25

JK Cement

85

15

0

20

Orient Paper

80

20

0

JK Lakshmi

52

48

0

Exhibit 44: ACC has the highest fixed cost

15

12

19

20

20

22

24

25

15

10 5 Shree Cement

ACC dispatches about 50% of its volume by rail as compared to 35% by UltraTech and 30% by Ambuja. Thus we have assigned rating of 3 to ACC. As Ambuja dispatches about 15% of the cement by sea, we have assigned rating of 2 to Ambuja and 1 to UltraTech.

5.1

5.5

Road

Source: Company, Elara Securities Research

8

8.5

(%)

Sea

In the midcaps OPI (2.7%) and Shree Cement (2.9%) have the lowest earnings sensitivity to price decline while India Cements (8%) has the highest earnings sensitivity.

Cement

India Cements

India Cement

91

ACC

95

83

JK Cement

95

68

JK Cement

65

ACC

JK Lakshmi

Ambuja

India Cement

95

ACC

96

Ambuja

90

Ultra tech

UltraTech

Ultra Tech

CY11/FY12E

Ambuja Cement

CY10/FY11E

JK Lakshmi

CY09/FY10

Shree Cement

% of power meet through CPP

Orient Paper

Company

Earning sensitivity: Lower earnings sensitivity to cement price decline will prevent the earnings of the company from sharp erosion in a downturn. A one percent price change is likely to impact the EPS of Ambuja, UltraTech and ACC by 3.4%, 3.5% and 3.8% respectively. Thus we have assigned a rating of 3 for Ambuja, 2 for UltraTech and 1 for ACC.

Orient Paper

Exhibit 41: Players look for self sufficiency in power

Source: Elara Securities Research

Elara Securities (India) Private Limited

15

Cement

Exhibit 45: Operational parameters Region wise

Volume Growth

Fixed Earning cost sensitivity capacity breakup YoY (%) Company as a Capacity to price % of CY09/ CY10/ CY11/ Domestic Imported Petcoke Other CY09/ CY10/ CY11/ decline North East South West Central sales FY10 FY11E FY12E Coal (%) Coal (%) FY10 FY11E FY12E (%) (%) % of power meet through CPP

UltraTech

90

96

Fuel Mix

95

62

29

9

0

26

14

23

26

11

14

5

12

3.5

20

52

Ambuja

65

95

95

70

30

0

0

42

14

0

37

7

7

6

13

3.4

20

25

ACC

68

83

91

85

15

0

0

24

18

36

4

18

1

(4)

16

3.8

25

31

India Cements Shree Cement JK Cement

9

9

37

45

55

0

0

0

0

92

8

0

20

13

6

8

22

16

97

97

97

0

0

100

0

100

0

0

0

0

21

1

9

2.9

12

14

83

97

97

10

0

90

0

62

0

38

0

0

13

18

15

5.5

24

8

Orient Paper

24

94

96.9

100

0

0

0

0

0

60

40

0

11

21

5

2.7

15

5

JK Lakshmi

70

95

95

0

0

90

10

88

0

0

12

0

14

(9)

12

5.1

19

5

Source: Company, Elara Securities Estimates

Volume growth: We also expect players who have recently completed capacity expansions such as OPI, Ambuja and JK Cement to be better off as volume growth will prevent a sharp erosion in absolute earnings of a company. Players who have not yet completed capacity expansions such as JK Lakshmi Cement are likely to witness a serious decline in earnings due to the subdued volume growth on account of capacity constraints. In the large cap space, Ambuja is expected to report a volume CAGR of 9.4% as in Q1CY10, the company has added two grinding units of 1.5mn tonnes each at Nalgarh (HP) and Dadri (UP). UltraTech is expected to report a CAGR of 8.2% while ACC is expected to report volume CAGR of 5.7% during the same period. Thus, we have assigned 3,2,1 rating to Ambuja, UltraTech and ACC respectively. In mid-cap space, JK Cement is expected to report a strong volume CAGR of 17% as its 3mn tonnes Karnataka plant has come on stream. JK Lakshmi Cement is expected to report lowest volume CAGR of ~1% due to capacity constraints.

EBITDA per tonne As UltraTech is in the process of restructuring, we have looked at FY12 EBITDA per tonne of cement players. In frontline cement companies, we expect Ambuja to earn the highest EBITDA per tonne (INR978) as compared to its peers due to its superior regional mix and operational efficiency. ACC is expected to have an EBITDA per tonne of INR892 due to its cost advantage while UltraTech is expected to earn an EBITDA per tonne of INR 769. Thus, we have assigned rating of 3, 2 and 1 for Ambuja, ACC and UltraTech respectively. Return ratios: Among the frontline players, ACC is expected to earn RoE of 18%-29% between in CY10-CY11 as compared to 17%- 26% earned by others. The superior RoE is enjoyed by ACC on the back of its cost advantage resulting from its higher dependence on domestic coal as a fuel and rail for dispatching cement. Ambuja is expected to have lower ROE than that UltraTech despite higher EBITDA/tonne because of the higher cash on the balance sheet which is earning a lower yield than the core cement business. Thus, we have assigned a 3, 2 and

Exhibit 46: Financial parameters Net debt equity ratio(x) Company UltraTech

CY09/ FY10

CY10/ FY11

RoE(%)

CY11/ FY12

EBITDA per tonne

CY09/ FY10

CY10/ FY11

CY11/ FY12

CY09/ FY10

CY10/ FY11

CY11/ FY12

Q1FY11

MCAP (bn)

0.3

0.3

0.1

26.1

20.9

18.4

979

832

769

792

310

Ambuja

(0.2)

(0.2)

(0.3)

20.1

18.8

16.8

993

1,061

978

1,108

226

ACC

(0.2)

(0.1)

(0.3)

29

18.5

17.9

1,117

888

892

1,115

200

0.7

0.5

0.4

10.5

5.2

7.8

758

494

833

376

36

India Cement Shree Cement

0.1

0.1

(0.3)

49.2

19.4

24.1

1,364

907

863

1,027

75

JK Cement

0.9

0.7

0.6

22.6

6.5

10.8

964

535

568

668

12

Orient Paper

0.6

0.1

(0.1)

22.6

23.2

19.7

892

879

785

887

12

JK Lakshmi

0.2

0.3

0.4

27.2

11.6

13.8

925

710

857

551

8

Source: Company, Elara Securities Estimates

16

Elara Securities (India) Private Limited

Cement

Cement

Exhibit 48: ACC: EV/EBITDA (x) and RoCE (%) EV/EBITDA is the highest when the return ratio is the lowest - which is a theoretical sign to sell shares 30

18

9

15

6

10

3

5

0

0

EV/EBITDA(LHS)

CY06

CY08

20

FY05

25

12

FY03

15

FY01

In frontline cement companies, Ambuja and ACC are expected to have net cash on balance sheets between CY09 to CY11. Thus, we have assigned Ambuja and ACC rating of 2. UltraTech, though is not likely to have a stretched balance sheet, with a comfortable net debt equity ratio of 0.3x in FY10, it is placed a notch below the rest. Considering the same, we have assigned UltraTech rating of 1.

Traditionally, earnings based valuation ratios have failed to time the cement cycles correctly. As is evident from the chart, the peak EV/EBITDA multiple made a good case to buy the stock and vice versa. Hence, we believe, the EV/tonne is a better representation of the valuations of companies in the volatile cement sector.

RoCE(%)

Balance sheet: We believe that as the industry enters the downturn phase, players having a healthy balance sheet will be better off than others. Lower debt equity ratio will not only reduce the interest and principal repayment burden on cash flows but will also enable the company to take advantage of any distress opportunities that might be available.

Earning based valuation irrelevant for industry

FY99

By the end of FY11, UltraTech will have capacity of ~52.4 mn tonnes (globally 9th largest) and will be 1.7x of ACC and 2.1x of Ambuja. Thus, we have assigned the highest rating to UltraTech on this parameter. We have assigned rating of 3, 2 and 1 to UltraTech, Ambuja and ACC respectively. In our midcap coverage universe, Shree Cement and India Cements are mid-size player who will have a capacity of close to 15.6mn tonnes and 13.5 mn tonnes by end of FY11.

FY97

Size: The larger size provides the benefit of economics of scale, pricing power and a bigger balance sheet to comfortably fund major projects.

FY95

In the midcap space, Shree Cement is expected to earn RoE of 19% in FY11 while Orient Paper is expected to earn 23%. These players are expected to have a superior ROE due to their low cost structure, diversfied revenue stream and volume growth due to completion of expansion. JK Lakshmi is expected to have lowest ROE i.e 11.6% (13.6% adjusted for CWIP) due to a sharp decline in earnings on account of subduded volume growth and funds getting blocked in CWIP.

Conclusion: Thus, in the environment of high energy prices, we believe that players dependent on rail for transport such as ACC and players dependent on domestic coal such as Orient Paper will be better off than players dependent on imported coal (such as India Cements ) and petcoke (such as JK Cement and Shree cement). We also believe that in the case of a downturn, players having a lower debt equity ratio such as ACC, Ambuja and Shree Cement will be better off than those with a higher ratio such as India Cements and JK cement. Lower debt equity ratio will help reduce the pressure on a companys opertaing cash flows to serve the interest and principal.

EV/EBITDA(x)

1 rating to ACC, UltraTech and Ambuja respectively.

RoCE(%)(RHS)

Source: Capitaline, Elara Securities Research

In the mid-cap space, only India Cements and JK Cement are likely to have debt equity ratio of more than 0.5x. Rest of the mid-cap spectrum is likely to have a healthy balance sheet. Exhibit 47: Vital statistics of frontline cement players Region

Fuel mix

CPP

Transport mix

Balance sheet

Earning sensitivity to price decline

Fixed cost

Volume growth

EBITDA per tonne

RoE

Size

Total

ACC

1

3

2

3

2

1

1

1

2

3

2

21

Ambuja

3

1

1

2

2

3

2

3

3

1

1

22

UltraTech

2

2

3

1

1

2

3

2

1

2

3

22

Note: 3 indicates the best. As we have given equal weight to all parameters we have just added the score At end of CY11 Acc and Ambuja both are expected to have same net debt equity ratio we have assigned 2 rating to both on balance sheet strength parameter Source: Company, Elara Securities Research

Elara Securities (India) Private Limited

17

Cement

EV/EBITDA(LHS)

50

40

40 30

30

20

20

10

(%)

(x)

50

10

0

0 CY08

CY06

FY05

FY03

FY01

FY99

FY97

FY95

(10)

RoE(RHS)

Source: Capitaline ,Elara Securities Research

Exhibit 51: ACC: Cash P/E (x) and Mcap (INR bn) 2.5

40

2.0

30

1.5

20

1.0

10

0.5

0

0.0 CY08

CY06

FY05

FY03

FY01

FY99

FY97

FY95

(INR bn)

P/CEPS(x)

50

Mcap (RHS)

Source: Capitaline ,Elara Securities Research

250

60

200

40

150

20

100

(%)

Exhibit 52: ACC: EV/tonne, RoE and RoCE (USD per tonne)

0

50 0 CY08

CY06

FY05

FY03

FY01

FY99

FY97

(20) FY95

0

0

EV/Tonne in USD (RHS)

Mid cap vs large cap: Valuation gap widens

Exhibit 50: ACC: Cash P/E (x)and RoE(%)

EV/Tonne in USD (LHS) RoCE (RHS)

50

Source: Capitaline, Elara Securities Estimates

Source: Capitaline ,Elara Securities Research

P/CEPS(LHS)

50

Market Cap (LHS)

Market Cap

P/CEPS(LHS)

100

CY10

CY08

CY06

FY05

FY03

FY01

0 FY99

0 FY97

1

FY95

3

100

CY08

6

150

CY06

1

150

FY05

9

200

FY03

(x)

2

(INR bn)

12

200

FY01

2

250

FY99

3

15

250

(USD)

18

EV per tonne is highest when stock has peaked out

EV per tonne bottom outs when stock bottom outs

FY97

If someone had brought ACC stock when EV/EBITDA was highest despite lower return ratio he would have made money at a CAGR of 22% over 5 years

FY95

If someone had brought ACC stock when EV/EBITDA was lowest he would have lost money at a CAGR of 22%

Exhibit 53: ACC: Market cap and EV/tonne

(INR bn)

Exhibit 49: ACC: EV/EBITDA (x) and MCAP (INR Bn)

RoNW (RHS)

Usually, mid cap cement companies have traded at a discount to their large cap peers. A major reason for the same is the pan-India presence of large cap peers which reduces the risk of regional concentration and lower free float. In terms of profitability, the mid-cap cement companies were less profitable in terms of EBITDA/tonne till FY07. But post FY07, when the pan-India witnessed a pricing increase in excess of ~25% coupled with cost cutting measures undertaken by cement companies, the profitability of mid-cap players has been aligned in line with that of large cap players. However, the gap of valuations in terms of EV/tonne has widened significantly, increasing from ~30% pre-FY07 to more than ~60% post FY07. The large cap players have consistently traded at a premium to their replacement costs in the past four years (excluding the period of subprime crises). In fact, they traded at nearly twice the replacement cost in FY07 and FY08 whereas mid-cap players have barely traded above their replacement cost. The maximum valuation that mid cap players managed was a ~10% to 15% discount to the replacement cost in FY06-FY07 period. Since then, these mid-cap players have traded well below their replacement cost. However, the valuation gap for mid-cap players has been consistently coming down which now lies in the range of ~50 -60% discount to large cap peers. We believe with improving cement pricing and bettering EBITDA/tonne for cement players, the valuation discount for mid-cap players will gradually narrow down. Therefore, we have valued mid-cap cement players at ~38% discount to the replacement cost. Our valuation of USD62/tonne assigned to mid-cap players indicates the distress case EV the cement plants deserve in case of a continued downturn.

Source: Capitaline, ,Elara Securities Research

18

Elara Securities (India) Private Limited

Cement

Source: CMIE, CMA, Elara Securities Estimates

(USD per tonne)

Exhibit 56: Better profitability justifies rich valuations 250

1,200

200

1,000 800

150

600

100

400

50

200 FY12E

FY11E

FY10

FY09

FY08

FY07

FY06

0 FY00

0

Cement

(%)

FY12E

FY10

FY11E

Average Large Caps EV per tonne (LHS) Capacity Utilization of the Industry (RHS)

(INR EBITDA/tonne)

The cement industry is likely to operate at capacity utilizations of 80% in FY11 and 81% in FY12; similar to the FY03-FY04 period. During FY03-FY04, large cap was trading at EV per tonne of USD67-80. Present valuations of cement players are 1.9x last down cycle. However there has also been corresponding improvement in EBITDA/tonne for cement players due to improvement in cost efficiency. Frontline cement players are expected to earn 1.9x higher EBITDA/tonne as compared to last down cycle. Thus we believe that present valuations for the frontline companies are fair.

FY09

FY00

Large cap valuations across business cycles

FY08

75 FY07

60 Source: Elara Securities Estimates

FY06

80 FY05

90 FY04

EBITDA/tonne disc

85

r=0.86

120

FY05

Valuation disc for mid caps

90

150

FY03

(100)

95

180

FY04

(80)

100

210

FY02

(60)

Run up in the stock prices much sharper than improvement in fundamentals of the industry

240

FY03

(40)

(USD Per tonne)

(%)

(20)

FY01

0

In last down cycle when industry operated at capacity utilizations of 80-81 the EV/tonne of large cap was USD67-80.With similar capacity utilizations expected for the industry valuations are 1.5x higher

FY02

20

Exhibit 55: All India capacity utilization, EV per tonne

FY01

FY12

FY11

FY10

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

FY01

Exhibit 54: Margin gaps narrows, valuation broadens

Average Large Caps EV per tonne (LHS) Average Large Caps EBITDA/tonne (RHS) Source: Capitaline, Elara Securities Estimates

Elara Securities (India) Private Limited

19

Cement

Valuation & Recommendation Earnings based valuation multiples not useful for cement stocks Large cap valued on discounted bull case EV per tonne multiple Mid cap valued on distress EV per tonne multiple, to factor in higher regional risks

Valuations With earnings based valuation multiples failing to provide a correct historical trend, we have used EV/tonne as our valuation multiple for all companies under our coverage. With the industry in the midst of a downturn and cement prices as well as profitability in a highly volatile zone, we have tried to value companies based on discounted upcycle valuations that these deserved. Considering the uncertain cement market scenario and given the outperformance of large cap cement players as well as the premium they command over mid-cap segment, we have tried to find whether large cap stocks still make value proposition at the current level.

In order to find a fair EV per tonne for frontline cement companies we have looked at the historical average upcycle valuation and theoretical bull cycle valuation. As mentioned earlier, our industry analysis indicates that the pace of capacity addition will slow down and the demand will grow at steady pace. We expect the demand to catch up with supply post FY12 and the pricing power to return to industry. However, in the intermediate period, we expect the profitability of the cement players to remain subdued. As we expect the bull cycle in the cement industry to be still 1 year away, we have discounted average up cycle valuation by 1 year using WACC of 13%. Upcycle average benchmark valuation for large caps We have used two approaches for the same viz. 1. Historical upcycle valuation and 2 Theoretical bull cycle valuation. 1.

Historical upcycle valuations

In this approach, we have considered average upcycle EV per tonne for Ambuja and ACC. As per our working, these players have traded at an average EV/tonne of USD155. However, as we anticipate the upycle for cement sector to be 1 year away from now, we have discounted the same for 1 year using WACC of 13%. The computation leads to an average benchmark valuation of USD137/tonne under this approach.

Exhibit 57: Historical upcycle valuations USD per tonne Ambuja

178

ACC

132

Average

155

PV multiple

0.88

PV EV per tonne

137

Source: Elara Securities Research

2.

Theoretical bull cycle value

This approach is based on the notion as to what should be the fair valuation for acquiring the existing company to reap benefits of an upcycle rather than going for a greenfield expansion. In our view, the industry player would pay replacement cost of ~USD100 per tonne + PV of profitability of three years (as it takes minimum three year to set up a greenfield plant) in order to reap the benefits of an upcycle in the cement industry. Exhibit 58: Bull case DCF Year (INR /tonne)

1

Capex cost INR mn

5,000

Debt INR mn

2,500

Capacity in tonne

2

3

1,000,000 1,000,000 1,000,000

Capacity Utilization (%)

100

Production in tonnes

100

100

1,000,000 1,000,000 1,000,000

EBITDA per tonne

1,200

1,200

1,200

Depreciation@ 5%

250

250

250

Interest

238

238

238

PBT per tonne

713

713

713

Tax per tonne

214

214

214

PAT per tonne

499

499

499

Increase WC per tonne Free cash flow per tonne

10

10

10

976

976

976

Free cash flow to firm INR mn

976

976

976

PV multiple

0.88

0.78

0.69

PV of Cash

864

765

677

Sum INR mn

2,305

Terminal value= replacement cost

5,000

EV per tonne in USD

162

PV multiple

0.9

PV EV per tonne

144

WACC (%)

13.0

Source: Elara Securities Research

20

Elara Securities (India) Private Limited

Cement