Financial

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Financial as PDF for free.

More details

- Words: 971

- Pages: 14

Loading documents preview...

Single Professional - Managing Debt • Case Study: Single Professional – Managing Debt • Children: None • Job Position: Health Care

Single Professional - Managing Debt • Kathy, age 44, is a radiologist in Taos who purchased a home in 2006 prior to the mortgage crises. • Her home was in need of repairs and obtained a second mortgage and third mortgage, one was for a new roof and the other was to upgrade the electrical. • In addition she had to borrow from her retirement plan in order to make other renovations. • She also has credit card debt, student loans and a car loan. • The burden of debt is overwhelming especially since she estimates that she purchased her home at the top of the market and the home value is less than the total outstanding mortgage debt.

• Her salary is $67,000 per year and that does not include the rent she receives from her roommate. • Kathy is a hard worker and has worked extra hours to cover her debt. She does some travel to visit her family in another state. • She also has been involved in business ventures. • She is savvy and knows that she needs to deal with her financial issues. • She does maintain a 403(b) fund and contributes to receive the maximum matching employer contribution. • Her cash flow is restricted because of the amount of debt she carries.

Step 1: What is important to Kathy?

Step 2: Financial Diagnostics • Tax Bracket: 25% • Anticipated taxes: $6,770 • Contributions to 401(k) plan: $100 per pay period or $3,600 per year. Retirement contributions are allocated to a well defined structured investment program. • Group Life Insurance: $65.000 and a universal life policy $13,000 • Existing Mortgage Interest Rate: 6.0%, Current Rate: 4.5% (Home Affordable Refinance Program)

Step 3: Goals Based Recommendation • Refinance first mortgage and pay off credit card debt. Upon payment of credit card debt,apply those payments to principal on second mortgage. • Increase the retirement contributions from 200/mo to $500/mo as follows: • Half of the $205 savings on the mortgage payment should be applied to the retirement plan. • Upon the 403(b) loan payoff in two years, apply the 200 per monthly payments as retirement contributions. • Make an appointment with an attorney to establish an estate plan.

Step 4: Implementation and Execution • Set up an appointment with mortgage lender to refinance first mortgage. Increased principal payments to pay off credit card debt. Further principal reductions on other loans will continue as each debt is paid off. • Increased initial contributions to retirement plan. • Opted to defer an appointment with an attorney. Kathy will use the health care power forms provided by her employer. • Will continue to set aside money for emergency saving.

RESULT • Refinancing the mortgage provided $2,400 saving to Kathy’s mortgage payments, the term length did not change. Kathy will have no debt by the time she retires. Concurrently, Kathy will add to her retirement plan. It is projected that upon retirement she will have accumulated $469,000 by the time she retires based on an assumed 5% annual return. The first two years the cash flow will be tight, however, as debt is paid off, there should be ample surplus in her cash flow to provide more leisure spending.

Single Individual - Pursuing an MBA • Case Study: Single Professional – Managing Debt • Children: None • Job Position: Health Care

Single Individual - Pursuing an MBA • Miguel, age 28, is a research analyst for an American company that has an office in Madrid, Spain. • He is single and no dependents. • Miguel desires to obtain his MBA at a top-tier business school. • His educational endeavor will be a major expense. • Although Miguel is an American citizen, he pays both US and Spanish taxes and participates in the Spanish health care and retirement programs. • Miguel monitors his income and spending. • He also sets aside savings for investments as well as contributes to his retirement plans.

Step 1: What is important to Miguel?

Step 2: Financial Diagnostics • Bracket: 29.7% (Foreign Tax Bracket) Anticipated taxes: $13,283 • Contributions to retirement plan: $308 per pay period or $7,380 per year. • Retirement contributions are allocated to a well defined structured investment program.

Step 3: Goals Based Recommendation • Review Business Schools – It was noted studies comparing income between attending a top-tiered MBA program and a lower MBA program over 20 years. • Educational Funding Sources – Miguel will need to draw from the following to finance his MBA • Miguel has saving in the amount of $46,000 • Miguel has retirement savings with a provision that he can draw without penalty provided it is used to fund education • Miguel will still need to rely on student loan ranging from 6.8% to 7.9% interest rates. However the above savings will reduce the reliance on such loans.

• Funding Source and Outlay – A plan was made to determine on when and how to draw on the mentioned resources to reduce the tax impact and the amount of loans necessary to finance his MBA. • Loan Balance and Monthly Payment – A projection was made to determine what his student loan payment obligations will be after he obtains his MBA

Step 4: Implementation and Execution • Miguel worked with his accountant to run a mock tax preparation to make sure there were no tax surprises in both foreign and US taxes. This plan was submitted as part of his application to one of the above MBA programs on how he intends to finance his education.

RESULT • Miguel was accepted to the MBA of his choice and will be beginning the program in the Fall of 2014.

Single Professional - Managing Debt • Kathy, age 44, is a radiologist in Taos who purchased a home in 2006 prior to the mortgage crises. • Her home was in need of repairs and obtained a second mortgage and third mortgage, one was for a new roof and the other was to upgrade the electrical. • In addition she had to borrow from her retirement plan in order to make other renovations. • She also has credit card debt, student loans and a car loan. • The burden of debt is overwhelming especially since she estimates that she purchased her home at the top of the market and the home value is less than the total outstanding mortgage debt.

• Her salary is $67,000 per year and that does not include the rent she receives from her roommate. • Kathy is a hard worker and has worked extra hours to cover her debt. She does some travel to visit her family in another state. • She also has been involved in business ventures. • She is savvy and knows that she needs to deal with her financial issues. • She does maintain a 403(b) fund and contributes to receive the maximum matching employer contribution. • Her cash flow is restricted because of the amount of debt she carries.

Step 1: What is important to Kathy?

Step 2: Financial Diagnostics • Tax Bracket: 25% • Anticipated taxes: $6,770 • Contributions to 401(k) plan: $100 per pay period or $3,600 per year. Retirement contributions are allocated to a well defined structured investment program. • Group Life Insurance: $65.000 and a universal life policy $13,000 • Existing Mortgage Interest Rate: 6.0%, Current Rate: 4.5% (Home Affordable Refinance Program)

Step 3: Goals Based Recommendation • Refinance first mortgage and pay off credit card debt. Upon payment of credit card debt,apply those payments to principal on second mortgage. • Increase the retirement contributions from 200/mo to $500/mo as follows: • Half of the $205 savings on the mortgage payment should be applied to the retirement plan. • Upon the 403(b) loan payoff in two years, apply the 200 per monthly payments as retirement contributions. • Make an appointment with an attorney to establish an estate plan.

Step 4: Implementation and Execution • Set up an appointment with mortgage lender to refinance first mortgage. Increased principal payments to pay off credit card debt. Further principal reductions on other loans will continue as each debt is paid off. • Increased initial contributions to retirement plan. • Opted to defer an appointment with an attorney. Kathy will use the health care power forms provided by her employer. • Will continue to set aside money for emergency saving.

RESULT • Refinancing the mortgage provided $2,400 saving to Kathy’s mortgage payments, the term length did not change. Kathy will have no debt by the time she retires. Concurrently, Kathy will add to her retirement plan. It is projected that upon retirement she will have accumulated $469,000 by the time she retires based on an assumed 5% annual return. The first two years the cash flow will be tight, however, as debt is paid off, there should be ample surplus in her cash flow to provide more leisure spending.

Single Individual - Pursuing an MBA • Case Study: Single Professional – Managing Debt • Children: None • Job Position: Health Care

Single Individual - Pursuing an MBA • Miguel, age 28, is a research analyst for an American company that has an office in Madrid, Spain. • He is single and no dependents. • Miguel desires to obtain his MBA at a top-tier business school. • His educational endeavor will be a major expense. • Although Miguel is an American citizen, he pays both US and Spanish taxes and participates in the Spanish health care and retirement programs. • Miguel monitors his income and spending. • He also sets aside savings for investments as well as contributes to his retirement plans.

Step 1: What is important to Miguel?

Step 2: Financial Diagnostics • Bracket: 29.7% (Foreign Tax Bracket) Anticipated taxes: $13,283 • Contributions to retirement plan: $308 per pay period or $7,380 per year. • Retirement contributions are allocated to a well defined structured investment program.

Step 3: Goals Based Recommendation • Review Business Schools – It was noted studies comparing income between attending a top-tiered MBA program and a lower MBA program over 20 years. • Educational Funding Sources – Miguel will need to draw from the following to finance his MBA • Miguel has saving in the amount of $46,000 • Miguel has retirement savings with a provision that he can draw without penalty provided it is used to fund education • Miguel will still need to rely on student loan ranging from 6.8% to 7.9% interest rates. However the above savings will reduce the reliance on such loans.

• Funding Source and Outlay – A plan was made to determine on when and how to draw on the mentioned resources to reduce the tax impact and the amount of loans necessary to finance his MBA. • Loan Balance and Monthly Payment – A projection was made to determine what his student loan payment obligations will be after he obtains his MBA

Step 4: Implementation and Execution • Miguel worked with his accountant to run a mock tax preparation to make sure there were no tax surprises in both foreign and US taxes. This plan was submitted as part of his application to one of the above MBA programs on how he intends to finance his education.

RESULT • Miguel was accepted to the MBA of his choice and will be beginning the program in the Fall of 2014.

Related Documents

Financial

January 2021 3

Financial Management

January 2021 1

Financial Accounting

February 2021 1

Financial Astrology

February 2021 0

Financial Accounting

March 2021 0

Financial Accounting

March 2021 0More Documents from "Samuel Kamau"

Financial

January 2021 3

El Acto Matrimonial, La Belleza Del Amor Sexual

February 2021 1

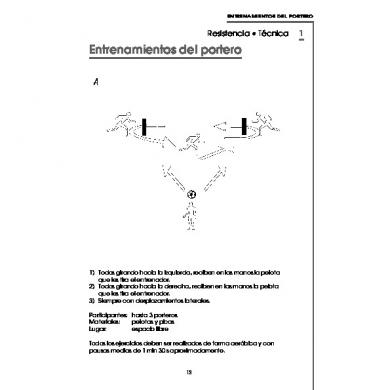

Entrenamientos Para Porteros

February 2021 1

Thermodynamics Problem Set With Solutions

January 2021 2