Govacc Finals Drills

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Govacc Finals Drills as PDF for free.

More details

- Words: 776

- Pages: 8

Loading documents preview...

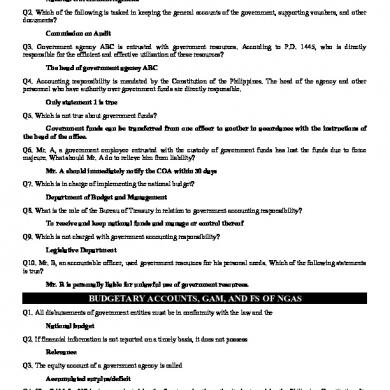

DRILL 1 - STATEMENT OF ACTIVITIES

Pure Air Rehabilitation Hospital has the following balances that are extracted from its December 31, 20x9 trial balan

Nursing Services Expense Professional Fees Expense General and Administrative Expense Depreciation Expense Interest Expense Asset Whose Use is Limited Repairs and Maintenance Expense Provision for Uncollectible Accounts Contractual Adjustments Patient Service Revenues Seminar Income Child Day Care Revenues Parking Fees Endowment Income - Temporarily Restricted Interest Income - Unrestricted Donations - Temporarily Restricted Gains (Distributable) on Sale of Endowments - Temporarily Restricted Net Assets - Unrestricted (January 1, 20x9) Net Assets - Temporarily Restricted Net Assets - Permanently Restricted

Debit 230,000 340,000 150,000 90,000 13,000 55,000 110,000 14,000 26,000

Credit

740,000 23,000 15,000 4,500 120,000 3,000 18,000 56,000 800,000 755,000 750,000

Prepare a Statement of Activities to answer the folowing questions. Do not use comma, centavo, and peso sign for yo 1 Net Patient Service Revenue is 714000 2 The total other operating revenue is 42500 3 The total operating revenues is 756500 4 The total operating expenses is 947000 5 The loss from operations is 190500 6 The total non-operating revenue (unrestricted and restricted) is 197000 7 Downward change in net assets - unrestricted is 187500 8 Upward change in net assets - temporarily restricted is 194000 9 The balance of ending Net Assets - Unrestricted is 612500 10 The total Net Assets is 2311500

Pure Air Rehabilitation Hospital Statement of Activities For Period Ended December 31, 20x9

Unrestricted Patient service revenues (net of 26,000 contractual adjustments) Other operating revenues:

714,000

Temporarily Restricted

Permanently Restricted

Seminar Income 23,000 Child Day Care Revenues 15,000 Parking Fees 4,500 Total other operating revenues 42,500 Total operating revenues 756,500 Operating expenses: Nursing Services Expense 230,000 Professional Fees Expense 340,000 General and Administrative Expense 150,000 Depreciation Expense 90,000 Interest Expense 13,000 Repairs and Maintenance Expense 110,000 Provision for Uncollectible Accounts 14,000 Total operating expenses 947,000 Loss from operations 190,500 Nonoperating revenue: Interest Income 3,000 Contributions/Donations Endownment Income Gains (Distributable) on Sale of Endowments Total nonoperating income 3,000 Change in net assets 187,500 Net assets, January 1, 20x9 800,000 Net assets, December 31, 20x9 612,500

18,000 120,000 56,000 194,000 194,000 755,000 949,000

750,000 750,000

m its December 31, 20x9 trial balance:

mma, centavo, and peso sign for your answer.

Total 714,000

23,000 15,000 4,500 42,500 756,500

-

230,000 340,000 150,000 90,000 13,000 110,000 14,000 947,000 190,500 3,000 18,000 120,000 56,000 197,000 6,500 2,305,000 2,311,500

PRACTICE EXERCISE ON ACCOUNTING FOR VHWO JOURNAL ENTRIES: 1 Cash Revenue - Annual Dues

20,000

2 Cash

31,000

20,000

Revenue - Snack Bar and Soda Fountain

31,000

3 Cash

7,000 Investment Income - Unrestricted

7,000

4 Expense - House Expense - Snack Bar and Soda Fountain Expense - General and Administrative Accounts Payable

17,000 26,000 11,000

5 Accounts Payable Cash

55,000

54,000

55,000

6 Cash

5,000 Public Support - Unrestricted Bequests

5,000

7 Investments Unrealized Gain on Investments - Unrestricted

7,000

8 Depreciation Expense - House Depreciation Expense - Snack Bar and Soda Fountain Depreciation Expense - General and Administrative Accumulated Depreciation - Building Accumulated Depreciation - Furniture and Equipment

9,000 2,000 1,000

9 Expense - Snack Bar and Soda Fountain Inventories

4,000

7,000

4,000 8,000

4,000

10 Cash

35,000 Contributions - Temporarily Restricted

35,000

11 Pledges Receivable Public Support - Contributions - Permanently Restricted

100,000 100,000

ReSA Sports Club Statement of Activities For Year Ended March 31, 20x9

Unrestricted Public support and revenue:

Temporarily Restricted

Permanently Restricted

Public support: Contributions Special events Unrestricted bequests Total public support

31,000 5,000 36,000

Revenue: Annual dues Investment revenue Unrealized gain on investments Total revenue

20,000 7,000 7,000 34,000

Total public support and revenue

70,000

Expenses: Snack bar and soda fountain House General and administrative Total expenses

32,000 26,000 12,000 70,000

Change in net assets Net assets, April 1, 20x8 Net assets, March 31, 20x9

12,000 12,000

Compute for the following: 1 The total unrestricted public support is 2 The total unrestricted revenues is 3 The total unrestricted public support and revenues is 4 The total unrestricted and restricted public support and revenues is 5 The total expenses is 6 The change in unrestricted net assets is 7 The unrestricted net assets at the end of the year is 8 The temporarily restricted net assets at the end of the year is 9 The permanently restricted net assets at the end of the year is 10 The total net assets at the end of the year is

35,000

100,000

35,000

100,000

35,000

35,000 52,000 87,000

100,000

100,000 400,000 500,000

36000 34000 70000 205000 70000 0 12000 87000 500000 599000

Total

135,000 31,000 5,000 171,000

20,000 7,000 7,000 34,000 205,000

32,000 26,000 12,000 70,000 135,000 464,000 599,000

Pure Air Rehabilitation Hospital has the following balances that are extracted from its December 31, 20x9 trial balan

Nursing Services Expense Professional Fees Expense General and Administrative Expense Depreciation Expense Interest Expense Asset Whose Use is Limited Repairs and Maintenance Expense Provision for Uncollectible Accounts Contractual Adjustments Patient Service Revenues Seminar Income Child Day Care Revenues Parking Fees Endowment Income - Temporarily Restricted Interest Income - Unrestricted Donations - Temporarily Restricted Gains (Distributable) on Sale of Endowments - Temporarily Restricted Net Assets - Unrestricted (January 1, 20x9) Net Assets - Temporarily Restricted Net Assets - Permanently Restricted

Debit 230,000 340,000 150,000 90,000 13,000 55,000 110,000 14,000 26,000

Credit

740,000 23,000 15,000 4,500 120,000 3,000 18,000 56,000 800,000 755,000 750,000

Prepare a Statement of Activities to answer the folowing questions. Do not use comma, centavo, and peso sign for yo 1 Net Patient Service Revenue is 714000 2 The total other operating revenue is 42500 3 The total operating revenues is 756500 4 The total operating expenses is 947000 5 The loss from operations is 190500 6 The total non-operating revenue (unrestricted and restricted) is 197000 7 Downward change in net assets - unrestricted is 187500 8 Upward change in net assets - temporarily restricted is 194000 9 The balance of ending Net Assets - Unrestricted is 612500 10 The total Net Assets is 2311500

Pure Air Rehabilitation Hospital Statement of Activities For Period Ended December 31, 20x9

Unrestricted Patient service revenues (net of 26,000 contractual adjustments) Other operating revenues:

714,000

Temporarily Restricted

Permanently Restricted

Seminar Income 23,000 Child Day Care Revenues 15,000 Parking Fees 4,500 Total other operating revenues 42,500 Total operating revenues 756,500 Operating expenses: Nursing Services Expense 230,000 Professional Fees Expense 340,000 General and Administrative Expense 150,000 Depreciation Expense 90,000 Interest Expense 13,000 Repairs and Maintenance Expense 110,000 Provision for Uncollectible Accounts 14,000 Total operating expenses 947,000 Loss from operations 190,500 Nonoperating revenue: Interest Income 3,000 Contributions/Donations Endownment Income Gains (Distributable) on Sale of Endowments Total nonoperating income 3,000 Change in net assets 187,500 Net assets, January 1, 20x9 800,000 Net assets, December 31, 20x9 612,500

18,000 120,000 56,000 194,000 194,000 755,000 949,000

750,000 750,000

m its December 31, 20x9 trial balance:

mma, centavo, and peso sign for your answer.

Total 714,000

23,000 15,000 4,500 42,500 756,500

-

230,000 340,000 150,000 90,000 13,000 110,000 14,000 947,000 190,500 3,000 18,000 120,000 56,000 197,000 6,500 2,305,000 2,311,500

PRACTICE EXERCISE ON ACCOUNTING FOR VHWO JOURNAL ENTRIES: 1 Cash Revenue - Annual Dues

20,000

2 Cash

31,000

20,000

Revenue - Snack Bar and Soda Fountain

31,000

3 Cash

7,000 Investment Income - Unrestricted

7,000

4 Expense - House Expense - Snack Bar and Soda Fountain Expense - General and Administrative Accounts Payable

17,000 26,000 11,000

5 Accounts Payable Cash

55,000

54,000

55,000

6 Cash

5,000 Public Support - Unrestricted Bequests

5,000

7 Investments Unrealized Gain on Investments - Unrestricted

7,000

8 Depreciation Expense - House Depreciation Expense - Snack Bar and Soda Fountain Depreciation Expense - General and Administrative Accumulated Depreciation - Building Accumulated Depreciation - Furniture and Equipment

9,000 2,000 1,000

9 Expense - Snack Bar and Soda Fountain Inventories

4,000

7,000

4,000 8,000

4,000

10 Cash

35,000 Contributions - Temporarily Restricted

35,000

11 Pledges Receivable Public Support - Contributions - Permanently Restricted

100,000 100,000

ReSA Sports Club Statement of Activities For Year Ended March 31, 20x9

Unrestricted Public support and revenue:

Temporarily Restricted

Permanently Restricted

Public support: Contributions Special events Unrestricted bequests Total public support

31,000 5,000 36,000

Revenue: Annual dues Investment revenue Unrealized gain on investments Total revenue

20,000 7,000 7,000 34,000

Total public support and revenue

70,000

Expenses: Snack bar and soda fountain House General and administrative Total expenses

32,000 26,000 12,000 70,000

Change in net assets Net assets, April 1, 20x8 Net assets, March 31, 20x9

12,000 12,000

Compute for the following: 1 The total unrestricted public support is 2 The total unrestricted revenues is 3 The total unrestricted public support and revenues is 4 The total unrestricted and restricted public support and revenues is 5 The total expenses is 6 The change in unrestricted net assets is 7 The unrestricted net assets at the end of the year is 8 The temporarily restricted net assets at the end of the year is 9 The permanently restricted net assets at the end of the year is 10 The total net assets at the end of the year is

35,000

100,000

35,000

100,000

35,000

35,000 52,000 87,000

100,000

100,000 400,000 500,000

36000 34000 70000 205000 70000 0 12000 87000 500000 599000

Total

135,000 31,000 5,000 171,000

20,000 7,000 7,000 34,000 205,000

32,000 26,000 12,000 70,000 135,000 464,000 599,000

Related Documents

Govacc Finals Drills

January 2021 1

Finals

January 2021 2

Post Drills

March 2021 0

Rock Drills

January 2021 3

Structure Drills

March 2021 0

Govacc - Quiz (universities)

January 2021 1More Documents from "Von Andrei Medina"

Quiz - Other Npes (ver. 3)

January 2021 1

Compilation 1 (midterms)

February 2021 1

Finals Summative 1 Compilation + New (ver. 9)

January 2021 1

Govacc Finals Drills

January 2021 1

Module 6 Quiz Answers

February 2021 1