Govacc - Quiz (universities)

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Govacc - Quiz (universities) as PDF for free.

More details

- Words: 2,463

- Pages: 12

Loading documents preview...

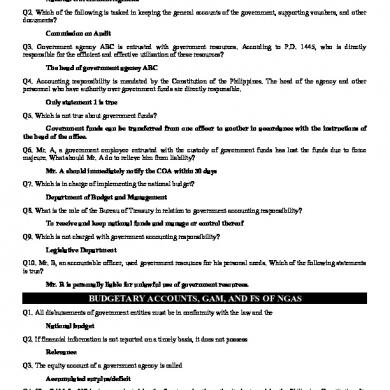

ACCOUNTING FOR NPE COLLEGES AND UNIVERSITIES LABELS: Yellow:

Correct answer

Red:

Wrong answer

Cyan:

Suggested answer

1. Where should an alumnus contribution of P50,000 to pay for scholarships for international study be accounted for? Current restricted fund 2. Which of the following is not an example of general and educational expenses recorded by a college or university? Purchase of sweatshirts for sale in the college bookstore 3. A collection of first editions is donated to Southern Luzon State University for its library. Which is the correct credit? No entry is required 4. Calbayog Institute of Science and Technology, an NPE, as of June 30, 2020, and for the year ended: I. Unrestricted net assets comprised P7,500,000 of assets and P4,500,000 of liabilities (including deferred revenues of P15,000). Among the receipts recorded during the year were unrestricted gifts of P550,000 and restricted grants totaling P330,000, of which P220,000 was expended during the year for current operations and P110,000 remained unexpended at the close of the year. II. Volunteers from the surrounding communities regularly contribute their service to the school and paid nominal amounts to cover their travel costs. During the year, travel costs reimbursed to volunteers aggregated to P18,000. The gross value of services performed by the volunteers and determined by reference to equivalent wages available in that area for similar services amounted to P200,000. The school normally purchases these types of contributed services, and it believes that these services enhance its assets. At June 30, 2020, the school’s unrestricted net assets balance was P3,000,000

5. Calbayog Institute of Science and Technology, an NPE, as of June 30, 2020, and for the year ended: I. Unrestricted net assets comprised P7,500,000 of assets and P4,500,000 of liabilities (including deferred revenues of P15,000). Among the receipts recorded during the year were unrestricted gifts of P550,000 and restricted grants totaling P330,000, of which P220,000 was expended during the year for current operations and P110,000 remained unexpended at the close of the year. II. Volunteers from the surrounding communities regularly contribute their service to the school and paid nominal amounts to cover their travel costs. During the year, travel costs reimbursed to volunteers aggregated to P18,000. The gross value of services performed by the volunteers and determined by reference to equivalent wages available in that area for similar services amounted to P200,000. The school normally purchases these types of contributed services, and it believes that these services enhance its assets. For the year ended June 30, 2020, what amount should be included in the school’s revenue for the unrestricted gifts and restricted grants? P880,000 6. Endowment income was restricted to student aid activities. Cash is paid for all activities. Which is the credit necessary for classification? Reclassification in-temporarily restricted, satisfaction of program restrictions 7. What is the basis of accounting used in accounting for NPE college or university? Accrual basis 8. For the summer session of 2020, Ateneo de Manila University assessed its students P1,700,000 (net of refunds) covering tuition and fees for educational and general purposes. However, only P1,500,000 was expected to be realized because scholarships totaling P150,000 had been granted to students for which services are rendered, and tuition remissions of P50,000 had been allowed to faculty members’ children attending Ateneo. How much should Ateneo report for the summer session ended 2020 as net revenue from tuition and fees? P1,650,000 9. Unrestricted current funds of Malayan University designated by the governing board for a specific future purpose should be reported as part of Unrestricted net assets

10. An alumni donates P10,000 to University of the Philippines for a new Women’s Studies program. The alumni wants the principal to remain intact but the investment earnings can be used to support the Women’s Studies program. This donation would be accounted for in the: Endowment fund 11. The Divine Word College issues long-term debt to build a bridge over the gap between two main campuses. The debt would be accounted for in the Investment in plant 12. An NPE college received an offer from an engineer, an alumnus, to teach Engineering Math for one semester at no cost. This contribution of service Should be recorded as a revenue with an equivalent amount recorded as an expenditure 13. For the summer session of 2020, Ateneo de Manila University assessed its students P1,700,000 (net of refunds) covering tuition and fees for educational and general purposes. However, only P1,500,000 was expected to be realized because scholarships totaling P150,000 had been granted to students for which no services are rendered, and tuition remissions of P50,000 had been allowed to faculty members’ children attending Ateneo. What amount should Ateneo include as net revenues from student tuition and fees? P1,500,000 14. NPE college or university student unions, dormitories, and residence halls are considered Auxiliary enterprises 15. Unexpended plant fund accounts for: Assets allotted for future plant acquisition 16. A university’s long-term boards issued to build dormitories would be recorded in the Investment in plant fund 17. The quasi-endowment fund of St. Augustine University would account funds set aside by The governing board of the university for future purpose

18. Catarman University has the following information:

On December 31, 2020, the total liabilities amounted to: P1,130,000 19. A life income fund is used when All income earned on donated assets are to be paid to the donor for his/her lifetime 20. Catarman University has the following information:

On December 31, 2020, the total assets amounted to: P5,365,000

21. For the 1st semester of 2020, DLSU-D assessed its students P4,000,000 (net of refunds), covering tuition and fees for educational and general purposes. However, only P3,700,000 was expected to be realized because tuition remissions of P80,000 were allowed to faculty members’ children attending DLSU-D, and scholarships with services rendered to the university totaling P220,000 were granted to students. What amount should DLSU-D include in net revenue from student tuition and fees for the first semester ended 2020? P3,920,000 22. Which plant fund subgroup would consider the following transaction. A bond principal payment is made on a bond that was issued with the proceeds being designated for construction of a new gymnasium? Plant fund for retirement of indebtedness 23. For the summer session of 2020, Ateneo de Manila University assessed its students P1,700,000 (net of refunds) covering tuition and fees for educational and general purposes. However, only P1,500,000 was expected to be realized because scholarships totaling P150,000 had been granted to students for which no services are rendered, and tuition remissions of P50,000 had been allowed to faculty members’ children attending Ateneo. The increase in unrestricted net assets for the summer session ended 2020 amounted to P1,500,000 24. Private grants which are essentially pass through financial aid to students are accounted for as Agency transactions 25. For San Sebastian College-Recoletos, the receipt for operating activities that have external restrictions as to the purpose for which they can be used is recorded by crediting: Contribution Revenue 26. The loan fund of Pangasinan State University would account for loans To university students 27. Which of the following is not an example of general and educational revenues of an NPE college or university? Room and board fees received by the dormitory 28. In an NPE university, government grants given directly to students are an example of An agency transaction

29. For the 1st semester of 2020, DLSU-D assessed its students P4,000,000 (net of refunds), covering tuition and fees for educational and general purposes. However, only P3,700,000 was expected to be realized because tuition remissions of P80,000 were allowed to faculty members’ children attending DLSU-D, and scholarships with services rendered to the university totaling P220,000 were granted to students. What amount should DLSU-D include in educational and general current funds or gross revenues (net of refunds) from student tuition and fees? P4,000,000 30. Cebu Central University budget funds for the maintenance and repair of its building. These funds would be accounted for under Plant fund for renewals and replacements 31. The Board of Trustees decides to set aside P5,000,000 to consider purchasing additional land on the first month of the next fiscal year. What type of transfer is this? Discretionary 32. CALEB decides to contribute P1,000,000 to his alma mater. Southwestern Samar College agrees to pay CALEB a fixed amount every month for the next 20 years in exchange for the donation. CALEB’s donation would be accounted for in the Annuity fund 33. Which of the following is not correct? Expenses denote outlay of resources 34. Which of the following is not an example of the major categories of funds for an NPE college or university? Proprietary funds 35. Which of the following receipts should be recorded in the restricted current fund of an NPE university? A cash donation to provide scholarships 36. Which of the following funds of an NPE university makes periodic payments of a fixed amount at equal intervals Annuity fund 37. In accounting for loan funds, revenue is recorded when the Contribution is received

38. The type of endowment fund for which the principal may be expended after the occurrence of an event specified by the donor is a/an None of these 39. Which university fund is most similar to the governmental general fund? Current-unrestricted 40. In a university, class cancellation refunds of tuition and fees should be recorded as I. Reduction of revenue from tuition and fees. II. Reduction of accounts receivable I only 41. The following funds were among those on Holy Spirit University’s books at December 31, 2020:

Funds to be used for acquisition of additional property for university purposes (unexpended at 12/31/2020) – P3,000,000

Funds set aside for debt service charges and for the retirement of indebtedness on university’s property – P7,000,000

P10,000,000 42. All of the following are plant funds in colleges and universities except: Plant replacement and expansion fund 43. An alumnus made a donation of an adjoining land to a university. The university would record the gift as An unrestricted revenue 44. Admissions, counseling, and registration are considered to be: Student services

45. Calbayog Institute of Science and Technology, an NPE, as of June 30, 2020, and for the year ended: I. Unrestricted net assets comprised P7,500,000 of assets and P4,500,000 of liabilities (including deferred revenues of P15,000). Among the receipts recorded during the year were unrestricted gifts of P550,000 and restricted grants totaling P330,000, of which P220,000 was expended during the year for current operations and P110,000 remained unexpended at the close of the year. II. Volunteers from the surrounding communities regularly contribute their service to the school and paid nominal amounts to cover their travel costs. During the year, travel costs reimbursed to volunteers aggregated to P18,000. The gross value of services performed by the volunteers and determined by reference to equivalent wages available in that area for similar services amounted to P200,000. The school normally purchases these types of contributed services, and it believes that these services enhance its assets. For the year ended June 30, 2020, what amount should the school record as contribution revenue from the volunteers’ services? P200,000 46. Which of the following is an example of an inter-fund transaction? Cash is set aside for payment of a mortgage 47. Calbayog Institute of Science and Technology, an NPE, as of June 30, 2020, and for the year ended: I. Unrestricted net assets comprised P7,500,000 of assets and P4,500,000 of liabilities (including deferred revenues of P15,000). Among the receipts recorded during the year were unrestricted gifts of P550,000 and restricted grants totaling P330,000, of which P220,000 was expended during the year for current operations and P110,000 remained unexpended at the close of the year. II. Volunteers from the surrounding communities regularly contribute their service to the school and paid nominal amounts to cover their travel costs. During the year, travel costs reimbursed to volunteers aggregated to P18,000. The gross value of services performed by the volunteers and determined by reference to equivalent wages available in that area for similar services amounted to P200,000. The school normally purchases these types of contributed services, and it believes that these services enhance its assets. What amount of total revenue from the above-mentioned transactions would be recognized as revenues? P970,000 48. Any restrictions on gifts, grants, or bequests received by NPE university are imposed by Donors

49. NPE college or university student unions, dormitories, and residence halls are considered Auxiliary enterprises

50. Which of the following is a mandatory transfer by Ateneo de Naga University? Principal and interest payments on long-term debt

LONG PROBLEM – DAYAG COLLEGE The preclosing trial balance of Dayag College of Business and the Arts shows the following balances:

1. In the statement of activities, unrestricted column, net assets at the end of the year is 395000 (please do not use peso sign, comma, or decimal) 2. In the statement of activities, temporarily restricted column, total revenues and gains excluding other support is 240000 (please do not use peso sign, comma, or decimal) 3. In the statement of activities, unrestricted column, decrease in net assets is 280000 (please do not use peso sign, comma, or decimal) 4. In the statement of activities, total unrestricted, temporarily restricted, and permanently restricted revenues and gains excluding other support is 4055000 (please do not use peso sign, comma, or decimal) 5. In the statement of activities, total expenses (expenditures) and losses (other deduction) is 3970000 (please do not use peso sign, comma, or decimal) 6. In the statement of activities, permanently restricted column, net assets at the end of the year is 3000000 (please do not use peso sign, comma, or decimal) 7. In the statement of activities, temporarily restricted column, decrease in net assets is 135000 (please do not use peso sign, comma, or decimal)

8. In the statement of activities, net assets (restricted and unrestricted) at the end of the year is 4235000 (please do not use peso sign, comma, or decimal) 9. In the statement of activities, unrestricted column, total revenues and gains excluding other support is 3315000 (please do not use peso sign, comma, or decimal) 10. In the statement of activities, unrestricted column, total revenues and gains and other other support is 3690000 (please do not use peso sign, comma, or decimal) 11. In the statement of activities, permanently restricted column, total revenues and gains excluding other support is 500000 (please do not use peso sign, comma, or decimal) 12. In the statement of activities, temporarily restricted column, net assets at the end of the year is 840000 (please do not use peso sign, comma, or decimal) 13. In the statement of activities, permanently restricted column, increase in net assets is 500000 (please do not use peso sign, comma, or decimal) 14. In the statement of activities, total net assets released from restrictions is 375000 (please do not use peso sign, comma, or decimal)

Correct answer

Red:

Wrong answer

Cyan:

Suggested answer

1. Where should an alumnus contribution of P50,000 to pay for scholarships for international study be accounted for? Current restricted fund 2. Which of the following is not an example of general and educational expenses recorded by a college or university? Purchase of sweatshirts for sale in the college bookstore 3. A collection of first editions is donated to Southern Luzon State University for its library. Which is the correct credit? No entry is required 4. Calbayog Institute of Science and Technology, an NPE, as of June 30, 2020, and for the year ended: I. Unrestricted net assets comprised P7,500,000 of assets and P4,500,000 of liabilities (including deferred revenues of P15,000). Among the receipts recorded during the year were unrestricted gifts of P550,000 and restricted grants totaling P330,000, of which P220,000 was expended during the year for current operations and P110,000 remained unexpended at the close of the year. II. Volunteers from the surrounding communities regularly contribute their service to the school and paid nominal amounts to cover their travel costs. During the year, travel costs reimbursed to volunteers aggregated to P18,000. The gross value of services performed by the volunteers and determined by reference to equivalent wages available in that area for similar services amounted to P200,000. The school normally purchases these types of contributed services, and it believes that these services enhance its assets. At June 30, 2020, the school’s unrestricted net assets balance was P3,000,000

5. Calbayog Institute of Science and Technology, an NPE, as of June 30, 2020, and for the year ended: I. Unrestricted net assets comprised P7,500,000 of assets and P4,500,000 of liabilities (including deferred revenues of P15,000). Among the receipts recorded during the year were unrestricted gifts of P550,000 and restricted grants totaling P330,000, of which P220,000 was expended during the year for current operations and P110,000 remained unexpended at the close of the year. II. Volunteers from the surrounding communities regularly contribute their service to the school and paid nominal amounts to cover their travel costs. During the year, travel costs reimbursed to volunteers aggregated to P18,000. The gross value of services performed by the volunteers and determined by reference to equivalent wages available in that area for similar services amounted to P200,000. The school normally purchases these types of contributed services, and it believes that these services enhance its assets. For the year ended June 30, 2020, what amount should be included in the school’s revenue for the unrestricted gifts and restricted grants? P880,000 6. Endowment income was restricted to student aid activities. Cash is paid for all activities. Which is the credit necessary for classification? Reclassification in-temporarily restricted, satisfaction of program restrictions 7. What is the basis of accounting used in accounting for NPE college or university? Accrual basis 8. For the summer session of 2020, Ateneo de Manila University assessed its students P1,700,000 (net of refunds) covering tuition and fees for educational and general purposes. However, only P1,500,000 was expected to be realized because scholarships totaling P150,000 had been granted to students for which services are rendered, and tuition remissions of P50,000 had been allowed to faculty members’ children attending Ateneo. How much should Ateneo report for the summer session ended 2020 as net revenue from tuition and fees? P1,650,000 9. Unrestricted current funds of Malayan University designated by the governing board for a specific future purpose should be reported as part of Unrestricted net assets

10. An alumni donates P10,000 to University of the Philippines for a new Women’s Studies program. The alumni wants the principal to remain intact but the investment earnings can be used to support the Women’s Studies program. This donation would be accounted for in the: Endowment fund 11. The Divine Word College issues long-term debt to build a bridge over the gap between two main campuses. The debt would be accounted for in the Investment in plant 12. An NPE college received an offer from an engineer, an alumnus, to teach Engineering Math for one semester at no cost. This contribution of service Should be recorded as a revenue with an equivalent amount recorded as an expenditure 13. For the summer session of 2020, Ateneo de Manila University assessed its students P1,700,000 (net of refunds) covering tuition and fees for educational and general purposes. However, only P1,500,000 was expected to be realized because scholarships totaling P150,000 had been granted to students for which no services are rendered, and tuition remissions of P50,000 had been allowed to faculty members’ children attending Ateneo. What amount should Ateneo include as net revenues from student tuition and fees? P1,500,000 14. NPE college or university student unions, dormitories, and residence halls are considered Auxiliary enterprises 15. Unexpended plant fund accounts for: Assets allotted for future plant acquisition 16. A university’s long-term boards issued to build dormitories would be recorded in the Investment in plant fund 17. The quasi-endowment fund of St. Augustine University would account funds set aside by The governing board of the university for future purpose

18. Catarman University has the following information:

On December 31, 2020, the total liabilities amounted to: P1,130,000 19. A life income fund is used when All income earned on donated assets are to be paid to the donor for his/her lifetime 20. Catarman University has the following information:

On December 31, 2020, the total assets amounted to: P5,365,000

21. For the 1st semester of 2020, DLSU-D assessed its students P4,000,000 (net of refunds), covering tuition and fees for educational and general purposes. However, only P3,700,000 was expected to be realized because tuition remissions of P80,000 were allowed to faculty members’ children attending DLSU-D, and scholarships with services rendered to the university totaling P220,000 were granted to students. What amount should DLSU-D include in net revenue from student tuition and fees for the first semester ended 2020? P3,920,000 22. Which plant fund subgroup would consider the following transaction. A bond principal payment is made on a bond that was issued with the proceeds being designated for construction of a new gymnasium? Plant fund for retirement of indebtedness 23. For the summer session of 2020, Ateneo de Manila University assessed its students P1,700,000 (net of refunds) covering tuition and fees for educational and general purposes. However, only P1,500,000 was expected to be realized because scholarships totaling P150,000 had been granted to students for which no services are rendered, and tuition remissions of P50,000 had been allowed to faculty members’ children attending Ateneo. The increase in unrestricted net assets for the summer session ended 2020 amounted to P1,500,000 24. Private grants which are essentially pass through financial aid to students are accounted for as Agency transactions 25. For San Sebastian College-Recoletos, the receipt for operating activities that have external restrictions as to the purpose for which they can be used is recorded by crediting: Contribution Revenue 26. The loan fund of Pangasinan State University would account for loans To university students 27. Which of the following is not an example of general and educational revenues of an NPE college or university? Room and board fees received by the dormitory 28. In an NPE university, government grants given directly to students are an example of An agency transaction

29. For the 1st semester of 2020, DLSU-D assessed its students P4,000,000 (net of refunds), covering tuition and fees for educational and general purposes. However, only P3,700,000 was expected to be realized because tuition remissions of P80,000 were allowed to faculty members’ children attending DLSU-D, and scholarships with services rendered to the university totaling P220,000 were granted to students. What amount should DLSU-D include in educational and general current funds or gross revenues (net of refunds) from student tuition and fees? P4,000,000 30. Cebu Central University budget funds for the maintenance and repair of its building. These funds would be accounted for under Plant fund for renewals and replacements 31. The Board of Trustees decides to set aside P5,000,000 to consider purchasing additional land on the first month of the next fiscal year. What type of transfer is this? Discretionary 32. CALEB decides to contribute P1,000,000 to his alma mater. Southwestern Samar College agrees to pay CALEB a fixed amount every month for the next 20 years in exchange for the donation. CALEB’s donation would be accounted for in the Annuity fund 33. Which of the following is not correct? Expenses denote outlay of resources 34. Which of the following is not an example of the major categories of funds for an NPE college or university? Proprietary funds 35. Which of the following receipts should be recorded in the restricted current fund of an NPE university? A cash donation to provide scholarships 36. Which of the following funds of an NPE university makes periodic payments of a fixed amount at equal intervals Annuity fund 37. In accounting for loan funds, revenue is recorded when the Contribution is received

38. The type of endowment fund for which the principal may be expended after the occurrence of an event specified by the donor is a/an None of these 39. Which university fund is most similar to the governmental general fund? Current-unrestricted 40. In a university, class cancellation refunds of tuition and fees should be recorded as I. Reduction of revenue from tuition and fees. II. Reduction of accounts receivable I only 41. The following funds were among those on Holy Spirit University’s books at December 31, 2020:

Funds to be used for acquisition of additional property for university purposes (unexpended at 12/31/2020) – P3,000,000

Funds set aside for debt service charges and for the retirement of indebtedness on university’s property – P7,000,000

P10,000,000 42. All of the following are plant funds in colleges and universities except: Plant replacement and expansion fund 43. An alumnus made a donation of an adjoining land to a university. The university would record the gift as An unrestricted revenue 44. Admissions, counseling, and registration are considered to be: Student services

45. Calbayog Institute of Science and Technology, an NPE, as of June 30, 2020, and for the year ended: I. Unrestricted net assets comprised P7,500,000 of assets and P4,500,000 of liabilities (including deferred revenues of P15,000). Among the receipts recorded during the year were unrestricted gifts of P550,000 and restricted grants totaling P330,000, of which P220,000 was expended during the year for current operations and P110,000 remained unexpended at the close of the year. II. Volunteers from the surrounding communities regularly contribute their service to the school and paid nominal amounts to cover their travel costs. During the year, travel costs reimbursed to volunteers aggregated to P18,000. The gross value of services performed by the volunteers and determined by reference to equivalent wages available in that area for similar services amounted to P200,000. The school normally purchases these types of contributed services, and it believes that these services enhance its assets. For the year ended June 30, 2020, what amount should the school record as contribution revenue from the volunteers’ services? P200,000 46. Which of the following is an example of an inter-fund transaction? Cash is set aside for payment of a mortgage 47. Calbayog Institute of Science and Technology, an NPE, as of June 30, 2020, and for the year ended: I. Unrestricted net assets comprised P7,500,000 of assets and P4,500,000 of liabilities (including deferred revenues of P15,000). Among the receipts recorded during the year were unrestricted gifts of P550,000 and restricted grants totaling P330,000, of which P220,000 was expended during the year for current operations and P110,000 remained unexpended at the close of the year. II. Volunteers from the surrounding communities regularly contribute their service to the school and paid nominal amounts to cover their travel costs. During the year, travel costs reimbursed to volunteers aggregated to P18,000. The gross value of services performed by the volunteers and determined by reference to equivalent wages available in that area for similar services amounted to P200,000. The school normally purchases these types of contributed services, and it believes that these services enhance its assets. What amount of total revenue from the above-mentioned transactions would be recognized as revenues? P970,000 48. Any restrictions on gifts, grants, or bequests received by NPE university are imposed by Donors

49. NPE college or university student unions, dormitories, and residence halls are considered Auxiliary enterprises

50. Which of the following is a mandatory transfer by Ateneo de Naga University? Principal and interest payments on long-term debt

LONG PROBLEM – DAYAG COLLEGE The preclosing trial balance of Dayag College of Business and the Arts shows the following balances:

1. In the statement of activities, unrestricted column, net assets at the end of the year is 395000 (please do not use peso sign, comma, or decimal) 2. In the statement of activities, temporarily restricted column, total revenues and gains excluding other support is 240000 (please do not use peso sign, comma, or decimal) 3. In the statement of activities, unrestricted column, decrease in net assets is 280000 (please do not use peso sign, comma, or decimal) 4. In the statement of activities, total unrestricted, temporarily restricted, and permanently restricted revenues and gains excluding other support is 4055000 (please do not use peso sign, comma, or decimal) 5. In the statement of activities, total expenses (expenditures) and losses (other deduction) is 3970000 (please do not use peso sign, comma, or decimal) 6. In the statement of activities, permanently restricted column, net assets at the end of the year is 3000000 (please do not use peso sign, comma, or decimal) 7. In the statement of activities, temporarily restricted column, decrease in net assets is 135000 (please do not use peso sign, comma, or decimal)

8. In the statement of activities, net assets (restricted and unrestricted) at the end of the year is 4235000 (please do not use peso sign, comma, or decimal) 9. In the statement of activities, unrestricted column, total revenues and gains excluding other support is 3315000 (please do not use peso sign, comma, or decimal) 10. In the statement of activities, unrestricted column, total revenues and gains and other other support is 3690000 (please do not use peso sign, comma, or decimal) 11. In the statement of activities, permanently restricted column, total revenues and gains excluding other support is 500000 (please do not use peso sign, comma, or decimal) 12. In the statement of activities, temporarily restricted column, net assets at the end of the year is 840000 (please do not use peso sign, comma, or decimal) 13. In the statement of activities, permanently restricted column, increase in net assets is 500000 (please do not use peso sign, comma, or decimal) 14. In the statement of activities, total net assets released from restrictions is 375000 (please do not use peso sign, comma, or decimal)

Related Documents

Govacc - Quiz (universities)

January 2021 1

Govacc Finals Drills

January 2021 1

Govacc-chapter-12

January 2021 1

Bc Quiz

January 2021 2

Quiz-applied.rtf

January 2021 1

Quiz Cibercultura

January 2021 2More Documents from "MariaDoraniSilvaLaguna"

Quiz - Other Npes (ver. 3)

January 2021 1

Compilation 1 (midterms)

February 2021 1

Finals Summative 1 Compilation + New (ver. 9)

January 2021 1

Govacc Finals Drills

January 2021 1

Module 6 Quiz Answers

February 2021 1