Tax Law Notes

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Tax Law Notes as PDF for free.

More details

- Words: 141,833

- Pages: 181

Loading documents preview...

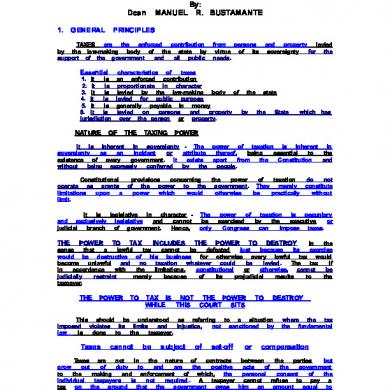

Taxation I

Objectives of the Power of Taxation

INTRODUCTION Power of Taxation, Defined

Process of collecting money to defray expenses of the government Inherent power of the state: no need for a constitution or enabling statute for the State to exercise the power of taxation

1. 2.

(a) Promotion of general welfare Taxation can be used as an implement of police power e.g. Excise Tax: a type of business tax; higher rate of tax can be imposed to certain industries (cigarettes, alcohols because the state discourages the use of these products) (b)

Regulation PAL v Edu: The state imposed a regulatory tax Regulatory Tax: A tax imposed to raise revenues and regulate a subject matter

(c)

Reduce Social Inequity Progressive System of Taxation

Local Government Units and Power of Taxation

Prior to the 1987 Constitution, there needs to be an enabling law before LGUs can collect taxes. With the effectivity of the 1987 Constitution, the power of taxation is no longer delegated to the LGUs but is directly conferred by the Constitution. The Constitution has a provision on Local Autonomy (Article X)

Sec.5 Each local government unit shall have the power to create its own sources of revenues and to levy taxes, fees and charges subject to such guidelines and limitations as the Congress may provide, consistent with the basic policy of local autonomy. Such taxes, fees and charges shall accrue exclusively to the local governments.

“Ability to pay” principle: the higher the income, the higher the tax. (d) Encourage Economic Growth Congress can grant incentives to promote a particular industry (e)

Protectionism Imposition of custom duties to protect locally manufactured goods e.g. “smuggled goods”

Characteristics of Taxation Being A Power 1. 2.

Inherent Supreme, Plenary, Unlimited and Comprehensive Can cover all subject matters provided in accordance with limitations (both inherent and constitutional limitations)

Power To Tax: Power To Destroy?

Justice Marshall: The power to tax includes the power to destroy The state can use the power of taxation to kill any business

Justice Holmes: The power to tax does not include the power to destroy while this court sits

Lifeblood Doctrine

If a tax imposed is valid, it can be used by the state to destroy. If it is an invalid tax, the state cannot use the power to tax to destroy a business.

Taxes are lifeblood of nation. Without taxes, the states cannot exist. The source of the power to tax is the main existence of the state

Justifications of the Power of Taxation 1.

Benefits-Received Theory We pay taxes because of the protection that we receive from the state

2.

Symbiotic Relationship Theory Notwithstanding reluctance, we must pay taxes because without it, the government cannot provide protection to its citizens.

3.

Necessity Theory Taxes are necessary for the government to operate Kindred to the Lifeblood doctrine

How to reconcile? The principle of Justice Marshall applies only to valid taxes, while that of Justice Holmes applies to invalid taxes.

Revenue Purposes Non-revenue Purposes

Benefits-Received Theory Benefits have been received, so we must pay tax.

Symbiotic Relationship Theory We must pay tax because benefits will be received from the government

Characteristics of the Power of Taxation 1.

Must be for public purpose Produce direct or indirect benefits to the people

2. 3. 4. 5. 6.

e.g. Collection of tax to prevent tuberculosis o Living in a healthy society is an indirect intangible benefit Inherent Inherently Legislative The power of taxation can only be exercised by the legislature by enactment of a law authorizing a tax Territorial It can only be exercised within the jurisdiction of the state Recognizes Tax Exemption of State Limited

Sison vs. Ancheta The power to tax is the power to build With the modern times, there is a need for more revenues to meet increasing social challenges. Lifeblood doctrine “It is manifest that the field of state activity has assumed a much wider scope xxx Hence the need for more revenues. The power to tax, an inherent prerogative, has to be availed of to assure the performance of vital state functions. It is the source of the bulk of public funds. To paraphrase a recent decision, taxes being the lifeblood of the government, their prompt and certain availability is of the essence.”

Philippine Health Care Providers vs. CIR

Documentary Stamp Tax of PHCP: 376 Net worth of PHCP: 259M (assets minus liabilities) PHCP alleges that the state is taxing it out of existence CIR alleges the principle of “Power to tax is the power to destroy” since the case involved valid tax

Supreme Court VAT was found valid DST was invalid DST can only be collected if the industry is an insurance provider. PHCP is not an insurance provider but a health service provider. Thus, DST cannot be imposed upon it. Since DST is an invalid tax (being imposed to a health service provider), the power to tax is not the power to destroy. While it is true that the power to tax is unlimited, supreme, plenary, unlimited and comprehensive, it must be exercised with precaution to avoid injury to proprietary rights of taxpayer. It must be fairly, equally and uniformly imposed. “The power of taxation is sometimes called also the power to destroy. Therefore it should be exercised with caution to minimize injury to the proprietary rights of a taxpayer. It must be exercised fairly, equally and uniformly, lest the tax collector kill the "hen that lays the golden egg." Legitimate enterprises enjoy the constitutional protection not to be taxed out of existence. Incurring losses because of a tax imposition may be an acceptable consequence but killing the business of an entity is another matter and should not be allowed. It is

counter-productive and ultimately subversive of the nation’s thrust towards a better economy which will ultimately benefit the majority of our people”

CIR vs. Algue Lifeblood doctrine “Taxes are the lifeblood of the government and so should be collected without unnecessary hindrance. On the other hand, such collection should be made in accordance with law as any arbitrariness will negate the very reason for government itself. It is therefore necessary to reconcile the apparently conflicting interests of the authorities and the taxpayers so that the real purpose of taxation, which is the promotion of the common good, may be achieved” Symbiotic Relationship Theory Those who can contribute must do so; Government responds to the taxes that we pay in the form of tangible and intangible benefits “It is said that taxes are what we pay for civilization society. Without taxes, the government would be paralyzed for lack of the motive power to activate and operate it. Hence, despite the natural reluctance to surrender part of one's hard earned income to the taxing authorities, every person who is able to must contribute his share in the running of the government. The government for its part, is expected to respond in the form of tangible and intangible benefits intended to improve the lives of the people and enhance their moral and material values. This symbiotic relationship is the rationale of taxation and should dispel the erroneous notion that it is an arbitrary method of exaction by those in the seat of power.”

Taxes must be reasonably collected “Even as we concede the inevitability and indispensability of taxation, it is a requirement in all democratic regimes that it be exercised reasonably and in accordance with the prescribed procedure. If it is not, then the taxpayer has a right to complain and the courts will then come to his succor. For all the awesome power of the tax collector, he may still be stopped in his tracks if the taxpayer can demonstrate, as it has here, that the law has not been observed.”

NAPOCOR vs. City of Cabanatuan Source of the exercise of taxing power: the very existence of the state Theory behind the power of taxation: Necessity So that the government can also provide for the citizens To promote general welfare LGU can exercise the power of taxation It is directly conferred by the Constitution (Sec 5. Article X, 1987 Constitution) The Local Government Code was enacted by the Congress Q: Does it grant the power to tax to the LGUs? A: No. It only sets limitation to the taxing power of the state and does not grant the power to collect the tax. It is the Constitution that grants the power to tax.

Philippine Airlines vs. EDU

Fees are being imposed to PAL in the form of registration fees. SC: these fees imposed are actually in the nature of taxes.

“They are taxes. Tax are for revenue, whereas fees are exactions for purposes of regulation and inspection, and are for that reason limited in amount to what is necessary to cover the cost of the services rendered in that connection. If the purpose is primarily revenue, or if revenue is, at least, one of the real and substantial purposes, then the exaction is properly called a tax.”

The fees are used for construction of highways. Only a portion is used for the operation of the motor vehicles. Since the fees are used for a public purpose, they are considered taxes. Tio vs. Videogram Regulatory Board

Tax Credit: deduction from tax liability Tax Deduction: reduction from the income “xxx Tax deduction -- defined as a subtraction "from income for tax purposes," or an amount that is "allowed by law to reduce income prior to [the] application of the tax rate to compute the amount of tax which is due." On the one hand, a tax credit reduces the tax due, including -- whenever applicable -- the income tax that is determined after applying the corresponding tax rates to taxable income. A tax deduction, on the other, reduces the income that is subject to tax in order to arrive at taxable income. To think of the former as the latter is to avoid, if not entirely confuse, the issue. A tax credit is used only after the tax has been computed; a tax deduction, before.” Elements of the Power of Eminent Domain 1. Taking of private property: 20% of the gross sale 2. For public use: discount for the senior citizens 3. For just compensation: tax credit

The corporation can incur whatever has been lost through the grant of tax credit. RA 9994: The 20% discount is already considered as tax deduction.

Taxes were not considered oppressive and were upheld to be valid. “It is beyond serious question that a tax does not cease to be valid merely because it regulates, discourages, or even definitely deters the activities taxed. The power to impose taxes is one so unlimited in force and so searching in extent, that the courts scarcely venture to declare that it is subject to any restrictions whatever, except such as rest in the discretion of the authority which exercises it. In imposing a tax, the legislature acts upon its constituents. This is, in general, a sufficient security against erroneous and oppressive taxation. “

Tax was used both as a regulatory and revenue measure

Three Stages in the Tax Process 1.

Levy Power of Taxation can be exercised through the law-making body How? By enactment of laws Nature: inherently legislative

2.

Assessment Computation of taxes Nature: administrative

3.

Collection Administrative in character

The tax imposed by the DECREE is not only a regulatory but also a revenue measure prompted by the realization that earnings of videogram establishments of around P600 million per annum have not been subjected to tax, thereby depriving the Government of an additional source of revenue

Tax as an instrument of police power: to protect video industry Lutz vs. Araneta

Tax as an implement of police power to promote general welfare “The tax is levied with a regulatory purpose, i.e. to provide means for the rehabilitation and stabilization of the threatened sugar industry. The act is primarily an exercise of police power and is not a pure exercise of taxing power. As sugar production is one of the great industries of the Philippines and its promotion, protection and advancement redounds greatly to the general welfare, the legislature found that the general welfare demanded that the industry should be stabilized, and provided that the distribution of benefits had to sustain.”

CIR vs. Central Luzon Drug Corporation Tax Credit vs. Tax Deduction

Principles of a Sound Tax System 1.

Fiscal Adequacy Fiscal: money Adequacy: sufficient Fiscal adequacy: Sufficient funds As much as possible, there should be no deficit and excessive surplus.

2.

Administrative Feasibility Tax laws should be capable of convenient, just and effective administration

3.

Theoretical Justice

Founded on the “ability-to-pay” principle Pay because you’re able Kindred concept of progressive system of taxation The higher the income, the higher the tax

Section 28, Article VI of the Constitution The Congress must evolve a progressive system of taxation Q: Will a violation of these principles result to unconstitutionality of the tax law? A:

General Rule: NO

Definition and Characteristics of Taxes Taxes are enforced, proportionate contribution levied by the law-making authority which has territorial jurisdiction over the source of the tax. Characteristics:

These are merely principles. They are guidelines and are therefore not mandatory The Constitution provides that the Congress must evolve a progressive system of taxation, but does not prohibit regressive system of taxation. For example, VAT is valid eventhough it does not consider the ability to pay principle because it is automatically imposed upon the consumers. The progressive system of taxation is merely encouraged and regressive system of taxation is merely frowned upon.

Article III, Section 20 (1987 PC) No person shall be imprisoned for debt or non-payment of a poll tax Q: Can a person legally refused to pay taxes? A: No. The privilege of living in a civilized society is a benefit derived from payment of taxes to the government.

Exception: If a law is violative of theoretical justice and in effect is harsh, oppressive and confiscatory such that it violates due process.

2. PROPORTIONATE CONTRIBUTION Progressive System of taxation and ability to pay principle.

3. LEVIED BY LAW-MAKING AUTHORITY Only the Congress has the authority to levy taxes through enactment of laws.

Diaz v. Secretary of Finance Concept of Administrative Feasibility Petitioner was assailing the validity of the impending imposition of valueadded tax (VAT) by the Bureau of Internal Revenue (BIR) on the collections of tollway operators The implementation of Section 108 of NIRC is not administratively feasible “In order to claim input VAT, the name, address and tax identification number of the tollway user must be indicated in the VAT receipt or invoice. The manner by which the BIR intends to implement the VAT by rounding off the toll rate and putting any excess collection in an escrow account is also illegal, while the alternative of giving change to thousands of motorists in order to meet the exact toll rate would be a logistical nightmare. Thus, according to them, the VAT on tollway operations is not administratively feasible” Non-observance of the canon of administrative feasibility would not make the law invalid. “Administrative feasibility is one of the canons of a sound tax system. It simply means that the tax system should be capable of being effectively administered and enforced with the least inconvenience to the taxpayer. Non-observance of the canon, however, will not render a tax imposition invalid except to the extent that specific constitutional or statutory limitations are impaired. Thus, even if the imposition of VAT on tollway operations may seem burdensome to implement, it is not necessarily invalid unless some aspect of it is shown to violate any law or the Constitution.” Moreover, the issue on the implementation is premature because it remains to be seen how the taxing authority will actually implement the VAT on tollway operations. Any declaration by the Court that the manner of its implementation is illegal or unconstitutional would be premature.

1. ENFORCED Mandated by law Poll tax: mandatory, but non-payment would not subject the person to imprisonment

Exceptions: a. Local Government Units b. Flexible Tariff Clause

Article VI, Sec 28 (2), 1987 PC The Congress may, by law, authorize the President to fix within specified limits, and subject to such limitations and restrictions as it may impose, tariff rates, import and export quotas, tonnage and wharfage dues, and other duties or imposts within the framework of the national development program of the Government. c.

Purely Administrative Functions

4.

HAVE TERRITORIAL JURISDICTION OVER THE SOURCE OF TAX Tax Situs (Section 42 of Tax Code) Place of Taxation

5.

PERSONAL IN NATURE One cannot make others liable for his own tax liability

Note: Tax Liability vs. Burden of Tax

Tax Liability Direct mandate of law Burden of Tax Who will shell out the funds

Q: VAT is an indirect tax. When someone buys a meal from Mcdonalds, a part of the purchase price that the consumer pays is the VAT. Is it a violation of the nature of Tax as personal in nature? A: No. Only the burden of tax is shifted to the consumer and not the tax liability.

Capital Gains Tax (CGT) Commonly the seller pays the tax of the property being sold. However, they can stipulate that the buyer will pay the CPG instead.

Q: If the buyer did not pay the tax, can the government run after the buyer? A: No. CPG is personal in nature. What was only shifted to the buyer was the burden of tax and not the tax liability. Hence, the liability remains to the seller. The government should run after the seller. The remedy of the seller is to file a complaint against the buyer. 6.

Q: Is his income subject to tax? A: Yes, regardless of the source of income, because he is a Filipino citizens. Withholding Tax Income earned by an employee The payor is the withholding agent: the employer. He serves as the collector of the government

Illustration: Manny Pacquaio is being paid an income by Las Vegas. Q: Can this income be subject to a withholding tax? A: No. It would be a violation of international comity. The Philippines cannot constitute the foreign corporation (“Top Rank Corp”) as a withholding agent, since the corporation has no business in the Philippines. Obligation of Pacquaio is to declare the income for income tax.

PUBLIC PURPOSE

Basic test of public purpose: it must be used for the support of the government To promote welfare for the common good.

Inherently Legislative The power to tax cannot be delegated to other branches of the government

Pascual vs. Secretary of Public Works and Communications et al.

A law was enacted wherein funds were appropriated for the construction of Pasig feeder road terminals, which have no connection with any government highway. Respondent Zulueta donated the feeder roads to the government AFTER the enactment of the law. SC: The law was invalid because public funds were appropriated for a private property. At the time of the enactment of the law, the property is still a private property.. The donation by Zulueta was made only to give semblance of legality to the project.

“The test of the constitutionality of a statute requiring the use of public funds is whether the statute is designed to promote the public interest, as opposed to the furtherance of the advantage of individuals, although each advantage to individuals might incidentally serve the public. The validity of a statute depends upon the powers of Congress at the time of its passage or approval, not upon events occurring, or acts performed, subsequently thereto, unless the latter consists of an amendment of the organic law, removing, with retrospective operation, the constitutional limitation infringed by said statute. Xxx Inasmuch as the land on which the projected feeder roads were to be constructed belonged then to respondent Zulueta, the result is that said appropriation sought a private purpose, and hence, was null and void”

International Comity

Courteous recognition and friendly relations between two sovereign states

Q: Can the Philippine Government impose tax to the income of the US Government? A: No. It will be a violation of international comity

Illustration: Manny Pacquaio is a Filipino citizen who is also being given an income by other states during his competitions.

Exceptions: 1. 2. 3.

LGU’s taxing power President’s taxing power Purely administrative function

Congress has the power to determine coverage of taxation, object of taxation, nature of taxation, the kind of tax to be imposed, and the tax rate.

Double Taxation Pepsi-Cola Bottling Company vs. Municipality of Tanauan There was no double taxation because there are different taxing authorities “Moreover, double taxation, in general, is not forbidden by our fundamental law, since we have not adopted as part thereof the injunction against double taxation found in the Constitution of the United States and some states of the Union. Double taxation becomes obnoxious only where the taxpayer is taxed twice for the benefit of the same governmental entity or by the same jurisdiction for the same purpose, but not in a case where one tax is imposed by the State and the other by the city or municipality.”

There was no undue delegation of the power of taxation “It is a power that is purely legislative and which the central legislative body cannot delegate either to the executive or judicial department of the government without infringing upon the theory of separation of powers. The exception, however, lies in the case of municipal corporations, to which, said theory does not apply. Legislative powers may be delegated to local governments in respect of matters of local concern. xxx Section 5, Article XI provides: "Each local government unit shall have the power to create its sources of revenue and to levy taxes, subject to such limitations as may be provided by law."

Pepsi-Cola Bottling Co. of the Philippines, Inc. vs. City of Butuan

Q: May the condominium be imposed with real property tax? A: No. It is located outside the Philippines.

Double taxation is not prohibited by our Constitution. It is only unconstitutional if it is obnoxious.

Eclectic Theory

Type kinds of Double Taxation

Q: May the income of Ryan be subject to income tax in the Philippines? A: Yes. The income is based on a right. Ryan is still a Filipino citizen who can be imposed with income tax by the Philippine Government even though he is a non-resident. Citizenship Principle

Direct Same type Same subject matter Same taxable period Same taxing authorities

Indirect Same type Same subject matter Same taxable period Different taxing authorities

However, the imposition of tax of 6% was found to be violative of due process and is considered confiscatory and obnoxious by the Supreme Court

Tax laws cannot extend beyond territorial jurisdiction of a State

Q: BUT is it subject to tax? A: No. RA 8429 (Tax Code) provides that only resident-citizens shall be subject to tax within or outside the Philippines Others are subject to tax only if the source is from the Philippines

xxx it would still be invalid, as discriminatory, and hence, violative of the uniformity required by the Constitution and the law therefor, since only sales by "agents or consignees" of outside dealers would be subject to the tax. Sales by local dealers, not acting for or on behalf of other merchants, regardless of the volume of their sales, and even if the same exceeded those made by said agents or consignees of producers or merchants established outside the City of Butuan, would be exempt from the disputed tax.

Tax Exemptions

GOCCs are not exempted from tax, except if its charter so provides that they are exempted.

Light Rail Transit Authority vs. Central Board of Assessment Appeals

Territoriality

Tax Situs: depends on the subject matter

Principles:

Source Principle Citizenship Principle Residence Principle

Source Principle State can impose tax to an income if such income has been earned in that State Citizenship Principle Tax is imposed to the income of all citizens of the State Residence Principle Tax is imposed to the income of the residents of a state

Taxes on Properties

Real properties: where it is located Personal properties Tangible: where it is located Intangible: mobilia sequitur persona follows the domicile of its owner

Illustration: Ryan is a Filipino Citizen who resides in Japan He owns a condo at Japan He earns P30,000 per month

The carriageways and passenger terminal stations are not public roads. They were merely elevated and only serve as improvements. “ XXX it must be emphasized that these structures do not form part of such roads, since the former have been constructed over the latter in such a way that the flow of vehicular traffic would not be impeded. These carriageways and terminal stations serve a function different from that of the public roads. The former are part and parcel of the light rail transit (LRT) system which, unlike the latter, are not open to use by the general public. The carriageways are accessible only to the LRT trains, while the terminal stations have been built for the convenience of LRTA itself and its customers who pay the required fare.”

Petitioner is a GOCC and is not exempted from real property taxes

“ Though the creation of the LRTA was impelled by public service -- to provide mass transportation to alleviate the traffic and transportation situation in Metro Manila -- its operation undeniably partakes of ordinary business. Petitioner is clothed with corporate status and corporate powers in the furtherance of its proprietary objectives. Indeed, it operates much like any private corporation engaged in the mass transport industry. Given that it is engaged in a service-oriented commercial endeavor, its carriageways and terminal stations are patrimonial property subject to tax, notwithstanding its claim of being a government-owned or controlled corporation.”

Mactan Cebu International Airport Authority vs. Hon. Ferdinand J. Marcos (1996) GOCC’s are taxable entities. Exception: If the charter provides for exemption.

However, the charter of MCIAA was already repealed upon enactment of the Local Government Code Instrumentalities of the government are exempted from real property taxes as provided by the Local Government Code. They are not taxable entities. MCIAA case on June 15 2015 MCIAA is no longer a GOCC and is now a government instrumentality In 2006, MIAA case was decided and Supreme Court considered it as an instrumentality, subject to tax exemption MCIAA filed a petition to the Court saying that it has the same functions with the MIAA and must also be exempted from real property taxes granted

Manila International Airport Authority vs. Court of Appeals

Constitutional Limitations Due Process Clause 2 Aspects: a. Substantive Due Process

No tax imposed if no law enacted

b.

Procedural Due Process

Government cannot levy property if no opportunity to be heard is given.

Basic Concepts to understand the CREBA Case Gross Sales: amount received from a business Cost of Sales: expenditure directly related to the earning of gross sales Gross Income: Gross Sales minus Cost of Sales Expenses: merely incidental expenditures Net Income: Gross Income minus Expenses

Illustration: MIAA is not a government-owned or controlled corporation Section 2(13) of the Introductory Provisions of the Administrative Code because it is not organized as a stock or non-stock corporation. MIAA is a government instrumentality vested with corporate powers. As operator of the international airport, MIAA administers the land, improvements and equipment within the NAIA Complex. 20% of its income reverts back to the government. Under Section 133 of the LGC, it is exempt from taxes SEC. 133. Common Limitations on the Taxing Powers of Local Government Units. – Unless otherwise provided herein, the exercise of the taxing powers of provinces, cities, municipalities, and barangays shall not extend to the levy of the following: xxxx (o) Taxes, fees or charges of any kind on the National Government, its agencies and instrumentalities and local government units

MIAA is exempt from real property taxes but not as to those properties leased to private entities, since these are taxable entities. SEC. 234. Exemptions from Real Property Tax. — The following are exempted from payment of the real property tax: (a) Real property owned by the Republic of the Philippines or any of its political subdivisions except when the beneficial use thereof has been granted, for consideration or otherwise, to a taxable person; Portions of the Airport Lands and Buildings that MIAA leases to private entities are not exempt from real estate tax. For example, the land area occupied by hangars that MIAA leases to private corporations is subject to real estate tax. In such a case, MIAA has granted the beneficial use of such land area for a consideration to a taxable person and therefore such land area is subject to real estate tax.

Atty. Carantes wants to sell 40 pcs of Boy Bawang. Her capital costs P40 (P1 per piece). She sold it for P5 per piece. Gross Sales: P200 Cost of Sales: P40 Gross Income: P160 Expense: P14 (jeepney fare) Net Income: P146

CREBA v. The Hon. Executive Secretary Alberto Romulo Under the Tax Code, a corporation can become subject to the Minimum Corporate Income Tax (MCIT) at the rate of 2% of gross income, beginning on the 4th taxable year immediately following the year in which it commenced its business operations, when such MCIT is greater than the normal corporate income tax. CREBA argued, among others, that the use of gross income as MCIT base amounts to a confiscation of capital because gross income, unlike net income, is not realized gain. It will be like imposing a tax even if there is no income yet.

In our earlier illustration, if the gross income is only P160 and the tax imposed is P170, there will be a net loss of –P10 Thus, CREBA alleges that it is confiscatory

MCIT is valid and is not confiscatory. MCIT is not an additional tax imposition. “It is imposed in lieu of the normal net income tax, and only if the normal income tax is suspiciously low. The MCIT merely approximates the amount of net income tax due from a corporation, pegging the rate at a very much reduced 2% and uses as the base the corporations gross income.” The purpose of MCIT is to prevent declaration of normal income tax that is suspiciously low.

CWT: P250,000 Tax Code aims to prevent corporations from bloating up their expenses to appear that they have no income.

MCIT is not a tax on a capital

“The imposition of the MCIT is constitutional. An income tax is arbitrary and confiscatory if it taxes capital, because it is income, and not capital, which is subject to income tax. However, MCIT is imposed on gross income which is computed by deducting from gross sales the capital spent by a corporation in the sale of its goods, i.e., the cost of goods and other direct expenses from gross sales. Clearly, the capital is not being taxed.”

300,000 250,000 ----------P50,000 Creditable next year

-

If you have no income 0 250,000 --------250,000 Can be utilized next taxable year

Taxation as an attribute of sovereignty

“Taxation is an inherent attribute of sovereignty. It is a power that is purely legislative. Essentially, this means that in the legislature primarily lies the discretion to determine the nature (kind), object (purpose), extent (rate), coverage (subjects) and situs (place) of taxation.It has the authority to prescribe a certain tax at a specific rate for a particular public purpose on persons or things within its jurisdiction. In other words, the legislature wields the power to define what tax shall be imposed, why it should be imposed, how much tax shall be imposed, against whom (or what) it shall be imposed and where it shall be imposed.”

Q: What if the business suffered loss until closure? Will CWIT be a confiscation of property? A: If the taxpayer cannot utilize the CWT, he can petition for tax refund 2 years from payment.

The government did not forfeit the CWT

COCA COLA

Creditable Withholding Tax is valid

Concept of CWT -

Imposed on the Gross Selling Price/Market Value of the property at the time of the sale

Illustration Real Property: P5M Seller receives 95% of this price Buyer withholds 5% and remits it directly to BIR Thus, petitioner alleges that it is confiscatory because the seller will not be assured that he/she will receive income. SC Ruling: CWT is Valid. It is imposable on the income. At the end of the year, income will be totaled and the CWT will be deducted.

Supreme Court: the amendatory law was null and void for non-compliance with the publication requirement, which is a requirement of due process Double Taxation: two ordinances imposed the same kind of tax Same subject: privilege of doing business Same taxing authority: City of Manila Same purpose: contribution of revenue Same jurisdiction: City of Manila Same period: per calendar year Same character: Local Business Tax

It is not an additional tax imposition but an advance payment of it during the taxable year. It only deals with method of tax collection. “The withholding tax system was devised for three primary reasons: first, to provide the taxpayer a convenient manner to meet his probable income tax liability; second, to ensure the collection of income tax which can otherwise be lost or substantially reduced through failure to file the corresponding returns and third, to improve the governments cash flow. This results in administrative savings, prompt and efficient collection of taxes, prevention of delinquencies and reduction of governmental effort to collect taxes through more complicated means and remedies”

Illustration: Real Property: P1m Tax (30%): P300,000

Tax Ordinance No. 7794, Section 21 provides for the exemption of Coca-Cola from additional taxes apart from local business tax Year 2000: The City of Manila amended the ordinance and removed the tax exemption of Coca-Cola

Direct Duplicate Taxation: the taxing measure becomes obnoxious Double Taxation is not unconstitutional. However, if it constituted direct double taxation and results to a measure that is obnoxious and confiscatory, it becomes unconstitutional and violative of due process.

Mayor Antonio J. Villegas vs.Hiu Chiong Tsai Pao Ho

Ordinance provides for an imposition of employer permit (P50) to alien residents before employment Supreme Court: Ordinance is unconstitutional

Violative of Due Process The fee imposed is not merely fore regulatory purposes but is actually for revenue. It results to a withdrawal of livelihoods from aliens without due process

Violative of Equal Protection Clause

2. “The P50.00 fee is unreasonable not only because it is excessive but because it fails to consider valid substantial differences in situation among individual aliens who are required to pay it. Although the equal protection clause of the Constitution does not forbid classification, it is imperative that the classification should be based on real and substantial differences having a reasonable relation to the subject of the particular legislation. The same amount of P50.00 is being collected from every employed alien whether he is casual or permanent, part time or full time or whether he is a lowly employee or a highly paid executive”

The power granted to the mayor was an undue delegation of powerOrdinance No. 6537 does not lay down any criterion or standard to guide the Mayor in the exercise of his discretion. It has been held that where an ordinance of a municipality fails to state any policy or to set up any standard to guide or limit the mayor's action, expresses no purpose to be attained by requiring a permit, enumerates no conditions for its grant or refusal, and entirely lacks standard, thus conferring upon the Mayor arbitrary and unrestricted power to grant or deny the issuance of building permits, such ordinance is invalid, being an undefined and unlimited delegation of power to allow or prevent an activity per se lawful.

Nature Purpose Force

Requirement

Ordinance No. 6537 is void because it does not contain or suggest any standard or criterion to guide the mayor in the exercise of the power which has been granted to him by the ordinance Mayor cannot impose tax: violation of legislative nature of taxation

The fee is for revenue purpose Power of taxation is inherently legislative Mayor is granted unrestricted authority

City of Baguio vs. de Leon

There is no double taxation since there are two different taxing authorities 1. National government 2. City of Baguio Indirect double taxation is not prohibited by the Constitution. What is prohibited is an obnoxious taxing measure such as direct double taxation.

Instances of due process violation: 1. Beyond jurisdiction of the state 2. Not for a public purpose 3. Retroactive statute that is so harsh and unreasonable 4. When it becomes oppressive and arbitrary.

CIR v. CA and Fortune

Procedural due process 2 types of administrative issuances: 1. Legislative Rule

Legislative Rule Subordinate legislation Provide details of the law Force and effect of a law, given weight by the court and must be binding upon the courts Publication, notice and hearing

Interpretative Rule Guidelines Interprets the law Force and effect of a law but is merely given weight by the courts Issuance

Memorandum Circular: administrative issuance Reclassified cigarette brands to locally manufactured bearing foreign brands Higher tax rates are imposed The issuance adds burden to taxpayer Legislative Rule As a legislative rule, it should have undergone publication, notice and hearing. Not having complied with the requirements, the rule should be unconstitutional When the issuance is merely interpretative, its applicability needs nothing further than its mere issuance Administrative issuance cannot go beyond the limits of the law. If it goes beyond the law, it will be an illegal administrative issuance

Reminder on how to answer questions If the argument is based on “procedural due process answer that the law is unconstitutional If the argument is based on the issuance going beyond the limits of the law answer that the issuance is illegal

CIR v. MJ Lhuiller

Sison v Ancheta

Interpretative Rule

Due Process violation 5% tax is imposed on pawn shops where the law imposed such tax ONLY to lending investors The issuance imposed the same tax without notice and hearing

Supreme Court The issuance is unconstitutional for violation of due process The issuance is illegal for going beyond the provision of the law

Equal Protection Clause

All persons subject of legislation shall be treated alike under similar circumstances, both in privilege conferred and liabilities imposed.

ABAKADA Guro vs. Purisima

Definition of Rational Basis Test There should be a reasonable foundation in the classification of the subject matter of the tax and such classification should not be arbitrary. Grant of incentives to BIR and BOC employees

Supreme Court: There is substantial distinction with employees of other agencies BIR and BOC are revenue-generating agencies Substantial classification. Reasonable foundation Classification is not arbitrary

Now: VAT is pegged at the rate of 20%

Association of Custom Brokers vs. Manila

Ordinance imposed tax to all vehicles passing through the City of Manila but only to those registered in the City of Manila The taxes were used for construction of roads

Issue: Was there a violation of the Equal Protection Clause? Supreme Court: Yes There is no substantial distinction between those vehicles registered in Manila and those that are not. They are all passing through the City roads. There is violation of Equal Protection Clause Hence, unconstitutional

Shell vs. Vano

Tax is imposed to all installation managers There was only one installation manager in the whole municipality

Issue: Was there a violation of Equal Protection Clause for the act of singling out the petitioner? Supreme Court: No. Tax imposed is applicable to all installation managers who will occupy the same profession in the future.

Shell vs. Vano

Ormoc Sugar Central The law evidently singled out not the sugar industry but Ormoc Sugar Central itself. There is violation of Equal Protection Clause

Tan v. Del Rosario Difference of tax treatment between single proprietors and corporations/partnerships

Individual Taxpayer Subject to scheduler tax rates Depend on income brackets (tax tables) 5%-32% Schedular system of taxation Income of taxpayer should be classified into its nature (e.g. income from profession is subject to normal tax while individual earned prize is subject to a withholding tax od 10%)

Tax imposed to “Ormoc Sugar Central” (specifically mentioned in the ordinance) There is violation of Equal Protection Clause for singling out the industry

The classification is based on profession. Applicable to all industries with the same profession There is no violation of Equal Protection Clause

No violation of equitability principle It recognizes exemption of those individuals who do not reach the threshold amount If amount is less than P200,000 Exempt from VAT Now: P1,919,500 is the threshold amount Small storeowners (sari-sari stores) are exempt from VAT, since their income is only for daily sustenance Farmers selling farm and marine products: also exempt from VAT

Equality and Uniformity All taxable articles of the same class shall be taxed at the same rate The legislature, in the exercise of its taxing power, has authority to make a reasonable classification Inequalities resulting from singling out a particular class does not infringe any constitutional provision or limitation.

Ormoc Sugar Central vs. Ormoc Treasurer

Kapatiran vs. Tan Value-added Tax No violation of uniformity principle It is imposed to all goods except as to those exempt by law Rate: 0-10%

Corporations/Partnerships Subject to fixed rate Pegged at 30%

Global tax system All kinds of income are combined (e.g. corporate income and prizes will be both based on fixed rate of 30%)

Petitioner alleges violation of Equal Protection Clause Supreme Court: No violation. There is a substantial distinction between individual taxpayers and corporations/partnerships. Taxing authorities have the power to classify subjects of tax as long as classification complies with the 4 elements a. Based on substantial distinction b. Germane to the purpose of the law c. Applicable to future conditions d. Applicable to all members of the same class

Philreca vs. DILG Philreca is a cooperative registered under PD 269

A law was passed imposing real property taxes on cooperatives registered under PD 269 Local Government Units Sec 190: Blanket withdrawal of tax exemptions Sec 234: Enumerates properties exempt from tax, one of which are properties of duly registered cooperatives under RA 6938 Issue: Was there a violation of Equal Protection Clause?

An appropriation law must not favor a particular religion No funds must be appropriated in favor of a religion American Bible Society vs. City of Manila License fee is imposed prior to conduct of activity No payment of fee, no selling of bibles

Issue: Was there a prior restraint imposed by the government? Held: No. There is a substantial distinction between cooperatives registered under PD 269 and RA 6938 PD 269 Members are not required to pay reasonable contributions; Only membership fee of P5.00 which is nonrefundable Cooperatives must be controlled by NEA

RA 6938 25-25 rule compliance 25% of authorized contributions must be subscribed, 25% of subscribed contribution must be paid. Subsidiarity They can act on their own without much governmental control or supervision Still controlled by government but exercises subsidiarity

Held: Yes The religious institution will not be able to express their religious belief “The power to tax the exercise of a privilege is the power to control or suppress its enjoyment. . . . Those who can tax the exercise of this religious practice can make its exercise so costly as to deprive it of the resources necessary for its maintenance. Those who can tax the privilege of engaging in this form of missionary evangelism can close all its doors to all those who do not have a full purse. Spreading religious beliefs in this ancient and honorable manner would thus be denied the needy” Q: What if after the ABS sells the bible, it earned P2M and the government imposed VAT on that earning? A: There will be no violation of Freedom of Religion since there is no prior restraint. If the tax is an imposition before the activity, there is a violation of Freedom of Religion. If the tax is imposed after the activity, there is no prior restraint and no violation of constitutional freedom of religion.

Those registered under PD 269 are not exempted from real property taxes.

Judy Anne Santos v People Case of Regine: dismissed by prosecutor Case of Judy Anne: not dismissed

Tolentino vs. Secretary of Finance No violation of Free Exercise Clause since the licensed fees are not prior restraints. Imposition of VAT to particular sectors is not prior restraint but an administrative imposition

Issue: Was there a violation of Equal Protection Clause?

Held: NO. Prosecution of guilty and non-prosecution of non-guilty is not violative of equal protection clause.

Progressivity Petitioner: VAT is an indirect tax and regressive tax which does not consider the ability to pay of the taxpayer Supreme Court: Constitution does not prohibit regressive system of taxation.

Refer to People v. Dela Pena Statute in conformity with a valid classification is valid. There is a violation of Equal Protection Clause only if the application and enforcement of a law leads to undue discrimination Equal Protection Clause cannot be invoked as a defense if you do not have clean hands.

NON-IMPRISONMENT FOR NON-PAYMENT OF POLL TAXES

Other kinds of taxes: 1. 2.

FREEDOM OF RELIGION 1.

Free-exercise Clause A freedom to act on a religious belief without restraint by government The restraint must be a prior restraint

2.

Non-establishment Clause

Poll tax/Persons Tax Subject: person E.g. Community tax, cedula

Property Tax Excise Tax Transaction, right, interest or privilege Income tax: right to earn income Donor tax: privilege of donating gratuitously.

Q: If a person does not pay poll tax, will he be liable for an offense? A: Yes, through the Revised Penal Code and not by non-payment of taxes.

NON-IMPAIRMENT CLAUSE o

No law shall be passed abridging contracts

o o

Also applies to taxation Applicable only in the exercise of government of its proprietary function. If in the exercise of government’s sovereignty function, non-impairment clause should not be invoked.

Casanova vs. Hord Non-impairment clause has been applicable since 1902 Government entered into a contact with the taxpayer The non-impairment clause applies because the contract was entered into by the exercise of the State’s proprietary function.

A: Yes. The contract was through the exercise of proprietary function of the state, and thus the non-impairment clause can be invoked. What is involved is a government loan agreement Government: debtor Taxpayer: creditor

Cagayan Power vs. CIR Congress granted tax exemption in favor of Cagayan Power Cagayan power will only pay 3% franchise tax. Congress enacted Internal Revenue Code All corporate taxpayers shall pay income tax Cagayan Power: invokes non-impairment clause. It asked for amendment of its charter so that it will only pay 3% franchise tax only.

Supreme Court No impairment of contract o The state exercised its governmental function o What is granted is a legislative franchise. o Constitution provides that the State may grant public franchise subject to amendment, revocation and alteration by the Congress. o Congress may enact a law revoking the previously granted franchise. Hence, the tax exemption may also be revoked. Cagayan Power must pay taxes from the effectivity of the Internal Revenue Code up to the amendment of its charter.

MERALCO vs. Province of Laguna Contractual tax exemptions: tax exemption granted in a contract between government and taxpayer, such is present in cases of government bonds and debenture Government bonds: offered by banks Risk-averse High interest Fixed rates There could be tax exemption Invoking non-impairment clause is applicable if what is granted is Contractual Tax Exemption RA 100678: T-bills Grant of tax exemption depends on type of bill obtained for a period based on the stipulation of the grant Interest income shall be exempt from tax Legally, income is subject to 20% final withholding tax. But with the enactment of this law, interest income is exempt from tax. The law states that the exemption is good for 5 years. After lapse of 2 years, Congress revoked the exemption

RCPI vs. Provincial Assessor Legislative franchise RCPI shall be exempt from real property tax Charter was granted prior to enactment of LGC Section 191 of LGC provides for the blanket withdrawal of tax exemptions previously granted to entities, except as to those enumerated under Sec 234

ISSUE: Was there a violation of Non-impairment Clause? HELD: No. Grant of legislative franchise is revocable. It is an exercise of governmental function so non-impairment clause cannot be invoked. Bayantel: same as Cagayan Power Smart Communications: legislative franchise repealed by Congress

Problem Government enacted RA 11111 which provides that all enterprises which will invest P10m and employ atleast 100 employees shall avail of income tax holiday for a period of 5 years. X Corporation invested P10m and employed 100 employees. After 2 years, Congress enacted a law revoking exemption. Q: Can the non-impairment clause be invoked? A: No. No contract was executed between government and taxpayer. For non-impairment clause to be invoked, there must be a contract. Tax exemption granted by RA 11111 is only a privilege that is given to those who comply under the law. If there is a contractual taxpayer exemption, non-impairment clause shall be invoked.

TRADITIONALLY EXEMPTED TAXPAYERS Article VI, Section 28 (3) Charitable institutions, churches and parsonages or convents appurtenant thereto, mosques, non-profit cemeteries, and all lands, buildings and improvements, actually, directly, and exclusively used for religious, charitable, or educational purposes shall be exempt from taxation. 1.

Subject Matter of the Tax: Lands, buildings, improvement Property tax only Not excise tax; Not poll tax

2.

Usage of Property: Actually, directly, exclusively Not the ownership of property but the usage

3.

Purpose: Religious, charitable or educational

Q: Was there a violation of the non-impairment clause?

If three elements are present, the institution is exempt from property tax.

3.

Illustrations

Building

1. P-Mall

Church

Lot

P-mall owned by diocese

Mall’s rental income: P1m/year Entire amount goes to church

Q: Is the Mall exempt from property tax? A: No. It is used for a commercial purpose. It does not matter if it is owned by diocese. It is the usage of property that determines its exemption from property tax. Q: What if the church was also being subjected to income tax? A: It is subject to income tax (excise tax: right to earn income) What constitution covers is exemption from property tax.

Lot

Q: Is the building exempt from real property tax? A: As to its first use, it is exempt since it was for charitable purpose. When it was leased to Systems College, it is no longer exempt from property tax. By virtue of the lease agreement, the institution earned rental income. It was used for a commercial purpose. The direct benefit of the owner is its proprietary use. Systems College Plus It is not the ownership or the indirect use that matters. Look on the direct usage of property.

Q: What if instead of a lease agreement, the building was donated to the SCP? A: It will be exempt from property tax.

2.

Classroom

Classroom & Gym

Canteen

Boutiques

If owned by B Family Corp, will it be exempted from Property Tax? A: Yes. Ownership is immaterial. It is used for actually, directly and exclusively for educational purpose.

Q: Is this subject to property tax? A: Yes. It is not exclusively used for an educational purpose. Q: What about the part of the building that is used as a classroom?

Lung Center of the Philippines vs. QC “Actually, directly and exclusively used” means “solely used”. The building must be entirely used for religious, education or charitable purpose.

The building is owned by a charitable institution. At first it was used for orphans. Afterwards, it was leased to Systems College Plus (a proprietary educational institution)

Lladoc v. CIR One corporation gave P100,000 to a diocese to build a church. The money was used to build a church. The diocese was compelled to pay donee’s tax. The diocese avails of constitutional exemption from taxes.

Issue: Was the contract of donation subject to donee’s tax? Held: Yes. The subject matter of donee’s tax is the privilege of receiving donations. It is in the form of an excise tax. Constitutional exemption applies only to property tax and not to donee’s tax. ABRA VALLEY vs. AQUINO Director’s residence

Student Residence

Exempted from property tax Incidental use Under the 1935 constitution, the term “used exclusively” includes the incidental use.

Exemption extends to facilities which are incidental to and reasonably necessary for the accomplishment of the main purposes. *Note, however, that this has been abandoned in the 1987 Constitution. Note also the case of Lung Center of the Philippines.

BISHOP OF NUEVA SEGOVIA Old Cemetery

Incidental

Remainder & Convent

Exempt

Church Yard & Convent

Incidental

Exempt

Vegetable Garden

*This case was also filed during the effectivity of 1935 Constitution.

xxx As a general principle, a charitable institution does not lose its character as such and its exemption from taxes simply because it derives income from paying patients, whether out-patient, or confined in the hospital, or receives subsidies from the government, so long as the money received is devoted or used altogether to the charitable object which it is intended to achieve; and no money inures to the private benefit of the persons managing or operating the institution.

2nd Question: Is it actually, directly and exclusively used for a charitable purpose? No The portion leased to doctors for private clinics is not exempt from property tax. Other portions: exempt

Vacant/ Idle lot

LUNG CENTER OF THE PHILIPPINES Non-stock, non-profit hospital Hospital Portion lease for private clinics

Elliptical Orchid and Garden Center (accepts entrance fee)

Supreme Court directed the City Assessor to determine which portion is leased to private individuals and are not exempt from property tax. Those that are not used for proprietary purpose are constitutionally exempted.

CIR vs. ST. LUKES Non-stock, non-profit corporation

Issue: Is the income subject to tax exemption under the Constitution? Held: No. The constitutional exemption pertains only to property tax.

Lung Center accepts paying patients.

1st Question: Is it a charitable institution? Yes Acceptance of paying patients will not reduce the character of Lung Center as charitable institution. To determine whether an enterprise is a charitable institution/entity or not, the elements which should be considered include the statute creating the enterprise, its corporate purposes, its constitution and by-laws, the methods of administration, the nature of the actual work performed, the character of the services rendered, the indefiniteness of the beneficiaries, and the use and occupation of the properties. In the legal sense, a charity may be fully defined as a gift, to be applied consistently with existing laws, for the benefit of an indefinite number of persons, either by bringing their minds and hearts under the influence of education or religion, by assisting them to establish themselves in life or otherwise lessening the burden of government. It may be applied to almost anything that tend to promote the well-doing and well-being of social man. It embraces the improvement and promotion of the happiness of man. The word charitable is not restricted to relief of the poor or sick. The test of a charity and a charitable organization are in law the same. The test whether an enterprise is charitable or not is whether it exists to carry out a purpose reorganized in law as charitable or whether it is maintained for gain, profit, or private advantage.

ARTICLE XIV, SEC 4(3), 1987 CONSTITUTION

All revenues and assets of non-stock, non-profit educational institutions used actually, directly and exclusively for educational purposes shall be exempt from taxes and duties. Upon the dissolution or cessation of the corporate existence of such institution, their assets shall be disposed of in the manner provided by the law. Proprietary educational institutions, including those cooperatively owned, may likewise be entitled to such exemptions subject to the limitations provided by law including restrictions on dividends and provisions for reinvestment. Subject Matter: Revenues and Assets Taxes: Excise tax (based on a right/privilege), and Property Tax Does not include poll/capitation tax. Ownership: Non-stock, non-profit educational institutions Usage: Educational Purpose

Exempt from property tax (Section 28(3), Article VI) It is owned by B Family Corporation. It collects tuition fees from students and uses the same for computer and laboratory equipments. Q: Is the revenue used for educational purposes?

A: YES!

“Taxation is the rule, and exemption is the exception”

Q: But is it owned by a non-stock, non-profit educational institution? A: NO. It is a Family Corporation.

Illustrations: 1. SLU is a non-stock, non-profit educational institution. It sold concert tickets to purchase computer and laboratory equipments. Note that the revenues were from the act of selling the tickets, not from the tuition fees. Q: Is the revenue exempt from income tax? A: Yes.

2.

Subject Matter: Revenue Ownership: Non-stock, non-profit educational institution Usage: Educational Purpose

A non-stock, non-profit corporation had a revenue of P10m. Revenue was used for charitable purposes.

Q: Is the revenue exempt from income tax? A: No.

Subject Matter: Revenue Ownership: Non-stock, non-profit educational institution Usage: CHARITABLE PURPOSE (Not educational purpose)

The Articles of Incorporation commonly specifies the character of the corporation as being non-stock, non-profit. However, the purpose of the corporation must be aligned with its designation as a non-stock, non profit corporation.

FORMS OF ESCAPE OF TAX LIABILITY A.

Resulting to Loss from the Government

1.

Tax Avoidance Tax minimization Tax-saving device within the means sanctioned by law.

2.

Tax Evasion Tax dodging Scheme used outside of those lawful means and when availed of, it usually subjects the taxpayer to further civil or criminal liability

3.

Tax Exemption

B.

No Result to Loss from the Government

1.

Shifting Act of transferring the burden of taxation to the consumer/purchaser Recall: difference between incidence of taxation (burden) vs. impact of taxation (liability) Tax Liability: direct mandate of the law Burden of Tax: who will shell out the funds

2.

Capitalization Reduction of price of the taxed object to reduce the amount of the tax

3.

Transformation The manufacturer or producer upon who the tax is imposed increases his process of production, with the additional income being used to shoulder the tax absorbed.

Illustration: P100,000 is the gross income. The taxpayer is imposed with P12,000 worth of tax. The taxpayer would increase the production so that the additional income would compensate the tax absorbed.

To invoke Sec 4(3), Article XIV of the Constitution, the purpose must be EDUCATIONAL.

Q: When is a corporation non-stock and non-profit? A: Non-profit: No portion of the income is distributed to its members Non-stock: The structure of the corporation is not divided into shares (?)

Grant of immunity from taxes ad when granted, it should be construed strictly against the taxpayer, following the principle:

Republic v. Heirs of Cesar Jalandoni

Jalandoni died and left his estate. This was subjected to an estate tax The CIR discovered that there were several items omitted in the inventory when it assessed the estate: 1. Several parcels of lands were not included 2. Value of sugar and rice land was declared in a lesser amount 3. There was discrepancy in value of stocks declared in estate tax return

Heirs alleged the following: 1. The omission of the three lots was because of an honest mistake 2. The undervaluation occurred because when the heirs valued the sugar and rice lands, they have based it on just judgment 3. As to the discrepancy in the value of stocks, the heirs allegedly did not know the value of the stocks at the time they filed the return. The corporation issued statement regarding the stocks 6 months after the death of Jalandoni.

Was there tax evasion by the heirs? Supreme Court: There was no tax evasion Tax evasion requires bad faith. The heirs were not in bad faith since they do not have any idea on the value of the shares of stock, since this value fluctuates every now and then. As to the undervaluation of the sugar and rice lands, the heirs are not in bad faith since they are not appraisers of real property. They are allowed to commit mistakes. Since there was no tax evasion, the heirs have no criminal liability

Prescriptive Period Government has 3 years to assess tax. After this, the government can no longer make the assessment. If there is a clear and convincing proof of fraud, prescriptive period is 10 years.

In this case, there was no evidence of fraud. Hence, the prescriptive period is 3 years. However, the assessment of the government was done beyond the 3year period. The government cannot assess the estate anymore.

Everytime a customer will order from Jackbilt, the customer invoice is issued by Norton. 100% of the shares of stock of Jackbilt goes to Norton. The operation of Jackbilt is also managed by Norton. The compensation of the employees of Jackbilt is dictated by Norton. The invoices received by the customers indicate that Norton and Jackbilt are intertwined.

CIR vs. Yutivo and Sons (1961)

GM—Yutivo—SMI

GM is a distributor. Yutivo is a wholesaler. SMI is a subsidiary of Yutivo. Yutivo imports products for amount of P6M. GM, as the distributor, is imposed with sales tax. GM then withdrew its appointment as a distributor. Yutivo was authorized as an importer of products and distributor to SMI and customers. Yutivo now pays the sales tax. CIR alleges that Yutivo is guilty of tax evasion. Sales tax must be imposed to Yutivo, not to SMI.

Was there an unlawful scheme?

Is there tax evasion?

YES

First, the sales invoice is indicative of bad faith. If Jackbilt is the customer of Norton, then Norton should have issued the sales invoice to Jackbilt, and the latter would issue the same to the customer. In this case, the sales invoice is issued to the customer directly. Second, Jackbilt is operated by Norton. This indicates that they are one entity. Hence, the separate and juridical personality of the two corporations is disregarded.

None. There was no bad faith in the part of Yutivo. Prior to appointment of Yutivo, GM has been paying the sales tax. This was continued by Yutivo upon withdrawal of GM as a distributor. There was no tax evasion. SMI has been existing even prior to appointment of Yutivo as a new distributor. Moreover, Yutivo even continued the payment of sales tax.

Another case in relation to Yutivo Law imposed sales tax to manufacturers of cigarette packs IF there will be 20 cigarettes per pack. A manufacturer produced 10 cigarette sticks per pack. These packs are thus not subject to tax. The manufacturer created a subsidiary to which the other 10 sticks would be transferred. This subsidiary is not imposed with the sales tax since it is not a manufacturer.

Note also that under the present law, there is no more sales tax. All are under the category of a business tax. Philippine Acetylene v. CIR

The subsidiary was clearly made to avoid the tax. Unlike in the case of Yutivo wherein SM as the subsidiary was already existing prior to the appointment of Yutivo as manufacturer, the case here involves a scheme created by the manufacturer after the enactment of the law imposing sales taxes on manufacturers of cigarettes which produce 20 cigarettes per pack. It was done to circumvent the imposition of sales tax.

CIR v. Norton Norton and Jackbilt had an agreement. Norton becomes the exclusive distributor of Jackbilt while the latter will sell Norton’s products to its customers.

Elements of tax evasion: 1. Fraud 2. Loss on the part of the government (either by reduction of tax or no payment of tax at all).

Note: Under the present law, corporate taxpayers are subject to 30% tax based on net income. If this present law is applied, there will be no different if the corporations are treated separately or as one entity. Hence, there will be no tax evasion by Norton since there is no reduction of tax in the part of the government.

Is there bad faith in the part of the manufacturer? YES

Norton and Jackbilt are both corporate taxpaters. If their income is taken separately, it would be subjected to lower tax. If the income of Norton and Jackbilt is combined as to treat the two as one entity, higher tax will be imposed.

Philippine Acetylene sold goods to NPC and VOA By virtue of the international agreement between the Philippine Government and the United States, NPC’s charter provides that it is exempt from direct and indirect tax. VOA’s charter also provides the same but with respect to several items only. Philippine Acetylene says that it should not be liable for sales tax in the transaction with NPC and VOA because these entities are exempt from taxes. Thus, Philippine Acetylene cannot shift the burden of taxation to them.

Should Philippine Acetylene be exempt from sales tax? NO.

What has been shifted to NPC and VOA is the burden of tax which is merely a matter of economics. The tax liability still remains to Philippine Acetylene as the taxpayer. What NPC and VOA paid is not the tax itself but the part of the purchase price. Its exemption to sales tax would not redound to the benefit of PA. CIR vs. JOHN GOTAMCO & SONS

Under an international agreement, the WHO is exempt from direct and indirect tax Gotamco transacts with the WHO. It alleges that it should not be liable for contractor’s tax, a form of indirect tax. Since its consumer is exempt from tax, Gotamco cannot shift the burden, hence it must also be exempt from tax.

Should Gotamco also be exempt from contractor’s tax? YES. Gotamco must be exempt from contractor’s tax. WHO is exempted from tax because there is a provision in the international agreement that exempts it from such. In addition to this, the international agreement also provides that “any person or entity that contracted with WHO on the construction of WHO building shall likewise be exempt from tax”.

Philippine Acetylene The charter and the agreement between the Philippines and USA do not contain provisions that any individual or entity transacting with NPC and VOA is likewise exempted

Gotamco The international agreement contains provisions that individuals and corporations transacting with WHO in the construction of WHO building shall likewise be exempt from tax.

ORIGIN OF REVENUE, APPROPRIATION AND TARIFF BILLS FLEXIBLE TARIFF CLAUSE ABAKADA Guro Partylist vs. Ermita 1.

Was there a violation of the constitutional provision on the origin of tariff bills?

NONE. The bill was initiated by the House of Representatives. “It is not the law – but the revenue bill – which is required by the Constitution to "originate exclusively" in the House of Representatives. It is important to emphasize this, because a bill originating in the House may undergo such extensive changes in the Senate that the result may be a rewriting of the whole. . . . At this point, what is important to note is that, as a result of the Senate action, a distinct bill may be produced. To insist that a revenue statute – and not only the bill which initiated the legislative process culminating in the enactment of the law – must substantially be the same as the House bill would be to deny the Senate’s power not only to " concur with amendments" but also to "propose amendments." Given, then, the power of the Senate to propose amendments, the Senate can propose its own version even with respect to bills which are required by the Constitution to originate in the House. ... Indeed, what the Constitution simply means is that the initiative for filing revenue, tariff or tax bills, bills authorizing an increase of the public debt, private bills and bills of local application must come from the House of Representatives on the theory that, elected as they are from the districts, the members of the House can be expected to be more sensitive to the local needs and problems. On the other hand, the senators, who are elected at large, are expected to approach the same problems from the national perspective. Both views are thereby made to bear on the enactment of such laws.33 Since there is no question that the revenue bill exclusively originated in the House of Representatives, the Senate was acting within its constitutional power to introduce amendments to the House bill when it included provisions in Senate Bill No. 1950 amending corporate income taxes, percentage, excise and franchise taxes. Verily, Article VI, Section 24 of the Constitution does not contain any prohibition or limitation on the extent of the amendments that may be introduced by the Senate to the House revenue bill. 2.

exercised under and in pursuance of the law. The first cannot be done; to the latter no valid objection can be made. The case before the Court is not a delegation of legislative power. It is simply a delegation of ascertainment of facts upon which enforcement and administration of the increase rate under the law is contingent. The legislature has made the operation of the 12% rate effective January 1, 2006, contingent upon a specified fact or condition. It leaves the entire operation or non-operation of the 12% rate upon factual matters outside of the control of the executive. No discretion would be exercised by the President. Highlighting the absence of discretion is the fact that the wordshall is used in the common proviso. The use of the word shall connotes a mandatory order. Xxx Thus, it is the ministerial duty of the President to immediately impose the 12% rate upon the existence of any of the conditions specified by Congress TAXATION BY LOCAL GOVERNMENT UNITS Nature: directly conferred by the Constitution Subject to the limitations provided by the Congress. These limitations were laid down through the enactment of the Local Government Code. VOTING REQUIREMENTS RE: GRANT OF TAX EXEMPTION Majority of all the members of the congress DOCTRINE OF JUDICIAL NON-INTERFERENCE Courts cannot inquire into the motive, policy, wisdom or expediency of legislation.

TAXPAYER’S SUIT In order for a taxpayer’s suit to prosper, there must be an illegal disbursement of a public fund. No illegal disbursement, no taxpayer’s suit

Was there an undue delegation of power to the President due to the standby authority granted to the latter?

NONE. The general rule barring delegation of legislative powers is subject to the following recognized limitations or exceptions: (1) Delegation of tariff powers to the President under Section 28 (2) of Article VI of the Constitution; (2) Delegation of emergency powers to the President under Section 23 (2) of Article VI of the Constitution; (3) Delegation to the people at large; (4) Delegation to local governments; and (5) Delegation to administrative bodies.

Exception: if the law is arbitrary

Public Interest Center vs. Roxas (January 31 2007) Fixed another condition for a taxpayer’s suit: The taxpayer must show his sufficient interest in preventing the illegal expenditure.

FORMS OF ESCAPE OF TAX LIABILITY A.

Resulting to Loss from the Government

1.

In every case of permissible delegation, there must be a showing that the delegation itself is valid. It is valid only if the law (a) is complete in itself, setting forth therein the policy to be executed, carried out, or implemented by the delegate; and (b) fixes a standard — the limits of which are sufficiently determinate and determinable — to which the delegate must conform in the performance of his functions

Tax Avoidance Tax minimization Tax-saving device within the means sanctioned by law.

2.

Tax Evasion Tax dodging Scheme used outside of those lawful means and when availed of, it usually subjects the taxpayer to further civil or criminal liability

The true distinction’, says Judge Ranney, ‘is between the delegation of power to make the law, which necessarily involves a discretion as to what it shall be, and conferring an authority or discretion as to its execution, to be

3.

Tax Exemption

Grant of immunity from taxes ad when granted, it should be construed strictly against the taxpayer, following the principle:

“Taxation is the rule, and exemption is the exception”

Prescriptive Period Government has 3 years to assess tax. After this, the government can no longer make the assessment. If there is a clear and convincing proof of fraud, prescriptive period is 10 years. In this case, there was no evidence of fraud. Hence, the prescriptive period is 3 years. However, the assessment of the government was done beyond the 3year period. The government cannot assess the estate anymore.

B.

No Result to Loss from the Government

1.

Shifting Act of transferring the burden of taxation to the consumer/purchaser Recall: difference between incidence of taxation (burden) vs. impact of taxation (liability) Tax Liability: direct mandate of the law Burden of Tax: who will shell out the funds

GM—Yutivo—SMI GM is a distributor. Yutivo is a wholesaler. SMI is a subsidiary of Yutivo. Yutivo imports products for amount of P6M. GM, as the distributor, is imposed with sales tax. GM then withdrew its appointment as a distributor. Yutivo was authorized as an importer of products and distributor to SMI and customers. Yutivo now pays the sales tax. CIR alleges that Yutivo is guilty of tax evasion. Sales tax must be imposed to Yutivo, not to SMI.

Capitalization Reduction of price of the taxed object to reduce the amount of the tax

3.

Transformation The manufacturer or producer upon whom the tax is imposed increases his process of production, the additional income being used to shoulder the tax absorbed.

Was there an unlawful scheme?

P100,000 is the gross income. The taxpayer is imposed with P12,000 worth of tax. The taxpayer would increase the production so that the additional income would compensate the tax absorbed. Republic v. Heirs of Cesar Jalandoni

2.

Illustration:

CIR vs. Yutivo and Sons (1961)

Jalandoni died and left his estate. This was subjected to an estate tax The CIR discovered that there were several items omitted in the inventory when it assessed the estate: 4. Several parcels of lands were not included 5. Value of sugar and rice land was declared in a lesser amount 6. There was discrepancy in value of stocks declared in estate tax return Heirs alleged the following: 4. The omission of the three lots was because of an honest mistake 5. The undervaluation occurred because when the heirs valued the sugar and rice lands, they have based it on just judgment 6. As to the discrepancy in the value of stocks, the heirs allegedly did not know the value of the stocks at the time they filed the return. The corporation issued statement regarding the stocks 6 months after the death of Jalandoni.

None. There was no bad faith in the part of Yutivo. Prior to appointment of Yutivo, GM has been paying the sales tax. This was continued by Yutivo upon withdrawal of GM as a distributor. There was no tax evasion. SMI has been existing even prior to appointment of Yutivo as a new distributor. Moreover, Yutivo even continued the payment of sales tax.

Another case in relation to Yutivo Law imposed sales tax to manufacturers of cigarette packs IF there will be 20 cigarettes per pack. A manufacturer produced 10 cigarette sticks per pack. These packs are thus not subject to tax. The manufacturer created a subsidiary to which the other 10 sticks would be transferred. This subsidiary is not imposed with the sales tax since it is not a manufacturer. Is there bad faith in the part of the manufacturer? YES The subsidiary was clearly made to avoid the tax. Unlike in the case of Yutivo wherein SM as the subsidiary was already existing prior to the appointment of Yutivo as manufacturer, the case here involves a scheme created by the manufacturer after the enactment of the law imposing sales taxes on manufacturers of cigarettes which produce 20 cigarettes per pack. It was done to circumvent the imposition of sales tax. CIR v. Norton

Was there tax evasion by the heirs?