Ch 14_translation Solution

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Ch 14_translation Solution as PDF for free.

More details

- Words: 368

- Pages: 3

Loading documents preview...

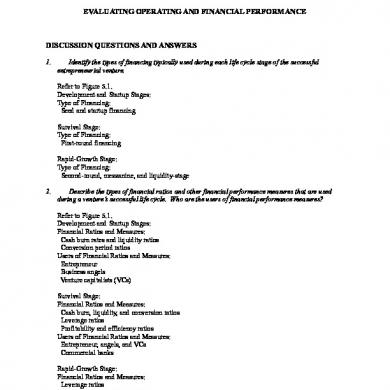

FOREIGN CURRENCY FINANCIAL STATEMENTS (TRANSLATION) P14-4

From Beams, Anthony, Bettinghaus, and Smith, Advanced Accounting, 11th ed. Sul Corporation * Translation Worksheet for 2011 Euros Exchange Rate

U.S. Dollars

Debits

Cash

€ 1,000,000

Accounts Receivable

2,000,000

Inventories

4,000,000

Equipment

8,000,000

Cost of Goods Sold

4,000,000

Depreciation Expense Operating Expenses Dividends Total

800,000 2,700,000 500,000

.60 .60 .60 .60 .55 .55 .55 .54

(C)

$ 600,000

(C)

1,200,000

(C)

2,400,000

(C)

4,800,000

(A)

2,200,000

(A)

440,000

(A)

1,485,000

(H)

270,000

€ 23,000,000

$13,395,000

Credits

Accumulated Depreciation Equip

€ 2,400,000

Accounts Payable

3,600,000

Capital Stock Retained Earnings Jan. 1, 2011

5,000,000

Sales Equity adjustment from Translation (AOCI) Total * **

2,000,000 10,000,000

.60 .60 .50 .50**

.55

(C)

$ 1,440,000

(C)

2,160,000

(H)

2,500,000

--

1,000,000

(A)

5,500,000

plug

€ 23,000,000

795.000 $13,395,000

Functional Currency for Sul Corporation is the Euro (€). Note that on the worksheet retained earnings always appears at its beginning balance. Thus, in the year of acquisition, it is translated at the historical rate. But in all subsequent years,

retained earnings will not be translated --- it will appear in the U.S. dollars column as last years ending balance from the Statement of Retained Earnings. Thus, on the Translation worksheet for year 2012, retained earnings (in dollars) will be $2,105,000. Accounting for Sul under the Equity Method CS RE BV

Euros 5,000,000 2,000,000 7,000,000

U.S. Dollars 7,000,000 x .5000 3,500,000

Investment in Sul BV Sul Net Assets Patent

Computation of Amortization of Patent Euros Rate Beg. Bal. (01/01/11) 1,000,000 (H) .50 Amortization (10%) ( 100,000 ) (A) .55 900,000 Equity Adjustment from plug Translation (AOCI) ---End. Bal. (12/31/11) 900,000 (C) .60 Income Summary – Sul 2,200,000 5,500,000 440,000 1,485,000 1,375,000 Investment in Sul 4,000,000 2,170,000 270,000 40,000 5,940,000

$ 4,000,000 3,500,000 $ 500,000

Dollars 500,000 ( 55,000 ) 445,000

95,000 540,000

Income from Sul 55,000

1,375,000 1,320,000

Equity Adj. from Trans. 795,000 95,000 890,000

JOURNAL ENTRIES ON PET’S BOOKS To record Income from Sul:

Investment in Sul Income from Sul Equity Adjustment from Translation (AOCI)

2,170,000 1,375,000 795,000

To record Patent Amortization:

Investment in Sul Income from Sul Equity Adjustment from Translation (AOCI)

40,000 55,000 95,000

To record dividends from Sul:

Cash

270,000 Investment in Sul

270,000

From Beams, Anthony, Bettinghaus, and Smith, Advanced Accounting, 11th ed. Sul Corporation * Translation Worksheet for 2011 Euros Exchange Rate

U.S. Dollars

Debits

Cash

€ 1,000,000

Accounts Receivable

2,000,000

Inventories

4,000,000

Equipment

8,000,000

Cost of Goods Sold

4,000,000

Depreciation Expense Operating Expenses Dividends Total

800,000 2,700,000 500,000

.60 .60 .60 .60 .55 .55 .55 .54

(C)

$ 600,000

(C)

1,200,000

(C)

2,400,000

(C)

4,800,000

(A)

2,200,000

(A)

440,000

(A)

1,485,000

(H)

270,000

€ 23,000,000

$13,395,000

Credits

Accumulated Depreciation Equip

€ 2,400,000

Accounts Payable

3,600,000

Capital Stock Retained Earnings Jan. 1, 2011

5,000,000

Sales Equity adjustment from Translation (AOCI) Total * **

2,000,000 10,000,000

.60 .60 .50 .50**

.55

(C)

$ 1,440,000

(C)

2,160,000

(H)

2,500,000

--

1,000,000

(A)

5,500,000

plug

€ 23,000,000

795.000 $13,395,000

Functional Currency for Sul Corporation is the Euro (€). Note that on the worksheet retained earnings always appears at its beginning balance. Thus, in the year of acquisition, it is translated at the historical rate. But in all subsequent years,

retained earnings will not be translated --- it will appear in the U.S. dollars column as last years ending balance from the Statement of Retained Earnings. Thus, on the Translation worksheet for year 2012, retained earnings (in dollars) will be $2,105,000. Accounting for Sul under the Equity Method CS RE BV

Euros 5,000,000 2,000,000 7,000,000

U.S. Dollars 7,000,000 x .5000 3,500,000

Investment in Sul BV Sul Net Assets Patent

Computation of Amortization of Patent Euros Rate Beg. Bal. (01/01/11) 1,000,000 (H) .50 Amortization (10%) ( 100,000 ) (A) .55 900,000 Equity Adjustment from plug Translation (AOCI) ---End. Bal. (12/31/11) 900,000 (C) .60 Income Summary – Sul 2,200,000 5,500,000 440,000 1,485,000 1,375,000 Investment in Sul 4,000,000 2,170,000 270,000 40,000 5,940,000

$ 4,000,000 3,500,000 $ 500,000

Dollars 500,000 ( 55,000 ) 445,000

95,000 540,000

Income from Sul 55,000

1,375,000 1,320,000

Equity Adj. from Trans. 795,000 95,000 890,000

JOURNAL ENTRIES ON PET’S BOOKS To record Income from Sul:

Investment in Sul Income from Sul Equity Adjustment from Translation (AOCI)

2,170,000 1,375,000 795,000

To record Patent Amortization:

Investment in Sul Income from Sul Equity Adjustment from Translation (AOCI)

40,000 55,000 95,000

To record dividends from Sul:

Cash

270,000 Investment in Sul

270,000

Related Documents

Ch 14_translation Solution

February 2021 0

Ch 5

January 2021 4

Ch 4

February 2021 3

Ch. 1 Ch. 2 Aswath Damodaran

January 2021 1

Ch 5

February 2021 3

Ch 6

February 2021 6More Documents from "Miftahudin Miftahudin"

Ch 14_translation Solution

February 2021 0

Kasus Money Londering

February 2021 2

Spasme Esofagus

February 2021 1