Financial-accounting.pdf

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Financial-accounting.pdf as PDF for free.

More details

- Words: 453

- Pages: 2

Loading documents preview...

FINANCIAL ACCOUNTING

Multiple Choice Questions & Answers 1. The accounts of non-trading concerns are generally maintained according to A. Mercantile accounting system B. Cash accounting system C. Double entry book keeping system D. Single entry system ANSWER: C 2. Depreciation is provided on ________. A. current asset . B. fixed assets. C. fictitious assets. D. investment. ANSWER: B 3. The permanent, continuing and gradual shrinkage in the book value of a fixed asset is called _______. A. depreciation . B. appreciation. C. reduction. D. computation. ANSWER: A 4. Mines, quarries, oilfields and forest are example of _______. A. fixed assets. B. current assets. C. wasting assets. D. intangible assets. ANSWER: C 5. Depreciation applies to________. A. current assets. B. wasting assets. C. intangible assets. D. fixed assets. ANSWER: D 6. The main source of income for non-trading concern is A. Subscription B. Sales C. Dividend on investment D. entrance fee ANSWER: A 7. The control of non-trading concern rest in the hand of A. Directors B. Managing agents C. Governing body D. Promoters ANSWER: C 8. The asset account appears in the books at original cost when a ______. A. P & L account is maintained. B. balance sheet is maintained. C. provision for depreciation account is maintained. D. provision for depreciation account is not maintained. ANSWER: C

FINANCIAL ACCOUNTING

Multiple Choice Questions & Answers 9. The value of asset can be reduced to zero under this method _____. A. straight line method . B. written down value method. C. annuity method. D. depreciation fund method. ANSWER: A 10. The balance in the asset account will not be reduced to zero under this method _____. A. straight line method . B. written down value method. C. annuity method. D. depreciation fund method. ANSWER: B 11. Income tax authorities recognize this method ______. A. straight line method . B. written down value method. C. annuity method. D. depreciation fund method. ANSWER: B 12. Deficit balance can be shown in balance sheet as A. Liability B. Assets C. Owner's equity D. None of above ANSWER: B 13. If debit side of income and expenditure account is greater it is termed as A. Excess of income over expenditure B. Net income C. Surplus balance D. Deficit balance ANSWER: D 14. Under annuity method the amount of depreciation is found out from _____. A. log tables. B. sinking fund tables. C. annuity tables. D. present value tables. ANSWER: C 15. Depreciation fund is also called ______. A. reserve fund. B. compensation fund. C. workers fund. D. sinking fund. ANSWER: D 16. An advance receipt of subscription from a member of the non-profit organization is considered as an A. Expense B. Liability C. Equity D. Asset ANSWER: B

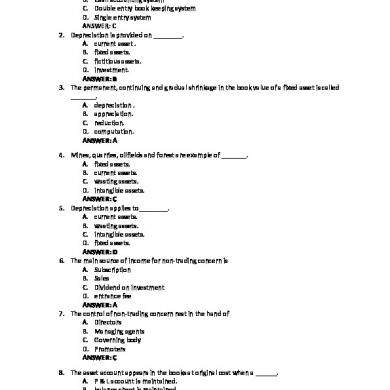

Multiple Choice Questions & Answers 1. The accounts of non-trading concerns are generally maintained according to A. Mercantile accounting system B. Cash accounting system C. Double entry book keeping system D. Single entry system ANSWER: C 2. Depreciation is provided on ________. A. current asset . B. fixed assets. C. fictitious assets. D. investment. ANSWER: B 3. The permanent, continuing and gradual shrinkage in the book value of a fixed asset is called _______. A. depreciation . B. appreciation. C. reduction. D. computation. ANSWER: A 4. Mines, quarries, oilfields and forest are example of _______. A. fixed assets. B. current assets. C. wasting assets. D. intangible assets. ANSWER: C 5. Depreciation applies to________. A. current assets. B. wasting assets. C. intangible assets. D. fixed assets. ANSWER: D 6. The main source of income for non-trading concern is A. Subscription B. Sales C. Dividend on investment D. entrance fee ANSWER: A 7. The control of non-trading concern rest in the hand of A. Directors B. Managing agents C. Governing body D. Promoters ANSWER: C 8. The asset account appears in the books at original cost when a ______. A. P & L account is maintained. B. balance sheet is maintained. C. provision for depreciation account is maintained. D. provision for depreciation account is not maintained. ANSWER: C

FINANCIAL ACCOUNTING

Multiple Choice Questions & Answers 9. The value of asset can be reduced to zero under this method _____. A. straight line method . B. written down value method. C. annuity method. D. depreciation fund method. ANSWER: A 10. The balance in the asset account will not be reduced to zero under this method _____. A. straight line method . B. written down value method. C. annuity method. D. depreciation fund method. ANSWER: B 11. Income tax authorities recognize this method ______. A. straight line method . B. written down value method. C. annuity method. D. depreciation fund method. ANSWER: B 12. Deficit balance can be shown in balance sheet as A. Liability B. Assets C. Owner's equity D. None of above ANSWER: B 13. If debit side of income and expenditure account is greater it is termed as A. Excess of income over expenditure B. Net income C. Surplus balance D. Deficit balance ANSWER: D 14. Under annuity method the amount of depreciation is found out from _____. A. log tables. B. sinking fund tables. C. annuity tables. D. present value tables. ANSWER: C 15. Depreciation fund is also called ______. A. reserve fund. B. compensation fund. C. workers fund. D. sinking fund. ANSWER: D 16. An advance receipt of subscription from a member of the non-profit organization is considered as an A. Expense B. Liability C. Equity D. Asset ANSWER: B

More Documents from "khalid iqbal"

Financial-accounting.pdf

March 2021 0

_exxon_-_exxon_pdc_vol_i

January 2021 1

Pengertian Cerpen

March 2021 0

Bab 9 Aplikasi Fungsi Tan Linear Dalam Ekonomi1

January 2021 2

Evaluation D Entreprise

January 2021 13