Foreign Currency Hedging

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Foreign Currency Hedging as PDF for free.

More details

- Words: 1,688

- Pages: 4

Loading documents preview...

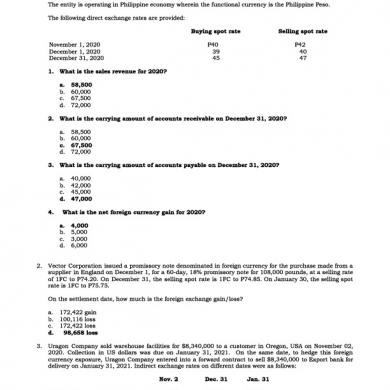

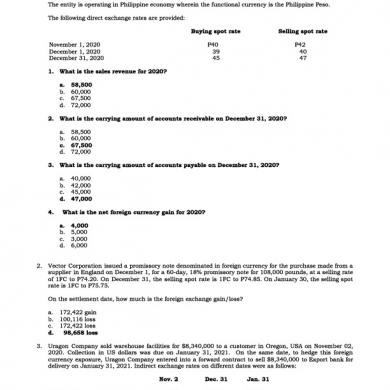

Foreign Currency Hedging Part II: Problem Solving 1. On November 1, 2020, an entity acquired on account goods from a foreign supplier at a cost of $1,000. The accounts payable are paid on January 30, 2021. On December 1, 2020, an entity sold on account the said goods to a foreign customer at a selling price of $1,500. The accounts receivable are collected on February 28, 2021. The entity is operating in Philippine economy wherein the functional currency is the Philippine Peso. The following direct exchange rates are provided: Buying spot rate Selling spot rate November 1, 2020 P40 P42 December 1, 2020 39 40 December 31, 2020 45 47 1. What is the sales revenue for 2020? a. 58,500 b. 60,000 c. 67,500 d. 72,000 2. What is the carrying amount of accounts receivable on December 31, 2020? a. 58,500 b. 60,000 c. 67,500 d. 72,000 3. What is the carrying amount of accounts payable on December 31, 2020? a. 40,000 b. 42,000 c. 45,000 d. 47,000 4. What is the net foreign currency gain for 2020? a. 4,000 b. 5,000 c. 3,000 d. 6,000 2. Vector Corporation issued a promissory note denominated in foreign currency for the purchase made from a supplier in England on December 1, for a 60-day, 18% promissory note for 108,000 pounds, at a selling rate of 1FC to P74.20. On December 31, the selling spot rate is 1FC to P74.85. On January 30, the selling spot rate is 1FC to P75.75. On the settlement date, how much is the foreign exchange gain/loss? a. 172,422 gain b. 100,116 loss c. 172,422 loss d. 98,658 loss 3. Uragon Company sold warehouse facilities for $8,340,000 to a customer in Oregon, USA on November 02, 2020. Collection in US dollars was due on January 31, 2021. On the same date, to hedge this foreign currency exposure, Uragon Company entered into a forward contract to sell $8,340,000 to Export bank for delivery on January 31, 2021. Indirect exchange rates on different dates were as follows: Nov. 2 Dec. 31 Jan. 31 Spot rate .02387 .02457 .02494 30-day futures .02364 .02475 .02278 60-day futures .02392 .02481 .02437 90-day futures .02463 .02403 .02304 1. How much is the effect on earnings due to hedged item in the December 31, 2020 profit and loss statement? a. (10,008,000) b. ( 5,838) c. 10,008,000 d. 5,838

2. How much is the effect on earnings due to hedging instrument in the 2021 profit and loss statement? a. 2,502,000 b. 1,585 c. (2,502,000) d. ( 1,585)

4. Barako Company acquired a heavy equipment for $14,100 from a supplier in Detroit, USA on December 1, 2020. Payment in US dollars was due on March 31, 2021. On the same date, to hedge this foreign currency exposure, Barako entered into a forward contract to purchase $14,100 from Citibank for delivery on March 31, 2021. Direct exchange rates for dollars on different dates were as follows: Spot Rates Bid Offer December 1, 2020 41.6 41.4 December 31, 2020 42.5 42.3 March 31, 2021 43.4 43.7 Forward Rates Dec. 1 Dec. 31 March 31 30-day futures 42.3 41.8 43.2 60-day futures 41.8 42.2 42.6 90-day futures 40.6 42.5 43.4 120-day futures 42.2 42.8 42.9 1. What is the reported value of the liability to the vendor at December 31, 2020? a. 596,430 b. 599,250 c. 596,400 d. 599,200 2. What is the net impact in Barako Company’s income in 2020 as a result of this hedging activity? a. 8,460 net gain b. 8,460 net loss c. 8,500 net gain d. 8,500 net loss 5. On November 2, 2020, P Corp entered into a firm commitment with Japanese firm to acquire equipment, delivery and passage of title on March 31, 2021, at a price of 4,375 yen. On the same date, to hedge against unfavorable changes in the exchange rate of the yen, P Corp. entered into a 150 day forward contract with BPI for 4,375 yen. The relevant exchange rates were as follows: 11/2/2020 12/31/2020 3/31/2021 Spot Rate P37 P38 P35 Forward Rate P40 P33 P35 1. What is the foreign currency gain/(loss) due to the change in the fair value of the underlying purchase commitment on December 31, 2020? a. 30,625 gain b. 30,625 loss c. 4,375 gain d. 4,375 loss 2. What is the amount debited to the equipment account? a. 161,875 on 11/2/2020 b. 175,000 on 11/2/2020 c. 153,125 on 3/31/2021 d. 175,000 on 3/31/2021 6. On November 1, 2020, 7D Co. entered into a firm commitment with Toki-Toki Japanese Company for the export of dried mangoes with a contract price of 10,000 Yen. The goods will be delivered by 7D Co. on January 30, 2021. On the same day, in order to protect itself from the risk of changes in fair value of the firm commitment due to changes in underlying foreign currency, 7D Co. entered into a forward contract with BDO for the sale of 10,000 Yen at the forward rate on November 1, 2020. IAS 39 provides that hedge of the foreign currency risk of a firm commitment may be accounted for as either fair value hedge or cash flow hedge. 7D Co. elected to account for the hedge of the firm commitment using fair value hedge. The following direct exchange rates are provided: November 1, 2020 December 31, 2020 January 30, 2021 Buying spot rate P10 P13 P12 Selling spot rate P13 P15 P16 Forward buying 90-daysP11 P14 P15 Forward selling 90-days P13 P16 P17

1.

2.

Forward buying 60-daysP14 P17 P16 Forward selling 60-days P15 P18 P14 Forward buying 30-daysP11 P15 P12 Forward selling 30-days P13 P11 P14 What is the foreign currency gain/(loss) due to hedged item for the year ended December 31, 2020? a. 40,000 gain b. 20,000 loss c. 30,000 gain d. 10,000 loss What is the foreign currency gain/(loss) due to hedging instrument for the year ended December 31, 2021? a. 50,000 loss b. 30,000 gain c. 20,000 gain d. 20,000 loss

EXERCISES 1. PAS 39 enumerated the following three types of hedging relationships, except a. Fair value hedge: a hedge of the exposure to changes in fair value of a recognized asset (AFS Securities) or liability or an unrecognized firm commitment, or an identified portion of such an asset, liability or firm commitment, that is attributable to a particular risk and could affect profit or loss. b. Cash flow hedge: a hedge of the exposure to variability in cash flows that (1) is attributable to a particular risk associated with a recognized asset or liability (such as all or some future interest payments on variable rate debt) or (2) a highly probable forecast transaction and (2) could affect profit or loss. c. Hedge of a net investment in foreign operation which is the hedge of the amount of the reporting entity’s interest in the net assets of the operation. d. Undesignated hedge such as hedge of foreign currency denominated payable or receivable. 2. In case of hedging transaction designated as fair value hedge, which of the following statements is correct? a. The gain or loss from remeasuring the hedging instrument/derivative designated as fair value hedge shall be recognized in profit or loss. b. The gain or loss on the changes in fair value of hedged item/(AFS Securities) attributable to the hedged risk shall adjust the carrying amount of the hedged item and be recognized in profit or loss. c. Both A and B. d. Neither A nor B. 3. In case of hedging transaction designated as cash flow hedge, which of the following statements is correct? a. The portion of the gain or loss on the hedging instrument/derivative designated as cash flow hedge that is determined to be an effective hedge or the change in intrinsic value of the derivative designated as cash flow hedge shall be recognized in other comprehensive income. b. The ineffective portion of the gain or loss on the hedging instrument/derivative designated as cash flow hedge or the change in time value of the derivative designated as cash flow hedge shall be recognized in profit or loss. c. The cumulative other comprehensive income recognized in equity arising from cumulative changes in intrinsic value of derivatives designated as cash flow hedge shall be reclassified from equity/cumulative OCI to profit or loss as a reclassification adjustment in the same period during which the hedged forecast cash flows affects profit or loss. d. All of the above. 4. Lastikman Company, a local company, bought raw materials as ingredients in its products from Superman Corporation, a US company, for 35,000 US Dollars in 2020. Pertinent exchange rates relating to this transaction are as follows: Buying Rate Selling Rate Receipt of order P47.10 P47.20 Date of shipment 47.25 47.45 Balance sheet date 49.50 49.60 Settlement date 49.45 49.50 What is the foreign exchange gain or loss of Lastikman Company for 2020? a. 78,750 loss b. 75,250 loss c. 78,750 gain d. 75,250 gain What is the value of the inventory, assuming it’s not yet sold, as of settlement date? a. 1,652,000 b. 1,660,750 c. 1,732,500 d. 1,653,750 5. Kline Company purchased inventory on November 30, 2018 for $10,000 payable March 1, 2019. On December 1, 2018, the entity entered into a forward contract to purchase $10,000 and to be delivered on February 28, 2019 to hedge the purchase of inventory on November 30, 2018. The relevant exchange rates are:

11/30/2018 12/01/2018 12/31/2018 02/28/2019 03/1/2019 Spot rate 45 46 50 51 55 Forward buying 90-days 44 43 42 41.5 45 Forward selling 90-days 47 48 42.5 44.5 46 Forward buying 60-days 50 51.5 48.5 54 50 Forward selling 60-days 52 53.5 51 55 51.5 Forward buying 30-days 55 50.5 49.5 56.5 47.5 Forward selling 30-days 54 51 52.5 53 56 What amount of foreign currency transaction gain from the forward contract should be included in net income for 2018? a. 50,000 b. 40,000 c. 30,000 d. 0 What amount of foreign currency transaction loss should be included in income from the revaluation of accounts payable for 2018? a. 40,000 b. 50,000 c. 10,000 d. 0 Answer 1. D 2. C 3. D 4. B/B 5. C/B

2. How much is the effect on earnings due to hedging instrument in the 2021 profit and loss statement? a. 2,502,000 b. 1,585 c. (2,502,000) d. ( 1,585)

4. Barako Company acquired a heavy equipment for $14,100 from a supplier in Detroit, USA on December 1, 2020. Payment in US dollars was due on March 31, 2021. On the same date, to hedge this foreign currency exposure, Barako entered into a forward contract to purchase $14,100 from Citibank for delivery on March 31, 2021. Direct exchange rates for dollars on different dates were as follows: Spot Rates Bid Offer December 1, 2020 41.6 41.4 December 31, 2020 42.5 42.3 March 31, 2021 43.4 43.7 Forward Rates Dec. 1 Dec. 31 March 31 30-day futures 42.3 41.8 43.2 60-day futures 41.8 42.2 42.6 90-day futures 40.6 42.5 43.4 120-day futures 42.2 42.8 42.9 1. What is the reported value of the liability to the vendor at December 31, 2020? a. 596,430 b. 599,250 c. 596,400 d. 599,200 2. What is the net impact in Barako Company’s income in 2020 as a result of this hedging activity? a. 8,460 net gain b. 8,460 net loss c. 8,500 net gain d. 8,500 net loss 5. On November 2, 2020, P Corp entered into a firm commitment with Japanese firm to acquire equipment, delivery and passage of title on March 31, 2021, at a price of 4,375 yen. On the same date, to hedge against unfavorable changes in the exchange rate of the yen, P Corp. entered into a 150 day forward contract with BPI for 4,375 yen. The relevant exchange rates were as follows: 11/2/2020 12/31/2020 3/31/2021 Spot Rate P37 P38 P35 Forward Rate P40 P33 P35 1. What is the foreign currency gain/(loss) due to the change in the fair value of the underlying purchase commitment on December 31, 2020? a. 30,625 gain b. 30,625 loss c. 4,375 gain d. 4,375 loss 2. What is the amount debited to the equipment account? a. 161,875 on 11/2/2020 b. 175,000 on 11/2/2020 c. 153,125 on 3/31/2021 d. 175,000 on 3/31/2021 6. On November 1, 2020, 7D Co. entered into a firm commitment with Toki-Toki Japanese Company for the export of dried mangoes with a contract price of 10,000 Yen. The goods will be delivered by 7D Co. on January 30, 2021. On the same day, in order to protect itself from the risk of changes in fair value of the firm commitment due to changes in underlying foreign currency, 7D Co. entered into a forward contract with BDO for the sale of 10,000 Yen at the forward rate on November 1, 2020. IAS 39 provides that hedge of the foreign currency risk of a firm commitment may be accounted for as either fair value hedge or cash flow hedge. 7D Co. elected to account for the hedge of the firm commitment using fair value hedge. The following direct exchange rates are provided: November 1, 2020 December 31, 2020 January 30, 2021 Buying spot rate P10 P13 P12 Selling spot rate P13 P15 P16 Forward buying 90-daysP11 P14 P15 Forward selling 90-days P13 P16 P17

1.

2.

Forward buying 60-daysP14 P17 P16 Forward selling 60-days P15 P18 P14 Forward buying 30-daysP11 P15 P12 Forward selling 30-days P13 P11 P14 What is the foreign currency gain/(loss) due to hedged item for the year ended December 31, 2020? a. 40,000 gain b. 20,000 loss c. 30,000 gain d. 10,000 loss What is the foreign currency gain/(loss) due to hedging instrument for the year ended December 31, 2021? a. 50,000 loss b. 30,000 gain c. 20,000 gain d. 20,000 loss

EXERCISES 1. PAS 39 enumerated the following three types of hedging relationships, except a. Fair value hedge: a hedge of the exposure to changes in fair value of a recognized asset (AFS Securities) or liability or an unrecognized firm commitment, or an identified portion of such an asset, liability or firm commitment, that is attributable to a particular risk and could affect profit or loss. b. Cash flow hedge: a hedge of the exposure to variability in cash flows that (1) is attributable to a particular risk associated with a recognized asset or liability (such as all or some future interest payments on variable rate debt) or (2) a highly probable forecast transaction and (2) could affect profit or loss. c. Hedge of a net investment in foreign operation which is the hedge of the amount of the reporting entity’s interest in the net assets of the operation. d. Undesignated hedge such as hedge of foreign currency denominated payable or receivable. 2. In case of hedging transaction designated as fair value hedge, which of the following statements is correct? a. The gain or loss from remeasuring the hedging instrument/derivative designated as fair value hedge shall be recognized in profit or loss. b. The gain or loss on the changes in fair value of hedged item/(AFS Securities) attributable to the hedged risk shall adjust the carrying amount of the hedged item and be recognized in profit or loss. c. Both A and B. d. Neither A nor B. 3. In case of hedging transaction designated as cash flow hedge, which of the following statements is correct? a. The portion of the gain or loss on the hedging instrument/derivative designated as cash flow hedge that is determined to be an effective hedge or the change in intrinsic value of the derivative designated as cash flow hedge shall be recognized in other comprehensive income. b. The ineffective portion of the gain or loss on the hedging instrument/derivative designated as cash flow hedge or the change in time value of the derivative designated as cash flow hedge shall be recognized in profit or loss. c. The cumulative other comprehensive income recognized in equity arising from cumulative changes in intrinsic value of derivatives designated as cash flow hedge shall be reclassified from equity/cumulative OCI to profit or loss as a reclassification adjustment in the same period during which the hedged forecast cash flows affects profit or loss. d. All of the above. 4. Lastikman Company, a local company, bought raw materials as ingredients in its products from Superman Corporation, a US company, for 35,000 US Dollars in 2020. Pertinent exchange rates relating to this transaction are as follows: Buying Rate Selling Rate Receipt of order P47.10 P47.20 Date of shipment 47.25 47.45 Balance sheet date 49.50 49.60 Settlement date 49.45 49.50 What is the foreign exchange gain or loss of Lastikman Company for 2020? a. 78,750 loss b. 75,250 loss c. 78,750 gain d. 75,250 gain What is the value of the inventory, assuming it’s not yet sold, as of settlement date? a. 1,652,000 b. 1,660,750 c. 1,732,500 d. 1,653,750 5. Kline Company purchased inventory on November 30, 2018 for $10,000 payable March 1, 2019. On December 1, 2018, the entity entered into a forward contract to purchase $10,000 and to be delivered on February 28, 2019 to hedge the purchase of inventory on November 30, 2018. The relevant exchange rates are:

11/30/2018 12/01/2018 12/31/2018 02/28/2019 03/1/2019 Spot rate 45 46 50 51 55 Forward buying 90-days 44 43 42 41.5 45 Forward selling 90-days 47 48 42.5 44.5 46 Forward buying 60-days 50 51.5 48.5 54 50 Forward selling 60-days 52 53.5 51 55 51.5 Forward buying 30-days 55 50.5 49.5 56.5 47.5 Forward selling 30-days 54 51 52.5 53 56 What amount of foreign currency transaction gain from the forward contract should be included in net income for 2018? a. 50,000 b. 40,000 c. 30,000 d. 0 What amount of foreign currency transaction loss should be included in income from the revaluation of accounts payable for 2018? a. 40,000 b. 50,000 c. 10,000 d. 0 Answer 1. D 2. C 3. D 4. B/B 5. C/B

Related Documents

Foreign Currency Hedging

January 2021 1

11-foreign-currency-transactionsxx.pdf

January 2021 0

Foreign Currency Convertible Bonds

January 2021 1

Accounting For Foreign Currency Transaction.docx

January 2021 0

Hedging (1).ppt

January 2021 0More Documents from "Anthony Kwo"

Foreign Currency Hedging

January 2021 1

Tipuri De Concurenta Neloiala

February 2021 2

Makalah Masa Pendudukan Jepang Di Indonesia

January 2021 1