Quiz - Accounting For Vhwo (ver. 7)

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Quiz - Accounting For Vhwo (ver. 7) as PDF for free.

More details

- Words: 2,930

- Pages: 9

Loading documents preview...

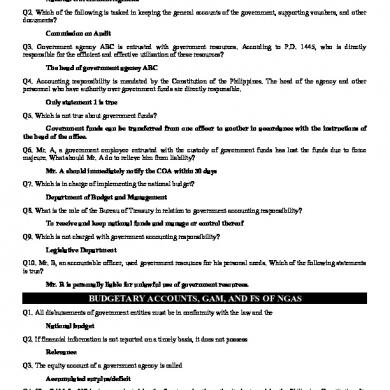

YELLOW - CORRECT ANSWER RED - WRONG ANSWER CYAN – SUGGESTED ANSWER

QUIZ - ACCOUNTING FOR VHWO 1. A VHWO has the following expenditures:

How should the organization report these items? Program service expenses of P100,000 and supporting services expenses of P160,000. 2. A donation of materials to be used in providing services was received by a VHWO. How should these donated materials be recorded? As inventory 3. Military Family Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received, half of which is payable in 2020 with the other half payable in 2021 for use in 2021. It was estimated that 10% of these pledges would be uncollectible. How much should Military Family Center report as net contribution revenues in 2020 with respect to the pledges? 720000 4. Bell Foundation, a VHWO supported by contributions from the general public, included the following costs in its statement of functional expenses for the year ended December 31, 2020. Fund raising - P1,000,000 Administrative - 600,000 Research - 200,000 Bell’s functional expenses for 2020 program services included 200000 5. A good reason for a VHWO to adopt fund accounting even though standards do not require it is because: The program services involve more than one type of revenue

6. A VHWO sends a mailing to all of its members including those who have donated in the past and others who have not donated. The mailing which costs P22,000 asks for monetary contributions to help achieve the organization’s mission. In addition, 80% of the materials included in the mailing is educational in nature. Which of the following is true? No part of the P22,000 should be reported as a program service cost because there is no specific call to action. 7. Greg takes a leave of absence from his job to work full-time for a VHWO for six months. He fills the position of finance director, a position that normally pays P88,000 per year. He accepts no remuneration for his work. How should these donated services be recorded? As public support of P44,000 and an expense of P44,000 8. A VHWO received unrestricted cash donations of P20,000 from donors who attended a dinner held for the benefit of the organization. These costs of the dinner, including room rental, and other expenses, amounted to P7,000. On the statement of activities prepared by the VHWO, the expenses of the dinner should be Reported as fund-raising costs 9. A donation was received by a VHWO specifically to care for indigent patients. Which of the following should be used to record the gift? Public support - temporarily restricted contributions 10. What is the proper method of carrying investments of a VHWO? Market value measured at year-end 11. Public support for a VHWO includes: Legacies and bequests 12. Which of the following organizations would be classified as a VHWO? The Sierra Madre Foundation, an environmental organization 13. In the absence of donor stipulations, revenues derived from an environment would be reported in the statement of activities of a VHWO as increases in: Unrestricted net assets 14. Which of the following expenses would be considered a program service expense for a local cancer society? Salary of a home care nurse

15. A contribution in 20x9 to a VHWO, which is restricted to usage to celebrate the millennium in the year 20x0, is recorded as a credit to: Revenue - permanently restricted 16. A VHWO receives a gift of new furniture having a fair value of P2,100. The group then gives the furniture to needy families following a flood. How should the organization record the receipt and distribution of this donation? Record public support of P2,100 and community assistance expense of P2,100 17. A VHWO receives P32,000 in cash from solicitations made in the local community. The organization receives an additional P1,500 from members in payment of annual dues. Members are assumed to receive benefits roughly equal in value to the amount of dues paid. How should this money be recorded? Public support of P32,000 and revenue of P1,500 18. A VHWO is permitted to use building facilities for free. This should be recorded as: Both as contribution and rent expense at fair market value 19. A VHWO received P200,000 pledges from donors on Feb 15, 2020. The donors did not place any time or use restrictions on the amount of pledged. The governing board estimated that 10% of the pledges would be uncollectible. During the remainder of fiscal year 2020, cash received from pledges amounted to P184,000. For the year ended June 30, 2020, what amount should the VHWO report as contributions-unrestricted? 184000 20. A CPA donates her services to prepare the annual financial report of a VHWO. The services should be recorded as: Both as revenues-unrestricted and accounting expenses 21. A VHWO received P300,000 contribution on April 15, 2020, from a donor who stipulated that the donation has to be invested permanently in stocks and bonds. The donor further stipulated that the earnings from the investment be at the discretion of the governing board of the VHWO. earnings from the investment for the year ended, June 30, 2020, amounted to P6,000. How would the VHWO report this information for the year ended June 30, 2020? Increase in permanently restricted net assets of P300,000, and in unrestricted net assets of P6,000 22. Which of the following is a VHWO? Charity raising money for underprivileged children 23. Government grants that are essentially flow-through transactions would be recorded by a VHWO as:

Liability 24. On June 30, 2020, a VHWO received pledges from donors amounting to P50,000. The donors did not place any time or use restrictions on the amount pledged. However, the donors intended to give the money three months after making the pledge. It was estimated that 10% of the pledges would not be collected. How should the VHWO report these pledges on the date the pledge was received? As contribution revenue - temporarily restricted for P50,000 25. During the fiscal year ended June 30, 2020, Global Charities, a VHWO, received unrestricted cash contributions of P500,000 and temporarily restricted cash contributions of P300,000. All of the temporarily restricted contributions were restricted by the donors for equipment acquisition. During the year ended, June 30, 2020, equipment costing P250,000 was acquired with the restricted contributions. As a result of these two contributions, Global Charities’ statement of cash flows prepared for the year ended June 30, 2020, would report an increase in net cash provided by operating activities of 500000 26. Which of the following financial statements is not required when reporting for a VHWO? Statement of Support, Revenue, Expenses, and Changes in Fund Balances 27. A VHWO developed and printed informational materials which were intended to both educate the public about how its resources are used to help people in need and to also appeal for much needed support. In this situation, the cost of informational materials should be: Allocated between expenses for program services and fund-raising expense 28. A VHWO reports pledges receivable on its statement of financial position at the present value of future cash collections. How is the increase in present value of the pledges receivable, which is due to the passage of time, reported on the VHWO’s statement of activities? As an increase in contributions – temporarily restricted 29. The Philippine Heart Association is having its annual Heart Ball. This is a major annual event of the organization. Any direct costs of the ball are considered: Fund-raising expenses 30. Which basis of accounting should a VHWO use? Accrual basis for all funds

31. On the statement of functional expenses of a VHWO, how are expenses classified? Program service expenses and supporting service expenses 32. Which of the following items is considered a special event support for a VHWO? Bingo games and bake sales 33. Which of the following is not a question individuals ask of a VHWO in considering whether to make contributions? How much should this organization receive? 34. Catherine Dee is a social worker on the staff of Military Family Center, a VHWO. She earns P42,000 annually for a normal workload of 2,000 hours. During 2020, she contributed an additional 800 hours of her time to the Military Family Center at no extra charge. How much should Military Family Center record in 2020 as contributed services expense? 16800 35. On the statement of functional expenses prepared for a VHWO, depreciation expense is allocated to I. Expenses for program services II. Expenses for supporting services Both I and II 36. What is the purpose of a VHWO’s statement of functional expenses? Separates program service expenses from supporting service expense

A DONOR… 37. A donor agrees to contribute P5,000 per year at the end of each year of the next five years to a VHWO. The donor did not place any use restrictions on the amount pledged. The stream of payments is discounted at 6%. The first payment of P5,000 is received at the end of the first year. The present value factor for a five-payment annuity due on June 30, 2020 at 6% is 4.2124. The increase in present value of the contributions receivable recognized at the end of the first year is: 1264 38. A donor agrees to contribute P5,000 per year at the end of each year of the next five years to a VHWO. The donor did not place any use restrictions on the amount pledged. The stream of payments is discounted at 6%. The first payment of P5,000 is received at the end of the first year. The present value factor for a five-payment annuity due on June 30, 2020 at 6% is 4.2124. At the end of the first year, the pledged increased unrestricted net assets by: 5000 39. A donor agrees to contribute P5,000 per year at the end of each year of the next five years to a VHWO. The donor did not place any use restrictions on the amount pledged. The stream of payments is discounted at 6%. The first payment of P5,000 is received at the end of the first year. The present value factor for a five-payment annuity due on June 30, 2020 at 6% is 4.2124. The journal entry to recognize present value at the time the pledge is received includes: A debit to Pledges Receivable - Temporarily Restricted for P21,062

LOCAL SERVICES Local Services, a VHWO had the following classes of net assets on July 1, 2020, the beginning of its fiscal year: Unrestricted Temporarily restricted Permanently restricted

P500,000 P100,000 P1,000,000

During the year ended June 30, 2020, the following events occurred: 1. It purchased equipment costing P100,000, from restricted contributions for this purpose. The contributions had been received from donors during June 2020. 2. It received P130,000 cash donations which were restricted for research activities. During the year ended June 30, 2021, P90,000 of the contributions were expended on research. 3. It sold investments classified in the net assets as permanently restricted for a loss of P40,000. Dividends and interest income earned on the investments amounted to P70,000. There were no restrictions on how investment income is to be used. 4. It received cash contributions of P200,000 from donors who did not place either time or use restrictions upon their donations. 5. Expenses, excluding depreciation expense, for program services and supporting services incurred during the year ended June 30, 2021 was P260,000. 6. Depreciation expense for the year ended June 30, 2021 was P80,000. 40. On the statement of activities for the year ended June 30, 2021, temporarily restricted net assets: Decreased 60000 41. Reclassifications on the statement of activities for the year ended June 30, 2021 would be: 190000 42. The amount of expenses under unrestricted column of the statement of activities would be: 340000 43. The amount of permanently restricted net assets reported on the statement of financial position would be: 960000 44. On the statement of activities for the year ended June 30, 2021, reclassifications would be reported at 190000

TOWN SERVICE CENTER 45. Town Service Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received. Half of this was received during 2020 and the remaining half is promised by the donor to be given the following year. It was estimated that 10% of the pledges receivable would be uncollectible. In addition, Halley Larson, a social worker on the VHWO staff with annual earnings of P30,000 for a normal workload of P1,500 hours contributed an additional 600 hours of her time to the VHWO at no charge. How much should Town report as net temporarily restricted contribution revenue for 2020 with respect to the pledges? 360000 46. Town Service Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received. Half of this was received during 2020 and the remaining half is promised by the donor to be given the following year. It was estimated that 10% of the pledges receivable would be uncollectible. In addition, Halley Larson, a social worker on the VHWO staff with annual earnings of P30,000 for a normal workload of P1,500 hours contributed an additional 600 hours of her time to the VHWO at no charge. How much should Town report as total unrestricted contribution revenue for 2020? 412000 47. Town Service Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received. Half of this was received during 2020 and the remaining half is promised by the donor to be given the following year. It was estimated that 10% of the pledges receivable would be uncollectible. In addition, Halley Larson, a social worker on the VHWO staff with annual earnings of P30,000 for a normal workload of P1,500 hours contributed an additional 600 hours of her time to the VHWO at no charge. How much should Town report as unrestricted contribution revenue for 2020 with respect to the pledges? 400000 48. Town Service Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received. Half of this was received during 2020 and the remaining half is promised by the donor to be given the following year. It was estimated that 10% of the pledges receivable would be uncollectible. In addition, Halley Larson, a social worker on the VHWO staff with annual earnings of P30,000 for a normal workload of P1,500 hours contributed an additional 600 hours of her time to the VHWO at no charge. How much should Town report as contribution service expense in 2020? 12000

STATE CENTER HEALTH AGENCY 49. On January 1, 2020, State Center Health Agency, a VHWO, received a bequest of P200,000 certificate of deposit maturing on December 31, 2024. The contributor’s only stipulations were that the certificate be held to maturity and the interest revenue received annually be used to purchase books for the children to read in the pre-school program run by the agency. Interest revenue each year is P9,000, and this fully spent for books each year. When the certificate was redeemed, the board of trustee’s adopted a formal resolution designing P150,000 of the proceeds for future purchase of playground equipment for the pre-school program. What amount should be reported in 2020 statement of activities as unrestricted public support or/and revenues? Transfers from the restricted fund of P9,000 50. On January 1, 2020, State Center Health Agency, a VHWO, received a bequest of P200,000 certificate of deposit maturing on December 31, 2024. The contributor’s only stipulations were that the certificate be held to maturity and the interest revenue received annually be used to purchase books for the children to read in the pre-school program run by the agency. Interest revenue each year is P9,000, and this fully spent for books each year. When the certificate was redeemed, the board of trustee’s adopted a formal resolution designing P150,000 of the proceeds for future purchase of playground equipment for the pre-school program. What should be reported in the December 31, 2024 statement of activities for the unrestricted fund? Transfers from restricted fund of P209,000 51. On January 1, 2020, State Center Health Agency, a VHWO, received a bequest of P200,000 certificate of deposit maturing on December 31, 2024. The contributor’s only stipulations were that the certificate be held to maturity and the interest revenue received annually be used to purchase books for the children to read in the pre-school program run by the agency. Interest revenue each year is P9,000, and this fully spent for books each year. When the certificate was redeemed, the board of trustee’s adopted a formal resolution designing P150,000 of the proceeds for future purchase of playground equipment for the pre-school program. What should be reported in the December 31, 2024 statement of financial position for the unrestricted fund? Board-designated funds, P150,000 52. On January 1, 2020, State Center Health Agency, a VHWO, received a bequest of P200,000 certificate of deposit maturing on December 31, 2024. The contributor’s only stipulations were that the certificate be held to maturity and the interest revenue received annually be used to purchase books for the children to read in the pre-school program run by the agency. Interest revenue each year is P9,000, and this fully spent for books each year. When the certificate was redeemed, the board of trustee’s adopted a formal resolution designing P150,000 of the proceeds for future purchase of playground equipment for the pre-school program. What would be reflected under temporarily restricted column of the statement of activities in 2020? All of these

QUIZ - ACCOUNTING FOR VHWO 1. A VHWO has the following expenditures:

How should the organization report these items? Program service expenses of P100,000 and supporting services expenses of P160,000. 2. A donation of materials to be used in providing services was received by a VHWO. How should these donated materials be recorded? As inventory 3. Military Family Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received, half of which is payable in 2020 with the other half payable in 2021 for use in 2021. It was estimated that 10% of these pledges would be uncollectible. How much should Military Family Center report as net contribution revenues in 2020 with respect to the pledges? 720000 4. Bell Foundation, a VHWO supported by contributions from the general public, included the following costs in its statement of functional expenses for the year ended December 31, 2020. Fund raising - P1,000,000 Administrative - 600,000 Research - 200,000 Bell’s functional expenses for 2020 program services included 200000 5. A good reason for a VHWO to adopt fund accounting even though standards do not require it is because: The program services involve more than one type of revenue

6. A VHWO sends a mailing to all of its members including those who have donated in the past and others who have not donated. The mailing which costs P22,000 asks for monetary contributions to help achieve the organization’s mission. In addition, 80% of the materials included in the mailing is educational in nature. Which of the following is true? No part of the P22,000 should be reported as a program service cost because there is no specific call to action. 7. Greg takes a leave of absence from his job to work full-time for a VHWO for six months. He fills the position of finance director, a position that normally pays P88,000 per year. He accepts no remuneration for his work. How should these donated services be recorded? As public support of P44,000 and an expense of P44,000 8. A VHWO received unrestricted cash donations of P20,000 from donors who attended a dinner held for the benefit of the organization. These costs of the dinner, including room rental, and other expenses, amounted to P7,000. On the statement of activities prepared by the VHWO, the expenses of the dinner should be Reported as fund-raising costs 9. A donation was received by a VHWO specifically to care for indigent patients. Which of the following should be used to record the gift? Public support - temporarily restricted contributions 10. What is the proper method of carrying investments of a VHWO? Market value measured at year-end 11. Public support for a VHWO includes: Legacies and bequests 12. Which of the following organizations would be classified as a VHWO? The Sierra Madre Foundation, an environmental organization 13. In the absence of donor stipulations, revenues derived from an environment would be reported in the statement of activities of a VHWO as increases in: Unrestricted net assets 14. Which of the following expenses would be considered a program service expense for a local cancer society? Salary of a home care nurse

15. A contribution in 20x9 to a VHWO, which is restricted to usage to celebrate the millennium in the year 20x0, is recorded as a credit to: Revenue - permanently restricted 16. A VHWO receives a gift of new furniture having a fair value of P2,100. The group then gives the furniture to needy families following a flood. How should the organization record the receipt and distribution of this donation? Record public support of P2,100 and community assistance expense of P2,100 17. A VHWO receives P32,000 in cash from solicitations made in the local community. The organization receives an additional P1,500 from members in payment of annual dues. Members are assumed to receive benefits roughly equal in value to the amount of dues paid. How should this money be recorded? Public support of P32,000 and revenue of P1,500 18. A VHWO is permitted to use building facilities for free. This should be recorded as: Both as contribution and rent expense at fair market value 19. A VHWO received P200,000 pledges from donors on Feb 15, 2020. The donors did not place any time or use restrictions on the amount of pledged. The governing board estimated that 10% of the pledges would be uncollectible. During the remainder of fiscal year 2020, cash received from pledges amounted to P184,000. For the year ended June 30, 2020, what amount should the VHWO report as contributions-unrestricted? 184000 20. A CPA donates her services to prepare the annual financial report of a VHWO. The services should be recorded as: Both as revenues-unrestricted and accounting expenses 21. A VHWO received P300,000 contribution on April 15, 2020, from a donor who stipulated that the donation has to be invested permanently in stocks and bonds. The donor further stipulated that the earnings from the investment be at the discretion of the governing board of the VHWO. earnings from the investment for the year ended, June 30, 2020, amounted to P6,000. How would the VHWO report this information for the year ended June 30, 2020? Increase in permanently restricted net assets of P300,000, and in unrestricted net assets of P6,000 22. Which of the following is a VHWO? Charity raising money for underprivileged children 23. Government grants that are essentially flow-through transactions would be recorded by a VHWO as:

Liability 24. On June 30, 2020, a VHWO received pledges from donors amounting to P50,000. The donors did not place any time or use restrictions on the amount pledged. However, the donors intended to give the money three months after making the pledge. It was estimated that 10% of the pledges would not be collected. How should the VHWO report these pledges on the date the pledge was received? As contribution revenue - temporarily restricted for P50,000 25. During the fiscal year ended June 30, 2020, Global Charities, a VHWO, received unrestricted cash contributions of P500,000 and temporarily restricted cash contributions of P300,000. All of the temporarily restricted contributions were restricted by the donors for equipment acquisition. During the year ended, June 30, 2020, equipment costing P250,000 was acquired with the restricted contributions. As a result of these two contributions, Global Charities’ statement of cash flows prepared for the year ended June 30, 2020, would report an increase in net cash provided by operating activities of 500000 26. Which of the following financial statements is not required when reporting for a VHWO? Statement of Support, Revenue, Expenses, and Changes in Fund Balances 27. A VHWO developed and printed informational materials which were intended to both educate the public about how its resources are used to help people in need and to also appeal for much needed support. In this situation, the cost of informational materials should be: Allocated between expenses for program services and fund-raising expense 28. A VHWO reports pledges receivable on its statement of financial position at the present value of future cash collections. How is the increase in present value of the pledges receivable, which is due to the passage of time, reported on the VHWO’s statement of activities? As an increase in contributions – temporarily restricted 29. The Philippine Heart Association is having its annual Heart Ball. This is a major annual event of the organization. Any direct costs of the ball are considered: Fund-raising expenses 30. Which basis of accounting should a VHWO use? Accrual basis for all funds

31. On the statement of functional expenses of a VHWO, how are expenses classified? Program service expenses and supporting service expenses 32. Which of the following items is considered a special event support for a VHWO? Bingo games and bake sales 33. Which of the following is not a question individuals ask of a VHWO in considering whether to make contributions? How much should this organization receive? 34. Catherine Dee is a social worker on the staff of Military Family Center, a VHWO. She earns P42,000 annually for a normal workload of 2,000 hours. During 2020, she contributed an additional 800 hours of her time to the Military Family Center at no extra charge. How much should Military Family Center record in 2020 as contributed services expense? 16800 35. On the statement of functional expenses prepared for a VHWO, depreciation expense is allocated to I. Expenses for program services II. Expenses for supporting services Both I and II 36. What is the purpose of a VHWO’s statement of functional expenses? Separates program service expenses from supporting service expense

A DONOR… 37. A donor agrees to contribute P5,000 per year at the end of each year of the next five years to a VHWO. The donor did not place any use restrictions on the amount pledged. The stream of payments is discounted at 6%. The first payment of P5,000 is received at the end of the first year. The present value factor for a five-payment annuity due on June 30, 2020 at 6% is 4.2124. The increase in present value of the contributions receivable recognized at the end of the first year is: 1264 38. A donor agrees to contribute P5,000 per year at the end of each year of the next five years to a VHWO. The donor did not place any use restrictions on the amount pledged. The stream of payments is discounted at 6%. The first payment of P5,000 is received at the end of the first year. The present value factor for a five-payment annuity due on June 30, 2020 at 6% is 4.2124. At the end of the first year, the pledged increased unrestricted net assets by: 5000 39. A donor agrees to contribute P5,000 per year at the end of each year of the next five years to a VHWO. The donor did not place any use restrictions on the amount pledged. The stream of payments is discounted at 6%. The first payment of P5,000 is received at the end of the first year. The present value factor for a five-payment annuity due on June 30, 2020 at 6% is 4.2124. The journal entry to recognize present value at the time the pledge is received includes: A debit to Pledges Receivable - Temporarily Restricted for P21,062

LOCAL SERVICES Local Services, a VHWO had the following classes of net assets on July 1, 2020, the beginning of its fiscal year: Unrestricted Temporarily restricted Permanently restricted

P500,000 P100,000 P1,000,000

During the year ended June 30, 2020, the following events occurred: 1. It purchased equipment costing P100,000, from restricted contributions for this purpose. The contributions had been received from donors during June 2020. 2. It received P130,000 cash donations which were restricted for research activities. During the year ended June 30, 2021, P90,000 of the contributions were expended on research. 3. It sold investments classified in the net assets as permanently restricted for a loss of P40,000. Dividends and interest income earned on the investments amounted to P70,000. There were no restrictions on how investment income is to be used. 4. It received cash contributions of P200,000 from donors who did not place either time or use restrictions upon their donations. 5. Expenses, excluding depreciation expense, for program services and supporting services incurred during the year ended June 30, 2021 was P260,000. 6. Depreciation expense for the year ended June 30, 2021 was P80,000. 40. On the statement of activities for the year ended June 30, 2021, temporarily restricted net assets: Decreased 60000 41. Reclassifications on the statement of activities for the year ended June 30, 2021 would be: 190000 42. The amount of expenses under unrestricted column of the statement of activities would be: 340000 43. The amount of permanently restricted net assets reported on the statement of financial position would be: 960000 44. On the statement of activities for the year ended June 30, 2021, reclassifications would be reported at 190000

TOWN SERVICE CENTER 45. Town Service Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received. Half of this was received during 2020 and the remaining half is promised by the donor to be given the following year. It was estimated that 10% of the pledges receivable would be uncollectible. In addition, Halley Larson, a social worker on the VHWO staff with annual earnings of P30,000 for a normal workload of P1,500 hours contributed an additional 600 hours of her time to the VHWO at no charge. How much should Town report as net temporarily restricted contribution revenue for 2020 with respect to the pledges? 360000 46. Town Service Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received. Half of this was received during 2020 and the remaining half is promised by the donor to be given the following year. It was estimated that 10% of the pledges receivable would be uncollectible. In addition, Halley Larson, a social worker on the VHWO staff with annual earnings of P30,000 for a normal workload of P1,500 hours contributed an additional 600 hours of her time to the VHWO at no charge. How much should Town report as total unrestricted contribution revenue for 2020? 412000 47. Town Service Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received. Half of this was received during 2020 and the remaining half is promised by the donor to be given the following year. It was estimated that 10% of the pledges receivable would be uncollectible. In addition, Halley Larson, a social worker on the VHWO staff with annual earnings of P30,000 for a normal workload of P1,500 hours contributed an additional 600 hours of her time to the VHWO at no charge. How much should Town report as unrestricted contribution revenue for 2020 with respect to the pledges? 400000 48. Town Service Center is a VHWO funded by contributions from the general public. During 2020, unrestricted pledges of P800,000 were received. Half of this was received during 2020 and the remaining half is promised by the donor to be given the following year. It was estimated that 10% of the pledges receivable would be uncollectible. In addition, Halley Larson, a social worker on the VHWO staff with annual earnings of P30,000 for a normal workload of P1,500 hours contributed an additional 600 hours of her time to the VHWO at no charge. How much should Town report as contribution service expense in 2020? 12000

STATE CENTER HEALTH AGENCY 49. On January 1, 2020, State Center Health Agency, a VHWO, received a bequest of P200,000 certificate of deposit maturing on December 31, 2024. The contributor’s only stipulations were that the certificate be held to maturity and the interest revenue received annually be used to purchase books for the children to read in the pre-school program run by the agency. Interest revenue each year is P9,000, and this fully spent for books each year. When the certificate was redeemed, the board of trustee’s adopted a formal resolution designing P150,000 of the proceeds for future purchase of playground equipment for the pre-school program. What amount should be reported in 2020 statement of activities as unrestricted public support or/and revenues? Transfers from the restricted fund of P9,000 50. On January 1, 2020, State Center Health Agency, a VHWO, received a bequest of P200,000 certificate of deposit maturing on December 31, 2024. The contributor’s only stipulations were that the certificate be held to maturity and the interest revenue received annually be used to purchase books for the children to read in the pre-school program run by the agency. Interest revenue each year is P9,000, and this fully spent for books each year. When the certificate was redeemed, the board of trustee’s adopted a formal resolution designing P150,000 of the proceeds for future purchase of playground equipment for the pre-school program. What should be reported in the December 31, 2024 statement of activities for the unrestricted fund? Transfers from restricted fund of P209,000 51. On January 1, 2020, State Center Health Agency, a VHWO, received a bequest of P200,000 certificate of deposit maturing on December 31, 2024. The contributor’s only stipulations were that the certificate be held to maturity and the interest revenue received annually be used to purchase books for the children to read in the pre-school program run by the agency. Interest revenue each year is P9,000, and this fully spent for books each year. When the certificate was redeemed, the board of trustee’s adopted a formal resolution designing P150,000 of the proceeds for future purchase of playground equipment for the pre-school program. What should be reported in the December 31, 2024 statement of financial position for the unrestricted fund? Board-designated funds, P150,000 52. On January 1, 2020, State Center Health Agency, a VHWO, received a bequest of P200,000 certificate of deposit maturing on December 31, 2024. The contributor’s only stipulations were that the certificate be held to maturity and the interest revenue received annually be used to purchase books for the children to read in the pre-school program run by the agency. Interest revenue each year is P9,000, and this fully spent for books each year. When the certificate was redeemed, the board of trustee’s adopted a formal resolution designing P150,000 of the proceeds for future purchase of playground equipment for the pre-school program. What would be reflected under temporarily restricted column of the statement of activities in 2020? All of these

Related Documents

Quiz - Accounting For Vhwo (ver. 7)

January 2021 1

Quiz - Other Npes (ver. 3)

January 2021 1

Intermediate Accounting Quiz Bee

February 2021 1

Accounting Information System Quiz 1

March 2021 0

Quiz 7 Sujeto

March 2021 0

3rd-quiz-intermediate-accounting-ii.docx

February 2021 0More Documents from "Rachel Villamor"

Quiz - Other Npes (ver. 3)

January 2021 1

Compilation 1 (midterms)

February 2021 1

Finals Summative 1 Compilation + New (ver. 9)

January 2021 1

Govacc Finals Drills

January 2021 1

Module 6 Quiz Answers

February 2021 1